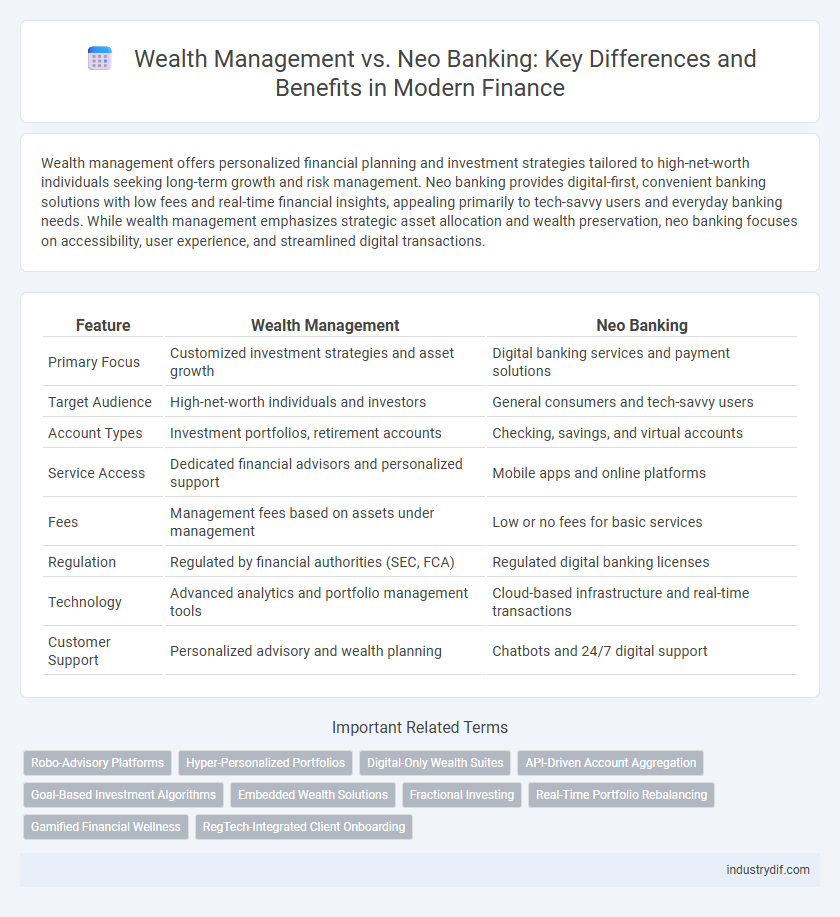

Wealth management offers personalized financial planning and investment strategies tailored to high-net-worth individuals seeking long-term growth and risk management. Neo banking provides digital-first, convenient banking solutions with low fees and real-time financial insights, appealing primarily to tech-savvy users and everyday banking needs. While wealth management emphasizes strategic asset allocation and wealth preservation, neo banking focuses on accessibility, user experience, and streamlined digital transactions.

Table of Comparison

| Feature | Wealth Management | Neo Banking |

|---|---|---|

| Primary Focus | Customized investment strategies and asset growth | Digital banking services and payment solutions |

| Target Audience | High-net-worth individuals and investors | General consumers and tech-savvy users |

| Account Types | Investment portfolios, retirement accounts | Checking, savings, and virtual accounts |

| Service Access | Dedicated financial advisors and personalized support | Mobile apps and online platforms |

| Fees | Management fees based on assets under management | Low or no fees for basic services |

| Regulation | Regulated by financial authorities (SEC, FCA) | Regulated digital banking licenses |

| Technology | Advanced analytics and portfolio management tools | Cloud-based infrastructure and real-time transactions |

| Customer Support | Personalized advisory and wealth planning | Chatbots and 24/7 digital support |

Understanding Wealth Management: Definition and Scope

Wealth management is a comprehensive financial service that integrates investment advice, financial planning, estate management, and tax strategies to optimize an individual's or family's financial well-being. It focuses on personalized, holistic approaches to asset allocation, risk management, and long-term wealth preservation. Unlike neo banking, which primarily provides digital banking services, wealth management delivers tailored solutions through professional advisors to enhance and protect wealth across multiple financial domains.

Neo Banking Explained: Modern Financial Solutions

Neo banking represents a revolutionary shift in finance, offering fully digital banking services without traditional branch networks. These platforms provide seamless access to personal and business accounts, real-time transaction monitoring, and integrated financial tools that enhance user experience and convenience. By leveraging advanced technologies like artificial intelligence and cloud computing, neo banks deliver personalized financial solutions and streamlined money management tailored to modern consumer needs.

Key Differences Between Wealth Management and Neo Banking

Wealth management offers personalized financial planning, investment advisory, and asset management services targeting high-net-worth individuals, emphasizing long-term wealth growth and preservation. Neo banking operates entirely online, providing digital banking services such as payments, loans, and account management with lower fees and enhanced accessibility for tech-savvy users. While wealth management focuses on tailored, comprehensive financial strategies, neo banking prioritizes convenience, real-time transactions, and streamlined digital experiences.

Core Services: Wealth Management vs Neo Banking

Wealth management focuses on personalized financial planning, investment advisory, and portfolio management services tailored to high-net-worth individuals, emphasizing long-term asset growth and risk management. Neo banking prioritizes digital-first banking services such as seamless account management, real-time payments, budgeting tools, and low-fee transactions, targeting tech-savvy customers seeking convenience and accessibility. Both sectors leverage advanced technology, but wealth management centers on wealth preservation and growth, while neo banking optimizes everyday financial operations.

Target Audience: Who Uses Each Service?

Wealth management primarily targets high-net-worth individuals seeking personalized investment strategies, retirement planning, and tax optimization services. Neo banking appeals to tech-savvy millennials and small business owners looking for low-cost, user-friendly digital banking solutions with seamless mobile access. Both services cater to distinct financial needs, with wealth management focusing on asset growth and preservation, while neo banks emphasize convenience and real-time financial management.

Technology Integration in Wealth Management and Neo Banking

Wealth management leverages advanced AI algorithms and big data analytics to offer personalized investment strategies and real-time portfolio monitoring, enhancing client decision-making and risk management. Neo banking utilizes cloud-native platforms and API-driven architectures to deliver seamless, user-centric digital banking experiences with rapid innovation cycles. Both sectors prioritize technology integration, but wealth management focuses on sophisticated asset optimization tools while neo banking emphasizes scalability and customer engagement through mobile-first solutions.

Regulatory Frameworks: Compliance and Security

Wealth management firms operate under stringent regulatory frameworks such as the Investment Advisers Act of 1940 and SEC oversight, ensuring comprehensive compliance and robust security protocols to protect client assets and data. Neo banking platforms, regulated primarily by fintech-specific authorities and subject to cybersecurity standards like PCI DSS, emphasize streamlined compliance with digital-first security measures including multi-factor authentication and encryption. Both sectors face evolving regulations aimed at safeguarding customer information and maintaining financial system integrity amid increasing digital transformation.

Costs and Fee Structures Compared

Wealth management services typically charge a percentage of assets under management, often ranging from 0.5% to 2% annually, reflecting personalized investment strategies and advisory fees. Neo banking platforms usually offer low-cost or no-fee accounts with minimal transaction fees, focusing on digital convenience rather than comprehensive wealth advisory. Comparing these models, wealth management incurs higher fees linked to tailored services, while neo banks prioritize affordability and accessibility with streamlined fee structures.

Benefits and Limitations of Wealth Management

Wealth management offers personalized financial planning, portfolio diversification, and tailored investment strategies to maximize long-term asset growth and risk management. It provides access to expert advisors and exclusive financial products, but typically involves higher fees and less liquidity compared to more flexible options like neo banking. Limitations include potential minimum investment requirements and less real-time transaction capabilities, which can reduce convenience for everyday banking needs.

Advantages and Challenges of Neo Banking

Neo banking offers seamless digital access to financial services with lower fees, real-time transaction tracking, and enhanced user experience through intuitive mobile apps. However, challenges include regulatory compliance complexities, limited physical branch presence, and potential cybersecurity risks. Wealth management typically involves personalized advisory services and broader asset management options, positioning neo banks as cost-effective but sometimes less comprehensive alternatives.

Related Important Terms

Robo-Advisory Platforms

Robo-advisory platforms in wealth management utilize advanced algorithms and AI to provide personalized, low-cost investment strategies, contrasting with neo banking which primarily offers digital banking services without comprehensive portfolio management. These platforms enable automated asset allocation, rebalancing, and tax optimization, making them a scalable solution for investors seeking efficient wealth growth and financial planning.

Hyper-Personalized Portfolios

Wealth management leverages advanced data analytics and AI to create hyper-personalized portfolios tailored to individual risk tolerance, financial goals, and life stages, enhancing client satisfaction and portfolio performance. Neo banking platforms integrate real-time transaction data with algorithm-driven advice, enabling dynamic, customizable investment strategies that adapt to users' evolving financial behaviors and preferences.

Digital-Only Wealth Suites

Digital-only wealth suites within neo banking platforms offer streamlined, technology-driven investment and financial planning tools that enhance accessibility and reduce fees compared to traditional wealth management firms. These innovative solutions leverage AI and big data analytics to deliver personalized portfolio management, real-time financial insights, and integrated banking services in a single digital interface.

API-Driven Account Aggregation

API-driven account aggregation enables wealth management platforms to seamlessly consolidate clients' financial data from multiple institutions, enhancing portfolio analysis and personalized advice. Neo banking leverages this technology to offer integrated, real-time financial insights and streamlined money management, positioning itself as a versatile alternative to traditional wealth management services.

Goal-Based Investment Algorithms

Wealth management leverages advanced goal-based investment algorithms to tailor portfolios aligned with clients' long-term financial objectives, optimizing asset allocation based on risk tolerance and time horizons. Neo banking integrates AI-driven goal-based investment tools within user-friendly platforms, enabling seamless, personalized investment strategies that adapt to real-time financial data and user behavior.

Embedded Wealth Solutions

Embedded wealth solutions integrate personalized financial planning and investment services directly into everyday banking platforms, enhancing user convenience and engagement compared to traditional wealth management. Neo banking leverages these embedded tools to offer seamless, real-time portfolio management and advisory services, disrupting conventional wealth management models through digital innovation.

Fractional Investing

Fractional investing enables wealth management platforms to offer diversified portfolios with smaller capital, democratizing access to high-value assets previously reserved for affluent clients. Neo banking leverages this innovation by integrating seamless fractional investing features within their digital wallets, empowering users to grow wealth alongside everyday banking services.

Real-Time Portfolio Rebalancing

Real-time portfolio rebalancing in wealth management leverages advanced algorithms and AI to continuously adjust asset allocations based on market fluctuations and client risk profiles. Neo banking platforms enhance this process by integrating instant transaction capabilities and data analytics, offering seamless, on-the-fly portfolio optimization without traditional banking delays.

Gamified Financial Wellness

Wealth management platforms integrate gamified financial wellness tools to enhance client engagement and improve long-term investment behavior through interactive goal-setting and reward systems. Neo banking leverages gamification by offering real-time spending insights and challenges that promote saving habits, making financial literacy more accessible for digital-first users.

RegTech-Integrated Client Onboarding

Wealth management platforms leverage RegTech-integrated client onboarding to enhance compliance, streamline KYC processes, and reduce onboarding time, ensuring secure and efficient asset management. Neo banking solutions also utilize RegTech tools for automated identity verification and real-time fraud detection, promoting seamless and compliant customer experience in digital finance environments.

Wealth Management vs Neo Banking Infographic

industrydif.com

industrydif.com