Stocks represent traditional equity ownership in a company, granting shareholders voting rights and dividends based on corporate performance. Tokenized securities digitize these financial assets on blockchain platforms, providing enhanced liquidity, fractional ownership, and faster settlement times. This innovation bridges conventional investing with decentralized finance, expanding access and transparency in capital markets.

Table of Comparison

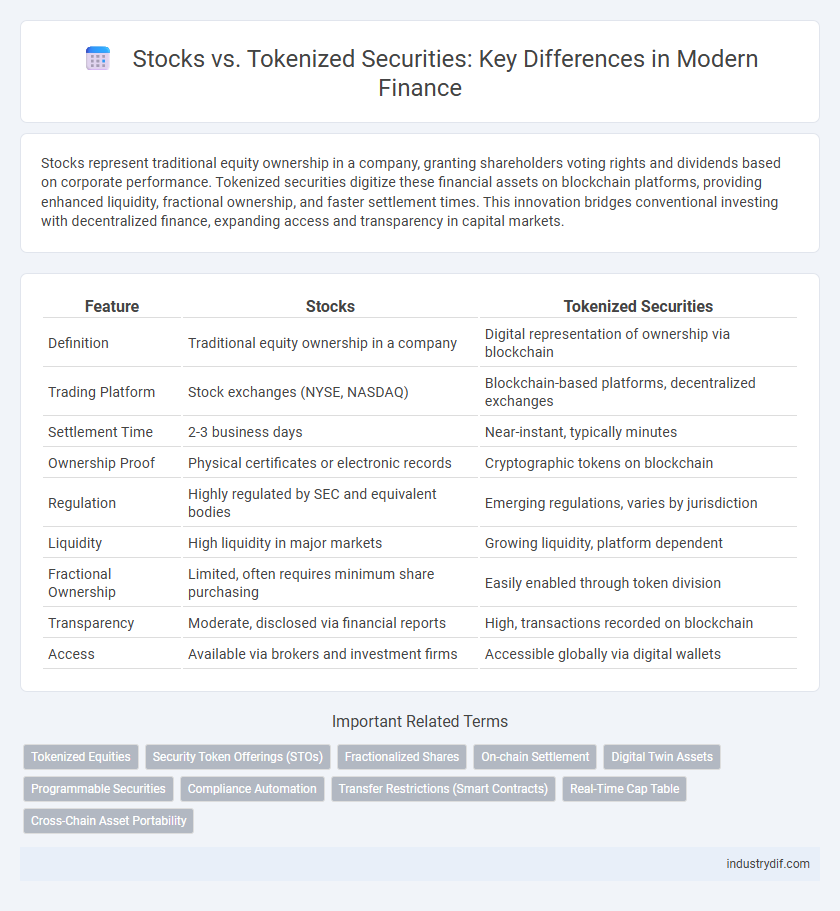

| Feature | Stocks | Tokenized Securities |

|---|---|---|

| Definition | Traditional equity ownership in a company | Digital representation of ownership via blockchain |

| Trading Platform | Stock exchanges (NYSE, NASDAQ) | Blockchain-based platforms, decentralized exchanges |

| Settlement Time | 2-3 business days | Near-instant, typically minutes |

| Ownership Proof | Physical certificates or electronic records | Cryptographic tokens on blockchain |

| Regulation | Highly regulated by SEC and equivalent bodies | Emerging regulations, varies by jurisdiction |

| Liquidity | High liquidity in major markets | Growing liquidity, platform dependent |

| Fractional Ownership | Limited, often requires minimum share purchasing | Easily enabled through token division |

| Transparency | Moderate, disclosed via financial reports | High, transactions recorded on blockchain |

| Access | Available via brokers and investment firms | Accessible globally via digital wallets |

Defining Stocks and Tokenized Securities

Stocks represent ownership shares in a corporation, granting shareholders rights to dividends and voting power in company decisions. Tokenized securities are digital representations of traditional financial assets, such as stocks or bonds, issued and traded on blockchain platforms, enabling fractional ownership and increased liquidity. Both instruments serve as investment vehicles but differ in regulatory frameworks and transactional efficiencies.

Key Differences Between Stocks and Tokenized Securities

Stocks represent traditional equity ownership in a corporation, governed by centralized exchanges and regulatory frameworks such as the SEC. Tokenized securities are blockchain-based digital assets that confer ownership rights similar to stocks but enable fractional ownership, enhanced liquidity, and 24/7 trading on decentralized platforms. Regulatory compliance, settlement speed, and transparency differ significantly, with tokenized securities offering programmable governance and real-time auditability through smart contracts.

Regulatory Landscape: Traditional vs. Blockchain Assets

Traditional stocks are subject to stringent regulations enforced by agencies like the SEC, ensuring investor protection through transparent reporting and compliance standards. Tokenized securities operate within a rapidly evolving regulatory landscape, where decentralized finance platforms must navigate emerging guidelines such as the SEC's framework for digital assets and anti-money laundering (AML) requirements. Regulatory uncertainty and jurisdictional differences pose significant challenges for blockchain-based securities, contrasting with the more established compliance infrastructure governing conventional stock markets.

Ownership Rights: Shares vs. Digital Tokens

Ownership rights in stocks grant shareholders traditional claims such as voting rights, dividends, and residual assets during liquidation, backed by regulatory frameworks like the SEC in the United States. Tokenized securities represent ownership digitally on a blockchain, enabling fractional ownership, faster settlement, and programmable compliance through smart contracts. Despite increased accessibility and liquidity, tokenized securities maintain legally enforceable rights comparable to traditional shares under securities law.

Liquidity and Accessibility in Secondary Markets

Stocks typically offer higher liquidity due to well-established exchanges like NYSE and NASDAQ, facilitating rapid buying and selling by a broad investor base. Tokenized securities, leveraging blockchain technology, enable 24/7 trading and fractional ownership, increasing accessibility for global investors and reducing entry barriers. Secondary markets for tokenized securities are emerging with decentralized exchanges, enhancing liquidity but still evolving compared to traditional stock markets.

Settlement and Transaction Speed Comparison

Settlement times for traditional stocks typically range from two to three business days, due to the reliance on centralized clearinghouses and regulatory compliance processes. Tokenized securities leverage blockchain technology to enable near-instant settlement, often completing transactions within minutes or even seconds, reducing counterparty risk and settlement costs. This accelerated transaction speed enhances liquidity and market efficiency compared to the conventional stock settlement framework.

Security and Custody Considerations

Stocks typically involve traditional custodians such as brokerage firms and regulated depositories, providing established security frameworks and investor protections under securities laws. Tokenized securities leverage blockchain technology to enable decentralized custody options, offering enhanced transparency and tamper-proof record-keeping but raising new challenges related to private key management and regulatory compliance. Security considerations in tokenized securities emphasize cryptographic safeguards and smart contract audits to mitigate cyber risks, whereas stocks rely on established legal infrastructures to safeguard asset ownership.

Globalization and Cross-Border Trading Potential

Tokenized securities enable seamless cross-border trading by leveraging blockchain technology, reducing settlement times from days to minutes and enhancing liquidity on a global scale. Traditional stocks face regulatory and operational barriers that limit access to international markets, while tokenized assets offer fractional ownership and 24/7 trading opportunities worldwide. This innovation expands investor reach, democratizes global finance, and fosters a more inclusive, borderless trading environment.

Risks and Challenges of Tokenized Securities

Tokenized securities present unique risks such as regulatory uncertainty, with varying compliance requirements across jurisdictions posing challenges for issuers and investors. Security vulnerabilities, including smart contract bugs and cyberattacks, increase the potential for fraud and loss of assets. Liquidity concerns arise due to limited adoption and fragmented trading platforms, affecting price discovery and the ability to exit positions promptly.

The Future Outlook: Integration of Traditional Stocks and Tokenization

The future of finance is poised to integrate traditional stocks with tokenized securities, enabling fractional ownership and enhanced liquidity in global markets. Blockchain technology ensures transparency and security, while regulatory frameworks are evolving to support seamless coexistence and interoperability between conventional equity and digital assets. This convergence promises increased accessibility for investors and streamlined capital formation processes, reshaping the landscape of investment opportunities.

Related Important Terms

Tokenized Equities

Tokenized equities represent a revolutionary development in finance by digitizing traditional stock ownership through blockchain technology, enabling fractional ownership, enhanced liquidity, and faster settlement times compared to conventional stocks. These digital securities comply with regulatory frameworks while providing investors increased transparency, reduced intermediaries, and access to global markets previously limited by traditional stock exchanges.

Security Token Offerings (STOs)

Security Token Offerings (STOs) represent a regulated method of raising capital by issuing blockchain-based tokens that signify ownership in traditional assets such as stocks or bonds. Unlike conventional stocks, STOs provide enhanced transparency, fractional ownership, and automated compliance through smart contracts, blending the benefits of securities regulation with blockchain technology.

Fractionalized Shares

Fractionalized shares in tokenized securities enable investors to buy and trade portions of high-value stocks, increasing market accessibility and liquidity. This digital approach leverages blockchain technology for transparent ownership, unlike traditional stock markets where fractional ownership often depends on brokerage services with limited flexibility.

On-chain Settlement

On-chain settlement for tokenized securities eliminates intermediaries by executing transactions directly on blockchain networks, significantly reducing settlement time from days to minutes compared to traditional stock exchanges. This blockchain-based process enhances transparency, auditability, and reduces counterparty risk, providing a more efficient and secure alternative to conventional stock settlement systems.

Digital Twin Assets

Tokenized securities create digital twin assets that replicate traditional stocks on blockchain, enabling faster settlement, enhanced transparency, and fractional ownership. These digital twins maintain legal compliance while providing liquidity and accessibility beyond conventional stock exchanges.

Programmable Securities

Tokenized securities offer programmable features through smart contracts, enabling automated dividend distribution, compliance checks, and real-time settlement, significantly enhancing efficiency over traditional stocks. This programmability allows for customizable governance rules and fractional ownership, attracting new investor demographics and improving liquidity in secondary markets.

Compliance Automation

Compliance automation in tokenized securities leverages smart contracts and blockchain technology to enforce regulatory requirements in real-time, reducing manual oversight and minimizing risks of non-compliance. Unlike traditional stocks, tokenized securities offer transparent, immutable transaction records and programmable compliance rules that streamline audits and reporting for regulators and issuers.

Transfer Restrictions (Smart Contracts)

Transfer restrictions in tokenized securities are enforced through programmable smart contracts, which automatically limit or approve transactions based on regulatory compliance and investor eligibility, enhancing security and transparency. Traditional stocks rely on manual, centralized processes for transfer approvals, often resulting in slower settlement times and higher administrative costs.

Real-Time Cap Table

Tokenized securities enable real-time cap table updates by leveraging blockchain technology, providing transparent and immutable records of ownership transfers instantly. Traditional stocks rely on centralized databases that often cause delays and inefficiencies in updating ownership information, hindering timely decision-making.

Cross-Chain Asset Portability

Cross-chain asset portability enables tokenized securities to be seamlessly transferred and traded across multiple blockchain networks, enhancing liquidity and accessibility compared to traditional stocks limited to centralized exchanges. This interoperability reduces settlement times and operational costs, positioning tokenized securities as a more flexible and efficient alternative in global financial markets.

Stocks vs Tokenized Securities Infographic

industrydif.com

industrydif.com