Merchant banking specializes in providing financial services such as underwriting, loan syndication, and advisory for mergers and acquisitions to corporations, typically operating through dedicated financial institutions. Embedded finance integrates financial services directly into non-financial platforms or apps, enabling businesses to offer banking, lending, or payment solutions seamlessly within their user experience. While merchant banking targets corporate clients with complex financial needs, embedded finance focuses on enhancing customer engagement by embedding financial functionality into everyday products and services.

Table of Comparison

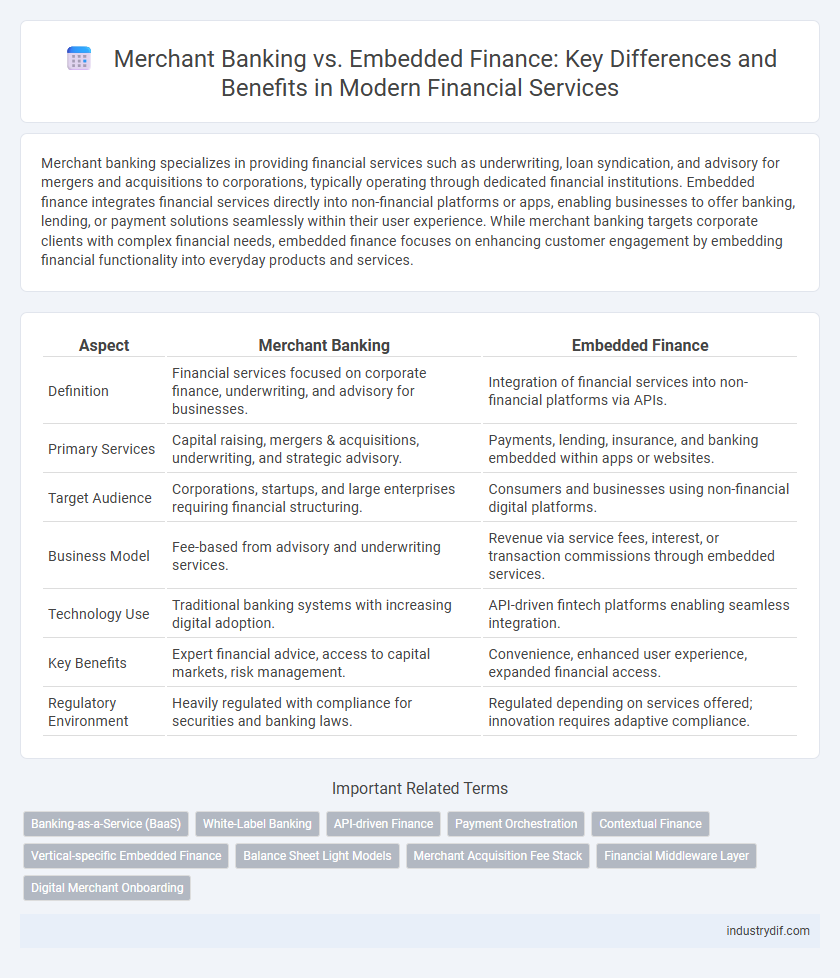

| Aspect | Merchant Banking | Embedded Finance |

|---|---|---|

| Definition | Financial services focused on corporate finance, underwriting, and advisory for businesses. | Integration of financial services into non-financial platforms via APIs. |

| Primary Services | Capital raising, mergers & acquisitions, underwriting, and strategic advisory. | Payments, lending, insurance, and banking embedded within apps or websites. |

| Target Audience | Corporations, startups, and large enterprises requiring financial structuring. | Consumers and businesses using non-financial digital platforms. |

| Business Model | Fee-based from advisory and underwriting services. | Revenue via service fees, interest, or transaction commissions through embedded services. |

| Technology Use | Traditional banking systems with increasing digital adoption. | API-driven fintech platforms enabling seamless integration. |

| Key Benefits | Expert financial advice, access to capital markets, risk management. | Convenience, enhanced user experience, expanded financial access. |

| Regulatory Environment | Heavily regulated with compliance for securities and banking laws. | Regulated depending on services offered; innovation requires adaptive compliance. |

Introduction to Merchant Banking

Merchant banking involves providing specialized financial services such as corporate advisory, underwriting, and capital raising for mergers and acquisitions. It targets high-net-worth clients and corporations seeking expert guidance in complex financial transactions. Merchant banks play a crucial role in facilitating equity and debt financing, enabling business growth and restructuring.

Understanding Embedded Finance

Embedded finance integrates financial services directly into non-financial platforms, allowing businesses to offer payment, lending, or insurance solutions without traditional banking intermediation. Unlike merchant banking, which focuses on underwriting, fundraising, and advisory for corporate clients, embedded finance enhances customer experience by embedding seamless financial products within everyday digital ecosystems. This innovation drives increased accessibility, reduces transaction friction, and expands revenue streams across industries.

Key Functions of Merchant Banking

Merchant banking primarily focuses on services such as underwriting, portfolio management, corporate advisory, and facilitating mergers and acquisitions for businesses. It plays a critical role in capital raising by providing expertise in issuing stocks and bonds, and managing initial public offerings (IPOs). Merchant banks also offer structured finance solutions, risk management strategies, and private equity investments to support corporate growth and financial restructuring.

Core Features of Embedded Finance

Embedded finance integrates financial services directly into non-financial platforms, enabling seamless customer experiences without redirecting to traditional banks. Core features include API-driven integration, real-time transactions, and personalized financial products tailored to user behavior within the host platform. This contrasts with merchant banking's focus on advisory, capital raising, and specialized financing for corporate clients.

Differences in Service Delivery

Merchant banking offers specialized financial services such as underwriting, loan syndication, and advisory for mergers and acquisitions, typically targeting corporate clients through direct relationship management. Embedded finance integrates financial services like payments, lending, or insurance directly into non-financial platforms, enabling seamless user experiences within apps or websites without the need for traditional banking intermediaries. The key difference in service delivery lies in merchant banking's personalized, high-touch approach versus embedded finance's automated, technology-driven integration within everyday digital ecosystems.

Regulatory Considerations in Both Models

Merchant banking operates under stringent regulatory frameworks including capital adequacy requirements, anti-money laundering (AML) laws, and securities regulations enforced by authorities like the SEC and FINRA. Embedded finance, integrating financial services into non-financial platforms, faces evolving regulatory challenges particularly in data privacy, consumer protection laws, and partnership compliance between tech firms and financial institutions. Both models require robust regulatory adherence to mitigate risks associated with fraud, systemic stability, and customer data security in a rapidly changing financial landscape.

Impact on Customer Experience

Merchant banking offers personalized financial products and advisory services that enhance client trust and long-term relationships, while embedded finance integrates seamless financial services into non-financial platforms, significantly improving convenience and speed for customers. Embedded finance leverages APIs to provide real-time access to payments, lending, and insurance within user journeys, reducing friction and increasing satisfaction. Merchant banking emphasizes customized solutions, whereas embedded finance prioritizes accessibility and instant financial interactions, transforming how customers engage with financial services.

Technology Integration in Finance

Merchant banking leverages advanced technologies such as AI-driven analytics and blockchain to provide tailored financial solutions and facilitate complex transactions for corporate clients. Embedded finance integrates seamlessly with digital platforms using APIs, enabling non-financial businesses to offer financial services like payments, lending, and insurance directly within their ecosystems. Both approaches rely heavily on cloud computing and cybersecurity technology to ensure scalable, secure, and efficient financial operations.

Future Trends: Merchant Banking vs Embedded Finance

Future trends indicate a significant shift as embedded finance integrates financial services directly into non-financial platforms, enhancing customer experience and operational efficiency. Merchant banking will continue to specialize in complex financial advisory, mergers, and capital raising, but its growth may be outpaced by the scalability and accessibility of embedded finance solutions. Advancements in AI, open banking APIs, and digital wallets are driving embedded finance adoption, reshaping traditional merchant banking models to remain competitive in a rapidly evolving financial ecosystem.

Choosing the Right Model for Your Business

Merchant banking provides specialized financial services such as fundraising, acquisitions, and advisory for established enterprises, offering tailored solutions that enhance capital efficiency and strategic growth. Embedded finance integrates financial services directly into non-financial platforms or products, enabling seamless customer experiences and driving revenue through digital innovation and ecosystem expansion. Selecting the right model depends on business scale, customer engagement strategy, and the desired level of financial service integration to maximize operational agility and market competitiveness.

Related Important Terms

Banking-as-a-Service (BaaS)

Merchant banking focuses on providing capital and advisory services to corporations for mergers, acquisitions, and underwriting, leveraging extensive financial expertise and direct market interaction. Embedded finance, powered by Banking-as-a-Service (BaaS) platforms, integrates banking services directly into non-financial digital ecosystems, enabling seamless access to payment processing, lending, and account management within third-party applications.

White-Label Banking

White-label banking enables merchant banks to integrate embedded finance solutions directly into their platforms, enhancing customer experience by offering seamless access to tailored financial products such as loans, payments, and investment services under their own brand. This approach reduces reliance on traditional banks, accelerates time-to-market for new offerings, and drives revenue growth through customized, scalable fintech innovations.

API-driven Finance

Merchant banking traditionally offers specialized financial services such as underwriting and advisory for mergers and acquisitions, while embedded finance leverages API-driven platforms to seamlessly integrate financial products like payments, lending, and insurance directly into non-financial apps. API-driven finance enables real-time data exchange and automation, enhancing customer experience and operational efficiency by embedding banking functionalities into ecosystems beyond traditional financial institutions.

Payment Orchestration

Merchant banking specializes in complex financial services such as underwriting, loan syndication, and corporate advisory, while embedded finance integrates payment orchestration directly into non-financial platforms to streamline transactions and enhance user experience. Payment orchestration in embedded finance optimizes payment routing, reduces transaction costs, and supports seamless multi-channel payments, contrasting with merchant banking's traditional, more segmented financial service approach.

Contextual Finance

Merchant banking specializes in providing financial advisory services, underwriting, and capital raising for corporate clients, emphasizing tailored solutions for mergers and acquisitions. Embedded finance integrates financial services directly into non-financial platforms, enabling seamless payments, lending, and insurance within everyday business operations.

Vertical-specific Embedded Finance

Merchant banking specializes in providing tailored financial services such as underwriting, advisory, and capital raising for specific industries, whereas vertical-specific embedded finance integrates financial products directly into industry-specific platforms, enabling seamless payments, lending, and insurance solutions within sector-focused ecosystems. Vertical-specific embedded finance drives enhanced customer engagement and operational efficiency in sectors like healthcare, retail, and real estate by embedding credit, payment processing, and risk management tools into core business workflows.

Balance Sheet Light Models

Merchant banking typically requires substantial capital investment and large balance sheets to underwrite and hold positions, whereas embedded finance operates with balance sheet light models by integrating financial services into platforms without extensive asset holdings. This lean approach allows embedded finance providers to leverage technology and partnerships, minimizing risk exposure and capital requirements while enhancing scalability and user experience.

Merchant Acquisition Fee Stack

Merchant acquisition fee stack in merchant banking typically includes upfront fees, transaction fees, and recurring account maintenance charges that generate steady revenue streams, whereas embedded finance integrates these fees directly into platform services, often reducing visible costs to merchants while enhancing customer experience and scalability for providers. Understanding the detailed fee composition--including onboarding, payment processing, and value-added services--is essential for optimizing profit margins and competitive positioning in both models.

Financial Middleware Layer

Merchant banking primarily operates through bespoke financial services and capital market activities, while embedded finance integrates banking capabilities seamlessly into non-financial platforms via a robust financial middleware layer that enables real-time data processing and API orchestration. The financial middleware layer acts as a crucial enabler for embedded finance by bridging diverse banking services with digital ecosystems, enhancing scalability, compliance, and seamless user experiences.

Digital Merchant Onboarding

Digital merchant onboarding in merchant banking leverages comprehensive due diligence and tailored financial products to support business growth and capital access, ensuring compliance with regulatory standards. Embedded finance streamlines this process by integrating financial services directly into digital platforms, enabling faster onboarding and seamless access to payments, lending, and insurance without leaving the merchant's operational environment.

Merchant Banking vs Embedded Finance Infographic

industrydif.com

industrydif.com