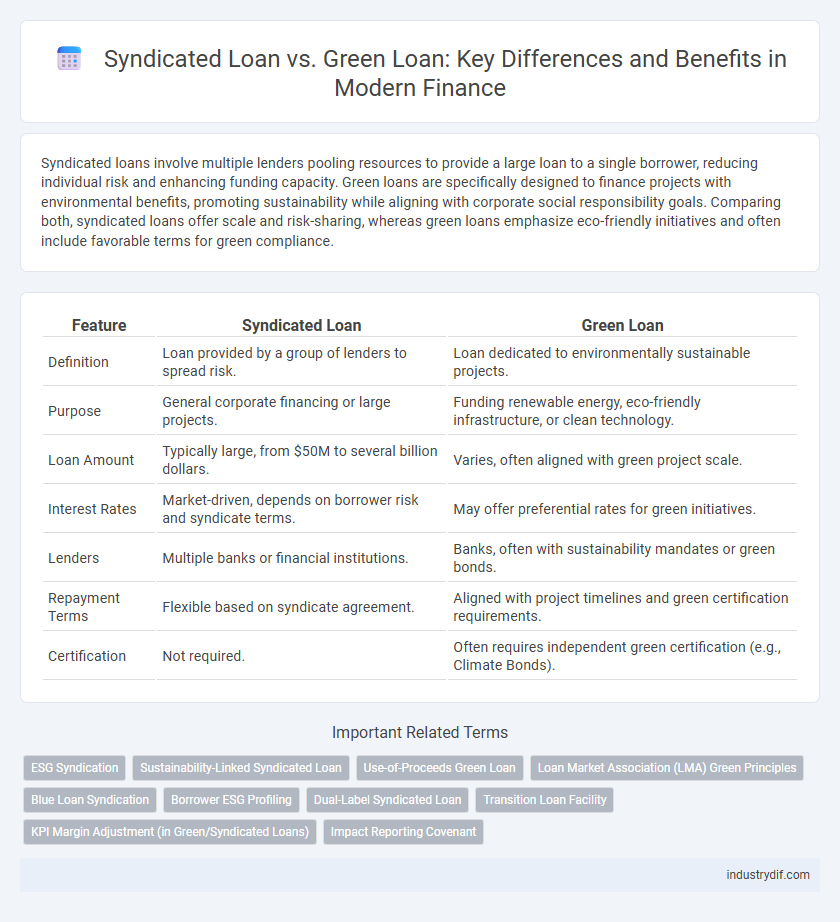

Syndicated loans involve multiple lenders pooling resources to provide a large loan to a single borrower, reducing individual risk and enhancing funding capacity. Green loans are specifically designed to finance projects with environmental benefits, promoting sustainability while aligning with corporate social responsibility goals. Comparing both, syndicated loans offer scale and risk-sharing, whereas green loans emphasize eco-friendly initiatives and often include favorable terms for green compliance.

Table of Comparison

| Feature | Syndicated Loan | Green Loan |

|---|---|---|

| Definition | Loan provided by a group of lenders to spread risk. | Loan dedicated to environmentally sustainable projects. |

| Purpose | General corporate financing or large projects. | Funding renewable energy, eco-friendly infrastructure, or clean technology. |

| Loan Amount | Typically large, from $50M to several billion dollars. | Varies, often aligned with green project scale. |

| Interest Rates | Market-driven, depends on borrower risk and syndicate terms. | May offer preferential rates for green initiatives. |

| Lenders | Multiple banks or financial institutions. | Banks, often with sustainability mandates or green bonds. |

| Repayment Terms | Flexible based on syndicate agreement. | Aligned with project timelines and green certification requirements. |

| Certification | Not required. | Often requires independent green certification (e.g., Climate Bonds). |

Definition of Syndicated Loan

A syndicated loan is a financing arrangement where multiple lenders collaborate to provide a single borrower with a large loan, spreading the risk among participants. This type of loan is commonly used by corporations and governments for substantial capital needs, facilitating access to larger funds than a single lender could supply. Compared to green loans, which specifically finance environmentally sustainable projects, syndicated loans offer broader usage for diverse business and infrastructure purposes.

Definition of Green Loan

A green loan is a financing instrument specifically designated for projects that promote environmental sustainability, such as renewable energy, energy efficiency, and pollution prevention initiatives. Unlike syndicated loans, which pool funds from multiple lenders for various corporate purposes, green loans are strictly earmarked to support eco-friendly and climate-resilient investments. These loans often require borrowers to meet specific environmental criteria, verified by third-party assessments or certification standards.

Key Features of Syndicated Loans

Syndicated loans involve multiple lenders pooling resources to provide large-scale financing, spreading risk among participants while offering borrowers access to substantial capital. These loans typically feature a lead arranger who coordinates terms, negotiations, and disbursement, ensuring streamlined administration and compliance. Syndicated loans support diverse financing needs, including corporate acquisitions, infrastructure projects, and refinancing, with flexible structuring options tailored to borrower credit profiles and market conditions.

Key Features of Green Loans

Green loans are specialized financing instruments designed to fund projects with clear environmental benefits, such as renewable energy, energy efficiency, and pollution prevention. They often require borrowers to meet specific sustainability criteria, verified through certifications or third-party assessments, ensuring alignment with environmental goals. Compared to syndicated loans, green loans typically offer more attractive terms tied to the borrower's environmental performance, promoting sustainable development within the financial sector.

Differences in Loan Structure

Syndicated loans involve multiple lenders pooling resources to provide a large loan, distributing risk and allowing borrowers to access substantial capital, while green loans are specifically earmarked for environmentally sustainable projects and may involve tailored reporting requirements. Unlike syndicated loans that focus on diverse financing needs, green loans emphasize loan structures that support sustainability goals, often with incentives linked to environmental performance metrics. Syndicated loans typically have complex negotiations due to multiple parties, whereas green loans prioritize transparency and adherence to green standards in their contractual terms.

Environmental Impact Considerations

Syndicated loans involve multiple lenders providing capital to a single borrower, often used for large-scale projects with varied risk profiles, but they do not inherently prioritize environmental impact. Green loans specifically target environmentally sustainable projects, requiring borrowers to meet strict environmental criteria and utilize funds exclusively for eco-friendly initiatives, thereby promoting green finance principles. The environmental impact considerations of green loans are embedded in their eligibility and reporting standards, ensuring measurable benefits such as reduced carbon emissions and enhanced resource efficiency, unlike traditional syndicated loans.

Qualification Criteria and Documentation

Syndicated loans require extensive qualification criteria including the borrower's creditworthiness, financial stability, and risk profile, supported by comprehensive documentation such as credit agreements, covenants, and due diligence reports. Green loans demand additional environmental eligibility criteria aligned with internationally recognized standards like the Green Loan Principles, with documentation emphasizing the use of proceeds, impact reporting, and independent verification of environmental benefits. Both loan types necessitate rigorous documentation, but green loans uniquely integrate sustainability compliance and monitoring frameworks.

Risk Assessment and Management

Syndicated loans involve multiple lenders sharing the risk, providing diversification and enhanced credit risk assessment through collective due diligence, whereas green loans require stringent environmental risk evaluations aligned with sustainability criteria, often integrating impact assessments into financial risk management. The risk management of syndicated loans emphasizes credit exposure distribution and borrower repayment capacity, while green loans focus on compliance with environmental standards, potential regulatory changes, and reputational risks associated with greenwashing. Effective risk assessment for both types incorporates financial, operational, and sector-specific factors to ensure loan performance and alignment with institutional risk appetite.

Market Trends and Growth in 2024

Syndicated loans continue to dominate the corporate financing landscape in 2024, driven by rising demand for large-scale capital projects and refinancing needs, with the global market expected to exceed $5 trillion. Green loans are experiencing exponential growth, growing at an estimated CAGR of 15% as ESG criteria influence investor preferences and corporate sustainability strategies. Market analysis highlights that financial institutions are increasingly integrating green financing into syndicated loan structures to cater to ESG-conscious borrowers and regulatory frameworks.

Choosing Between Syndicated and Green Loans

Choosing between syndicated loans and green loans depends on the borrower's project goals and sustainability commitments. Syndicated loans offer diversified funding from multiple lenders, ideal for large-scale projects requiring significant capital and risk-sharing. Green loans target environmentally friendly initiatives by providing favorable terms linked to sustainability criteria, attracting companies focused on reducing carbon footprints and meeting ESG standards.

Related Important Terms

ESG Syndication

ESG syndication integrates environmental, social, and governance criteria into syndicated loans, promoting sustainable investment through collective risk-sharing among multiple lenders. Green loans specifically fund projects with positive environmental impacts, leveraging syndication to scale capital towards renewable energy, clean technology, and resource-efficient initiatives.

Sustainability-Linked Syndicated Loan

Sustainability-linked syndicated loans integrate environmental, social, and governance (ESG) performance targets into traditional syndicated loan structures, incentivizing borrowers to achieve measurable sustainability goals while benefiting from lower interest rates. Unlike green loans, which finance specific environmentally friendly projects, these loans tie financial terms directly to overall corporate sustainability performance, enhancing accountability and long-term impact.

Use-of-Proceeds Green Loan

Syndicated loans involve multiple lenders sharing the credit risk and providing large-scale financing for diverse projects, whereas green loans specifically allocate funds to environmentally sustainable initiatives, with the Use-of-Proceeds green loan model ensuring transparent and dedicated funding exclusively for green projects such as renewable energy, energy efficiency, and pollution prevention. This targeted financial instrument supports corporate sustainability goals by enabling borrowers to finance eco-friendly assets while attracting investors focused on environmental, social, and governance (ESG) criteria.

Loan Market Association (LMA) Green Principles

The Loan Market Association (LMA) Green Principles provide a standardized framework for green loans, ensuring transparency and environmental sustainability throughout the lending process. Unlike syndicated loans, which involve multiple lenders sharing the risk without specific environmental criteria, green loans under LMA guidelines require the proceeds to be exclusively used for environmentally beneficial projects, promoting accountability and impact measurement in the finance sector.

Blue Loan Syndication

Blue loan syndication represents a specialized subset of syndicated loans, focusing on financing projects that support ocean sustainability, such as marine conservation and clean water initiatives. Compared to traditional syndicated and green loans, blue loans integrate environmental impact metrics specific to aquatic ecosystems, attracting investors committed to blue economy goals.

Borrower ESG Profiling

Syndicated loans typically involve multiple lenders sharing risk, allowing borrowers to leverage collective capital for large-scale financing, while green loans specifically finance projects with positive environmental impacts, supporting borrowers' ESG profiling through targeted sustainability criteria. Borrowers utilizing green loans demonstrate a commitment to environmental, social, and governance (ESG) standards, enhancing their reputation and aligning with investor demands for responsible financing.

Dual-Label Syndicated Loan

Dual-label syndicated loans combine the broad capital-raising capabilities of syndicated loans with the sustainability criteria of green loans, enabling borrowers to access diversified financing while meeting environmental, social, and governance (ESG) targets. These hybrid instruments attract a wider investor base by offering both traditional credit risk profiles and dedicated green loan benefits, aligning financial performance with corporate sustainability objectives.

Transition Loan Facility

Transition loan facilities serve as crucial financial instruments bridging traditional syndicated loans and green loans by funding companies' sustainability transitions. These facilities enable borrowers to secure capital while implementing environmental, social, and governance (ESG) criteria, facilitating a gradual shift toward green financing within syndicated loan structures.

KPI Margin Adjustment (in Green/Syndicated Loans)

Margin adjustment in syndicated loans primarily depends on overall credit risk, borrower leverage, and market conditions, whereas green loans incorporate specific sustainability KPIs such as carbon emission reduction or renewable energy targets that directly influence margin discounts or step-ups. The presence of these environmental performance indicators in green loans fosters incentive-driven margin adjustments, aligning financial costs with the borrower's achievement of predefined green objectives.

Impact Reporting Covenant

Syndicated loans typically require detailed impact reporting covenants that ensure transparent tracking of financial and operational metrics across multiple lenders, while green loans focus impact reporting covenants on environmental outcomes aligned with sustainability goals and Green Bond Principles. Both financial instruments leverage these covenants to enhance accountability, but green loan covenants emphasize measurable environmental performance indicators such as carbon emissions reduction and renewable energy utilization.

Syndicated Loan vs Green Loan Infographic

industrydif.com

industrydif.com