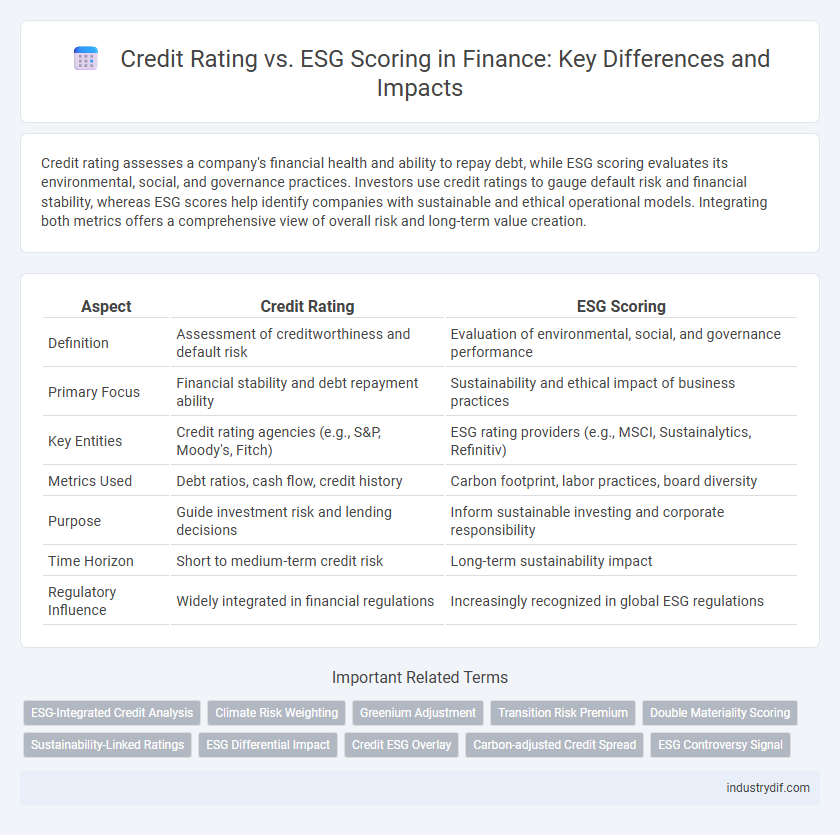

Credit rating assesses a company's financial health and ability to repay debt, while ESG scoring evaluates its environmental, social, and governance practices. Investors use credit ratings to gauge default risk and financial stability, whereas ESG scores help identify companies with sustainable and ethical operational models. Integrating both metrics offers a comprehensive view of overall risk and long-term value creation.

Table of Comparison

| Aspect | Credit Rating | ESG Scoring |

|---|---|---|

| Definition | Assessment of creditworthiness and default risk | Evaluation of environmental, social, and governance performance |

| Primary Focus | Financial stability and debt repayment ability | Sustainability and ethical impact of business practices |

| Key Entities | Credit rating agencies (e.g., S&P, Moody's, Fitch) | ESG rating providers (e.g., MSCI, Sustainalytics, Refinitiv) |

| Metrics Used | Debt ratios, cash flow, credit history | Carbon footprint, labor practices, board diversity |

| Purpose | Guide investment risk and lending decisions | Inform sustainable investing and corporate responsibility |

| Time Horizon | Short to medium-term credit risk | Long-term sustainability impact |

| Regulatory Influence | Widely integrated in financial regulations | Increasingly recognized in global ESG regulations |

Understanding Credit Rating and ESG Scoring

Credit rating evaluates an entity's creditworthiness by analyzing financial stability, debt levels, and repayment history to determine default risk and borrowing costs. ESG scoring assesses environmental, social, and governance practices, measuring a company's sustainability performance and ethical impact. Both metrics influence investment decisions, with credit ratings focusing on financial risk and ESG scores highlighting long-term corporate responsibility.

Key Differences Between Credit Ratings and ESG Scores

Credit ratings evaluate an entity's creditworthiness by analyzing financial health, repayment capacity, and default risk, primarily using quantitative financial data. ESG scores assess environmental, social, and governance factors, measuring sustainability and ethical impact through qualitative and quantitative metrics. Unlike credit ratings that focus on financial stability and risk, ESG scores emphasize corporate responsibility and long-term non-financial performance.

The Methodology Behind Credit Ratings

Credit rating agencies employ quantitative and qualitative analyses to assess a borrower's creditworthiness by examining financial statements, debt levels, and economic conditions. This methodology prioritizes default risk and the likelihood of timely repayment, incorporating factors such as cash flow stability, capital structure, and market competitiveness. ESG scoring, while increasingly integrated, remains supplementary, focusing on environmental, social, and governance criteria that influence long-term risk but are not the core determinants in traditional credit rating models.

How ESG Scores Are Calculated

ESG scores are calculated by analyzing a company's environmental impact, social responsibility, and governance practices using quantitative and qualitative data from reports, regulatory filings, and third-party sources. These scores are derived from criteria such as carbon emissions, labor practices, board diversity, and anti-corruption policies, weighted based on their relevance to the industry and geographic location. The resulting ESG rating provides investors with insights into non-financial risks that could affect long-term financial performance, complementing traditional credit ratings focused on creditworthiness and default risk.

Impact of Credit Ratings on Investment Decisions

Credit ratings directly influence investment decisions by assessing the creditworthiness and default risk of issuers, guiding investors on potential financial risks and returns. Higher credit ratings typically lead to lower borrowing costs and increased investor confidence, shaping portfolio allocations and risk management strategies. In contrast, ESG scoring focuses more on sustainability factors, but credit ratings remain crucial for evaluating financial stability and credit risk in investments.

The Growing Influence of ESG Scoring in Finance

ESG scoring is increasingly influencing investment decisions as financial institutions integrate environmental, social, and governance factors alongside traditional credit ratings. This shift reflects a broader recognition that ESG metrics can affect long-term creditworthiness and risk assessment. Incorporating ESG scores enhances the ability to predict financial performance and align portfolios with sustainable development goals.

Regulatory Frameworks: Credit Rating vs ESG Scoring

Credit rating frameworks are governed by established financial regulatory bodies such as the Securities and Exchange Commission (SEC) and the Basel Committee on Banking Supervision, ensuring standardized risk assessment in lending and investment decisions. ESG scoring regulations are rapidly evolving, with frameworks like the EU Sustainable Finance Disclosure Regulation (SFDR) and the Task Force on Climate-related Financial Disclosures (TCFD) driving transparency and integration of environmental, social, and governance factors into investment analysis. The convergence of credit rating agencies and ESG evaluators under these regulatory frameworks is reshaping risk evaluation by incorporating sustainability metrics alongside traditional financial indicators.

Challenges in Integrating Credit Ratings and ESG Scores

Integrating credit ratings and ESG scores presents challenges such as inconsistent data standards and varying methodologies across rating agencies, which complicate comparability and reliability. The differing time horizons of credit risk assessments and ESG evaluations create difficulties in aligning short-term financial metrics with long-term sustainability factors. Moreover, the lack of regulatory frameworks and transparency in ESG disclosures limits the effective incorporation of environmental, social, and governance data into traditional credit rating models.

The Role of Agencies in Rating and Scoring

Credit rating agencies evaluate an entity's creditworthiness by analyzing financial stability, debt levels, and repayment capacity, providing crucial benchmarks for investors and lenders. ESG scoring agencies assess environmental, social, and governance factors, giving insights into sustainable and ethical business practices that influence long-term risk and opportunity. Both types of agencies play a pivotal role in shaping investment decisions by offering complementary frameworks that integrate financial performance with sustainability metrics.

Future Trends: Convergence of Credit and ESG Assessment

Credit rating agencies and ESG scoring frameworks are increasingly integrating methodologies to provide a comprehensive risk profile that encompasses financial health and sustainability factors. The future trend indicates a convergence driven by investor demand for holistic insights, leveraging big data and AI to enhance predictive accuracy in assessing creditworthiness alongside environmental, social, and governance criteria. This integration is reshaping capital markets by aligning credit risk evaluation with long-term sustainability performance, influencing lending, investment decisions, and regulatory standards.

Related Important Terms

ESG-Integrated Credit Analysis

ESG-integrated credit analysis combines traditional credit rating assessments with environmental, social, and governance (ESG) factors to provide a holistic evaluation of credit risk and sustainability performance. Incorporating ESG scoring enhances the predictive accuracy of credit ratings by identifying non-financial risks that may impact an issuer's long-term creditworthiness and resilience.

Climate Risk Weighting

Credit rating agencies increasingly incorporate climate risk weighting into their assessments, evaluating how environmental factors impact an issuer's long-term financial stability and creditworthiness. ESG scoring complements this by quantifying a company's exposure to climate-related risks and opportunities, influencing investor decisions and risk management strategies in sustainable finance.

Greenium Adjustment

Credit rating primarily evaluates a company's creditworthiness based on financial stability and risk, while ESG scoring assesses environmental, social, and governance performance, influencing investor decisions through factors like Greenium adjustment, where green bonds may receive preferential yield spreads due to sustainable impact. The Greenium adjustment reflects the market's willingness to accept lower returns for environmentally friendly investments, integrating ESG metrics directly into credit pricing.

Transition Risk Premium

Credit rating models quantify financial risk based on historical creditworthiness and debt repayment capacity, whereas ESG scoring evaluates environmental, social, and governance factors influencing long-term sustainability and reputational risk. Transition risk premium integrates into credit spreads by accounting for potential financial losses linked to regulatory changes and market shifts during the low-carbon transition, reflecting heightened uncertainty in credit risk assessments.

Double Materiality Scoring

Credit rating evaluates an entity's financial risk and default potential, while ESG scoring assesses environmental, social, and governance impacts reflecting sustainability performance; double materiality scoring integrates both financial materiality and impact materiality by linking creditworthiness with a firm's broader societal and environmental footprint. This approach enables investors to gauge the financial risks from ESG factors alongside the entity's tangible contributions to sustainable development, enhancing decision-making in sustainable finance.

Sustainability-Linked Ratings

Sustainability-linked credit ratings integrate Environmental, Social, and Governance (ESG) factors to provide a comprehensive assessment of a company's financial health and long-term sustainability performance. These ratings influence investor decisions by quantifying how effectively companies manage ESG risks alongside traditional credit risk metrics.

ESG Differential Impact

Credit ratings primarily assess a company's creditworthiness and default risk based on financial metrics, while ESG scoring evaluates environmental, social, and governance factors influencing long-term sustainability and ethical impact. The ESG differential impact highlights how non-financial ESG risks and opportunities can affect credit risk profiles, potentially altering borrowing costs and investment decisions.

Credit ESG Overlay

Credit ESG overlay integrates environmental, social, and governance factors into credit rating assessments, enhancing risk evaluation by reflecting a company's sustainability practices alongside traditional financial metrics. This approach improves predictive accuracy for credit defaults and aligns investment decisions with long-term value creation and regulatory expectations.

Carbon-adjusted Credit Spread

Carbon-adjusted credit spreads integrate ESG scoring with traditional credit ratings to reflect the financial risks associated with a company's carbon footprint, providing investors a more comprehensive risk assessment. This approach quantifies the potential cost of carbon-related liabilities, aligning credit risk analysis with sustainability metrics for improved long-term investment decisions.

ESG Controversy Signal

Credit rating primarily assesses a company's financial risk and creditworthiness, while ESG scoring evaluates environmental, social, and governance factors, with a critical focus on ESG controversy signals that highlight recent incidents or scandals impacting a firm's reputation and sustainability profile. Integrating ESG controversy signals into credit analysis enhances risk assessment by identifying potential liabilities that might affect long-term credit stability and investment decisions.

Credit Rating vs ESG Scoring Infographic

industrydif.com

industrydif.com