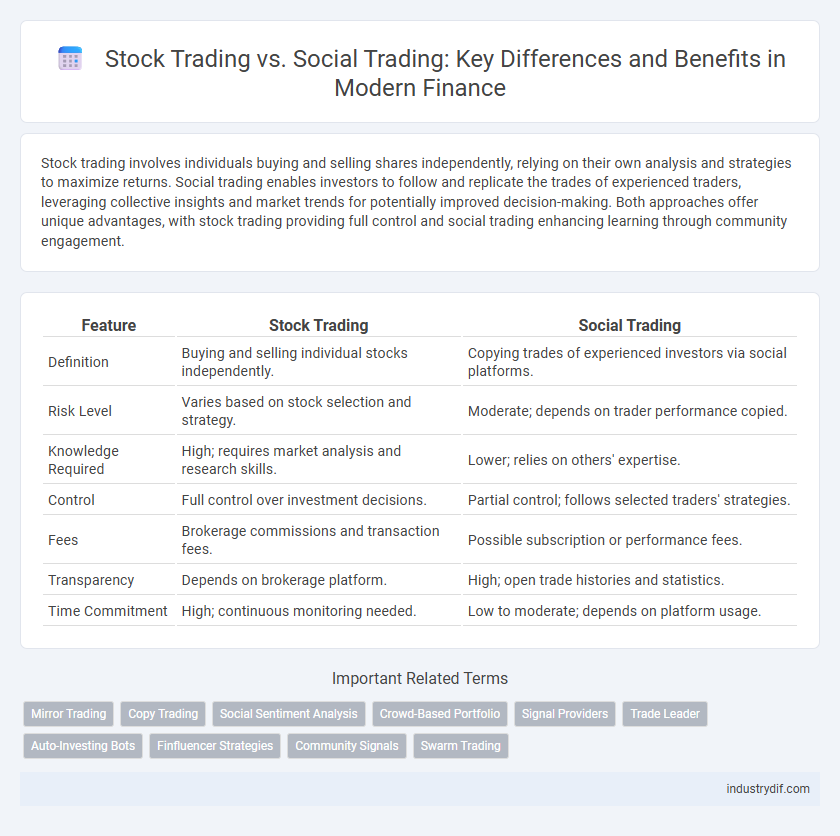

Stock trading involves individuals buying and selling shares independently, relying on their own analysis and strategies to maximize returns. Social trading enables investors to follow and replicate the trades of experienced traders, leveraging collective insights and market trends for potentially improved decision-making. Both approaches offer unique advantages, with stock trading providing full control and social trading enhancing learning through community engagement.

Table of Comparison

| Feature | Stock Trading | Social Trading |

|---|---|---|

| Definition | Buying and selling individual stocks independently. | Copying trades of experienced investors via social platforms. |

| Risk Level | Varies based on stock selection and strategy. | Moderate; depends on trader performance copied. |

| Knowledge Required | High; requires market analysis and research skills. | Lower; relies on others' expertise. |

| Control | Full control over investment decisions. | Partial control; follows selected traders' strategies. |

| Fees | Brokerage commissions and transaction fees. | Possible subscription or performance fees. |

| Transparency | Depends on brokerage platform. | High; open trade histories and statistics. |

| Time Commitment | High; continuous monitoring needed. | Low to moderate; depends on platform usage. |

Understanding Stock Trading: Core Concepts

Stock trading involves buying and selling shares of publicly traded companies through platforms like NYSE or NASDAQ, requiring knowledge of market orders, limit orders, and stock price fluctuations. Core concepts include analyzing financial statements, understanding market trends, and utilizing technical and fundamental analysis to make informed trading decisions. Mastery of risk management techniques and awareness of trading fees and regulations are essential for successful stock trading.

Exploring Social Trading: A New Paradigm

Social trading revolutionizes stock market participation by allowing investors to replicate the strategies of top traders, enhancing decision-making through collective wisdom and real-time insights. This paradigm shift democratizes access to financial markets, reducing the learning curve and enabling diverse portfolios driven by community performance metrics. Platforms like eToro and ZuluTrade exemplify this trend, integrating social networking features with advanced trading tools to foster transparency and collaborative investment strategies.

Key Differences Between Stock Trading and Social Trading

Stock trading involves individual investors buying and selling shares based on personal research and market analysis, emphasizing independent decision-making and strategies. Social trading leverages collective insights by allowing traders to follow and replicate the trades of experienced investors, integrating social networking features and real-time interaction. Key differences include the level of personal control, reliance on peer insights, and the integration of community-driven information versus solo analytical approaches.

Pros and Cons of Traditional Stock Trading

Traditional stock trading offers direct control over investment decisions, allowing traders to execute personalized strategies tailored to individual risk tolerance and market analysis. However, it requires substantial market knowledge, time commitment, and emotional discipline to manage volatility and avoid costly mistakes. The lack of community support in traditional trading can limit access to diverse insights and collaborative learning opportunities found in social trading platforms.

Advantages and Risks of Social Trading Platforms

Social trading platforms offer the advantage of leveraging collective market insights by allowing users to follow and copy experienced traders, potentially enhancing returns through collaborative strategies. These platforms reduce the learning curve for novice investors by providing access to real-time trade activities and performance data of successful traders. However, risks include overreliance on others' decisions, lack of control over individual trades, and vulnerability to herd behavior, which can lead to amplified losses during market volatility.

Technology’s Role in Modern Trading Methods

Technology integration in stock trading leverages algorithms and high-frequency trading platforms to execute rapid, data-driven market decisions, optimizing traditional investment strategies. Social trading platforms utilize real-time data sharing, social networks, and AI analytics to democratize access to collective market insights and foster community-driven portfolio management. Advancements in mobile applications and cloud computing further enhance accessibility and speed, transforming how traders interact with financial markets.

Social Trading vs Stock Trading: Performance and Returns

Social trading leverages collective market insights by mirroring experienced investors' trades, often resulting in diversified portfolios and potentially higher returns compared to individual stock trading. Studies indicate social trading platforms can reduce risks through shared strategies while enabling novice traders to achieve competitive performance without in-depth market analysis. Stock trading requires extensive knowledge and active management, which can limit returns for less experienced investors, whereas social trading democratizes access to profitable market opportunities via community-driven decision-making.

Regulatory Considerations for Both Trading Styles

Stock trading is subject to stringent regulatory oversight, including compliance with SEC rules, mandatory disclosures, and anti-fraud measures to protect investors. Social trading platforms must adhere to similar regulations but face additional challenges in monitoring user-generated content and ensuring transparency in trade copying practices. Both trading styles require robust risk management frameworks to align with financial regulations and prevent market manipulation.

Which Trading Approach Suits Different Investor Profiles?

Stock trading appeals to investors seeking control over individual stock selection, emphasizing technical analysis and market timing, making it suitable for experienced traders comfortable with risk and self-directed decision-making. Social trading attracts novice or time-constrained investors by enabling them to replicate strategies of professional traders and diversify portfolios through community insights and real-time performance tracking. Conservative investors may favor social trading for its community validation and reduced emotional bias, while aggressive investors often prefer direct stock trading for higher potential returns and personalized risk management.

Future Trends in Stock Trading and Social Trading

Future trends in stock trading indicate increased automation through AI-driven algorithms, enhancing predictive accuracy and trade execution speed. Social trading platforms are evolving with augmented reality and blockchain integration to boost transparency and community engagement. Both approaches are expected to leverage big data analytics, creating more personalized and adaptive trading strategies.

Related Important Terms

Mirror Trading

Mirror trading in finance enables investors to automatically replicate the trades of experienced traders, offering a hands-free approach to stock trading that leverages collective market insights. Unlike traditional stock trading, where decisions are made solely by the investor, mirror trading integrates social trading strategies to optimize portfolio performance and risk management.

Copy Trading

Copy trading allows investors to automatically replicate the trades of experienced stock traders, leveraging their expertise to potentially enhance returns without requiring deep market knowledge. This social trading strategy democratizes access to financial markets by enabling users to follow top-performing traders' portfolios in real time, aligning investment decisions with proven strategies.

Social Sentiment Analysis

Social sentiment analysis leverages real-time data from social media platforms to gauge investor emotions and market trends, providing a competitive edge in social trading. Unlike traditional stock trading that relies heavily on fundamental and technical analysis, social trading integrates collective sentiment to inform decisions and enhance portfolio performance.

Crowd-Based Portfolio

Crowd-based portfolios in social trading leverage collective intelligence from diverse investors, enhancing decision-making through shared insights and real-time market sentiment analysis. Unlike traditional stock trading where individual investors rely solely on personal research, social trading platforms enable users to follow expert strategies, replicate trades, and benefit from collaborative risk management.

Signal Providers

Signal providers in stock trading offer algorithm-driven or expert-generated buy and sell recommendations directly to individual traders, enabling personalized decision-making based on market analysis. In social trading, signal providers act as influential traders whose real-time strategies are automatically replicated by followers, fostering a collaborative environment where performance and reputation drive trading choices.

Trade Leader

Trade leaders in stock trading offer individualized strategies driven by personal expertise and market analysis, whereas in social trading, trade leaders gain credibility by consistently outperforming peers and directly influencing follower decisions through transparent performance metrics. The impact of trade leaders in social trading platforms enhances collective decision-making, leveraging crowd intelligence and real-time feedback to optimize portfolio diversification and risk management.

Auto-Investing Bots

Auto-investing bots in stock trading offer algorithm-driven execution based on market data and individual strategies, enabling precise, risk-adjusted portfolio management. In social trading, these bots replicate top investors' trades automatically, providing a hands-free approach that leverages collective expertise for diversified market exposure.

Finfluencer Strategies

Finfluencer strategies in stock trading emphasize independent market analysis and personalized portfolio management, leveraging deep financial expertise to maximize returns. In contrast, social trading strategies prioritize community-driven insights and real-time trade copying, enabling investors to benefit from collective intelligence and expert recommendations.

Community Signals

Community signals in social trading leverage collective insights from a network of traders to influence decision-making, offering real-time sentiment and trend analysis that traditional stock trading lacks. These signals enhance trading strategies by integrating crowd-sourced data, increasing the potential for identifying profitable opportunities and mitigating risks.

Swarm Trading

Swarm trading leverages collective intelligence by aggregating the insights of numerous individual investors to predict market movements more accurately than traditional stock trading methods. This approach harnesses real-time data and crowd behavior analysis, offering enhanced decision-making power and potentially higher returns compared to solitary stock trading strategies.

Stock Trading vs Social Trading Infographic

industrydif.com

industrydif.com