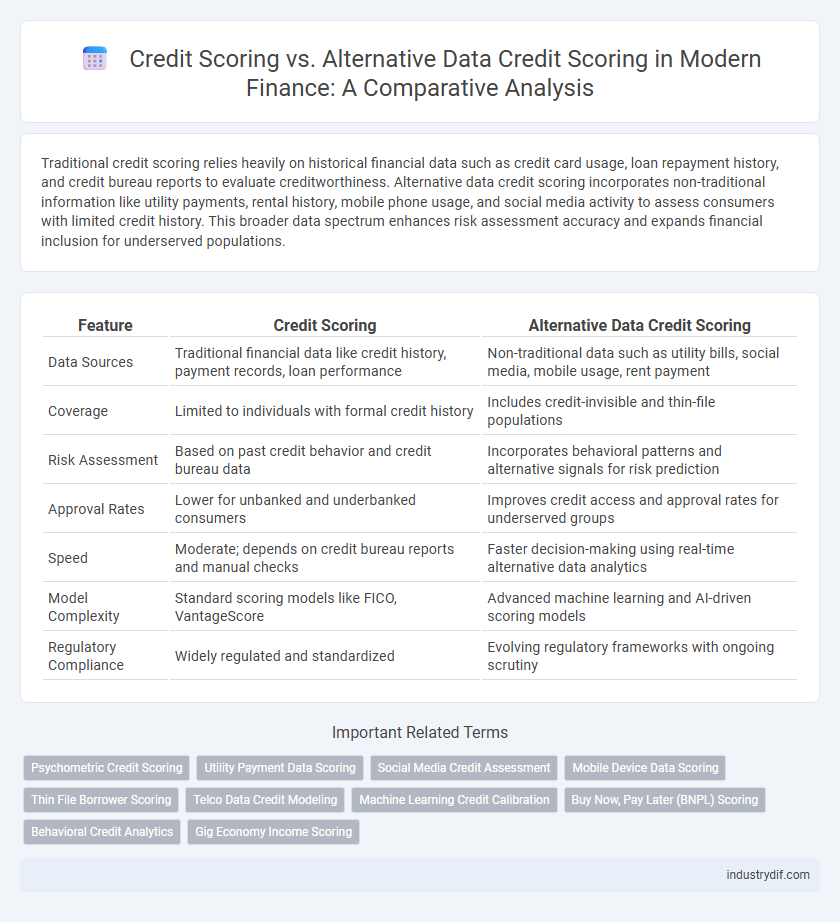

Traditional credit scoring relies heavily on historical financial data such as credit card usage, loan repayment history, and credit bureau reports to evaluate creditworthiness. Alternative data credit scoring incorporates non-traditional information like utility payments, rental history, mobile phone usage, and social media activity to assess consumers with limited credit history. This broader data spectrum enhances risk assessment accuracy and expands financial inclusion for underserved populations.

Table of Comparison

| Feature | Credit Scoring | Alternative Data Credit Scoring |

|---|---|---|

| Data Sources | Traditional financial data like credit history, payment records, loan performance | Non-traditional data such as utility bills, social media, mobile usage, rent payment |

| Coverage | Limited to individuals with formal credit history | Includes credit-invisible and thin-file populations |

| Risk Assessment | Based on past credit behavior and credit bureau data | Incorporates behavioral patterns and alternative signals for risk prediction |

| Approval Rates | Lower for unbanked and underbanked consumers | Improves credit access and approval rates for underserved groups |

| Speed | Moderate; depends on credit bureau reports and manual checks | Faster decision-making using real-time alternative data analytics |

| Model Complexity | Standard scoring models like FICO, VantageScore | Advanced machine learning and AI-driven scoring models |

| Regulatory Compliance | Widely regulated and standardized | Evolving regulatory frameworks with ongoing scrutiny |

Introduction to Credit Scoring in Finance

Credit scoring in finance evaluates an individual's creditworthiness based on traditional data such as payment history, credit utilization, and length of credit history. Alternative data credit scoring incorporates non-traditional information like utility payments, rental history, and social behavior to assess credit risk for borrowers with limited credit records. Employing alternative data enhances financial inclusion by providing more accurate risk assessments for underserved populations.

Traditional Credit Scoring: Methods and Limitations

Traditional credit scoring relies heavily on historical financial data such as payment history, credit utilization, and length of credit history to assess an individual's creditworthiness. This method often excludes non-traditional borrowers due to limited or no formal credit history, leading to potential biases and lower credit accessibility. Limitations include inability to capture real-time financial behavior and lack of consideration for alternative financial activities, resulting in incomplete risk assessment models.

What Is Alternative Data Credit Scoring?

Alternative data credit scoring leverages non-traditional information such as utility payments, rental history, mobile phone usage, and social media activity to evaluate creditworthiness. This method provides a more inclusive assessment for individuals with limited or no credit history by analyzing alternative financial behaviors and patterns. Utilizing alternative data enhances predictive accuracy and reduces biases inherent in conventional credit scoring models.

Key Differences Between Traditional and Alternative Data Credit Scoring

Traditional credit scoring relies primarily on historical financial data such as credit card usage, loan repayment history, and credit bureau reports to evaluate creditworthiness. Alternative data credit scoring incorporates non-traditional information including utility payments, rental history, social media behavior, and mobile phone usage patterns to assess risk, offering a broader view of an individual's financial reliability. This shift enables lenders to extend credit to underbanked populations by leveraging diverse datasets that better capture real-time financial behaviors and socioeconomic factors.

Types of Alternative Data Used in Credit Assessment

Alternative data credit scoring incorporates diverse non-traditional information such as utility payments, rental history, social media activity, and mobile phone usage patterns to complement traditional credit scores. This approach enhances the accuracy of credit assessments, especially for individuals with limited or no formal credit history, by providing a broader view of financial behavior and stability. Data sources like transaction records, educational background, and employment history further enrich alternative credit models, enabling lenders to make more inclusive and informed credit decisions.

Benefits of Alternative Data Credit Scoring

Alternative data credit scoring enhances financial inclusion by utilizing non-traditional data sources, such as utility payments, rental history, and social media activity, to evaluate creditworthiness. This approach provides a more comprehensive risk assessment for individuals lacking traditional credit histories, reducing reliance on limited credit bureau data. By incorporating diverse data points, alternative credit scoring models improve accuracy, enable personalized lending decisions, and expand access to credit for underserved populations.

Challenges and Risks in Alternative Data Credit Evaluation

Alternative data credit scoring faces challenges such as data privacy concerns, inconsistent data quality, and potential biases embedded in unconventional data sources like social media activity or utility payments. These risks can lead to inaccurate credit assessments, unfair lending decisions, and regulatory scrutiny, complicating the integration of alternative data into traditional credit evaluation frameworks. Ensuring transparency, data security, and algorithmic fairness remains critical to mitigating risks in alternative credit scoring models.

Regulatory Considerations in Credit Scoring Approaches

Credit scoring models must comply with regulations such as the Equal Credit Opportunity Act (ECOA) and the Fair Credit Reporting Act (FCRA), ensuring fairness and transparency in evaluating creditworthiness. Alternative data credit scoring introduces challenges related to data privacy, consent, and potential biases, requiring regulators to adapt guidelines for non-traditional data sources like social media, utility payments, and rent history. Financial institutions using alternative credit data must implement robust compliance frameworks to mitigate risks associated with discrimination and unauthorized data use while enhancing access to credit for underserved populations.

Impact on Financial Inclusion and Lending Access

Traditional credit scoring relies on limited financial history, often excluding underserved populations from credit access. Alternative data credit scoring incorporates non-traditional information such as utility payments, rental history, and social behavior, significantly expanding financial inclusion. This approach enhances lending access by providing a more comprehensive risk profile, enabling lenders to serve individuals with little or no formal credit history.

The Future of Credit Scoring: Trends and Innovations

Traditional credit scoring relies heavily on historical financial data such as credit card usage, loans, and payment history, often excluding individuals with limited credit records. Alternative data credit scoring incorporates non-traditional sources like utility payments, social media activity, and smartphone usage patterns to enhance accuracy and financial inclusion. Emerging technologies such as machine learning and artificial intelligence are driving innovations in credit scoring, enabling more dynamic risk assessment and personalized lending solutions.

Related Important Terms

Psychometric Credit Scoring

Psychometric credit scoring utilizes behavioral and personality data to assess creditworthiness, offering a nuanced alternative to traditional credit scoring models that rely heavily on financial history and credit reports. This approach leverages alternative data sources such as surveys and cognitive tests to predict repayment likelihood, enhancing credit access for individuals lacking extensive credit records.

Utility Payment Data Scoring

Credit scoring traditionally relies on credit history and financial behavior, whereas alternative data credit scoring incorporates utility payment data to provide a broader view of creditworthiness. Utility payment data scoring enhances risk assessment models by including consistent, timely payments for services like electricity and water, benefiting those with limited or no formal credit history.

Social Media Credit Assessment

Social media credit assessment uses alternative data such as online behavior, social connections, and digital footprints to evaluate creditworthiness beyond traditional credit scoring methods. Integrating social media metrics can enhance risk prediction accuracy for individuals with limited credit history or unbanked populations.

Mobile Device Data Scoring

Credit scoring traditionally relies on credit history and financial records, whereas alternative data credit scoring uses non-traditional information such as mobile device data, including call logs, app usage, and location patterns, to assess creditworthiness. This approach enables lenders to evaluate borrowers with limited credit history by leveraging real-time behavioral insights from mobile devices, improving credit access and risk prediction accuracy.

Thin File Borrower Scoring

Traditional credit scoring relies heavily on conventional credit history, often excluding thin file borrowers with limited credit activity, whereas alternative data credit scoring incorporates non-traditional information such as utility payments, rental history, and social behavior to better assess the creditworthiness of these individuals. This approach enhances financial inclusion by providing a more comprehensive risk profile, reducing loan denials for thin file borrowers who lack extensive credit records.

Telco Data Credit Modeling

Telco data credit modeling leverages call detail records, payment histories, and usage patterns to enhance credit scoring accuracy beyond traditional financial data. Integrating alternative telco data improves risk assessment for underserved consumers by capturing real-time behavior and mobile financial activity, enabling more inclusive credit decisions.

Machine Learning Credit Calibration

Machine learning credit calibration enhances traditional credit scoring by integrating alternative data sources like social behavior, utility payments, and digital footprints, improving risk prediction accuracy and inclusivity for underbanked populations. This approach leverages advanced algorithms to continuously refine credit risk models, outperforming conventional systems reliant solely on historical financial records.

Buy Now, Pay Later (BNPL) Scoring

Traditional credit scoring relies heavily on credit history and financial statements, often excluding younger or thin-file consumers from Buy Now, Pay Later (BNPL) credit assessments. Alternative data credit scoring for BNPL incorporates real-time transaction behavior, utility payments, and social data, enhancing risk prediction accuracy and expanding access to credit for underserved demographics.

Behavioral Credit Analytics

Behavioral Credit Analytics enhances traditional credit scoring by incorporating alternative data such as payment habits, social interactions, and online behavior, providing a more comprehensive risk assessment. This approach improves credit decision accuracy for individuals with limited credit history by analyzing patterns beyond conventional financial metrics.

Gig Economy Income Scoring

Credit scoring traditionally relies on credit history and financial records, while alternative data credit scoring incorporates non-traditional metrics such as gig economy income patterns, social media activity, and mobile phone usage. Gig economy income scoring enhances credit accessibility by analyzing fluctuating earnings from platforms like Uber and Upwork, providing a more accurate risk assessment for freelancers and contract workers.

Credit scoring vs Alternative data credit scoring Infographic

industrydif.com

industrydif.com