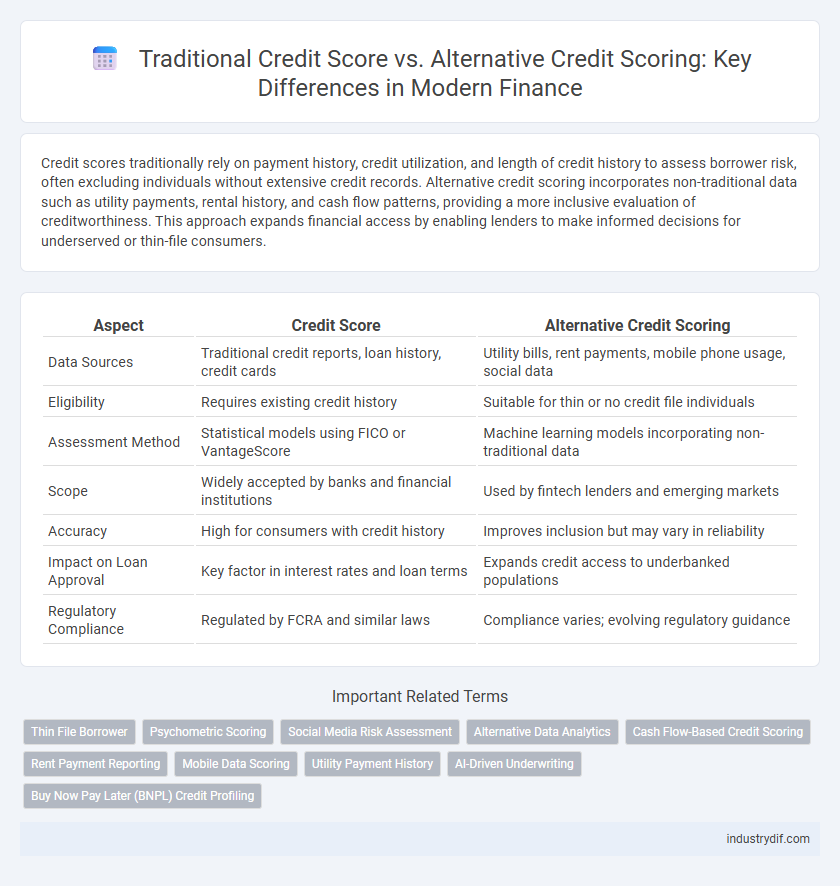

Credit scores traditionally rely on payment history, credit utilization, and length of credit history to assess borrower risk, often excluding individuals without extensive credit records. Alternative credit scoring incorporates non-traditional data such as utility payments, rental history, and cash flow patterns, providing a more inclusive evaluation of creditworthiness. This approach expands financial access by enabling lenders to make informed decisions for underserved or thin-file consumers.

Table of Comparison

| Aspect | Credit Score | Alternative Credit Scoring |

|---|---|---|

| Data Sources | Traditional credit reports, loan history, credit cards | Utility bills, rent payments, mobile phone usage, social data |

| Eligibility | Requires existing credit history | Suitable for thin or no credit file individuals |

| Assessment Method | Statistical models using FICO or VantageScore | Machine learning models incorporating non-traditional data |

| Scope | Widely accepted by banks and financial institutions | Used by fintech lenders and emerging markets |

| Accuracy | High for consumers with credit history | Improves inclusion but may vary in reliability |

| Impact on Loan Approval | Key factor in interest rates and loan terms | Expands credit access to underbanked populations |

| Regulatory Compliance | Regulated by FCRA and similar laws | Compliance varies; evolving regulatory guidance |

Understanding Traditional Credit Scores

Traditional credit scores, such as FICO and VantageScore, rely primarily on historical financial data including payment history, credit utilization, length of credit history, types of credit accounts, and recent credit inquiries. These scores quantify credit risk by analyzing patterns in borrowing and repayment behaviors from established credit reports maintained by bureaus like Experian, Equifax, and TransUnion. Understanding these conventional metrics is essential for grasping the baseline framework against which alternative credit scoring models are compared and developed.

What Is Alternative Credit Scoring?

Alternative credit scoring uses non-traditional data sources such as utility payments, rental history, and social media activity to assess an individual's creditworthiness. This method provides credit access to consumers lacking a traditional credit history by leveraging alternative financial behaviors. Fintech companies and lenders increasingly adopt alternative credit scoring to enhance risk assessment and expand credit inclusion.

Key Differences Between Credit Score and Alternative Credit Scoring

Traditional credit scores rely heavily on credit history, payment records, and debt levels to evaluate an individual's creditworthiness, often excluding those with limited borrowing backgrounds. Alternative credit scoring incorporates non-traditional data sources such as utility payments, rental history, and even social behavior patterns to provide a more inclusive financial profile. This approach enables lenders to assess risk more accurately for individuals without extensive credit histories, expanding access to credit for underserved populations.

Data Sources Used in Alternative Credit Scoring

Alternative credit scoring leverages diverse data sources beyond traditional credit reports, including payment history on utilities, rent, phone bills, and subscription services, capturing a broader financial behavior spectrum. It also integrates transactional data from bank accounts, employment records, and even social media activity to assess creditworthiness more dynamically. This multifaceted data approach enhances predictive accuracy for individuals lacking conventional credit history, promoting financial inclusion and risk assessment precision.

Pros and Cons of Traditional Credit Scores

Traditional credit scores rely heavily on credit history, which provides a standardized measure of creditworthiness but may exclude individuals with limited or no credit data, known as thin-file or no-file consumers. These scores offer lenders a fast, widely accepted risk assessment tool but can perpetuate biases and fail to capture non-traditional financial behaviors such as rent or utility payments. While traditional credit scoring enables easier access to mainstream credit products, its limitations in inclusivity and adaptability highlight the need for alternative credit scoring methods that incorporate broader data sources.

Advantages of Alternative Credit Scoring Methods

Alternative credit scoring methods leverage non-traditional data such as rent payments, utility bills, and social behavior, enabling a more inclusive assessment of creditworthiness for individuals with limited conventional credit history. These methods improve access to credit for unbanked or underbanked populations, reducing reliance on FICO scores that often overlook diverse financial behaviors. Enhanced predictive accuracy and risk assessment from alternative models support lenders in making informed decisions while expanding financial inclusion.

Impact on Financial Inclusion

Traditional credit scores rely heavily on historical credit data, often excluding individuals with limited or no credit history, thereby restricting their access to mainstream financial services. Alternative credit scoring models utilize non-traditional data sources such as utility payments, rental histories, and social behavior, enabling a more inclusive evaluation of creditworthiness for underserved populations. This expanded approach significantly enhances financial inclusion by providing credit opportunities to those previously marginalized by conventional scoring systems.

Regulatory Considerations for Credit Assessment

Regulatory considerations for credit assessment increasingly emphasize transparency and consumer protection in both traditional credit scores and alternative credit scoring models. Traditional credit scoring is governed by strict regulations such as the Fair Credit Reporting Act (FCRA) in the US, which mandates accuracy and dispute resolution, while alternative credit scoring faces evolving guidelines addressing data privacy and algorithmic fairness. Compliance with these regulations is crucial for lenders to mitigate legal risks and promote equitable access to credit for underserved populations.

Adopting Hybrid Credit Scoring Models

Hybrid credit scoring models combine traditional credit scores with alternative data sources like utility payments, rental history, and social media behavior to provide a more comprehensive assessment of creditworthiness. This approach enhances predictive accuracy and financial inclusion by capturing the credit risks of individuals with thin or no credit files. Financial institutions leveraging hybrid models can reduce default rates and expand lending to underbanked populations while maintaining effective risk management.

The Future of Consumer Credit Evaluation

The future of consumer credit evaluation increasingly incorporates alternative credit scoring methods that leverage non-traditional data such as social media activity, utility payments, and rental history to provide a more inclusive financial assessment. These innovative models enhance accuracy and accessibility for consumers with limited or no traditional credit history, addressing gaps in conventional credit scoring systems like FICO. Advances in machine learning and big data analytics drive the shift toward personalized and dynamic credit profiles, enabling lenders to evaluate risk more effectively and foster financial inclusion.

Related Important Terms

Thin File Borrower

Traditional credit scores often fail to accurately assess thin file borrowers due to limited credit history, leading to higher risk classification and reduced loan access. Alternative credit scoring models incorporate non-traditional data such as rental payments, utility bills, and cash flow patterns to provide a more comprehensive evaluation, increasing financial inclusion for individuals with sparse credit records.

Psychometric Scoring

Psychometric scoring evaluates creditworthiness by analyzing behavioral traits and decision-making patterns, offering a nuanced alternative to traditional credit scores that rely on financial history and repayment records. This innovative approach enables lenders to assess risk more accurately for individuals with limited or no credit history, enhancing financial inclusion and access to credit services.

Social Media Risk Assessment

Social media risk assessment in alternative credit scoring analyzes online behavior and social interactions to supplement traditional credit score evaluations, capturing financial reliability signals missed by conventional metrics. Incorporating data from platforms like Facebook, Twitter, and LinkedIn enhances predictive accuracy for lenders by revealing spending habits, social influence, and community engagement patterns that correlate with creditworthiness.

Alternative Data Analytics

Alternative credit scoring leverages alternative data analytics, harnessing non-traditional information such as utility payments, rental history, and social behavior to provide a more comprehensive risk assessment. This method enhances credit accessibility for underserved populations by incorporating diverse data points beyond conventional credit scores.

Cash Flow-Based Credit Scoring

Cash flow-based credit scoring evaluates an individual's creditworthiness by analyzing real-time income and expense patterns instead of relying solely on traditional credit scores derived from credit history and past loan repayments. This alternative credit scoring method provides a more accurate financial risk assessment for individuals with limited or no credit history, enabling better access to credit for underserved populations.

Rent Payment Reporting

Rent payment reporting enhances alternative credit scoring models by incorporating monthly housing payments often excluded from traditional credit score calculations. This method provides a more comprehensive financial profile, helping renters build credit histories and improve loan eligibility in underserved populations.

Mobile Data Scoring

Mobile data scoring leverages real-time mobile usage patterns, call records, and app activity to provide a dynamic alternative to traditional credit scores, offering more inclusive credit assessments. This method enhances credit accessibility for underbanked populations by utilizing behavioral data beyond conventional financial history.

Utility Payment History

Utility payment history plays a significant role in alternative credit scoring by providing lenders with additional insights into a consumer's repayment behavior beyond traditional credit scores, which primarily rely on loan and credit card data. Incorporating utility payments such as electricity, water, and phone bills can enhance credit access for individuals with limited or no formal credit history, improving financial inclusion and lending accuracy.

AI-Driven Underwriting

AI-driven underwriting leverages machine learning algorithms to analyze alternative credit scoring data such as social media activity, utility payments, and rental history, offering a more comprehensive risk assessment than traditional credit scores. This technology enhances predictive accuracy, enabling lenders to approve more applicants with limited credit history while reducing default rates.

Buy Now Pay Later (BNPL) Credit Profiling

Buy Now Pay Later (BNPL) credit profiling leverages alternative credit scoring models that incorporate transaction histories, payment behavior, and digital footprints beyond traditional credit scores, providing a more inclusive assessment of consumer creditworthiness. These alternative models enable lenders to evaluate consumers with limited credit history, improving access to financial products in the BNPL sector, while traditional credit scores primarily focus on past loan repayment and credit utilization data.

Credit Score vs Alternative Credit Scoring Infographic

industrydif.com

industrydif.com