Credit score remains a key metric used by lenders to evaluate creditworthiness, relying on traditional data such as payment history and outstanding debts. Alternative credit data, including utility payments, rental history, and digital transaction records, offers a broader perspective on an individual's financial behavior, especially for those with limited credit history. Incorporating alternative data can enhance lending decisions and increase access to credit for underserved populations.

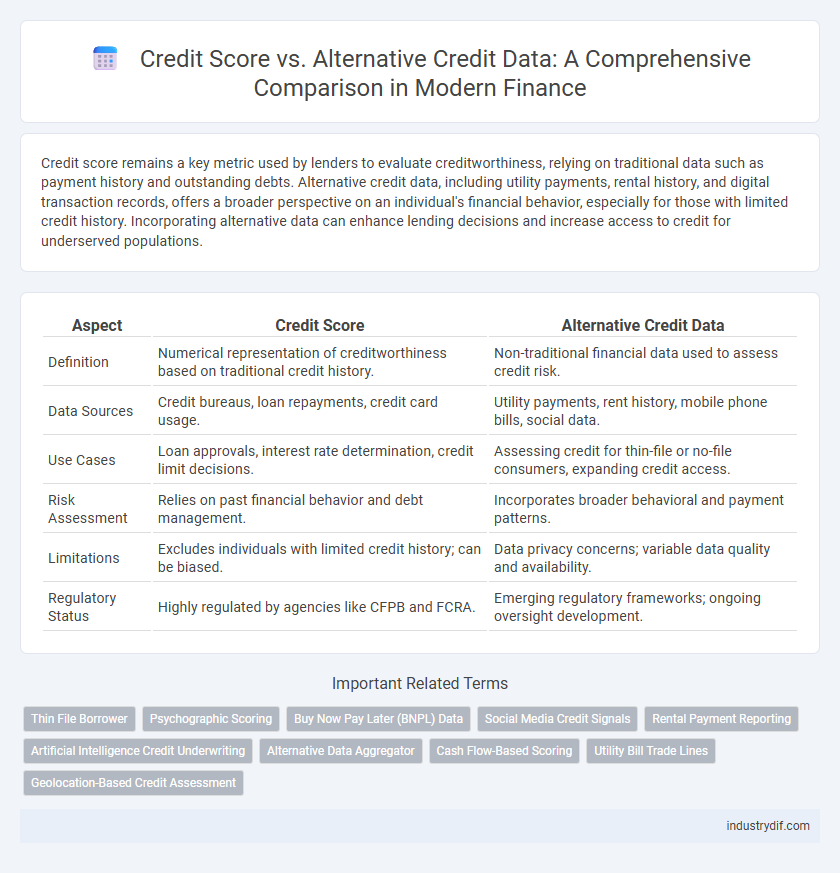

Table of Comparison

| Aspect | Credit Score | Alternative Credit Data |

|---|---|---|

| Definition | Numerical representation of creditworthiness based on traditional credit history. | Non-traditional financial data used to assess credit risk. |

| Data Sources | Credit bureaus, loan repayments, credit card usage. | Utility payments, rent history, mobile phone bills, social data. |

| Use Cases | Loan approvals, interest rate determination, credit limit decisions. | Assessing credit for thin-file or no-file consumers, expanding credit access. |

| Risk Assessment | Relies on past financial behavior and debt management. | Incorporates broader behavioral and payment patterns. |

| Limitations | Excludes individuals with limited credit history; can be biased. | Data privacy concerns; variable data quality and availability. |

| Regulatory Status | Highly regulated by agencies like CFPB and FCRA. | Emerging regulatory frameworks; ongoing oversight development. |

Understanding Traditional Credit Scores

Traditional credit scores, such as FICO and VantageScore, primarily assess an individual's creditworthiness based on payment history, amounts owed, length of credit history, new credit, and credit mix. These scores leverage data from credit bureaus, reflecting past borrowing habits, timely payments, and outstanding balances to predict future credit risk. Understanding the limitations of traditional credit scores is essential, as they often exclude individuals with limited or no credit history, prompting the rise of alternative credit data sources.

What is Alternative Credit Data?

Alternative credit data refers to non-traditional financial information used to evaluate a borrower's creditworthiness, including utility payments, rental history, and mobile phone bills. Unlike conventional credit scores that rely primarily on credit card and loan repayment history reported to credit bureaus, alternative data provides a broader view of financial behavior. This expansion allows lenders to assess individuals with limited or no credit history, improving access to credit for underserved populations.

Key Differences Between Credit Scores and Alternative Data

Credit scores primarily rely on traditional financial information such as payment history, credit utilization, and length of credit history, whereas alternative credit data incorporates non-traditional sources like utility payments, rental history, and mobile phone usage. Credit scores are widely used by lenders to assess creditworthiness, while alternative data expands credit access for individuals with limited or no conventional credit records. The integration of alternative data aims to provide a more comprehensive and inclusive evaluation of an individual's financial behavior beyond standard credit reporting metrics.

How Lenders Use Credit Scores

Lenders primarily use credit scores to evaluate the creditworthiness of borrowers by analyzing their payment history, outstanding debts, and credit utilization. These scores provide a standardized, quantifiable measure that helps predict the likelihood of default and informs lending decisions. In contrast, alternative credit data, such as utility payments and rental history, supplements traditional scores by offering a broader view of financial behavior for individuals with limited credit history.

The Rise of Alternative Credit Data in Finance

The rise of alternative credit data in finance is reshaping credit scoring by incorporating non-traditional information such as utility payments, rental history, and digital transaction records. This expanded data set enhances risk assessment accuracy, enabling lenders to offer credit to underserved populations with limited or no traditional credit history. As a result, alternative credit data fosters greater financial inclusion while maintaining creditworthiness evaluation integrity.

Benefits of Alternative Credit Data for Consumers

Alternative credit data enhances consumer credit profiles by incorporating non-traditional financial information such as utility payments, rent history, and subscription services. This expanded data set enables lenders to assess creditworthiness more accurately for individuals with limited or no traditional credit history, increasing access to loans and credit products. Consumers benefit from improved credit opportunities, potentially lower interest rates, and increased financial inclusion.

Challenges Associated with Alternative Credit Data

Alternative credit data presents challenges such as inconsistent reporting standards, limited data coverage, and potential biases affecting credit assessments. Many traditional lenders lack infrastructure to integrate non-traditional data sources like utility payments or rental history, resulting in unreliable credit evaluations. Regulatory concerns surrounding data privacy and consumer protection also complicate the widespread adoption of alternative credit data in financial decision-making.

Impact on Credit Access and Inclusion

Credit scores remain a crucial metric for lenders assessing creditworthiness, directly influencing access to traditional financing options and interest rates. Alternative credit data, such as utility payments, rental history, and digital transaction records, expands credit access by including individuals with limited or no formal credit history, promoting financial inclusion. Integrating alternative data reduces approval bias, enabling more equitable lending decisions and increasing opportunities for underserved populations in the financial ecosystem.

Regulatory Considerations for Alternative Credit Data

Regulatory considerations for alternative credit data emphasize consumer privacy and data accuracy under frameworks such as the Fair Credit Reporting Act (FCRA). Financial institutions must ensure transparency, obtain consumer consent, and implement robust data security measures when incorporating non-traditional data sources like rent payments or utility bills. Compliance with guidelines from entities like the Consumer Financial Protection Bureau (CFPB) is crucial to prevent discriminatory practices and ensure fair access to credit.

Future Trends in Credit Assessment Techniques

Emerging trends in credit assessment emphasize integrating alternative credit data such as utility payments, rental history, and social behavior analytics alongside traditional credit scores to enhance credit risk evaluation accuracy. Machine learning algorithms analyze this diverse data to identify creditworthy individuals lacking extensive credit histories, expanding financial inclusion. The future of credit assessment relies on real-time data processing and AI-driven models to provide dynamic, personalized credit scoring and reduce default rates.

Related Important Terms

Thin File Borrower

Thin file borrowers often lack sufficient traditional credit history, making it difficult for credit scores like FICO to accurately assess their creditworthiness. Alternative credit data, such as utility payments and rental history, provides valuable insights that help lenders evaluate these borrowers more comprehensively and extend credit with reduced risk.

Psychographic Scoring

Psychographic scoring leverages behavioral and personality data to assess creditworthiness beyond traditional credit scores, incorporating factors such as spending habits, lifestyle choices, and social interactions. This alternative credit data provides lenders with deeper insights into borrower reliability, enhancing risk assessment accuracy and expanding credit access to individuals with limited or no credit history.

Buy Now Pay Later (BNPL) Data

Buy Now Pay Later (BNPL) data offers a valuable alternative credit metric that enhances traditional credit scores by providing real-time insights into consumer payment behavior and financial responsibility. Incorporating BNPL transaction histories enables lenders to assess risk more accurately and extend credit to underserved populations lacking conventional credit profiles.

Social Media Credit Signals

Social media credit signals leverage behavioral data from platforms like Facebook and Twitter to supplement traditional credit scores, offering lenders deeper insights into an individual's financial habits and reliability. This alternative credit data enhances risk assessment by incorporating real-time social interactions, purchase patterns, and network trust metrics, which can improve credit access for thin-file or unbanked consumers.

Rental Payment Reporting

Rental payment reporting enhances credit scoring models by integrating alternative credit data, offering a more comprehensive view of a consumer's financial behavior beyond traditional credit bureau reports. Incorporating on-time rent payments can improve credit access for individuals with limited credit history, reducing reliance on conventional credit sources and promoting financial inclusion.

Artificial Intelligence Credit Underwriting

Artificial intelligence-powered credit underwriting leverages both traditional credit scores and alternative credit data, such as utility payments and social media behavior, to enhance predictive accuracy and financial inclusion. By integrating machine learning algorithms, AI models can identify creditworthy individuals beyond standard credit bureau reports, reducing bias and improving lending decisions.

Alternative Data Aggregator

Alternative data aggregators collect and analyze non-traditional financial information such as utility payments, rental history, and mobile phone usage to assess creditworthiness for individuals with limited or no credit history. These platforms enhance credit scoring models by incorporating diverse data points, enabling more inclusive lending decisions beyond conventional credit scores.

Cash Flow-Based Scoring

Cash flow-based scoring assesses creditworthiness by analyzing real-time income and expenditure patterns instead of relying solely on traditional credit scores, offering a more accurate reflection of an individual's financial health. This method incorporates bank transaction data, enabling lenders to evaluate repayment capacity for credit decisions in underserved markets with limited credit history.

Utility Bill Trade Lines

Utility bill trade lines provide alternative credit data that enhances traditional credit scoring models by incorporating payment histories from essential services such as electricity, water, and telecommunications. This inclusion offers lenders a more comprehensive view of borrower reliability, especially for individuals with limited or no conventional credit history.

Geolocation-Based Credit Assessment

Geolocation-based credit assessment leverages alternative credit data, such as location patterns and regional economic activity, to provide a dynamic evaluation of creditworthiness beyond traditional credit scores. By integrating geospatial analytics, lenders can better predict risk and extend financial services to underserved populations lacking comprehensive credit histories.

Credit Score vs Alternative Credit Data Infographic

industrydif.com

industrydif.com