Crowdfunding allows startups to raise capital from a large number of small investors, offering equity or rewards in exchange for funds, whereas tokenization transforms ownership rights of assets into digital tokens on a blockchain. Tokenization enhances liquidity, transparency, and enables fractional ownership, making it easier to trade assets compared to traditional crowdfunding models. Both methods democratize investment but differ significantly in regulatory complexity, scalability, and the nature of investor engagement.

Table of Comparison

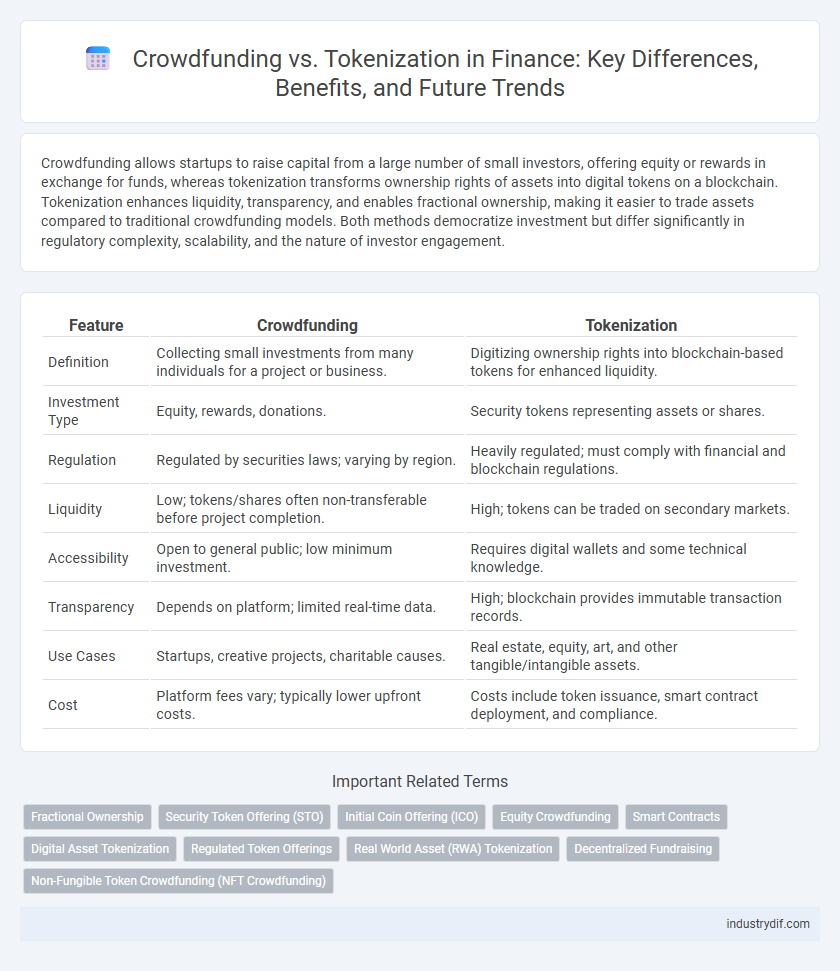

| Feature | Crowdfunding | Tokenization |

|---|---|---|

| Definition | Collecting small investments from many individuals for a project or business. | Digitizing ownership rights into blockchain-based tokens for enhanced liquidity. |

| Investment Type | Equity, rewards, donations. | Security tokens representing assets or shares. |

| Regulation | Regulated by securities laws; varying by region. | Heavily regulated; must comply with financial and blockchain regulations. |

| Liquidity | Low; tokens/shares often non-transferable before project completion. | High; tokens can be traded on secondary markets. |

| Accessibility | Open to general public; low minimum investment. | Requires digital wallets and some technical knowledge. |

| Transparency | Depends on platform; limited real-time data. | High; blockchain provides immutable transaction records. |

| Use Cases | Startups, creative projects, charitable causes. | Real estate, equity, art, and other tangible/intangible assets. |

| Cost | Platform fees vary; typically lower upfront costs. | Costs include token issuance, smart contract deployment, and compliance. |

Understanding Crowdfunding in Modern Finance

Crowdfunding in modern finance leverages online platforms to pool small investments from a large number of individuals, enabling startups and small businesses to access capital without traditional bank loans or venture capital. This method democratizes investment, offering diverse funding options such as rewards-based, equity, and debt crowdfunding. A growing trend, crowdfunding accelerates innovation by providing early-stage companies with essential financial resources while fostering community engagement and investor participation.

What is Tokenization? Key Concepts Explained

Tokenization in finance refers to the process of converting rights to an asset into a digital token on a blockchain, enabling fractional ownership and increased liquidity. Key concepts include smart contracts, which automate transactions securely, and decentralized ledgers that ensure transparency and immutability of records. Tokenization allows diverse asset classes--such as real estate, equity, or art--to be easily traded, expanding access and reducing traditional barriers in investment markets.

How Crowdfunding Works: Models and Mechanisms

Crowdfunding operates through various models such as donation-based, reward-based, equity-based, and debt-based platforms, each enabling investors to fund projects or businesses in exchange for non-financial rewards, equity shares, or interest payments. Fundraisers present detailed campaigns outlining financial goals, timelines, and use of funds while attracting backers via online platforms that facilitate transparent transactions and progress updates. The underlying mechanism relies on pooling numerous small investments, mitigating individual risk and enabling access to capital markets beyond traditional banking systems.

Tokenization Process: From Assets to Digital Tokens

Tokenization transforms real-world assets such as real estate, equities, or commodities into digital tokens on a blockchain, enabling fractional ownership and enhanced liquidity. The process involves asset verification, digital representation creation through smart contracts, and secure registration on a distributed ledger to ensure transparency and immutability. This method streamlines asset transfer and trading by reducing intermediaries and operational costs while increasing accessibility to global investors.

Advantages of Crowdfunding for Investors and Businesses

Crowdfunding offers investors direct access to innovative projects with lower entry barriers and diversified risk exposure compared to traditional financing methods. Businesses benefit from crowdfunding by raising capital quickly while simultaneously validating market demand and building a loyal customer base. This approach enhances transparency and community engagement, fostering stronger trust between companies and investors.

Benefits of Tokenization in Asset Management

Tokenization in asset management enhances liquidity by enabling fractional ownership and easier transfer of traditionally illiquid assets such as real estate and private equity. It improves transparency and security through blockchain technology, providing immutable records and reducing the risk of fraud. Furthermore, tokenization lowers barriers to entry, allowing a broader range of investors to participate with smaller capital commitments and diversified portfolios.

Regulatory Considerations: Crowdfunding vs Tokenization

Regulatory considerations for crowdfunding typically involve compliance with securities laws such as the JOBS Act in the U.S., which governs investor limits and disclosure requirements to protect retail investors. Tokenization falls under evolving regulatory frameworks that often classify tokens as securities, requiring adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations, with oversight from agencies like the SEC and FINRA. Differences in jurisdictional regulations and enforcement approaches create complexity in ensuring compliance for both crowdfunding platforms and tokenized asset offerings.

Risks and Challenges: A Comparative Analysis

Crowdfunding faces risks such as regulatory uncertainty, fraud, and limited investor protection, while tokenization encounters challenges including smart contract vulnerabilities, market volatility, and potential legal complexities surrounding digital asset classification. Both methods require robust due diligence, transparency, and compliance frameworks to mitigate financial and operational risks. The evolving regulatory landscape demands continuous adaptation to ensure investor trust and secure fund management in both crowdfunding and tokenization ecosystems.

Use Cases: Crowdfunding vs Tokenization in Real-World Finance

Crowdfunding enables startups and small businesses to raise capital directly from a broad base of individual investors, often driving innovation in creative projects and community ventures. Tokenization transforms real-world assets like real estate, art, or equity into digital tokens, enhancing liquidity and allowing fractional ownership on blockchain platforms. These use cases demonstrate crowdfunding's strength in democratizing early-stage funding, while tokenization empowers market participants with greater access, transparency, and tradability of traditionally illiquid assets.

Future Trends: The Evolving Landscape of Fundraising

Crowdfunding and tokenization are transforming the future of finance by democratizing access to capital through decentralized platforms and blockchain technology. Tokenization enables fractional ownership and increases liquidity in traditionally illiquid assets, while crowdfunding leverages social networks to rapidly raise funds from diverse pools of investors. Emerging trends highlight the integration of smart contracts and regulatory frameworks that enhance transparency, security, and investor protection in both fundraising methods.

Related Important Terms

Fractional Ownership

Fractional ownership through tokenization enables investors to acquire and trade digital shares of high-value assets like real estate or art, providing enhanced liquidity and transparency compared to traditional crowdfunding models that pool funds without offering divisible equity stakes. Tokenization leverages blockchain technology to ensure secure, immutable records of ownership, facilitating seamless transfers and reducing entry barriers for smaller investors in financial markets.

Security Token Offering (STO)

Security Token Offerings (STOs) represent a regulated fundraising method leveraging blockchain to issue digitized securities, providing investors enhanced transparency and legal protection compared to traditional crowdfunding. STOs integrate compliance with securities laws, reducing fraud risks and enabling fractional ownership, while crowdfunding often lacks standardized investor safeguards and operates under looser regulatory frameworks.

Initial Coin Offering (ICO)

Initial Coin Offerings (ICOs) leverage tokenization to raise capital by issuing digital tokens on blockchain platforms, offering investors liquidity and potential governance rights unlike traditional crowdfunding methods which typically provide limited or no equity. ICOs facilitate faster fundraising with global reach and lower regulatory barriers, while traditional crowdfunding relies on smaller individual contributions without creating tradable assets.

Equity Crowdfunding

Equity crowdfunding enables investors to acquire shares in startups or growing companies through online platforms, providing direct ownership and potential dividends, unlike tokenization which digitizes assets on a blockchain for fractional trading. This method enhances access to capital markets for small businesses while offering regulatory oversight and investor protections not always present in token-based fundraising models.

Smart Contracts

Smart contracts automate and enforce the terms of crowdfunding campaigns by securely managing funds and investor rights without intermediaries. Tokenization leverages smart contracts to create digital assets representing ownership stakes, enabling fractional investment and enhanced liquidity in fundraising processes.

Digital Asset Tokenization

Digital asset tokenization transforms ownership rights into blockchain-based tokens, enhancing liquidity and enabling fractional investments that surpass traditional crowdfunding limitations. This innovation streamlines asset transfer, reduces intermediaries, and unlocks global investor access within the rapidly evolving digital finance ecosystem.

Regulated Token Offerings

Regulated Token Offerings (RTOs) provide a compliant framework for fundraising by combining blockchain tokenization with securities regulations, offering enhanced investor protection compared to traditional crowdfunding methods. These offerings enable issuers to access a global pool of accredited investors while ensuring transparency and adherence to financial compliance standards.

Real World Asset (RWA) Tokenization

Real World Asset (RWA) tokenization transforms physical assets such as real estate and commodities into digital tokens on a blockchain, enabling fractional ownership, enhanced liquidity, and transparent transactions. Unlike traditional crowdfunding that pools capital through centralized platforms with limited secondary market options, RWA tokenization leverages decentralized finance (DeFi) infrastructure to facilitate 24/7 trading and global investor access.

Decentralized Fundraising

Decentralized fundraising leverages blockchain technology to enable crowdfunding through tokenization, allowing investors to receive digital assets representing ownership or future profits. Tokenization enhances liquidity and transparency compared to traditional crowdfunding by facilitating peer-to-peer transactions on decentralized platforms without intermediaries.

Non-Fungible Token Crowdfunding (NFT Crowdfunding)

Non-Fungible Token Crowdfunding (NFT Crowdfunding) leverages blockchain technology to raise capital by offering unique digital assets, providing investors with verifiable ownership and scarcity. Compared to traditional crowdfunding, NFT Crowdfunding enhances transparency, liquidity, and market reach by enabling fractional ownership and seamless secondary market trading of digital tokens.

Crowdfunding vs Tokenization Infographic

industrydif.com

industrydif.com