Wire transfers offer secure, large-amount transactions that may take several hours to complete, making them ideal for international or high-value payments. Real-time payments provide instantaneous fund transfers, enhancing cash flow and allowing businesses to settle transactions immediately within domestic networks. Both methods serve distinct purposes, with wire transfers excelling in reliability and international reach, while real-time payments prioritize speed and accessibility for everyday transactions.

Table of Comparison

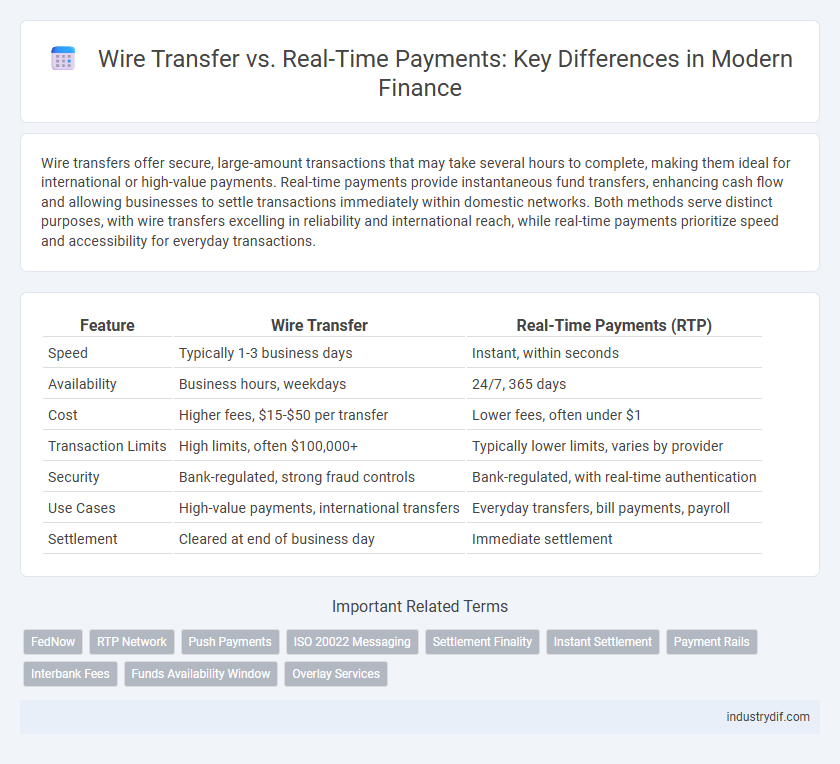

| Feature | Wire Transfer | Real-Time Payments (RTP) |

|---|---|---|

| Speed | Typically 1-3 business days | Instant, within seconds |

| Availability | Business hours, weekdays | 24/7, 365 days |

| Cost | Higher fees, $15-$50 per transfer | Lower fees, often under $1 |

| Transaction Limits | High limits, often $100,000+ | Typically lower limits, varies by provider |

| Security | Bank-regulated, strong fraud controls | Bank-regulated, with real-time authentication |

| Use Cases | High-value payments, international transfers | Everyday transfers, bill payments, payroll |

| Settlement | Cleared at end of business day | Immediate settlement |

Introduction to Wire Transfers and Real-Time Payments

Wire transfers are traditional electronic funds transfers between banks or financial institutions, often used for high-value or international transactions, with settlement times ranging from same day to several days. Real-time payments enable instant or near-instantaneous fund transfers, available 24/7, providing immediate availability of funds and improved cash flow management for businesses and individuals. Both methods involve secure networks, but real-time payments leverage modern technology for faster processing and enhanced payment transparency.

Key Differences Between Wire Transfers and Real-Time Payments

Wire transfers are typically processed through established banking networks like SWIFT or Fedwire, often taking hours to a day to complete, whereas real-time payments are executed instantaneously, 24/7, via platforms such as RTP or Faster Payments Service. Wire transfers usually involve higher fees and require detailed beneficiary information, while real-time payments are cost-effective with simpler recipient requirements. Security protocols differ, with wire transfers relying heavily on intermediary banks and real-time payments employing advanced encryption and fraud detection technologies.

Speed of Funds Settlement: Wire vs. RTP

Wire transfers typically settle funds within the same business day, often requiring several hours depending on the banks involved and cut-off times. Real-time payments (RTP) offer instantaneous settlement, enabling funds to be available to recipients within seconds, 24/7, including weekends and holidays. This immediacy of RTP systems significantly reduces liquidity risk and enhances cash flow management compared to traditional wire transfers.

Costs and Fees: Wire Transfers Compared to RTP

Wire transfers typically incur higher fees, ranging from $15 to $50 per transaction, whereas Real Time Payments (RTP) often have lower or no fees, reducing overall transaction costs for businesses. Banks charge wire transfers for processing, intermediary handling, and international conversion, making them less cost-effective for frequent transfers. RTP networks leverage automated clearing houses and faster settlement systems, which streamline payments and minimize operational expenses.

Security Features in Wire Transfers and Real-Time Payments

Wire transfers utilize robust encryption protocols and multi-factor authentication to ensure the security of funds during transmission, minimizing risks of interception or fraud. Real-time payments incorporate tokenization and continuous transaction monitoring, enabling immediate fraud detection and prevention for instant fund transfers. Both systems employ secure communication channels and regulatory compliance to safeguard financial data, but wire transfers often offer enhanced security due to established verification processes.

Cross-Border Capabilities: Wire Transfers vs. RTP

Wire transfers dominate cross-border payments due to their wide global acceptance, supporting multiple currencies and SWIFT network integration for secure international transfers. Real-time payments (RTP) offer instant fund availability domestically but face limited adoption and infrastructure challenges across different countries, restricting cross-border capabilities. Financial institutions prioritize wire transfers for cross-border transactions despite RTP's speed advantage in local settlements.

Availability and Accessibility of Each Payment Method

Wire transfers are widely accessible through banks and financial institutions worldwide but often have limited availability outside regular business hours, causing delays of one to three business days. Real-time payments (RTP) operate 24/7, providing immediate fund availability and seamless accessibility via digital platforms and mobile apps. The continuous accessibility of RTP ensures faster liquidity for businesses and consumers compared to traditional wire transfers.

Use Cases: When to Use Wire Transfers vs. Real-Time Payments

Wire transfers are ideal for large-value transactions, international payments, and situations requiring guaranteed settlement and enhanced security, such as corporate payroll or real estate closings. Real-time payments excel in use cases demanding instant fund availability and high frequency, like retail purchases, bill payments, and peer-to-peer transfers. Selecting the appropriate method depends on transaction urgency, amount, cross-border requirements, and cost considerations.

Impact on Businesses: Choosing the Right Payment Solution

Wire transfers offer secure, high-value transactions ideal for large payments but typically involve higher fees and longer processing times, potentially impacting cash flow management for businesses. Real-time payments enable instant fund transfers with lower costs, enhancing liquidity and operational efficiency, which is crucial for small to medium-sized enterprises requiring fast access to capital. Businesses must evaluate transaction volume, speed requirements, and cost structure to determine whether wire transfers or real-time payments best align with their financial strategy and operational needs.

Future Trends in Electronic Payments: Wire vs. RTP

Future trends in electronic payments indicate a growing preference for Real-Time Payments (RTP) due to their instantaneous settlement and enhanced transparency compared to traditional wire transfers. Financial institutions are investing heavily in RTP infrastructure to support increased transaction volumes and enable seamless cross-border payments with reduced costs. Despite wire transfers' continued use for large-value and international transactions, RTP's scalability and integration with digital wallets position it as the dominant payment method in the evolving financial ecosystem.

Related Important Terms

FedNow

FedNow offers real-time payment processing, enabling nearly instantaneous settlement between banks within the United States, whereas traditional wire transfers typically require several hours or even days to complete. The FedNow Service enhances liquidity management and reduces payment delays by providing 24/7 availability and immediate funds availability, positioning it as a competitive alternative to slower, batch-processed wire transfers.

RTP Network

The RTP Network enables real-time payments, offering faster settlement and enhanced transaction transparency compared to traditional wire transfers, which typically involve longer processing times and higher fees. Utilizing the RTP system improves liquidity management for businesses by providing immediate funds availability and seamless integration with modern banking platforms.

Push Payments

Push payments such as wire transfers enable direct, sender-initiated fund transfers ensuring secure, high-value transactions typically settled within the same business day. Real-time payments (RTP) systems enhance push payments by offering instant clearing and settlement, 24/7 availability, and improved transparency, significantly boosting liquidity and cash flow efficiency for businesses.

ISO 20022 Messaging

ISO 20022 messaging enhances both wire transfers and real-time payments by standardizing financial data across global networks, improving interoperability and reducing errors. Real-time payments benefit from ISO 20022 through immediate settlement and enriched remittance information, while wire transfers gain improved transparency and efficiency in cross-border transactions.

Settlement Finality

Wire transfers offer guaranteed settlement finality, ensuring funds are irrevocably transferred once processed, which provides a high level of security and certainty for large transactions. Real-time payments settle instantly but may have limited or conditional finality depending on the payment system and regulatory framework, impacting risk management strategies.

Instant Settlement

Wire transfers typically settle within one to two business days, while real-time payments guarantee instant settlement, enhancing cash flow efficiency for businesses and consumers. Instant settlement in real-time payments reduces counterparty risk and enables immediate fund availability, revolutionizing liquidity management in financial operations.

Payment Rails

Wire transfers utilize established payment rails like SWIFT and Fedwire, offering secure, high-value transactions with settlement times ranging from hours to days. Real-time payments leverage faster rails such as RTP and Faster Payments Service (FPS), enabling instant funds transfer and round-the-clock availability for enhanced liquidity management.

Interbank Fees

Wire transfers typically incur higher interbank fees due to the involvement of multiple correspondent banks and legacy processing systems. Real-time payments significantly reduce interbank fees by utilizing modern, digital clearing networks that enable instant settlement and lower transactional costs.

Funds Availability Window

Wire transfers typically offer funds availability within the same business day, often settling in a few hours, whereas real-time payments provide immediate funds availability, enabling instant access to transferred money 24/7. The faster clearing system in real-time payments enhances liquidity management, reducing delays associated with traditional banking hours and batch processing in wire transfers.

Overlay Services

Wire transfer systems primarily rely on batch processing with slower settlement times, whereas Real-Time Payments (RTP) enable instantaneous fund transfers bolstered by overlay services such as request-for-payment and enhanced transaction messaging. Overlay services in RTP platforms improve transparency, reduce fraud risks, and facilitate richer data exchange, offering a significantly more efficient and secure payment infrastructure compared to traditional wire transfers.

Wire transfer vs Real time payments Infographic

industrydif.com

industrydif.com