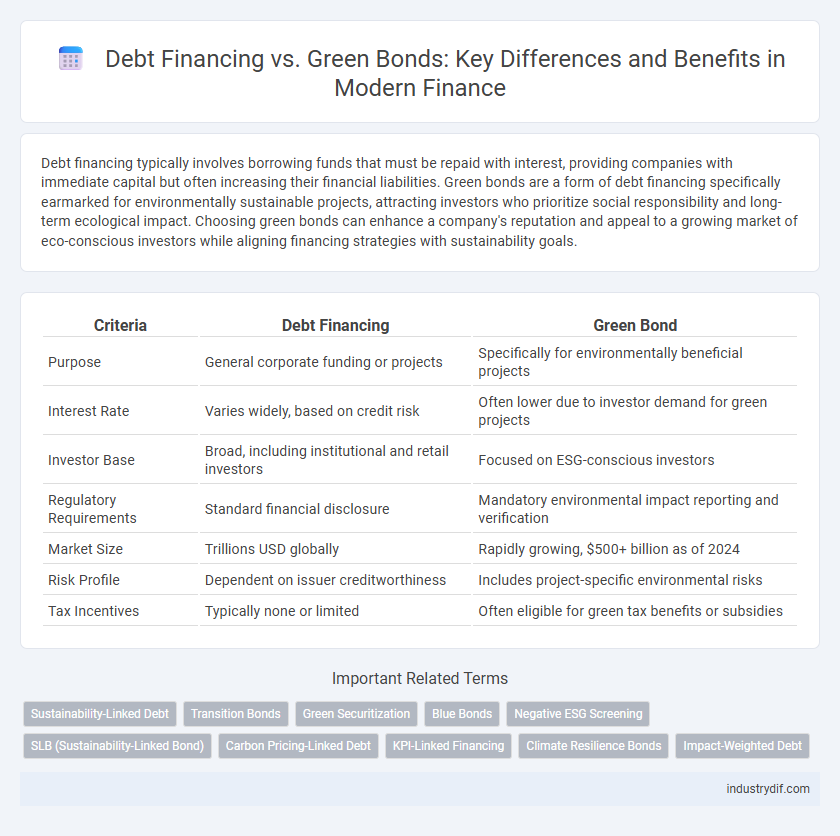

Debt financing typically involves borrowing funds that must be repaid with interest, providing companies with immediate capital but often increasing their financial liabilities. Green bonds are a form of debt financing specifically earmarked for environmentally sustainable projects, attracting investors who prioritize social responsibility and long-term ecological impact. Choosing green bonds can enhance a company's reputation and appeal to a growing market of eco-conscious investors while aligning financing strategies with sustainability goals.

Table of Comparison

| Criteria | Debt Financing | Green Bond |

|---|---|---|

| Purpose | General corporate funding or projects | Specifically for environmentally beneficial projects |

| Interest Rate | Varies widely, based on credit risk | Often lower due to investor demand for green projects |

| Investor Base | Broad, including institutional and retail investors | Focused on ESG-conscious investors |

| Regulatory Requirements | Standard financial disclosure | Mandatory environmental impact reporting and verification |

| Market Size | Trillions USD globally | Rapidly growing, $500+ billion as of 2024 |

| Risk Profile | Dependent on issuer creditworthiness | Includes project-specific environmental risks |

| Tax Incentives | Typically none or limited | Often eligible for green tax benefits or subsidies |

Understanding Debt Financing in Modern Finance

Debt financing is a critical mechanism in modern finance, allowing companies to raise capital through loans or bond issuance while retaining equity control. It provides predictable repayment schedules and fixed or variable interest rates tailored to the borrower's financial profile and market conditions. Understanding the nuances of debt financing enables businesses to optimize capital structure, manage risk, and improve liquidity for sustainable growth.

What Are Green Bonds? Definitions and Features

Green bonds are fixed-income financial instruments specifically designed to raise capital for projects with positive environmental benefits, such as renewable energy, clean transportation, and sustainable water management. Unlike traditional debt financing, green bonds require issuers to comply with established environmental standards and reporting frameworks to ensure transparency and impact measurement. These features attract socially responsible investors seeking to support climate-friendly initiatives while earning returns.

Key Differences: Debt Financing vs Green Bond

Debt financing involves borrowing capital from external lenders, typically with fixed interest payments and maturity dates, primarily used for general business purposes. Green bonds are a type of debt financing specifically earmarked for funding environmentally sustainable projects, offering investors opportunities aligned with ESG criteria. Unlike traditional debt, green bonds often benefit from preferential treatment such as tax incentives and enhanced investor demand due to their positive environmental impact.

Benefits of Traditional Debt Financing

Traditional debt financing offers predictable repayment schedules and fixed interest rates, providing businesses with financial stability and budget certainty. It typically allows for larger capital amounts compared to green bonds, supporting extensive operational or expansion projects. Furthermore, traditional debt financing is generally accessible to a wider range of companies, without the stringent environmental criteria required by green bonds.

Advantages of Green Bonds for Sustainable Investment

Green bonds offer a targeted approach to debt financing by specifically funding environmentally sustainable projects, enhancing transparency and investor confidence through dedicated impact reporting. They attract a growing base of socially responsible investors seeking to support climate action, often benefiting from favorable regulatory incentives and green certifications. This alignment with environmental, social, and governance (ESG) criteria helps issuers improve their public image and access capital markets with potentially lower borrowing costs.

Risks and Challenges: Debt Financing Compared to Green Bonds

Debt financing carries risks such as high interest rates, credit default, and cash flow constraints, which can jeopardize a company's financial stability. Green bonds present challenges regarding strict reporting requirements, project eligibility, and potential greenwashing concerns that may impact investor confidence. Compared to traditional debt, green bonds require enhanced transparency and compliance with environmental standards, increasing administrative costs and regulatory scrutiny.

Market Trends: Growth in Debt Financing and Green Bonds

The global debt financing market is expanding rapidly, driven by increased corporate borrowing and favorable interest rates, reaching over $250 trillion in outstanding debt as of 2024. Simultaneously, green bonds are experiencing exponential growth, with issuance surpassing $600 billion in 2023, reflecting rising investor demand for sustainable finance instruments. Market trends indicate a strong preference for green bonds among environmentally conscious investors, while traditional debt financing remains dominant for large-scale corporate and infrastructure projects.

Regulatory Frameworks Impacting Debt Financing and Green Bonds

Regulatory frameworks for debt financing and green bonds significantly influence market dynamics and investor confidence by setting stringent disclosure and sustainability criteria. Green bond regulations, such as the EU Green Bond Standard, require issuers to adhere to environmental impact reporting and use-of-proceeds verification, driving transparency and attracting ESG-focused capital. Conversely, traditional debt financing faces evolving compliance demands on creditworthiness and risk assessment but lacks the specialized environmental mandates that differentiate green bonds in the regulatory landscape.

Environmental Impact: Green Bonds vs Conventional Debt Instruments

Green bonds finance projects with measurable environmental benefits such as renewable energy, pollution reduction, and sustainable resource management, directly supporting climate action goals. Conventional debt instruments typically fund general corporate operations without specific environmental criteria, often resulting in higher carbon footprints and limited ecological accountability. Investors increasingly favor green bonds for their transparency and positive environmental impact, aligning financial returns with sustainable development objectives.

Choosing the Right Financing Option: Strategic Considerations

Choosing between debt financing and green bonds depends on the company's sustainability goals, cost of capital, and investor base. Debt financing offers flexible terms and broader access to capital but may lack environmental appeal, while green bonds attract environmentally conscious investors with potentially lower interest rates and enhanced corporate reputation. Evaluating regulatory incentives, market demand for ESG-compliant assets, and long-term financial impact is crucial for aligning the financing strategy with organizational priorities.

Related Important Terms

Sustainability-Linked Debt

Sustainability-linked debt offers a flexible alternative to traditional debt financing by tying interest rates to the achievement of specific environmental, social, and governance (ESG) targets, thus incentivizing companies to improve their sustainability performance. Unlike green bonds, which fund only designated green projects, sustainability-linked debt integrates broader corporate sustainability goals, aligning financial returns with measurable ESG improvements.

Transition Bonds

Transition bonds are a specialized form of green bonds designed to finance projects that help high-carbon industries reduce emissions and shift toward sustainability. Unlike traditional debt financing, these bonds target measurable environmental improvements in sectors with challenges meeting green bond criteria, linking financial returns to climate transition milestones.

Green Securitization

Green securitization creates a sustainable financing structure by bundling green bonds with debt instruments, enhancing capital market access for eco-friendly projects. Compared to traditional debt financing, this approach reduces risk, lowers capital costs, and attracts ESG-focused investors seeking environmental impact and financial returns.

Blue Bonds

Blue bonds, a specialized form of green bonds, provide debt financing specifically aimed at marine and ocean conservation projects, offering investors a sustainable investment that supports environmental protection while generating financial returns. Compared to traditional debt financing, blue bonds target ecological impact with transparent use of proceeds, attracting interest from institutions prioritizing environmental, social, and governance (ESG) criteria.

Negative ESG Screening

Negative ESG screening in debt financing excludes companies with poor environmental, social, and governance practices, ensuring investments avoid high-risk, non-compliant issuers. Green bonds specifically channel capital towards projects with positive environmental impacts, offering a targeted approach to sustainable investment without the broad exclusions typical of negative ESG screening.

SLB (Sustainability-Linked Bond)

Sustainability-Linked Bonds (SLBs) differentiate from traditional debt financing by directly tying interest rates to the issuer's achievement of predefined ESG performance targets, incentivizing sustainable business practices. Unlike standard Green Bonds, which allocate proceeds to specific environmental projects, SLBs offer greater flexibility by linking overall corporate sustainability improvements to financial terms, appealing to investors seeking both impact and fiscal returns.

Carbon Pricing-Linked Debt

Carbon pricing-linked debt integrates environmental impact costs into financing by aligning interest rates or repayment terms with carbon price fluctuations, incentivizing lower emissions. This innovative approach contrasts traditional debt financing by embedding sustainability metrics directly into financial liabilities, thereby promoting green investments and lowering overall carbon footprints.

KPI-Linked Financing

Debt financing involves borrowing capital that must be repaid with interest, while green bonds specifically fund environmentally sustainable projects. KPI-linked financing enhances these methods by tying interest rates or repayments to specific environmental or financial performance indicators, driving accountability and improved outcomes.

Climate Resilience Bonds

Climate Resilience Bonds, a specialized form of green bonds, channel debt financing into projects that enhance infrastructure and community adaptations against climate change impacts, offering investors sustainable returns linked to environmental benefits. These bonds prioritize funding for climate-resilient initiatives such as flood defenses, renewable energy systems, and sustainable agriculture, differentiating them from traditional debt financing by directly supporting long-term ecological stability and risk mitigation.

Impact-Weighted Debt

Impact-weighted debt integrates environmental and social performance metrics into traditional debt financing, enhancing transparency and accountability for sustainable outcomes. Green bonds specifically allocate capital to eco-friendly projects, while impact-weighted debt aligns broader corporate debt strategies with measurable sustainability impact goals.

Debt Financing vs Green Bond Infographic

industrydif.com

industrydif.com