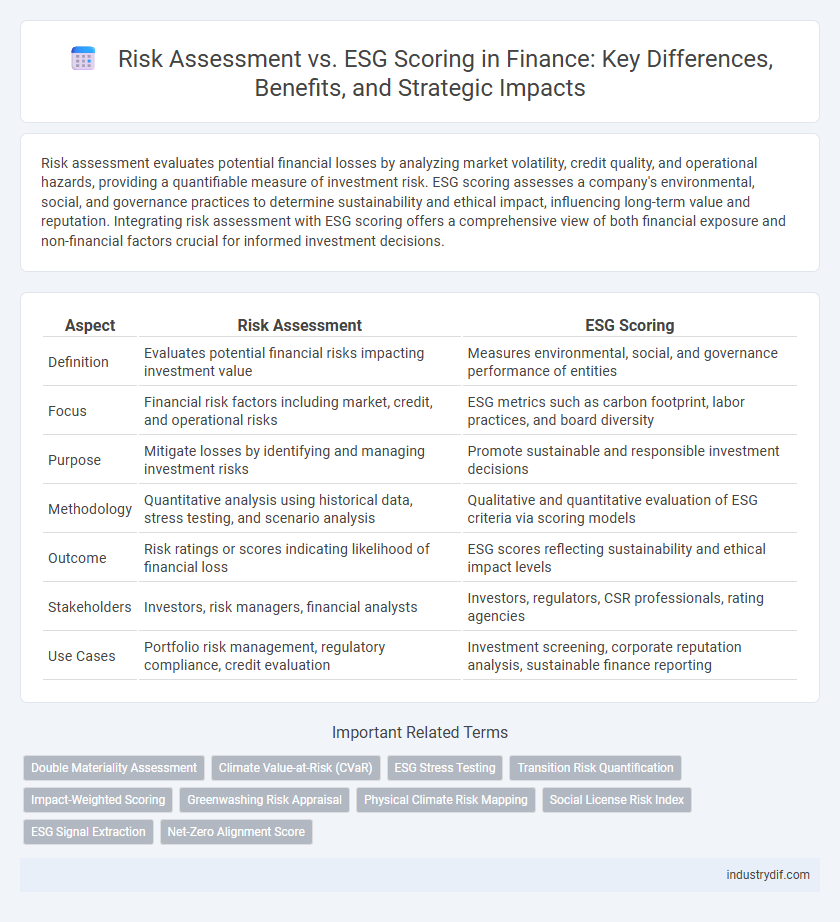

Risk assessment evaluates potential financial losses by analyzing market volatility, credit quality, and operational hazards, providing a quantifiable measure of investment risk. ESG scoring assesses a company's environmental, social, and governance practices to determine sustainability and ethical impact, influencing long-term value and reputation. Integrating risk assessment with ESG scoring offers a comprehensive view of both financial exposure and non-financial factors crucial for informed investment decisions.

Table of Comparison

| Aspect | Risk Assessment | ESG Scoring |

|---|---|---|

| Definition | Evaluates potential financial risks impacting investment value | Measures environmental, social, and governance performance of entities |

| Focus | Financial risk factors including market, credit, and operational risks | ESG metrics such as carbon footprint, labor practices, and board diversity |

| Purpose | Mitigate losses by identifying and managing investment risks | Promote sustainable and responsible investment decisions |

| Methodology | Quantitative analysis using historical data, stress testing, and scenario analysis | Qualitative and quantitative evaluation of ESG criteria via scoring models |

| Outcome | Risk ratings or scores indicating likelihood of financial loss | ESG scores reflecting sustainability and ethical impact levels |

| Stakeholders | Investors, risk managers, financial analysts | Investors, regulators, CSR professionals, rating agencies |

| Use Cases | Portfolio risk management, regulatory compliance, credit evaluation | Investment screening, corporate reputation analysis, sustainable finance reporting |

Understanding Risk Assessment in Finance

Risk assessment in finance involves analyzing potential threats to investment portfolios by evaluating credit risk, market volatility, liquidity challenges, and operational uncertainties. This process uses quantitative models and historical data to estimate the probability and impact of adverse financial events, enabling institutions to implement mitigation strategies. Unlike ESG scoring, which measures environmental, social, and governance performance, risk assessment focuses on identifying and managing financial exposures to safeguard assets and ensure regulatory compliance.

Defining ESG Scoring: Key Components

ESG scoring evaluates a company's performance across Environmental, Social, and Governance criteria, measuring sustainability and ethical impact. Key components include carbon emissions, labor practices, board diversity, and transparency, providing investors with insights beyond traditional financial risk. This scoring helps identify non-financial risks and opportunities, complementing standard risk assessment frameworks in investment decisions.

Methodologies: Risk Assessment vs ESG Scoring

Risk assessment methodologies primarily analyze quantitative financial data and historical risk events to evaluate potential future losses and exposure, emphasizing credit, market, and operational risks. ESG scoring frameworks integrate qualitative and quantitative criteria, assessing environmental impact, social responsibility, and governance practices through company disclosures, third-party audits, and sustainability reports. These distinct approaches utilize different data sources and analytical tools, with risk assessments focusing on financial stability and ESG scoring targeting broader sustainability and ethical performance metrics.

Data Sources for Risk and ESG Evaluation

Risk assessment relies heavily on quantitative financial data, credit reports, market volatility indexes, and historical loss records to evaluate potential threats to investment or operational stability. ESG scoring incorporates a broader spectrum of data sources, including environmental impact reports, social responsibility audits, corporate governance disclosures, and third-party sustainability ratings to measure non-financial performance. Both methodologies increasingly utilize big data analytics, satellite imagery, and real-time monitoring tools to enhance the accuracy and timeliness of their evaluations.

Regulatory Implications of Risk and ESG Scores

Regulatory frameworks increasingly mandate transparent Risk Assessment and ESG Scoring to ensure financial institutions address systemic risks and sustainability criteria. Risk assessments focus on identifying credit, market, and operational risks with regulatory compliance tied to capital adequacy and stress testing, while ESG scores evaluate environmental, social, and governance factors critical for meeting evolving disclosure requirements from bodies like the SEC and EU SFDR. Non-compliance with these regulations can lead to significant penalties and reputation risk, emphasizing the need for integrated risk and ESG management systems aligned with global regulatory standards.

Impact on Investment Decision-Making

Risk assessment evaluates potential financial losses by analyzing market volatility, credit risk, and operational challenges, directly influencing portfolio diversification and asset allocation. ESG scoring measures environmental, social, and governance factors to identify sustainable and ethical investment opportunities, affecting long-term value and reputational risk. Integrating risk assessment with ESG scoring enhances investment decision-making by aligning financial performance goals with sustainability criteria and regulatory compliance.

Integration of ESG Scoring into Risk Frameworks

Integrating ESG scoring into risk assessment frameworks enhances the identification of non-financial risks linked to environmental, social, and governance factors, enabling a comprehensive evaluation of potential impacts on asset value. Advanced analytics and ESG data enable risk managers to quantify exposure to climate change, regulatory shifts, and social controversies, improving predictive accuracy for portfolio resilience. This fusion supports investors in aligning risk management strategies with sustainable finance goals, promoting long-term value creation and regulatory compliance.

Challenges in Standardizing Scores

Risk assessment and ESG scoring face significant challenges in standardizing scores due to varying methodologies, data quality, and reporting frameworks across industries and regions. The lack of a unified taxonomy and inconsistent metrics complicate comparability and reliability for investors seeking consistent insights. Addressing these disparities requires collaborative efforts among regulators, data providers, and financial institutions to establish transparent, harmonized standards.

The Future of Risk Assessment and ESG in Finance

The future of risk assessment in finance will increasingly integrate ESG scoring as key metrics drive sustainable investment decisions and regulatory compliance. Advanced analytics and AI-powered models will enhance the precision of risk evaluations by incorporating environmental, social, and governance factors alongside traditional financial indicators. This convergence supports resilient portfolio management aimed at long-term value creation and mitigating non-financial risks in dynamic markets.

Best Practices for Combining Risk and ESG Scoring

Integrating risk assessment with ESG scoring enhances investment decision-making by providing a comprehensive analysis of financial, environmental, social, and governance factors. Best practices involve aligning ESG metrics with traditional risk models to identify potential long-term risks and opportunities that impact asset valuation and portfolio resilience. Leveraging advanced data analytics and stakeholder engagement ensures a dynamic approach to managing both financial risks and sustainability outcomes effectively.

Related Important Terms

Double Materiality Assessment

Double Materiality Assessment integrates traditional Risk Assessment with ESG Scoring by evaluating both financial risks and broader environmental, social, and governance impacts on company value. This approach ensures comprehensive analysis of how external ESG factors affect financial performance and how corporate activities influence society and the environment.

Climate Value-at-Risk (CVaR)

Climate Value-at-Risk (CVaR) quantifies potential financial losses driven by climate-related risks, offering a forward-looking metric that integrates transition and physical climate risks into traditional risk assessment models. Unlike ESG scoring, which evaluates corporate sustainability performance across multiple criteria, CVaR provides a more precise, financially grounded measure enabling investors to gauge exposure to climate-induced market volatility and regulatory impacts.

ESG Stress Testing

ESG stress testing integrates environmental, social, and governance factors into traditional risk assessment models to evaluate potential vulnerabilities under various adverse scenarios. This approach enables financial institutions to quantify ESG-related risks, enhance portfolio resilience, and align investment strategies with sustainability goals.

Transition Risk Quantification

Transition risk quantification in finance assesses the potential economic impact of shifting to a low-carbon economy, integrating factors such as regulatory changes, technological advancements, and market dynamics. Unlike ESG scoring, which broadly evaluates environmental, social, and governance performance, transition risk quantification provides a targeted analysis crucial for strategic risk management and investment decision-making.

Impact-Weighted Scoring

Impact-Weighted Scoring integrates financial risk assessment with Environmental, Social, and Governance (ESG) criteria by quantifying a company's social and environmental impacts in monetary terms, allowing investors to evaluate true value creation beyond traditional financial metrics. This approach enhances decision-making by translating ESG performance into tangible financial risks and opportunities, aligning investment strategies with sustainable and responsible growth objectives.

Greenwashing Risk Appraisal

Risk assessment in finance evaluates potential financial losses and operational threats, while ESG scoring measures a company's environmental, social, and governance performance. Greenwashing risk appraisal specifically targets the credibility and transparency of ESG claims to prevent misleading investors and ensure genuine sustainability practices.

Physical Climate Risk Mapping

Physical climate risk mapping integrates geographic and environmental data to assess potential financial impacts on assets due to climate change, offering detailed insights beyond traditional risk assessments. ESG scoring includes these risk factors but primarily serves as a broader sustainability metric, whereas physical climate risk mapping provides precise, location-specific evaluations critical for investment decisions.

Social License Risk Index

Risk assessment evaluates potential financial losses from various operational hazards, while ESG scoring measures corporate performance on environmental, social, and governance criteria; the Social License Risk Index specifically quantifies reputational and operational risks tied to community and stakeholder acceptance. Integrating the Social License Risk Index into risk assessment frameworks enhances investors' ability to gauge non-financial risks that impact long-term value and sustainability.

ESG Signal Extraction

Risk assessment integrates quantitative financial metrics with qualitative ESG signal extraction to identify potential vulnerabilities and opportunities linked to environmental, social, and governance factors. ESG scoring systematically analyzes data points such as carbon emissions, labor practices, and board diversity to enhance predictive accuracy in risk models and drive sustainable investment decisions.

Net-Zero Alignment Score

Risk assessment evaluates financial and operational threats impacting investment stability, while ESG scoring measures environmental, social, and governance factors, with the Net-Zero Alignment Score specifically quantifying a company's progress toward reducing carbon emissions to achieve net-zero targets. Incorporating the Net-Zero Alignment Score into risk assessment enhances investment decisions by identifying climate-related risks and opportunities aligned with sustainable finance principles.

Risk Assessment vs ESG Scoring Infographic

industrydif.com

industrydif.com