Traditional insurance policies provide coverage based on actual losses assessed after a claim event, requiring detailed loss verification processes that can delay compensation. Parametric insurance offers predefined payouts triggered by specific parameters or indices, such as weather conditions or seismic activity, enabling faster claims settlements without the need for loss adjustment. This model reduces administrative costs and improves transparency, making it ideal for risks with clear, measurable triggers.

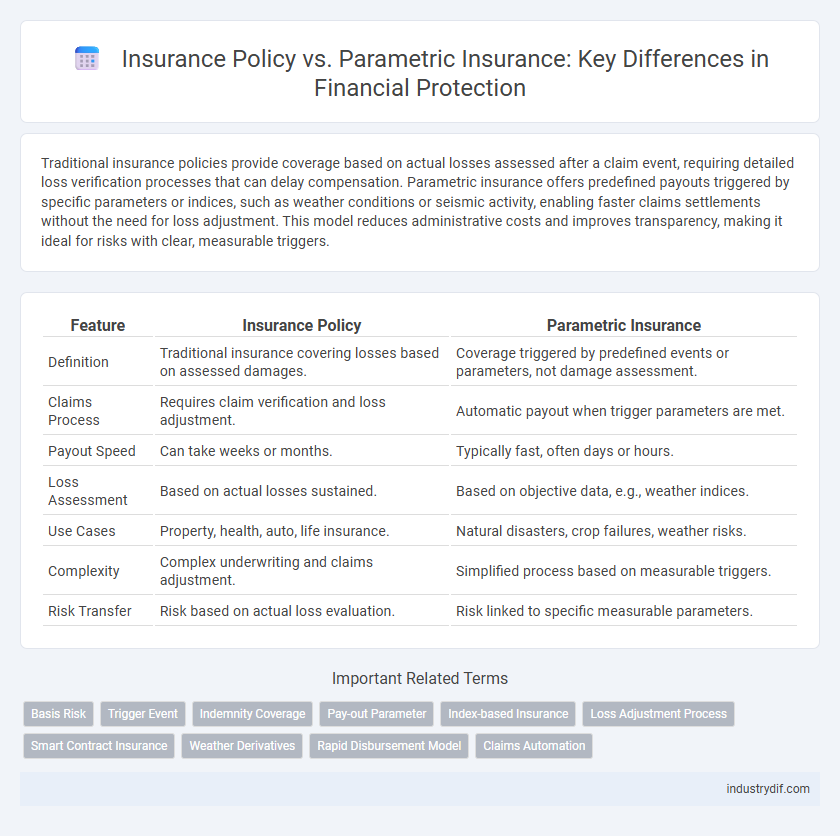

Table of Comparison

| Feature | Insurance Policy | Parametric Insurance |

|---|---|---|

| Definition | Traditional insurance covering losses based on assessed damages. | Coverage triggered by predefined events or parameters, not damage assessment. |

| Claims Process | Requires claim verification and loss adjustment. | Automatic payout when trigger parameters are met. |

| Payout Speed | Can take weeks or months. | Typically fast, often days or hours. |

| Loss Assessment | Based on actual losses sustained. | Based on objective data, e.g., weather indices. |

| Use Cases | Property, health, auto, life insurance. | Natural disasters, crop failures, weather risks. |

| Complexity | Complex underwriting and claims adjustment. | Simplified process based on measurable triggers. |

| Risk Transfer | Risk based on actual loss evaluation. | Risk linked to specific measurable parameters. |

Understanding Traditional Insurance Policies

Traditional insurance policies provide financial protection by covering specific losses after verifying the actual damage through claims adjustment, often requiring extensive documentation and time-consuming assessments. These policies typically involve indemnity-based contracts that reimburse the policyholder for calculated losses, including property damage, liability, or health-related expenses. Understanding the detailed terms, coverage limits, deductibles, and claim processes is essential for policyholders to ensure adequate protection and compliance with underwriting requirements.

What Is Parametric Insurance?

Parametric insurance is a type of coverage that pays out a predetermined amount based on the occurrence of a specific event or parameter, such as the magnitude of a hurricane or the level of rainfall, rather than assessing actual losses. This approach allows for faster claims processing and reduces administrative costs by eliminating the need for traditional loss adjustment. Parametric insurance is particularly useful for managing risks in agriculture, natural disasters, and climate-related events where timely payouts are critical.

Key Differences Between Indemnity and Parametric Insurance

Indemnity insurance reimburses the actual loss suffered by the policyholder, requiring detailed loss assessments and claims adjustment processes, while parametric insurance pays out a predetermined amount based on a trigger event, such as a specific weather parameter or seismic activity exceeding a threshold. Indemnity policies involve risk assessment and underwriting based on individual exposure, whereas parametric insurance relies on objective data from trusted sources, enabling faster settlements and reduced administrative costs. The key difference lies in indemnity insurance compensating for verified financial loss, while parametric insurance offers rapid liquidity by predefining payout conditions linked to measurable events.

Claims Process: Parametric vs Traditional Insurance

Traditional insurance claims process involves documentation, assessment, and approval, often leading to lengthy waits and subjective evaluations. Parametric insurance triggers automatic payouts based on predefined parameters or indices, drastically reducing the time for claims settlement and minimizing disputes. This model enhances transparency and efficiency by relying on objective data such as weather events or earthquake magnitudes, streamlining the claims experience for policyholders.

Risk Assessment in Parametric Insurance

Parametric insurance utilizes pre-defined triggers based on measurable parameters such as weather data or seismic activity to assess risk, enabling faster claim settlements without the need for traditional loss adjustments. This method enhances transparency and reduces the uncertainty in risk evaluation by relying on objective data sources rather than subjective damage assessments. Consequently, parametric risk assessment provides more efficient coverage for natural disasters and other predictable events, optimizing financial protection and resource allocation.

Advantages of Parametric Insurance Solutions

Parametric insurance offers faster claim payouts by triggering payments based on predefined parameters like weather data, eliminating the need for complex damage assessments. It enhances transparency and predictability, allowing businesses to manage risks with greater certainty and reduce administrative costs compared to traditional insurance policies. This solution is particularly beneficial for industries exposed to climate-related risks, providing timely financial relief after events such as hurricanes or floods.

Challenges and Limitations of Parametric Insurance

Parametric insurance faces challenges such as basis risk, where the payout may not fully cover the actual loss due to predefined triggers that do not account for all damage nuances. Limited customization options restrict its suitability for complex or unique risk profiles, reducing its applicability across diverse sectors. Regulatory uncertainty and data reliability issues further complicate the widespread adoption and effectiveness of parametric insurance in financial risk management.

Use Cases and Industry Applications

Insurance policies typically cover losses based on actual damages verified through claims adjustment, making them suitable for sectors like healthcare, property, and casualty insurance where detailed loss assessment is crucial. Parametric insurance offers predefined payouts triggered by specific, measurable events such as weather indices or natural disasters, benefiting industries such as agriculture, energy, and travel by providing faster claims settlement and reducing administrative costs. Use cases for parametric insurance include crop failure protection, hurricane impact mitigation, and flight delay coverage, enhancing risk management efficiency in volatile environments.

Cost Implications and Premium Structures

Insurance policies traditionally involve indemnity-based coverage with premiums calculated on risk assessments, leading to potentially higher costs due to administrative expenses and claims adjustment processes. Parametric insurance employs predefined triggers and payouts, substantially lowering operational costs and enabling more transparent, often lower premiums. This model reduces uncertainty in pricing by linking premium structures directly to measurable parameters like weather indices or loss thresholds.

Future Trends in Insurance: The Rise of Parametric Models

Parametric insurance is revolutionizing the finance sector by offering faster claims processing through automated triggers based on predefined parameters like weather data or catastrophic indices. Future trends indicate a surge in adoption of parametric models, driven by advancements in IoT, blockchain, and AI, enhancing transparency and reducing administrative costs. This shift aligns with growing demand for innovative risk mitigation solutions tailored to climate change and natural disaster frequency.

Related Important Terms

Basis Risk

Insurance policies traditional rely on indemnity-based coverage, which can lead to basis risk when actual losses differ from claims due to assessment delays or disputes. Parametric insurance minimizes basis risk by triggering payouts based on pre-defined, objective parameters like weather data or seismic activity, ensuring quicker and more transparent compensation.

Trigger Event

Insurance policies typically require a loss assessment after a covered event to trigger a payout, relying on documented damage and claims processing. Parametric insurance, in contrast, uses pre-defined trigger events such as specific weather conditions or seismic measurements, allowing for faster, automated payouts without the need for traditional loss adjustment.

Indemnity Coverage

Traditional insurance policies provide indemnity coverage based on actual loss assessment and claim verification, requiring detailed documentation and underwriting processes. Parametric insurance offers pre-defined payouts triggered by specific parameters or events, enabling faster compensation but without direct correlation to the exact loss amount.

Pay-out Parameter

Insurance policies typically determine pay-out based on verified losses assessed through claims processes, while parametric insurance triggers pay-outs automatically when predefined parameters, such as rainfall levels or earthquake magnitude, are met, enabling faster and more transparent compensation. The pay-out parameter in parametric insurance is quantifiable and objective, reducing disputes and administrative costs compared to traditional indemnity-based policies.

Index-based Insurance

Index-based parametric insurance offers rapid, predefined payouts triggered by measurable events such as weather indices or natural disaster parameters, bypassing traditional claim assessments typical of standard insurance policies. This approach minimizes moral hazard and administrative costs, providing transparent risk transfer for agriculture, disaster relief, and climate-related financial protection.

Loss Adjustment Process

Traditional insurance policies involve a complex loss adjustment process requiring claim verification and on-site assessments, often resulting in delayed payouts. Parametric insurance streamlines this process by triggering automatic payments based on predefined parameters, such as weather data or seismic readings, eliminating the need for extensive loss evaluations.

Smart Contract Insurance

Smart contract insurance leverages blockchain technology to automate claims processing through predefined conditions, contrasting traditional insurance policies that rely on manual evaluations. Parametric insurance utilizes smart contracts to trigger payouts based on measurable events like weather data, enhancing transparency and reducing claim settlement time.

Weather Derivatives

Insurance policies provide traditional indemnity coverage based on verified losses, whereas parametric insurance uses pre-defined weather indices to trigger payouts without loss assessment, enhancing claims efficiency. Weather derivatives serve as financial instruments allowing firms to hedge against weather-related risks by settling based on measurable weather parameters, complementing parametric insurance models.

Rapid Disbursement Model

Parametric insurance leverages predefined parameters and triggers rapid disbursement by automatically releasing funds once specific conditions, such as weather indices or seismic activity thresholds, are met, bypassing traditional claim assessments. This rapid disbursement model contrasts with conventional insurance policies that require time-consuming loss evaluations, enabling faster financial relief and improved liquidity amid crises.

Claims Automation

Insurance policy claims automation streamlines the traditional indemnity process by digitizing claim submissions, verification, and payouts based on loss assessments. Parametric insurance enhances claims automation through predefined triggers and data-driven parameters, enabling instantaneous and transparent payouts without lengthy claim adjustments.

Insurance Policy vs Parametric Insurance Infographic

industrydif.com

industrydif.com