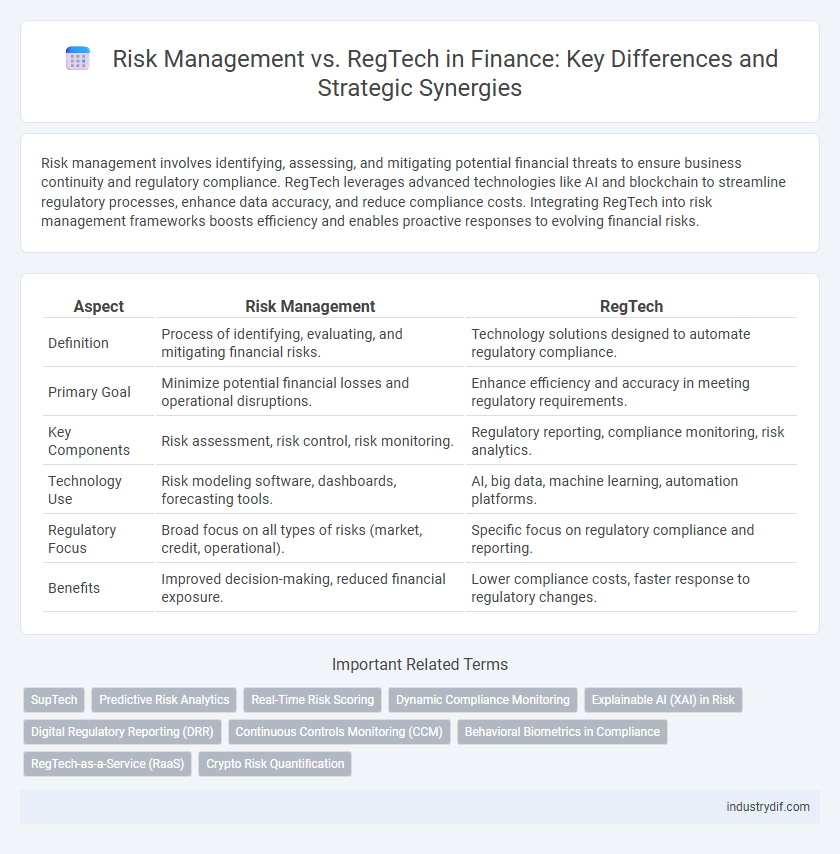

Risk management involves identifying, assessing, and mitigating potential financial threats to ensure business continuity and regulatory compliance. RegTech leverages advanced technologies like AI and blockchain to streamline regulatory processes, enhance data accuracy, and reduce compliance costs. Integrating RegTech into risk management frameworks boosts efficiency and enables proactive responses to evolving financial risks.

Table of Comparison

| Aspect | Risk Management | RegTech |

|---|---|---|

| Definition | Process of identifying, evaluating, and mitigating financial risks. | Technology solutions designed to automate regulatory compliance. |

| Primary Goal | Minimize potential financial losses and operational disruptions. | Enhance efficiency and accuracy in meeting regulatory requirements. |

| Key Components | Risk assessment, risk control, risk monitoring. | Regulatory reporting, compliance monitoring, risk analytics. |

| Technology Use | Risk modeling software, dashboards, forecasting tools. | AI, big data, machine learning, automation platforms. |

| Regulatory Focus | Broad focus on all types of risks (market, credit, operational). | Specific focus on regulatory compliance and reporting. |

| Benefits | Improved decision-making, reduced financial exposure. | Lower compliance costs, faster response to regulatory changes. |

Overview of Risk Management in Finance

Risk management in finance involves identifying, assessing, and prioritizing financial risks to minimize potential losses and ensure regulatory compliance. This process integrates techniques such as credit risk analysis, market risk measurement, and operational risk controls to safeguard assets and maintain stability. Advanced technologies like RegTech enhance risk management by automating compliance monitoring and improving real-time risk assessment accuracy.

Defining RegTech: Revolutionizing Compliance

RegTech, short for Regulatory Technology, leverages advanced digital solutions to transform risk management and compliance processes within the finance sector. By automating regulatory reporting, monitoring, and data analytics, RegTech reduces operational risks and improves accuracy in adhering to evolving financial regulations. This revolution in compliance accelerates response times to regulatory changes, enhances transparency, and minimizes costs associated with manual risk management efforts.

Traditional Risk Management Approaches

Traditional risk management approaches in finance primarily rely on manual processes, quantitative models, and historical data analysis to identify and mitigate potential losses. These methods include credit scoring, stress testing, and scenario analysis to assess financial risks such as market volatility, credit defaults, and operational failures. Despite their widespread use, traditional approaches often struggle with real-time data integration and adaptiveness compared to emerging RegTech solutions that leverage advanced analytics and automation.

Key Technologies Driving RegTech

Key technologies driving RegTech in risk management include artificial intelligence (AI), machine learning (ML), and blockchain, which enhance automated compliance and real-time risk assessment. Advanced data analytics enable the identification of emerging risks and regulatory changes faster than traditional methods. Cloud computing supports scalable, cost-effective deployment of RegTech solutions, improving transparency and operational efficiency in financial institutions.

Risk Management vs RegTech: Core Differences

Risk Management focuses on identifying, assessing, and controlling financial risks through strategic frameworks, while RegTech leverages technology to enhance regulatory compliance and reporting efficiency. Core differences include Risk Management's emphasis on risk mitigation and decision-making processes versus RegTech's automation of regulatory tasks and real-time monitoring capabilities. Integrating RegTech solutions streamlines compliance but does not replace the strategic, holistic approach inherent in Risk Management practices.

Benefits of Integrating RegTech into Risk Frameworks

Integrating RegTech into risk management frameworks enhances the accuracy and efficiency of compliance monitoring by automating regulatory reporting and real-time risk assessments. It reduces operational costs and mitigates human error through advanced analytics and machine learning, enabling faster identification of emerging risks. Financial institutions benefit from improved transparency and adaptability to evolving regulatory landscapes, ensuring robust risk control and regulatory adherence.

Regulatory Challenges and Evolving Compliance

Risk management in finance faces growing regulatory challenges as frameworks become increasingly complex and dynamic, requiring continuous adaptation to mitigate compliance risks effectively. RegTech leverages advanced technologies like AI and blockchain to streamline regulatory reporting, enhance real-time monitoring, and ensure adherence to evolving compliance standards. This technological evolution transforms traditional risk management by enabling proactive identification and resolution of regulatory gaps, reducing operational costs and improving transparency.

Impact of RegTech on Financial Risk Mitigation

RegTech accelerates financial risk mitigation by automating compliance processes, reducing human error, and enhancing real-time monitoring of regulatory requirements. Advanced data analytics and AI-driven tools enable institutions to identify and respond to emerging risks faster than traditional risk management approaches. Integration of RegTech solutions leads to improved transparency, operational efficiency, and cost-effective adherence to complex financial regulations.

Future Trends: Risk Management and RegTech Synergy

Future trends in finance emphasize the growing synergy between Risk Management and RegTech, leveraging advanced AI and machine learning to enhance real-time risk assessment and regulatory compliance. Integration of RegTech solutions streamlines data analytics and automates reporting processes, reducing operational risks and improving decision-making accuracy. This convergence supports predictive risk modeling and dynamic regulatory adaptation, positioning financial institutions to proactively manage emerging threats and regulatory complexities.

Selecting the Right Solution: Risk Management or RegTech?

Selecting the right solution between Risk Management and RegTech requires evaluating organizational priorities, regulatory complexity, and technological adaptability. Risk Management offers comprehensive frameworks to identify, assess, and mitigate financial risks, while RegTech leverages advanced technologies like AI and blockchain to automate compliance and reporting processes efficiently. Companies must weigh their need for proactive risk control against the demand for real-time regulatory adherence to maximize operational resilience and reduce compliance costs.

Related Important Terms

SupTech

SupTech leverages advanced technologies such as AI, big data analytics, and machine learning to enhance regulatory supervision, providing real-time risk detection and improving compliance monitoring. While Risk Management focuses on identifying and mitigating financial risks within institutions, SupTech enables regulators to efficiently oversee these risks and enforce regulatory standards through automated, data-driven tools.

Predictive Risk Analytics

Predictive Risk Analytics enhances Risk Management by leveraging advanced machine learning algorithms and real-time data from RegTech platforms to identify potential threats before they materialize. Integrating RegTech solutions with predictive models improves compliance accuracy, reduces regulatory penalties, and optimizes capital allocation for financial institutions.

Real-Time Risk Scoring

Risk management leverages real-time risk scoring to monitor and mitigate financial threats dynamically, utilizing data analytics and advanced algorithms for immediate insights. RegTech enhances this process by automating compliance and regulatory reporting, ensuring accurate risk assessment and faster decision-making in financial institutions.

Dynamic Compliance Monitoring

Dynamic compliance monitoring leverages RegTech solutions to provide real-time risk assessment and automatic regulatory updates, enhancing adaptive risk management frameworks. This integration allows financial institutions to proactively identify compliance breaches and optimize decision-making processes, reducing operational risks and regulatory penalties.

Explainable AI (XAI) in Risk

Explainable AI (XAI) enhances Risk Management by providing transparent, interpretable models that clarify decision-making processes, enabling firms to better assess and mitigate financial risks. In RegTech, XAI facilitates regulatory compliance by offering clear audit trails and justifications for automated risk assessments, improving trust and accountability in financial oversight.

Digital Regulatory Reporting (DRR)

Digital Regulatory Reporting (DRR) enhances risk management by enabling real-time data analytics and automated compliance monitoring, reducing regulatory breaches and costly penalties. RegTech solutions streamline DRR processes through AI-driven reporting tools, ensuring faster, more accurate submissions aligned with evolving financial regulations.

Continuous Controls Monitoring (CCM)

Continuous Controls Monitoring (CCM) enhances risk management by automating real-time compliance checks and anomaly detection, reducing manual oversight and enabling proactive mitigation of financial risks. RegTech solutions leverage CCM to streamline regulatory adherence, improve data accuracy, and provide actionable insights through advanced analytics and machine learning algorithms.

Behavioral Biometrics in Compliance

Behavioral biometrics enhances risk management by continuously analyzing user patterns such as typing rhythm and mouse movements to detect anomalies, thereby reducing fraud and ensuring compliance with regulatory standards. RegTech leverages this technology to automate identity verification processes, improve real-time monitoring, and streamline compliance reporting, minimizing financial risks and operational costs.

RegTech-as-a-Service (RaaS)

RegTech-as-a-Service (RaaS) enhances risk management by automating compliance processes and providing real-time regulatory monitoring through cloud-based platforms, reducing operational risks and costs. Leveraging AI-driven analytics, RaaS enables financial institutions to swiftly adapt to evolving regulations, improving transparency and mitigating regulatory penalties.

Crypto Risk Quantification

Crypto risk quantification integrates advanced RegTech solutions to enhance real-time monitoring and predictive analytics, enabling precise assessment of market volatility, liquidity risks, and regulatory compliance within decentralized finance. Effective risk management leverages blockchain data transparency and machine learning algorithms to identify potential fraud, cyber threats, and systemic risks, optimizing capital allocation and safeguarding digital asset portfolios.

Risk Management vs RegTech Infographic

industrydif.com

industrydif.com