Wire transfers provide a secure method for sending large sums across domestic and international banks, typically completing within one to two business days. Real-time payments enable instant fund transfers between accounts, ensuring immediate availability and enhancing liquidity for businesses and individuals. Choosing between wire transfer and real-time payment depends on factors like transaction speed, cost, and the geographical scope of the payment.

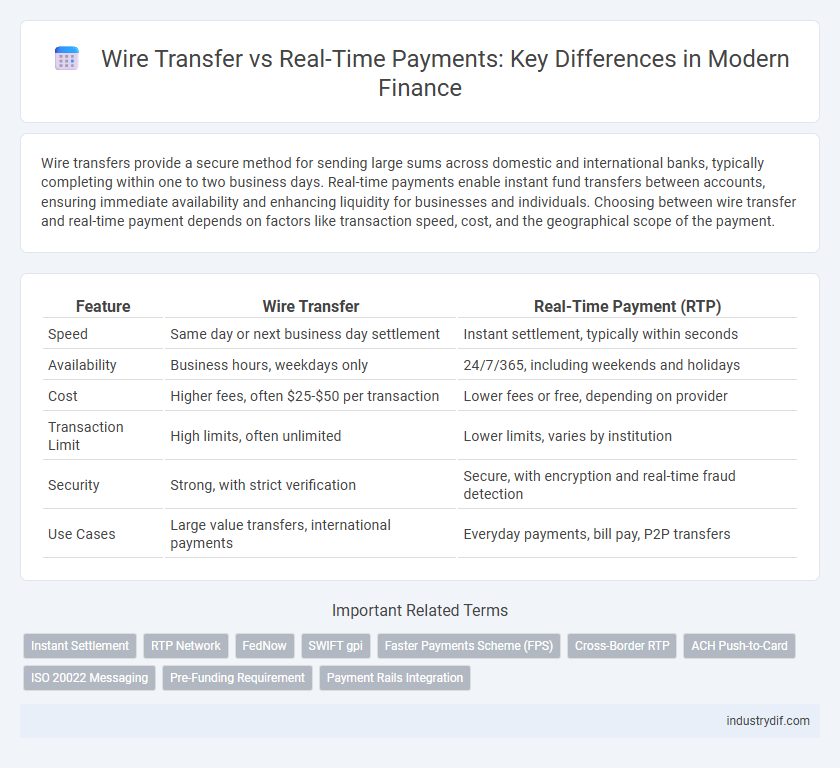

Table of Comparison

| Feature | Wire Transfer | Real-Time Payment (RTP) |

|---|---|---|

| Speed | Same day or next business day settlement | Instant settlement, typically within seconds |

| Availability | Business hours, weekdays only | 24/7/365, including weekends and holidays |

| Cost | Higher fees, often $25-$50 per transaction | Lower fees or free, depending on provider |

| Transaction Limit | High limits, often unlimited | Lower limits, varies by institution |

| Security | Strong, with strict verification | Secure, with encryption and real-time fraud detection |

| Use Cases | Large value transfers, international payments | Everyday payments, bill pay, P2P transfers |

Introduction to Wire Transfer and Real-Time Payment

Wire transfers are a traditional electronic method of transferring funds between banks, often involving intermediary institutions and requiring several hours to days for settlement. Real-time payments (RTP) enable instant fund transfers between bank accounts, providing immediate availability of funds and enhanced transaction transparency. Both systems play crucial roles in modern finance, with wire transfers suited for high-value, cross-border transactions, while RTP is optimized for rapid, domestic payments.

Key Differences Between Wire Transfer and Real-Time Payment

Wire transfers are typically used for high-value, one-time transactions and involve intermediaries, resulting in processing times ranging from a few hours to several days. Real-time payments enable instant fund transfers 24/7, supporting lower amounts and often integrating directly with digital wallets or apps. While wire transfers usually incur higher fees and require detailed beneficiary information, real-time payments offer cost-effective, immediate settlement with simplified identification protocols.

Transaction Speed: Wire Transfer vs Real-Time Payment

Wire transfers typically complete within one to two business days, while real-time payments process almost instantly, often within seconds. The faster settlement time of real-time payments improves cash flow management and reduces liquidity risk for businesses. Wire transfers, while reliable for large-value transactions, lack the immediacy necessary for time-sensitive payments compared to real-time payment networks.

Cost Comparison: Fees and Charges

Wire transfers typically involve higher fees, often ranging from $15 to $50 per transaction for domestic transfers and up to $75 or more for international transfers, reflecting intermediaries' costs and currency conversion charges. Real-time payments usually incur lower fees or are free, as they leverage modern automated clearing houses that reduce operational costs and eliminate correspondent banking fees. Evaluating these cost differences is crucial for businesses and individuals aiming to optimize transaction expenses and cash flow efficiency.

Security Features and Fraud Prevention

Wire transfers employ robust encryption protocols and multi-factor authentication to ensure secure transaction processing, reducing the risk of unauthorized access. Real-time payments integrate advanced fraud detection algorithms and real-time monitoring systems that analyze transaction patterns to prevent fraudulent activities promptly. Both systems utilize secure communication channels and compliance with regulatory standards like AML and KYC to enhance security and minimize fraud risks effectively.

Accessibility and Availability

Wire transfers typically require bank account details and may be limited to business hours and banking days, restricting accessibility for urgent transactions. Real-time payments operate 24/7, providing immediate fund transfers anytime, which enhances availability for both individuals and businesses. This continuous accessibility makes real-time payments a preferred choice for instant liquidity and on-demand financial operations.

Use Cases: When to Choose Wire Transfer or Real-Time Payment

Wire transfers are ideal for high-value transactions requiring enhanced security, such as real estate purchases or business-to-business payments, due to their widespread acceptance and reliability. Real-time payments excel in urgent, low-value scenarios like retail purchases, bill payments, or peer-to-peer transfers where instant fund availability enhances user experience. Choosing between wire transfers and real-time payments depends on transaction speed, amount, cost, and the urgency of fund accessibility.

Regulatory Compliance and Oversight

Wire transfers are subject to stringent regulatory frameworks such as the Bank Secrecy Act and Anti-Money Laundering (AML) regulations, requiring financial institutions to conduct thorough due diligence and reporting to prevent fraud and illicit activities. Real-time payments operate under evolving regulatory standards that emphasize immediate transaction monitoring, enhanced transparency, and adherence to faster settlement obligations mandated by entities like NACHA and the Federal Reserve. Both payment methods necessitate rigorous compliance protocols, but real-time payments demand advanced technological controls to meet the heightened oversight of instant fund transfers.

Impact on Businesses and Consumers

Wire transfers provide businesses and consumers a reliable method for high-value, cross-border payments, though they typically involve higher fees and slower processing times. Real-time payments enable instant settlement, enhancing cash flow for businesses and improving convenience and liquidity management for consumers through 24/7 availability. The choice impacts transaction costs, speed, and operational efficiency, influencing financial planning and customer satisfaction.

Future Trends in Funds Transfer Methods

Real-time payment systems are rapidly advancing with increased adoption of blockchain technology and artificial intelligence to enhance transaction speed and security. Wire transfers remain crucial for high-value international transactions but face pressure from next-generation payment platforms offering lower costs and instantaneous settlement. Future trends indicate a convergence of traditional banking infrastructure with innovative digital solutions, enabling seamless, cross-border fund transfers with reduced friction and improved transparency.

Related Important Terms

Instant Settlement

Wire transfers typically require several hours to days for settlement, while real-time payments offer instant settlement by enabling funds to be transferred and accessed within seconds. Instant settlement through real-time payment systems enhances liquidity management and reduces counterparty risk compared to the delayed processing of traditional wire transfers.

RTP Network

The RTP Network enables real-time payment settlements, offering immediate fund availability and enhanced transactional transparency compared to traditional wire transfers, which typically involve longer processing times and higher fees. Financial institutions leveraging the RTP system benefit from improved liquidity management and reduced operational risks through instant payment confirmation and irrevocability.

FedNow

FedNow offers real-time payment settlements enabling instant transfers and improved liquidity management compared to traditional wire transfers, which typically take several hours to process and clear funds. By integrating FedNow, financial institutions can enhance payment speed, reduce transaction costs, and provide customers with 24/7 access to immediate funds availability across the United States.

SWIFT gpi

SWIFT gpi revolutionizes international wire transfers by enabling faster, more transparent cross-border payments with end-to-end tracking and same-day settlement in many corridors. Real-Time Payments excel in domestic transactions by providing instant clearing and accessibility but lack the global reach and standardized traceability features inherent to SWIFT gpi.

Faster Payments Scheme (FPS)

The Faster Payments Scheme (FPS) enables real-time payments in the UK, offering immediate fund transfers typically within seconds, contrasting with traditional wire transfers that often take several hours to days to clear. FPS streamlines domestic transactions with lower fees and enhanced convenience, making it a preferred solution for urgent financial transfers compared to the slower, costlier wire transfer methods.

Cross-Border RTP

Cross-border real-time payments (RTP) enable instant settlement of funds across international borders, significantly reducing transaction times compared to traditional wire transfers, which often take several days due to intermediary banks and clearing processes. Financial institutions leveraging RTP benefit from enhanced transparency, lower transaction costs, and improved liquidity management in global payments.

ACH Push-to-Card

Wire transfers provide reliable, high-value fund transfers with same-day or next-day settlement, while real-time payments, particularly ACH Push-to-Card, enable instant crediting of funds directly to debit or prepaid cards, enhancing transaction speed and consumer convenience. ACH Push-to-Card leverages the ACH network for faster settlement compared to standard ACH debits, supporting immediate access to funds for payroll, disbursements, and peer-to-peer payments.

ISO 20022 Messaging

ISO 20022 messaging standard enhances both wire transfers and real-time payments by enabling richer data exchange and improved interoperability across financial institutions. Real-time payments leverage ISO 20022 to facilitate instant fund transfers with detailed remittance information, while wire transfers benefit from standardized messaging that supports global transaction efficiency and compliance.

Pre-Funding Requirement

Wire transfers require pre-funding as funds must be available in the sender's account before the transfer initiates, ensuring the payment clears through correspondent banks. Real-time payments eliminate pre-funding needs by allowing instant debiting and crediting of accounts via a central clearing system, enabling immediate fund availability.

Payment Rails Integration

Wire transfer systems rely on established banking networks like SWIFT and Fedwire, offering secure but often slower settlement times suited for high-value transactions. Real-time payment rails, such as RTP and Faster Payments, enable instantaneous fund transfers and immediate settlement, demanding advanced integration capabilities for seamless payment processing and liquidity management.

Wire Transfer vs Real-Time Payment Infographic

industrydif.com

industrydif.com