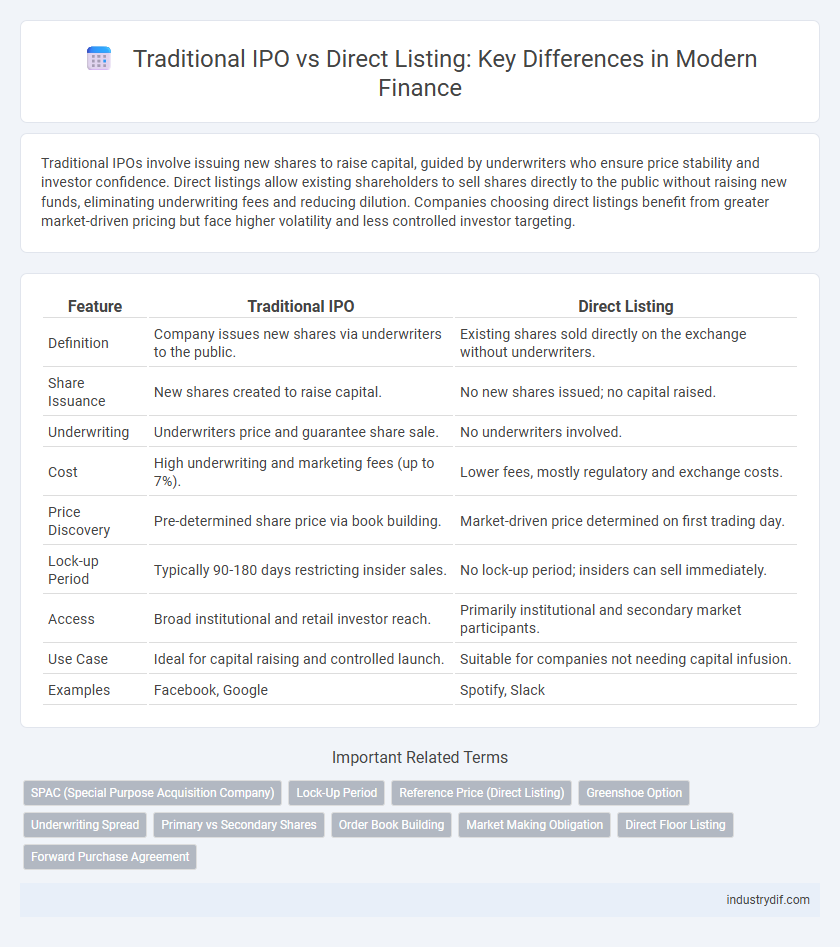

Traditional IPOs involve issuing new shares to raise capital, guided by underwriters who ensure price stability and investor confidence. Direct listings allow existing shareholders to sell shares directly to the public without raising new funds, eliminating underwriting fees and reducing dilution. Companies choosing direct listings benefit from greater market-driven pricing but face higher volatility and less controlled investor targeting.

Table of Comparison

| Feature | Traditional IPO | Direct Listing |

|---|---|---|

| Definition | Company issues new shares via underwriters to the public. | Existing shares sold directly on the exchange without underwriters. |

| Share Issuance | New shares created to raise capital. | No new shares issued; no capital raised. |

| Underwriting | Underwriters price and guarantee share sale. | No underwriters involved. |

| Cost | High underwriting and marketing fees (up to 7%). | Lower fees, mostly regulatory and exchange costs. |

| Price Discovery | Pre-determined share price via book building. | Market-driven price determined on first trading day. |

| Lock-up Period | Typically 90-180 days restricting insider sales. | No lock-up period; insiders can sell immediately. |

| Access | Broad institutional and retail investor reach. | Primarily institutional and secondary market participants. |

| Use Case | Ideal for capital raising and controlled launch. | Suitable for companies not needing capital infusion. |

| Examples | Facebook, Google | Spotify, Slack |

Overview of Traditional IPO and Direct Listing

Traditional IPO involves underwriting by investment banks, pricing shares, and allocating them to institutional investors through a roadshow process. Direct listing allows companies to bypass underwriters, letting existing shareholders sell shares directly on the public market without issuing new shares. This method offers immediate liquidity but often lacks the price stabilization provided in an IPO.

Key Differences Between Traditional IPOs and Direct Listings

Traditional IPOs involve underwriters who set an initial share price and manage the issuance process, providing price stabilization and capital raising through new shares. Direct listings bypass underwriters, allowing companies to sell existing shares directly on the exchange without issuing new shares, often reducing costs and dilution. Key differences include pricing mechanisms, capital issuance, and underwriting roles, affecting market impact and investor access.

Process Flow: Traditional IPOs Explained

Traditional IPOs involve a company working with underwriters to determine the offer price, conduct roadshows, and allocate shares to institutional investors before public trading begins. This process typically includes filing extensive regulatory documents with the SEC, generating investor interest, and managing price stabilization post-listing. The structured sequence aims to maximize capital raised while providing price certainty and initial market support.

How Direct Listings Work

Direct listings enable companies to sell existing shares directly on a public exchange without issuing new stock or raising capital, unlike traditional IPOs. This process allows for immediate liquidity for current shareholders and eliminates underwriter fees, providing cost efficiency. Market demand solely determines the share price during the opening trade, offering transparent price discovery.

Costs and Fees Comparison

Traditional IPOs typically involve underwriter fees averaging 7% of gross proceeds, along with expenses for marketing and legal services, leading to higher overall costs. Direct listings bypass underwriters, significantly reducing fees but may still incur legal and advisory costs, generally resulting in lower total expenses. Companies choosing direct listings benefit from cost efficiency but must carefully manage the lack of underwriter support in pricing and market stabilization.

Regulatory and Disclosure Requirements

Traditional IPOs require extensive regulatory filings with the SEC, including a detailed S-1 prospectus outlining financials and risk factors, ensuring comprehensive disclosure to protect investors. Direct listings bypass underwriters but still mandate SEC registration and financial disclosures, though they often face less pressure to conform to marketing demands. Both methods enforce strict compliance with securities laws, but traditional IPOs involve greater regulatory scrutiny due to the involvement of underwriters and roadshows.

Impact on Share Price and Market Volatility

Traditional IPOs often lead to significant initial price surges due to underwriter price stabilization and investor demand, while direct listings typically exhibit immediate price discovery reflecting true market value without lock-up periods. Market volatility tends to be higher in direct listings as supply and demand dynamically influence share price without underwriter support or price stabilization mechanisms. The absence of underwriters in direct listings can result in wider trading ranges and more pronounced price fluctuations compared to the relatively controlled price movements during the traditional IPO process.

Suitability for Different Company Types

Traditional IPOs are ideal for companies seeking substantial capital infusion and extensive underwriting support, commonly favored by firms with established financial histories and a need for price stabilization. Direct listings suit mature companies with strong brand recognition and ample cash reserves, aiming to provide liquidity to existing shareholders without diluting ownership. High-growth startups often prefer IPOs for fundraising, while tech firms with steady cash flows lean towards direct listings for cost efficiency and market-driven pricing.

Case Studies: Successful IPOs and Direct Listings

Spotify's 2018 direct listing showcased a pioneering approach, allowing existing shareholders to sell shares directly to the public without underwriting fees, resulting in rapid market access and liquidity. In contrast, Airbnb's 2020 traditional IPO, managed by multiple underwriters, ensured price stability and significant capital raising through strategic pricing and roadshows. These case studies highlight how direct listings prioritize shareholder flexibility and cost savings, while traditional IPOs emphasize capital influx and controlled market entry.

Pros and Cons: Choosing the Right Path for Going Public

Traditional IPO offers companies underwriter support, price stabilization, and capital raising but involves higher fees and lengthy regulatory processes. Direct listing provides lower costs, immediate liquidity, and market-driven pricing but lacks guaranteed capital infusion and can lead to price volatility. Selecting the optimal route depends on factors like capital needs, market conditions, and shareholder objectives.

Related Important Terms

SPAC (Special Purpose Acquisition Company)

Traditional IPOs often involve underwriters to price and sell shares, whereas SPAC mergers bypass this process by allowing private companies to go public through a reverse merger with the SPAC, providing faster access to capital and reduced regulatory hurdles. Unlike direct listings, SPACs offer private firms certainty on valuation and capital raise upfront, making them a popular alternative in the evolving financial markets.

Lock-Up Period

Traditional IPOs impose a lock-up period typically lasting 90 to 180 days, restricting insiders from selling shares immediately post-listing to stabilize stock prices. In contrast, direct listings eliminate the lock-up period, allowing immediate trading of existing shares and increased liquidity for early investors.

Reference Price (Direct Listing)

The reference price in a direct listing is a benchmark established by the exchange to indicate a fair market value before trading begins, contrasting with traditional IPOs where the offering price is set by underwriters. This mechanism enhances transparency and price discovery by reflecting real-time market demand without underwriter price stabilization.

Greenshoe Option

The Greenshoe option, a key feature in traditional IPOs, allows underwriters to purchase additional shares up to 15% of the offering to stabilize the stock price post-launch. Direct listings typically do not include a Greenshoe mechanism, resulting in higher price volatility due to the absence of underwriter price stabilization.

Underwriting Spread

The underwriting spread in a traditional IPO typically ranges from 5% to 7% of the gross proceeds, representing fees paid to investment banks for underwriting and distributing shares. Direct listings eliminate underwriting spreads altogether, allowing companies to save on these fees but forgo the price stabilization and marketing support provided by underwriters.

Primary vs Secondary Shares

Traditional IPOs primarily involve issuing new primary shares to raise capital, resulting in shareholder dilution, while direct listings solely facilitate the sale of existing secondary shares by current investors without creating new shares or raising funds. This distinction impacts ownership structure, with IPOs expanding equity and direct listings providing liquidity without altering the company's equity base.

Order Book Building

Order book building in a traditional IPO involves underwriters collecting investor demand to set a pricing range, ensuring price discovery and allocation control. In contrast, a direct listing omits this phase, allowing market-driven price discovery through real-time trading without predetermined price or allocations.

Market Making Obligation

Traditional IPOs require underwriters to provide market making obligations by stabilizing share prices through buying shares post-offering, whereas direct listings lack formal market making obligations, relying instead on natural market demand and liquidity. This difference significantly impacts price volatility and investor confidence during the initial trading period.

Direct Floor Listing

Direct Floor Listing enables companies to bypass intermediaries and underwriters, reducing costs and allowing existing shareholders to sell shares immediately on the exchange. This method enhances market transparency and price discovery by facilitating direct transactions on the trading floor compared to traditional IPO processes.

Forward Purchase Agreement

A Forward Purchase Agreement (FPA) in a Traditional IPO involves underwriters committing to buy shares at a set price before the public offering, providing price stability and guaranteed capital for the company; this contrasts with Direct Listings, where no such agreements exist, leading to more price volatility as shares are directly sold on the open market without guaranteed demand. FPAs reduce underwriting risk and ensure focused capital raising, making them a key differentiator in the structured financing process of Traditional IPOs.

Traditional IPO vs Direct Listing Infographic

industrydif.com

industrydif.com