Mutual funds pool investor capital to be managed by professional fund managers, offering diversified portfolios and regulatory oversight, which ensures transparency and investor protection. Decentralized Autonomous Organizations (DAOs) operate on blockchain technology, enabling decentralized decision-making through smart contracts without centralized management, enhancing transparency and reducing intermediary costs. Investors seeking traditional regulatory safeguards may prefer mutual funds, whereas those prioritizing innovation and autonomy might opt for DAOs in their investment strategy.

Table of Comparison

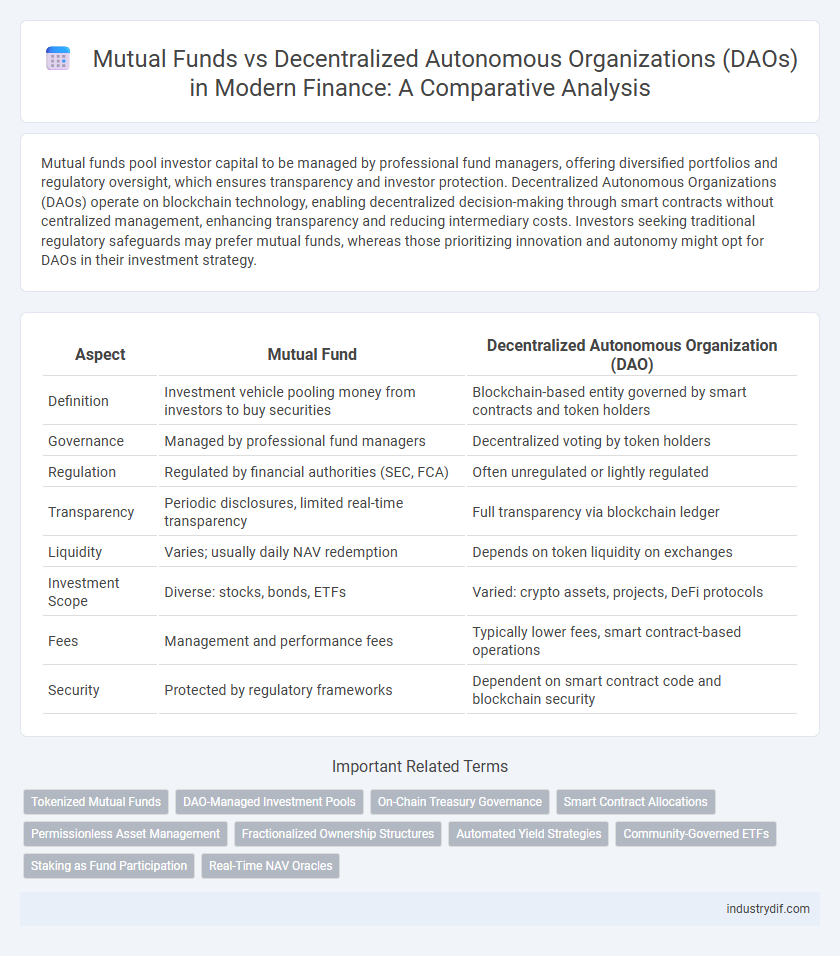

| Aspect | Mutual Fund | Decentralized Autonomous Organization (DAO) |

|---|---|---|

| Definition | Investment vehicle pooling money from investors to buy securities | Blockchain-based entity governed by smart contracts and token holders |

| Governance | Managed by professional fund managers | Decentralized voting by token holders |

| Regulation | Regulated by financial authorities (SEC, FCA) | Often unregulated or lightly regulated |

| Transparency | Periodic disclosures, limited real-time transparency | Full transparency via blockchain ledger |

| Liquidity | Varies; usually daily NAV redemption | Depends on token liquidity on exchanges |

| Investment Scope | Diverse: stocks, bonds, ETFs | Varied: crypto assets, projects, DeFi protocols |

| Fees | Management and performance fees | Typically lower fees, smart contract-based operations |

| Security | Protected by regulatory frameworks | Dependent on smart contract code and blockchain security |

Definition of Mutual Fund and DAO

A Mutual Fund is an investment vehicle that pools capital from multiple investors to purchase a diversified portfolio of securities managed by professional fund managers. A Decentralized Autonomous Organization (DAO) operates on blockchain technology, enabling participants to collectively make decisions and manage assets through smart contracts without centralized control. Both structures offer shared investment opportunities, but Mutual Funds rely on centralized management, whereas DAOs emphasize decentralized governance and transparency.

Key Structural Differences

Mutual funds operate under centralized management with regulatory oversight, pooling investors' capital to purchase diversified assets, while Decentralized Autonomous Organizations (DAOs) run on blockchain technology, allowing members to govern and make decisions through smart contracts without intermediaries. Mutual funds have a hierarchical structure led by fund managers, whereas DAOs rely on token-based voting systems, enabling decentralized control and transparent operations. The regulatory framework for mutual funds ensures investor protection, contrasting with the emerging and less regulated environment for DAOs, which poses varying levels of risk and compliance challenges.

Governance Models Compared

Mutual funds operate under centralized governance where fund managers and regulatory bodies oversee investment decisions and compliance, ensuring accountability and risk management. Decentralized Autonomous Organizations (DAOs) utilize blockchain-based governance with token-holder voting mechanisms that distribute decision-making power and promote transparency through smart contracts. This shift from centralized control in mutual funds to decentralized, algorithm-driven governance in DAOs transforms investor participation and operational dynamics in financial management.

Investment Strategies and Objectives

Mutual funds employ centralized investment strategies managed by professional fund managers aiming for diversified portfolios to optimize risk-adjusted returns. Decentralized Autonomous Organizations (DAOs) utilize blockchain technology to enable community-driven, transparent investment decisions often focused on innovation and emerging assets. While mutual funds prioritize regulatory compliance and steady growth, DAOs emphasize decentralization, liquidity, and disruptive financial opportunities.

Transparency and Accountability

Mutual funds operate under strict regulatory frameworks with transparent reporting requirements, ensuring accountability through regular audits and fiduciary oversight. Decentralized Autonomous Organizations (DAOs) leverage blockchain technology to provide transparent, immutable transaction records, enabling participants to verify activities in real time. While mutual funds rely on centralized management for accountability, DAOs use decentralized governance models to distribute decision-making authority among token holders.

Regulatory Compliance and Legal Status

Mutual funds operate under strict regulatory frameworks established by financial authorities such as the SEC, ensuring investor protection and transparency through mandatory disclosures and compliance requirements. Decentralized Autonomous Organizations (DAOs), however, face uncertain legal status and minimal regulatory oversight due to their blockchain-based structure, creating challenges in jurisdiction, accountability, and adherence to traditional financial laws. The evolving regulatory landscape for DAOs contrasts with the well-defined compliance mechanisms governing mutual funds, impacting investor confidence and operational legitimacy.

Risk Management Approaches

Mutual funds implement risk management through professional portfolio diversification, regulatory oversight, and stringent compliance with financial laws to mitigate market volatility and safeguard investor assets. Decentralized Autonomous Organizations (DAOs) rely on blockchain technology and smart contracts to automate transparency and enforce preset risk parameters, yet they face unique challenges due to inherent code vulnerabilities and governance decentralization. While mutual funds benefit from centralized expertise and risk controls, DAOs prioritize decentralized consensus mechanisms, which can introduce both innovative risk mitigation and novel exposure to systemic risks in the financial ecosystem.

Accessibility for Investors

Mutual funds offer broad accessibility to investors through regulated platforms and low entry thresholds, allowing individuals to pool capital managed by professional fund managers. Decentralized Autonomous Organizations (DAOs) provide accessibility via blockchain technology, enabling global participation without intermediaries and offering fractional ownership through tokenization. While mutual funds require KYC compliance and regulatory oversight, DAOs offer greater inclusivity but face challenges with regulatory ambiguity and technological proficiency barriers.

Fees and Cost Structures

Mutual funds typically charge management fees ranging from 0.5% to 2% of assets under management, along with potential sales loads and administrative expenses that impact overall returns. Decentralized Autonomous Organizations (DAOs) generally operate with lower overhead due to blockchain automation, often requiring minimal transaction fees and no traditional management charges. The cost structure of DAOs emphasizes transparency and efficiency, reducing intermediary costs compared to traditional mutual fund fee models.

Future Trends in Asset Management

Future trends in asset management reveal a shift towards integrating decentralized autonomous organizations (DAOs) to enhance transparency and democratize investment decisions compared to traditional mutual funds. Blockchain technology enables DAOs to facilitate real-time governance and reduce intermediaries, increasing efficiency and security in managing collective assets. Innovations in smart contracts and tokenization are expected to reshape asset liquidity and investor participation, driving the evolution of decentralized finance within the investment landscape.

Related Important Terms

Tokenized Mutual Funds

Tokenized mutual funds leverage blockchain technology to offer decentralized ownership and increased liquidity compared to traditional mutual funds, enabling investors to trade fund shares as digital tokens on secondary markets. Decentralized Autonomous Organizations (DAOs) manage these tokenized funds through smart contracts, enhancing transparency, reducing intermediaries, and automating governance processes in finance.

DAO-Managed Investment Pools

DAO-managed investment pools leverage blockchain technology to enable decentralized, transparent asset management without traditional intermediaries, offering investors real-time access to fund performance and governance through tokenized voting rights. Unlike mutual funds, DAOs provide increased liquidity and democratized decision-making, reducing management fees and enhancing trust through immutable smart contract execution.

On-Chain Treasury Governance

On-chain treasury governance in mutual funds typically relies on centralized management with regulatory oversight, ensuring structured investment strategies and compliance, whereas Decentralized Autonomous Organizations (DAOs) utilize blockchain-based smart contracts for transparent, automated decision-making and direct token holder participation in fund allocation. This shift enables DAOs to enhance liquidity, reduce administrative costs, and offer real-time governance updates, contrasting with the slower, less transparent processes of traditional mutual funds.

Smart Contract Allocations

Smart contract allocations in decentralized autonomous organizations (DAOs) enable automated, transparent, and tamper-proof investment management without intermediaries, contrasting with mutual funds that rely on centralized managers for portfolio decisions. This blockchain-based innovation enhances real-time asset allocation efficiency and reduces operational costs, offering investors decentralized control and programmable financial strategies.

Permissionless Asset Management

Mutual funds operate under centralized regulatory frameworks requiring formal permissions, whereas Decentralized Autonomous Organizations (DAOs) enable permissionless asset management through blockchain technology, allowing investors to participate without intermediaries. This permissionless nature enhances transparency, reduces operational costs, and democratizes investment opportunities by leveraging smart contracts for automated governance and fund management.

Fractionalized Ownership Structures

Fractionalized ownership structures in mutual funds allow investors to pool capital and obtain proportional shares of a diversified portfolio managed by financial experts, providing liquidity and regulatory oversight. Decentralized Autonomous Organizations (DAOs) leverage blockchain technology to enable transparent, programmable fractional ownership where token holders participate directly in governance and asset management without intermediaries.

Automated Yield Strategies

Mutual funds rely on centralized management teams to optimize automated yield strategies through algorithm-driven portfolio adjustments and risk assessments, leveraging human expertise and regulatory compliance. Decentralized Autonomous Organizations (DAOs) utilize blockchain-based smart contracts for fully automated, transparent yield generation, enabling decentralized decision-making and real-time strategy execution without intermediaries.

Community-Governed ETFs

Community-governed ETFs leverage decentralized autonomous organizations (DAOs) to enable collective decision-making and transparent management, contrasting with traditional mutual funds that rely on centralized fund managers. This innovative structure allows token holders to vote on portfolio adjustments and fee structures, enhancing investor control and aligning with decentralized finance (DeFi) principles.

Staking as Fund Participation

Mutual funds pool investor capital managed by professional fund managers, offering diversified portfolios, while Decentralized Autonomous Organizations (DAOs) enable participants to stake tokens directly, granting governance rights and automated fund participation through smart contracts. Staking in DAOs provides transparent, decentralized control of assets with real-time voting power, contrasting traditional mutual fund structures reliant on centralized decision-making and periodic reporting.

Real-Time NAV Oracles

Mutual funds rely on centralized real-time NAV oracles to provide accurate and timely net asset value calculations essential for investor transactions and portfolio valuation. In contrast, Decentralized Autonomous Organizations (DAOs) utilize blockchain-based oracles to deliver transparent, tamper-resistant real-time NAV data, enhancing trust and efficiency in asset management without centralized intermediaries.

Mutual Fund vs Decentralized Autonomous Organization Infographic

industrydif.com

industrydif.com