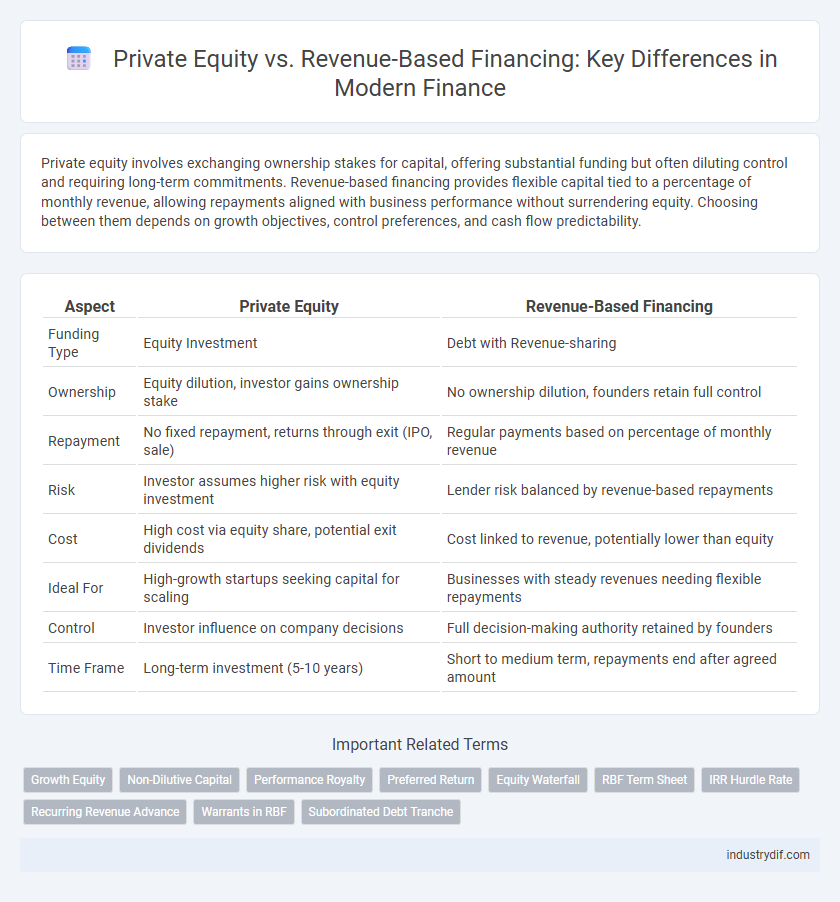

Private equity involves exchanging ownership stakes for capital, offering substantial funding but often diluting control and requiring long-term commitments. Revenue-based financing provides flexible capital tied to a percentage of monthly revenue, allowing repayments aligned with business performance without surrendering equity. Choosing between them depends on growth objectives, control preferences, and cash flow predictability.

Table of Comparison

| Aspect | Private Equity | Revenue-Based Financing |

|---|---|---|

| Funding Type | Equity Investment | Debt with Revenue-sharing |

| Ownership | Equity dilution, investor gains ownership stake | No ownership dilution, founders retain full control |

| Repayment | No fixed repayment, returns through exit (IPO, sale) | Regular payments based on percentage of monthly revenue |

| Risk | Investor assumes higher risk with equity investment | Lender risk balanced by revenue-based repayments |

| Cost | High cost via equity share, potential exit dividends | Cost linked to revenue, potentially lower than equity |

| Ideal For | High-growth startups seeking capital for scaling | Businesses with steady revenues needing flexible repayments |

| Control | Investor influence on company decisions | Full decision-making authority retained by founders |

| Time Frame | Long-term investment (5-10 years) | Short to medium term, repayments end after agreed amount |

Introduction to Private Equity and Revenue-Based Financing

Private equity involves investing substantial capital in private companies, typically obtaining significant ownership stakes to drive growth and increase enterprise value before eventual exit strategies like IPOs or acquisitions. Revenue-based financing provides flexible capital by allowing businesses to repay investors with a fixed percentage of their ongoing gross revenues, aligning repayments with cash flow without diluting equity. Both financing methods serve distinct business needs, with private equity favoring long-term growth and control, while revenue-based financing suits companies seeking non-dilutive, performance-linked capital.

Key Differences Between Private Equity and Revenue-Based Financing

Private equity involves selling ownership stakes in a company, granting investors voting rights and potential influence over business decisions, while revenue-based financing provides capital in exchange for a percentage of future revenues without equity dilution or control loss. Private equity typically requires a longer-term commitment with an exit strategy through events like IPOs or acquisitions, whereas revenue-based financing offers more flexible repayment terms tied directly to company performance. The cost of capital differs significantly, as private equity can demand higher returns due to risk and growth expectations, whereas revenue-based financing aligns repayments with revenue fluctuations, reducing financial strain during slower periods.

How Private Equity Works in Business Financing

Private equity involves raising capital through the sale of ownership stakes, typically by private investors or firms, who seek significant control and influence over business operations. These investors provide substantial funds in exchange for equity, aiming for long-term growth and eventual returns through a sale or public offering. Unlike debt-based financing, private equity dilutes ownership but offers strategic guidance and resources to accelerate business development.

Understanding Revenue-Based Financing Models

Revenue-based financing models provide capital investments repaid through a fixed percentage of monthly revenue, aligning investor returns with business performance and cash flow variability. Unlike private equity, which requires equity ownership and potential dilution, revenue-based financing maintains founder control and offers flexible repayment terms tied directly to sales growth. This model suits companies with predictable revenue streams seeking non-dilutive funding without relinquishing equity or control.

Advantages of Private Equity for Companies

Private equity provides companies with significant capital infusion without monthly payment obligations, enabling large-scale growth initiatives and operational improvements. Investors often bring strategic expertise, industry connections, and governance support that drive long-term value creation. This form of financing also aligns stakeholder interests through equity ownership, fostering commitment to business success and expansion.

Benefits of Revenue-Based Financing for SMEs

Revenue-based financing (RBF) offers SMEs flexible repayment tied directly to monthly revenue, reducing cash flow pressure during downturns and eliminating equity dilution common in private equity deals. This model preserves full ownership and decision-making power for business founders while aligning investor returns with company performance. RBF also provides quicker access to capital with fewer restrictions, making it ideal for SMEs seeking growth without sacrificing control.

Risks and Challenges of Private Equity Investments

Private equity investments carry significant risks, including high capital lock-up periods and exposure to market volatility that can impact portfolio valuation. These investments often involve intense operational involvement and strategic shifts, which may not always yield expected returns, thus posing execution risk. Furthermore, limited liquidity and dependency on exit opportunities add financial uncertainty, making private equity a challenging funding route compared to more flexible alternatives like revenue-based financing.

Potential Drawbacks of Revenue-Based Financing

Revenue-based financing often results in higher total repayment amounts compared to equity financing, especially if the business experiences rapid revenue growth. Limited access to large capital sums can restrict business expansion opportunities due to the periodic payment structure tied to revenue percentage. Lack of alignment between investor and entrepreneur incentives can pose challenges, as investors receive returns linked to sales rather than long-term value creation.

Choosing the Right Financing Option for Your Business

Choosing between private equity and revenue-based financing depends on your business's growth stage and capital needs. Private equity provides significant capital and strategic support but often requires giving up equity and control, ideal for companies seeking long-term expansion. Revenue-based financing offers flexible repayment tied to monthly revenue, preserving ownership and cash flow, making it suitable for businesses with steady sales but limited access to traditional loans.

Future Trends in Alternative Business Financing

Future trends in alternative business financing reveal a growing preference for revenue-based financing due to its flexibility and non-dilutive nature, allowing businesses to retain equity while accessing capital. Private equity continues to attract large-scale investments for established firms seeking substantial growth and strategic guidance, but emerging startups favor revenue-based models for faster, performance-linked funding. Advances in data analytics and fintech platforms are enhancing the transparency and efficiency of both financing methods, driving increased adoption across diverse industries.

Related Important Terms

Growth Equity

Growth equity provides minority investments in mature companies with proven revenue streams, allowing businesses to scale without significant ownership dilution. Revenue-based financing offers flexible repayment tied to revenue performance, enabling companies to retain full control while accessing capital aligned with cash flow variability.

Non-Dilutive Capital

Non-dilutive capital from revenue-based financing allows businesses to raise funds without giving up equity, preserving ownership and control, unlike private equity which requires equity stakes and potential dilution. This type of financing is ideal for companies with steady revenue streams seeking flexible repayment tied to performance rather than fixed debt obligations.

Performance Royalty

Private equity typically involves selling company equity to investors, while revenue-based financing provides capital in exchange for a percentage of ongoing revenue, structured as a performance royalty. Performance royalties align investor returns directly with business performance, reducing dilution risk compared to equity financing.

Preferred Return

Preferred return in private equity typically ensures investors receive a minimum annual profit before the fund managers earn carried interest, aligning incentives and mitigating risk. Revenue-based financing does not offer a preferred return but instead provides investors with a fixed percentage of ongoing revenue until the principal and agreed returns are fully repaid, emphasizing cash flow over equity growth.

Equity Waterfall

Equity Waterfall in Private Equity structures profit distribution by prioritizing capital return, preferred return, and catch-up phases before residual profits reach common equity holders, ensuring aligned interests among investors and management. In contrast, Revenue-based Financing bypasses equity dilution and waterfall complexities by enabling repayments as a fixed percentage of ongoing revenue, offering a flexible alternative for growth capital without ownership relinquishment.

RBF Term Sheet

Revenue-based financing (RBF) term sheets typically outline repayment as a fixed percentage of monthly revenue until a predetermined cap is reached, contrasting with private equity deals that involve equity dilution and board control changes. RBF term sheets prioritize flexible cash flow-based repayments without relinquishing ownership, making them ideal for companies seeking growth capital without equity forfeiture.

IRR Hurdle Rate

Private equity typically targets IRR hurdle rates between 15% and 20%, reflecting higher risk tolerance and expected returns, whereas revenue-based financing offers more flexible return structures without a fixed IRR hurdle, focusing instead on a percentage of ongoing revenues. This difference impacts investor risk profiles and capital cost, as private equity demands achieving specific hurdle rates before carried interest is awarded, contrasting with revenue-based financing's alignment with business cash flow performance.

Recurring Revenue Advance

Recurring Revenue Advance in revenue-based financing offers flexible capital access tied directly to predictable income streams without diluting equity, contrasting with private equity where investors gain ownership stakes and influence. This method suits companies with steady monthly revenue seeking growth funds while maintaining control and avoiding long-term debt commitments.

Warrants in RBF

Warrants in revenue-based financing offer investors the option to purchase equity at a predetermined price, enhancing upside potential without immediate dilution, contrasting with traditional private equity where equity stakes are exchanged upfront. This hybrid feature allows for flexible capital structures, aligning investor returns more closely with company revenue performance.

Subordinated Debt Tranche

Subordinated debt tranches in private equity often carry higher risk and yield compared to revenue-based financing, where repayments are tied directly to a company's revenue performance without fixed debt obligations. This structure makes subordinated debt a strategic choice for investors seeking higher returns with a secondary claim, whereas revenue-based financing offers flexible, performance-dependent capital without diluting equity.

Private Equity vs Revenue-based Financing Infographic

industrydif.com

industrydif.com