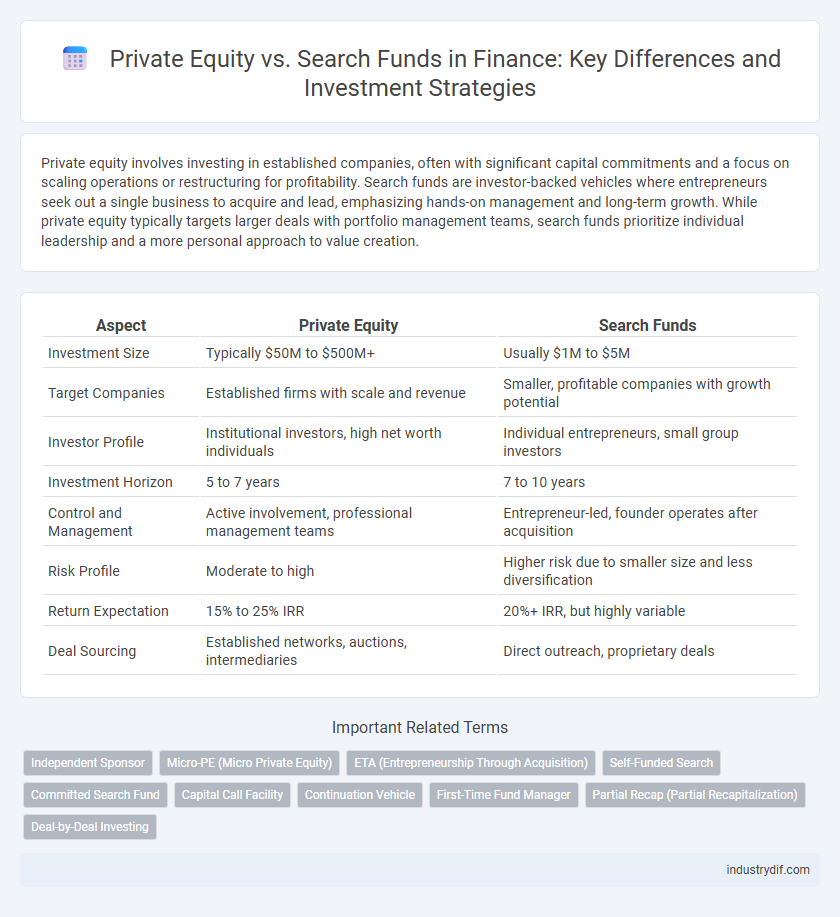

Private equity involves investing in established companies, often with significant capital commitments and a focus on scaling operations or restructuring for profitability. Search funds are investor-backed vehicles where entrepreneurs seek out a single business to acquire and lead, emphasizing hands-on management and long-term growth. While private equity typically targets larger deals with portfolio management teams, search funds prioritize individual leadership and a more personal approach to value creation.

Table of Comparison

| Aspect | Private Equity | Search Funds |

|---|---|---|

| Investment Size | Typically $50M to $500M+ | Usually $1M to $5M |

| Target Companies | Established firms with scale and revenue | Smaller, profitable companies with growth potential |

| Investor Profile | Institutional investors, high net worth individuals | Individual entrepreneurs, small group investors |

| Investment Horizon | 5 to 7 years | 7 to 10 years |

| Control and Management | Active involvement, professional management teams | Entrepreneur-led, founder operates after acquisition |

| Risk Profile | Moderate to high | Higher risk due to smaller size and less diversification |

| Return Expectation | 15% to 25% IRR | 20%+ IRR, but highly variable |

| Deal Sourcing | Established networks, auctions, intermediaries | Direct outreach, proprietary deals |

Overview of Private Equity and Search Funds

Private Equity involves pooled investment funds that acquire equity ownership in companies, typically aiming for operational improvements and profitable exits over a 4-7 year horizon. Search Funds are investment vehicles where entrepreneurs raise capital to locate and acquire a single company, often targeting small to medium-sized businesses with stable cash flows. While Private Equity firms manage diversified portfolios with significant capital, Search Funds emphasize founder-led acquisitions and hands-on management post-purchase.

Key Differences Between Private Equity and Search Funds

Private equity involves pooled capital investments into established companies for growth or restructuring, while search funds are entrepreneur-led investment vehicles targeting a single business acquisition. Private equity firms typically manage larger funds with diversified portfolios, whereas search funds focus on acquiring and operating one company, often with hands-on management. The investment horizon in private equity tends to be shorter, aiming for exits within 3-7 years, compared to search funds that prioritize long-term value creation through active ownership.

Investment Structures in Private Equity vs Search Funds

Private equity investment structures typically involve limited partnerships where institutional investors commit capital to a fund managed by general partners, allowing diversified investments across multiple companies. Search funds utilize a distinct model where individual entrepreneurs raise initial capital to finance a focused search and acquire a single target company, creating a more concentrated equity structure. The key difference lies in private equity's pooled capital investment compared to search funds' entrepreneur-driven, single acquisition-focused ownership.

Capital Sourcing and Fundraising Strategies

Private equity firms typically raise capital from institutional investors through structured funds with multi-year commitments, leveraging established track records and large-scale pools of capital. Search funds source capital primarily from high-net-worth individuals and family offices, often beginning with a smaller search capital fund before raising acquisition capital in a follow-on capital raise. Fundraising strategies in private equity emphasize scale and diversification, whereas search funds focus on personalized investor relationships and targeted deal-by-deal capital deployment.

Target Company Criteria and Deal Sourcing

Private equity firms typically target mature companies with stable cash flows and established market positions, focusing on industries with potential for operational improvements or growth. Search funds prioritize smaller, founder-operated businesses with revenues between $5 million and $30 million, often sourcing deals through proprietary networks and direct outreach. Deal sourcing in private equity relies heavily on intermediaries like investment banks, whereas search funds use personal connections and targeted marketing to identify acquisition opportunities.

Due Diligence Processes Compared

Due diligence in private equity involves extensive financial, legal, and operational analysis, often utilizing large teams and rigorous data rooms to assess target company risks and growth potential. Search funds conduct more personalized due diligence, relying heavily on founder expertise and direct management relationships due to typically smaller deal sizes and focused investment theses. Both approaches prioritize thorough market analysis and strategic fit, but private equity tends to emphasize scalability and exit strategies more intensely.

Value Creation Strategies: Private Equity vs Search Funds

Private equity firms primarily create value through operational improvements, strategic acquisitions, and financial engineering within portfolio companies. Search funds focus on value creation by leveraging the entrepreneurial operator's hands-on management to drive growth and optimize performance in a single acquired company. Both models emphasize enhancing cash flow and profitability but differ in scale and management involvement intensity.

Management Involvement and Operational Roles

Private equity firms typically deploy external management teams or portfolio executives, focusing on strategic oversight, financial structuring, and value creation through financial engineering. Search funds involve entrepreneurs or executive searchers personally managing daily operations, emphasizing hands-on leadership and direct operational control. This intensive management involvement in search funds often results in deeper operational engagement compared to the oversight role predominant in traditional private equity models.

Exit Strategies and Investor Returns

Private equity firms typically pursue exit strategies such as initial public offerings (IPOs), mergers and acquisitions (M&A), or secondary sales to realize investor returns, often targeting internal rates of return (IRR) between 20-30%. Search funds focus on acquiring a single company and driving growth before exit, primarily through strategic sales or recapitalizations, aiming for IRRs in the 25-35% range due to hands-on operational involvement. The difference in exit timing and value creation mechanisms often results in varied risk profiles and return expectations for investors in private equity versus search funds.

Risk Profiles and Stakeholder Considerations

Private equity typically involves larger capital pools and diversified portfolios, resulting in a moderate risk profile with established exit strategies supporting investor confidence. Search funds concentrate on acquiring and managing a single small to medium-sized business, bearing higher operational and market risks due to limited asset diversification. Stakeholders in private equity benefit from experienced management teams and structured governance, while search fund investors often assume active roles in company growth and decision-making processes.

Related Important Terms

Independent Sponsor

Independent sponsors in private equity operate without committed capital, sourcing deals and securing financing post-agreement, contrasting with traditional search funds that raise capital upfront to identify acquisitions. This model allows independent sponsors greater flexibility and control in deal structuring, often targeting niche markets or undervalued assets for strategic growth.

Micro-PE (Micro Private Equity)

Micro-Private Equity (Micro-PE) firms typically invest in small to medium-sized enterprises with enterprise values between $10 million and $100 million, providing operational expertise alongside capital. Search funds differ by involving entrepreneurs who raise initial capital to identify, acquire, and operate a single target company, often focusing on micro-PE opportunities but with hands-on management involvement during acquisition and growth phases.

ETA (Entrepreneurship Through Acquisition)

Entrepreneurship Through Acquisition (ETA) distinguishes itself within private equity by emphasizing founder-operators who acquire and actively manage established businesses, contrasting with traditional private equity firms that typically pursue portfolio management through financial engineering and strategic oversight. Search funds, a subset of ETA, enable entrepreneurs to raise capital specifically to identify, acquire, and grow smaller companies, offering a scalable model for hands-on value creation compared to conventional private equity buyouts.

Self-Funded Search

Self-funded search funds allow entrepreneurs to independently acquire small to mid-sized companies, maintaining greater control and equity compared to traditional private equity models that often involve external investors and institutional capital. This approach minimizes dilution and aligns incentives directly with operational value creation, offering a compelling alternative for driven individuals seeking hands-on ownership in the private equity landscape.

Committed Search Fund

Committed Search Funds offer investors a structured investment vehicle with upfront capital commitments, enabling dedicated entrepreneurs to rapidly identify and acquire a target company, contrasting with traditional Private Equity funds that typically deploy larger capital pools into existing businesses. This model provides greater alignment between searchers and investors, facilitating efficient deal sourcing and operational involvement in smaller, lower-middle-market acquisitions.

Capital Call Facility

Capital Call Facilities in private equity provide short-term liquidity to bridge capital commitments, enabling timely investments without immediate capital calls from limited partners. In contrast, search funds typically employ smaller or no capital call facilities due to their early-stage, singular deal focus, prioritizing cost efficiency and limited fundraise complexity.

Continuation Vehicle

Continuation vehicles in private equity serve as strategic tools that allow firms to extend the life of high-performing assets beyond the typical fund duration, enabling further value creation and liquidity events. In contrast, search funds primarily focus on entrepreneurial acquisition and operational involvement in a single company, making continuation vehicles less common but increasingly relevant for investors seeking to maximize returns in portfolio companies post-acquisition.

First-Time Fund Manager

First-time fund managers in private equity often face significant challenges in raising capital compared to search fund entrepreneurs, who typically leverage personal networks and demonstrate operational experience through acquiring and running a single company. Search funds provide a focused, lower-scale investment vehicle that appeals to investors seeking hands-on management and clear value creation, whereas private equity funds require a proven track record and larger capital commitments.

Partial Recap (Partial Recapitalization)

Partial recapitalization in private equity involves restructuring a company's capital structure by replacing a portion of equity with debt to optimize financial leverage and return on investment, often enabling early liquidity for investors while maintaining operational control. In contrast, search funds typically utilize partial recapitalizations to facilitate founder liquidity or to bring in new investors during growth phases, balancing risk and capital infusion without fully exiting ownership.

Deal-by-Deal Investing

Private equity firms typically engage in deal-by-deal investing by pooling capital from multiple investors to acquire diversified portfolios of companies, optimizing risk and returns across sectors. In contrast, search funds rely on individual entrepreneurs who initially raise investment to identify, acquire, and operate a single target company, focusing on hands-on management and value creation within that specific business.

Private Equity vs Search Funds Infographic

industrydif.com

industrydif.com