Mutual funds offer diversified portfolios managed by professionals, reducing risk through broad market exposure, while thematic investing targets specific trends or sectors aligned with investors' interests or values, potentially yielding higher returns but with increased volatility. Thematic investing allows for focused bets on growth areas like technology or sustainability, contrasting with the balanced approach of mutual funds that aim for steady, long-term growth. Investors must weigh the risk tolerance and investment goals to choose between the stable diversification of mutual funds and the targeted potential of thematic investing.

Table of Comparison

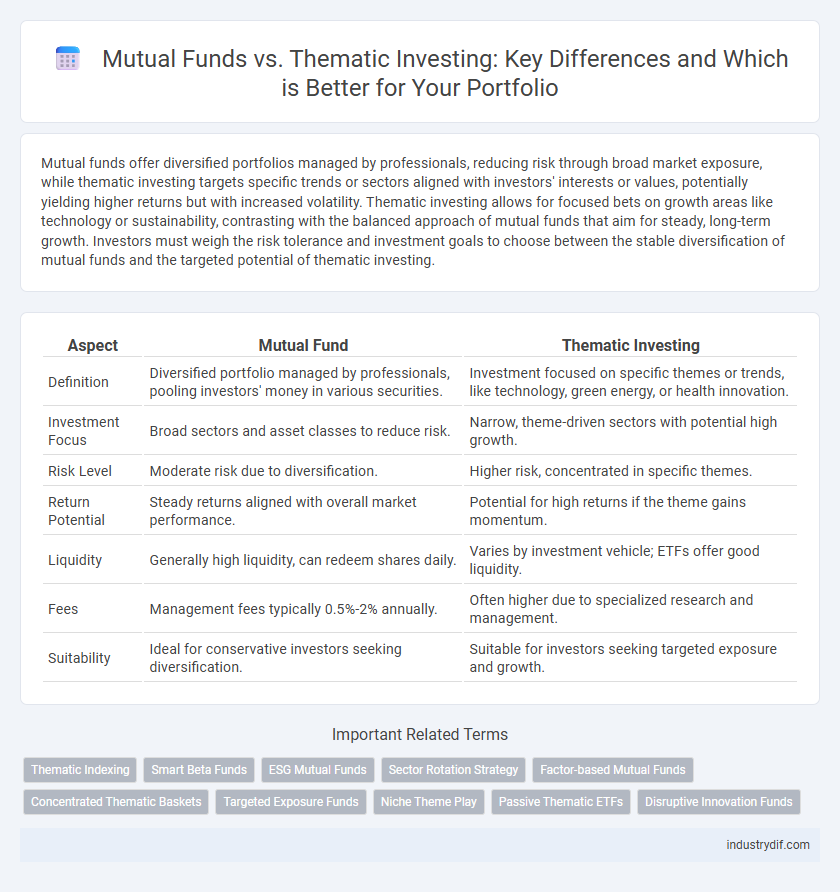

| Aspect | Mutual Fund | Thematic Investing |

|---|---|---|

| Definition | Diversified portfolio managed by professionals, pooling investors' money in various securities. | Investment focused on specific themes or trends, like technology, green energy, or health innovation. |

| Investment Focus | Broad sectors and asset classes to reduce risk. | Narrow, theme-driven sectors with potential high growth. |

| Risk Level | Moderate risk due to diversification. | Higher risk, concentrated in specific themes. |

| Return Potential | Steady returns aligned with overall market performance. | Potential for high returns if the theme gains momentum. |

| Liquidity | Generally high liquidity, can redeem shares daily. | Varies by investment vehicle; ETFs offer good liquidity. |

| Fees | Management fees typically 0.5%-2% annually. | Often higher due to specialized research and management. |

| Suitability | Ideal for conservative investors seeking diversification. | Suitable for investors seeking targeted exposure and growth. |

Understanding Mutual Funds: An Overview

Mutual funds pool capital from multiple investors to create a diversified portfolio managed by professional fund managers, offering exposure to stocks, bonds, or other securities. They provide liquidity, professional management, and risk diversification, making them suitable for investors seeking balanced growth and income. Understanding mutual funds involves recognizing different types such as equity, debt, and hybrid funds, each designed to meet varying investment goals and risk tolerances.

What is Thematic Investing?

Thematic investing focuses on targeting specific trends, sectors, or themes such as technology innovation, clean energy, or aging populations, aiming to capitalize on long-term structural shifts in the market. Unlike traditional mutual funds that diversify across multiple sectors for risk management, thematic investing concentrates assets in companies aligned with particular growth ideas or societal changes. This approach can offer higher growth potential but carries increased risk due to its sector-specific exposure and reliance on trend sustainability.

Key Differences Between Mutual Funds and Thematic Investing

Mutual funds pool capital from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities, offering broad market exposure and professional management. Thematic investing targets specific sectors, trends, or ideas, such as clean energy or technology innovation, aiming for concentrated returns based on a particular theme. Key differences include diversification level, risk profile, and investment focus, with mutual funds emphasizing risk management through diversification and thematic investing focusing on growth potential in niche markets.

Types of Mutual Funds: Equity, Debt, and Hybrid

Equity mutual funds primarily invest in stocks, aiming for high returns through capital appreciation, while debt mutual funds focus on fixed-income securities to provide stable income with lower risk. Hybrid mutual funds combine equity and debt instruments, balancing growth potential and risk management for diversified portfolio exposure. Understanding these types helps investors align their goals with risk tolerance and market conditions.

Popular Thematic Investing Strategies

Popular thematic investing strategies in mutual funds include technology innovation, clean energy, healthcare advancements, and artificial intelligence sectors, targeting high-growth potential industries. These strategies capture specific market trends by focusing on themes like digital transformation, renewable energy solutions, biotechnology breakthroughs, and AI-driven automation. Mutual funds employing thematic investing offer diversified exposure while aiming to capitalize on long-term structural shifts within the global economy.

Risk Factors: Mutual Funds vs Thematic Approaches

Mutual funds typically offer diversified portfolios that mitigate specific market risks by spreading investments across various sectors and asset classes, thereby reducing volatility. Thematic investing concentrates on niche sectors or trends, exposing investors to higher sector-specific risks and potential for greater fluctuations due to market sensitivity. Risk factors in mutual funds are generally lower compared to thematic approaches, which face increased risk from sector concentration, trend dependency, and potential regulatory changes affecting targeted themes.

Performance Comparison: Historical Returns

Historical returns reveal that mutual funds often provide steady, diversified growth with average annual returns ranging between 6% to 10%, depending on fund type and market conditions. Thematic investing, focused on sectors like technology or clean energy, can yield higher short-term gains around 12% to 15% but comes with increased volatility and risk exposure. Performance comparison highlights that while mutual funds suit conservative investors seeking consistency, thematic investing appeals to those targeting aggressive growth through sector-specific opportunities.

Costs and Fees: Mutual Funds vs Thematic Investments

Mutual funds typically charge expense ratios averaging 0.50% to 1.5%, covering management fees, administrative costs, and distribution expenses, while thematic investments often carry higher fees due to specialized expertise and niche market focus, with expense ratios ranging from 1% to 2%. Load fees apply variably in mutual funds but are generally absent in thematic ETFs, which may have higher bid-ask spreads impacting transaction costs. Investors should evaluate total expense ratio (TER), management fees, and potential hidden costs to optimize net returns in mutual fund and thematic investment options.

Suitability: Which Strategy Fits Your Financial Goals?

Mutual funds offer diversified portfolios suited for investors seeking steady growth and reduced risk, making them ideal for long-term financial goals like retirement planning. Thematic investing targets specific sectors or trends, appealing to those aiming for higher returns and willing to accept increased volatility aligned with their risk tolerance. Assessing your investment horizon, risk appetite, and financial objectives is crucial to choosing between the broad exposure of mutual funds and the concentrated potential of thematic strategies.

Emerging Trends in Mutual Funds and Thematic Investing

Emerging trends in mutual funds reveal a growing demand for ESG-focused and technology-driven portfolios, reflecting increased investor awareness of sustainability and innovation. Thematic investing is gaining traction by targeting specific sectors like clean energy, artificial intelligence, and blockchain, offering more concentrated exposure to high-growth areas. This shift towards specialized themes within mutual funds enhances diversification strategies while aligning investments with evolving market dynamics and investor preferences.

Related Important Terms

Thematic Indexing

Thematic indexing in mutual funds focuses on investing in sectors or trends such as clean energy, technology, or healthcare, allowing investors to target specific growth themes while maintaining diversification. This strategy uses customized indices to track thematic investments, offering a structured yet agile approach to capitalize on emerging market opportunities.

Smart Beta Funds

Smart Beta funds combine elements of traditional Mutual Funds and Thematic Investing by using quantitative strategies to select assets based on factors like value, momentum, and volatility, aiming to outperform market-cap weighted indexes. Unlike thematic investing that focuses on sector-specific trends, Smart Beta funds provide diversified exposure with a rules-based approach to enhance returns and manage risk efficiently.

ESG Mutual Funds

ESG mutual funds focus on companies with strong environmental, social, and governance practices, providing investors with a diversified portfolio aligned with ethical standards and long-term sustainability. Thematic investing targets specific sectors or trends, such as clean energy or social impact, but ESG mutual funds incorporate broader criteria to balance financial returns with responsible investing principles.

Sector Rotation Strategy

Mutual funds offer diversified exposure across various sectors, while thematic investing concentrates on specific themes or sectors aligned with macroeconomic trends, often leveraging sector rotation strategies to capitalize on cyclical market movements. Sector rotation strategy involves shifting investments between sectors expected to outperform based on economic cycles, enhancing returns by anticipating phases such as expansion, peak, contraction, and trough.

Factor-based Mutual Funds

Factor-based mutual funds utilize quantitative models to target specific investment factors such as value, momentum, or quality, offering diversification and risk management advantages over traditional thematic investing that centers on sector or trend-specific bets. These funds systematically capture broad factor premia, potentially delivering more consistent returns compared to the concentrated exposure and cyclical risks inherent in thematic investment strategies.

Concentrated Thematic Baskets

Concentrated thematic baskets in mutual funds concentrate investments in specific sectors or trends, offering targeted exposure that can lead to higher growth potential but increased risk compared to diversified mutual funds. These baskets enable investors to capitalize on emerging themes like technology or sustainability while maintaining professional portfolio management and risk assessment.

Targeted Exposure Funds

Targeted exposure funds in thematic investing concentrate on specific sectors or trends, offering investors precision and potential for higher returns by capitalizing on growth areas like technology or sustainability. Mutual funds, while diversified across broader asset classes, generally provide more balanced risk management but lack the focused sector exposure that targeted funds deliver.

Niche Theme Play

Mutual funds offer diversified portfolios managed by professionals, while thematic investing focuses on niche themes such as clean energy or technology innovation, allowing investors to target specific market trends and sectors. Thematic investments can deliver higher growth potential but come with increased volatility compared to broad-market mutual funds.

Passive Thematic ETFs

Passive thematic ETFs offer targeted exposure to specific sectors or trends while maintaining low costs and broad diversification compared to traditional mutual funds. These ETFs track predefined indexes aligned with themes like technology innovation or clean energy, providing investors with efficient, transparent access to high-growth opportunities without active management fees.

Disruptive Innovation Funds

Disruptive Innovation Funds within mutual fund portfolios target high-growth companies driving technological breakthroughs, offering concentrated exposure to cutting-edge sectors like artificial intelligence, biotechnology, and renewable energy. Thematic investing hones in on specific trends or innovations, allowing investors to capitalize on long-term market shifts through focused, innovation-driven fund strategies.

Mutual Fund vs Thematic Investing Infographic

industrydif.com

industrydif.com