Credit cards offer instant purchasing power with revolving credit and the flexibility to pay over time, often with interest charges on unpaid balances. Buy Now Pay Later (BNPL) services provide interest-free installments for short-term purchases, making budgeting easier but sometimes limited to specific merchants. Consumers should compare fees, interest rates, and repayment terms to determine the best option for their financial needs.

Table of Comparison

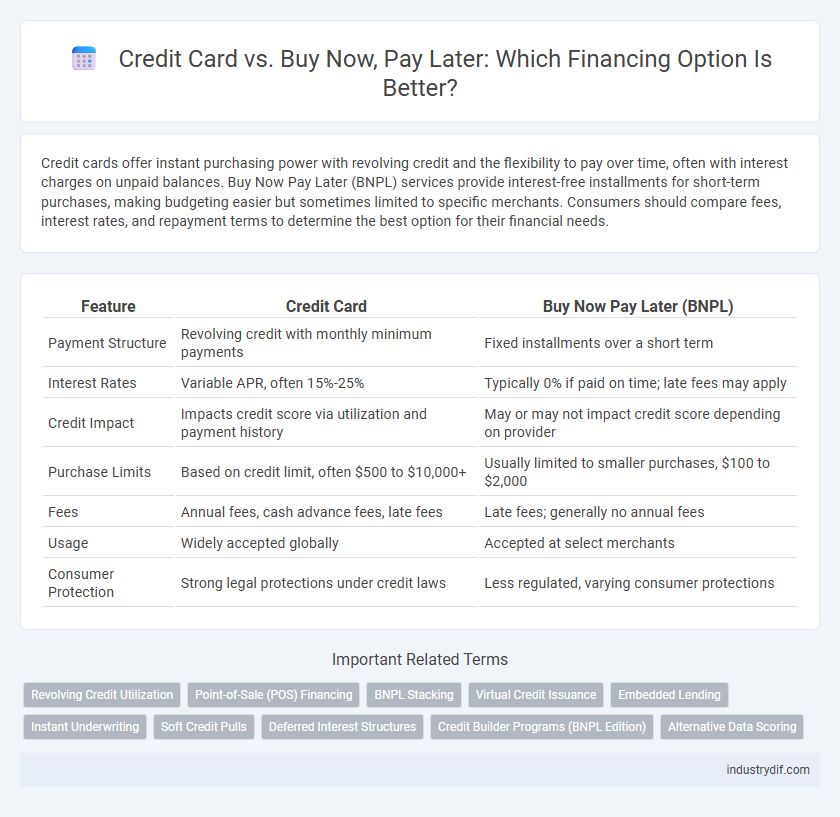

| Feature | Credit Card | Buy Now Pay Later (BNPL) |

|---|---|---|

| Payment Structure | Revolving credit with monthly minimum payments | Fixed installments over a short term |

| Interest Rates | Variable APR, often 15%-25% | Typically 0% if paid on time; late fees may apply |

| Credit Impact | Impacts credit score via utilization and payment history | May or may not impact credit score depending on provider |

| Purchase Limits | Based on credit limit, often $500 to $10,000+ | Usually limited to smaller purchases, $100 to $2,000 |

| Fees | Annual fees, cash advance fees, late fees | Late fees; generally no annual fees |

| Usage | Widely accepted globally | Accepted at select merchants |

| Consumer Protection | Strong legal protections under credit laws | Less regulated, varying consumer protections |

Understanding Credit Cards and Buy Now Pay Later: Key Differences

Credit cards offer revolving credit with interest charges on unpaid balances, while Buy Now Pay Later (BNPL) services provide short-term, interest-free installment payments for specific purchases. Credit cards impact credit scores through payment history and credit utilization, whereas BNPL typically has minimal or no immediate effect on credit reports. The primary differences lie in payment flexibility, interest rates, and credit reporting implications, influencing consumers' debt management strategies.

How Credit Cards Work: An Overview

Credit cards enable consumers to borrow funds up to a preset credit limit for purchases or cash advances, with mandatory monthly payments and interest charged on outstanding balances. Interest rates vary based on creditworthiness and card terms, often leading to higher costs compared to other financing options. Key benefits include fraud protection, rewards programs, and the ability to build credit history when payments are made on time.

Buy Now Pay Later Explained: Mechanisms and Models

Buy Now Pay Later (BNPL) services allow consumers to split purchases into interest-free installments, enhancing affordability and budgeting flexibility. The primary mechanisms involve a merchant partnership, where the BNPL provider pays upfront to the retailer and collects payments from consumers over time. Common models include point-of-sale financing, pay-in-4, and installment loans, each varying in repayment terms and fees, driving widespread adoption in e-commerce and retail sectors.

Interest Rates and Fees: Comparing Costs

Credit cards typically charge interest rates ranging from 15% to 25% APR, with fees including annual charges, late payments, and cash advances. Buy Now Pay Later (BNPL) services often offer interest-free periods but may impose late fees or higher interest rates if payments are missed. Evaluating total costs requires careful comparison of interest accrual, fee structures, and payment schedules for both options.

Impact on Credit Score: Credit Card vs. BNPL

Credit cards impact credit scores by influencing credit utilization rates and payment history, which are key factors in credit scoring models like FICO. Buy Now Pay Later (BNPL) services often do not report to credit bureaus unless payments are missed, leading to minimal positive credit history benefits but potential negative impacts if defaults occur. Responsible credit card usage typically builds credit more effectively compared to BNPL, which may remain invisible to credit reports without traditional credit checks or consistent reporting.

Consumer Protections and Regulations

Credit cards are regulated under the Credit CARD Act of 2009, offering robust consumer protections such as limits on interest rate hikes and mandatory clear disclosure of terms, while Buy Now Pay Later (BNPL) services often fall under less comprehensive regulations, potentially exposing consumers to fewer safeguards. Credit cards provide well-established dispute resolution mechanisms and fraud protections, whereas BNPL plans may lack standardized protocols, leading to varying levels of consumer security. Understanding these regulatory differences is crucial for consumers to make informed decisions about their payment options and associated risks.

Approval Process and Accessibility

Credit card approval typically requires a detailed credit check and a high credit score to assess risk, making accessibility limited for individuals with poor credit history. Buy Now Pay Later (BNPL) services offer more lenient approval processes by using alternative data points and instant credit decision algorithms, enhancing accessibility for younger consumers and those with thin credit files. BNPL platforms often enable faster, frictionless applications without formal credit inquiries, providing broader financial inclusion compared to traditional credit cards.

Rewards, Perks, and Incentives

Credit cards often offer extensive rewards programs, including cashback, travel points, and partner discounts that accumulate with every purchase, enhancing long-term value for users. Buy Now Pay Later (BNPL) services typically provide limited perks, focusing on interest-free payment installments rather than rewards, making them ideal for short-term budgeting rather than earning incentives. Consumers seeking ongoing benefits and maximum rewards should prioritize credit cards, while those valuing flexible payment without interest might prefer BNPL options despite fewer incentives.

Risks and Responsible Usage

Credit cards pose risks such as high-interest rates and potential debt accumulation if payments are missed, requiring users to maintain timely payments and monitor spending closely. Buy Now Pay Later (BNPL) options can lead to overspending due to deferred payments and lack of interest but often lack the consumer protections that credit cards provide. Responsible usage involves understanding the terms, setting budgets, and using these payment methods only when confident in the ability to repay on time to avoid financial strain.

Choosing the Right Payment Option for Your Financial Goals

Evaluating credit cards versus Buy Now Pay Later (BNPL) services requires aligning each option with your financial goals and spending habits. Credit cards offer rewards, credit building, and emergency funds but may carry high interest rates if balances are not paid in full. BNPL provides interest-free installment plans that enhance budget management but can impact credit scores and lead to overspending if not used responsibly.

Related Important Terms

Revolving Credit Utilization

Revolving credit utilization plays a critical role in credit card management, directly impacting credit scores by measuring the ratio of outstanding balances to credit limits, whereas Buy Now Pay Later (BNPL) programs typically do not affect revolving credit utilization since they operate as short-term installment plans without revolving balances. Proper management of credit card utilization, ideally keeping it below 30%, can enhance creditworthiness, while BNPL offers flexibility without immediate credit score implications but may lead to increased debt if multiple plans are used simultaneously.

Point-of-Sale (POS) Financing

Point-of-Sale (POS) financing options like Buy Now Pay Later (BNPL) provide consumers with flexible repayment plans at checkout, often without interest if paid on time, contrasting with traditional credit cards that typically involve revolving credit and interest charges. BNPL platforms integrate directly with merchants, offering instant approval and simplified budgeting, which appeals to customers seeking transparency and short-term credit without impacting credit scores as heavily as credit cards can.

BNPL Stacking

Buy Now Pay Later (BNPL) stacking involves using multiple BNPL services simultaneously to finance a single purchase, which can increase the risk of overextension and impact credit scores if payments are missed. Unlike credit cards that report to credit bureaus regularly, BNPL providers often do not, making BNPL stacking less visible to lenders but riskier for consumers managing multiple deferred payments.

Virtual Credit Issuance

Virtual credit issuance offers a seamless alternative to traditional credit cards by enabling instant access to funds through digital platforms, enhancing security and convenience for users. Buy Now Pay Later services leverage virtual credit lines to provide flexible payment options without impacting credit scores, making them an attractive choice for budget-conscious consumers.

Embedded Lending

Embedded lending integrates Buy Now Pay Later (BNPL) options directly into digital platforms, offering seamless credit access at the point of sale without traditional credit card application processes. This shift enhances consumer convenience and approval speed while enabling merchants to increase conversion rates and average order values through frictionless financing solutions.

Instant Underwriting

Instant underwriting in Buy Now Pay Later (BNPL) services leverages real-time data and advanced algorithms to approve transactions within seconds, offering faster credit decisions than traditional credit card underwriting processes. This immediate evaluation minimizes friction during checkout, enhancing customer experience while reducing reliance on credit scores commonly emphasized in credit card approvals.

Soft Credit Pulls

Soft credit pulls, often used in Buy Now Pay Later (BNPL) services, do not impact credit scores and allow consumers to access immediate financing without affecting their creditworthiness. In contrast, credit card applications typically involve hard credit inquiries, which can temporarily lower credit scores and influence future lending decisions.

Deferred Interest Structures

Credit cards typically apply deferred interest by charging interest from the purchase date if the balance is not paid in full within the promotional period, whereas Buy Now Pay Later (BNPL) plans often offer interest-free periods but impose full retroactive interest if payments are missed or delayed. Understanding these differing deferred interest structures is crucial for consumers to manage potential finance charges and avoid unexpected debt accumulation.

Credit Builder Programs (BNPL Edition)

Credit Builder Programs integrated within Buy Now Pay Later (BNPL) services offer consumers an alternative to traditional credit cards by enabling incremental credit score improvements through timely installment payments. These BNPL credit builders leverage transaction data and repayment behavior to report to major credit bureaus, facilitating credit history development without the high interest rates commonly associated with credit cards.

Alternative Data Scoring

Alternative data scoring leverages non-traditional financial information such as utility payments, rental history, and social media behavior to assess creditworthiness in Buy Now Pay Later (BNPL) platforms, offering a more inclusive approach than conventional credit card credit scoring models reliant on credit reports and income statements. This expanded dataset enables BNPL providers to approve a broader range of consumers, particularly those with limited or thin credit files, while potentially reducing default risk through more nuanced predictive analytics.

Credit Card vs Buy Now Pay Later Infographic

industrydif.com

industrydif.com