Mergers and acquisitions (M&A) involve the direct purchase or consolidation of companies to enhance market share, operational efficiency, and competitive advantage. Special Purpose Acquisition Companies (SPACs) offer a faster, less complex alternative for companies seeking public listings by merging with existing public shells. While M&A strategies require extensive due diligence and regulatory approval, SPACs provide greater flexibility but may carry higher market volatility and investor uncertainty.

Table of Comparison

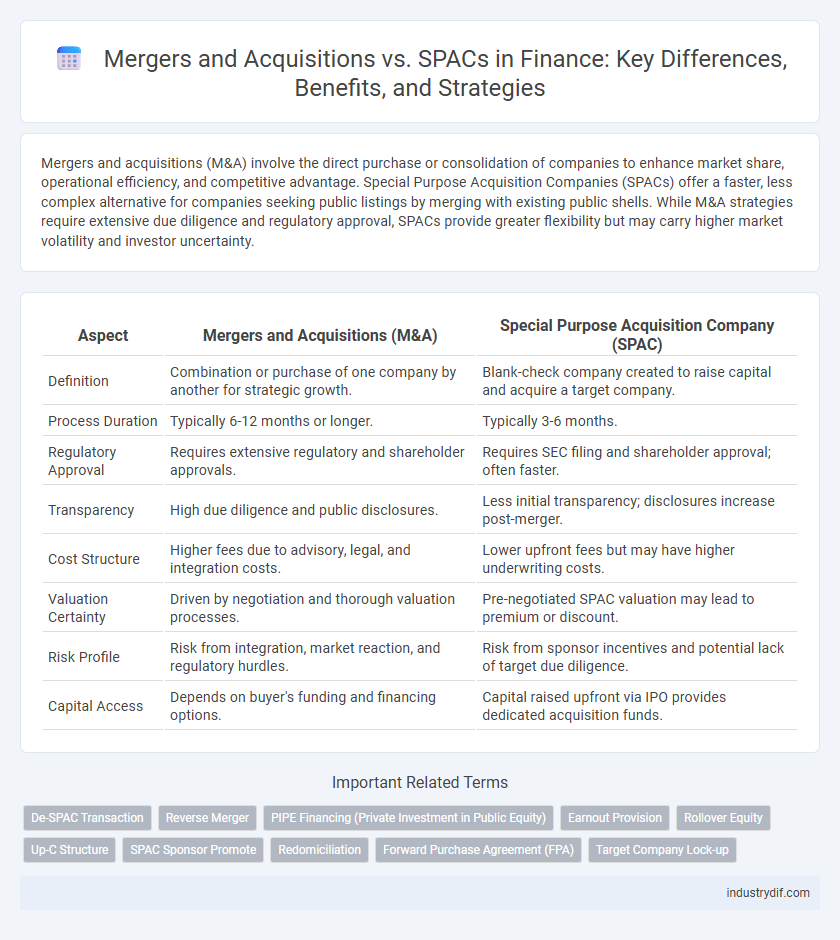

| Aspect | Mergers and Acquisitions (M&A) | Special Purpose Acquisition Company (SPAC) |

|---|---|---|

| Definition | Combination or purchase of one company by another for strategic growth. | Blank-check company created to raise capital and acquire a target company. |

| Process Duration | Typically 6-12 months or longer. | Typically 3-6 months. |

| Regulatory Approval | Requires extensive regulatory and shareholder approvals. | Requires SEC filing and shareholder approval; often faster. |

| Transparency | High due diligence and public disclosures. | Less initial transparency; disclosures increase post-merger. |

| Cost Structure | Higher fees due to advisory, legal, and integration costs. | Lower upfront fees but may have higher underwriting costs. |

| Valuation Certainty | Driven by negotiation and thorough valuation processes. | Pre-negotiated SPAC valuation may lead to premium or discount. |

| Risk Profile | Risk from integration, market reaction, and regulatory hurdles. | Risk from sponsor incentives and potential lack of target due diligence. |

| Capital Access | Depends on buyer's funding and financing options. | Capital raised upfront via IPO provides dedicated acquisition funds. |

Overview of Mergers and Acquisitions (M&A)

Mergers and Acquisitions (M&A) represent strategic transactions where companies consolidate to enhance market share, diversify product lines, or achieve operational synergies. This process involves complex financial, legal, and regulatory considerations, including due diligence, valuation, and negotiation of terms. Effective M&A execution can significantly impact corporate growth trajectories and shareholder value in competitive industries.

Understanding Special Purpose Acquisition Companies (SPACs)

Special Purpose Acquisition Companies (SPACs) are publicly traded shell companies created to raise capital through an initial public offering (IPO) with the sole purpose of acquiring or merging with existing private companies. SPACs offer an alternative route for private firms to go public without the traditional IPO process, often resulting in faster market entry and potentially lower regulatory scrutiny. Unlike conventional mergers and acquisitions that involve direct negotiation and due diligence, SPAC transactions rely on pre-raised funds and investor confidence in the management team's ability to identify a viable target.

Key Differences Between M&A and SPAC Transactions

Mergers and acquisitions (M&A) involve the direct negotiation and purchase of a company, often requiring extensive due diligence and regulatory approval, while SPAC (Special Purpose Acquisition Company) transactions utilize a publicly traded shell company to acquire a target within a specified timeframe. M&A deals typically offer more control over pricing and terms but require longer timelines and disclosure, whereas SPACs provide faster access to public markets with an accelerated process but may face shareholder approval and market volatility risks. The structure, speed, and regulatory considerations define the key differences between traditional M&A and SPAC transactions in corporate finance.

Regulatory Environment for M&A and SPAC Deals

Mergers and Acquisitions (M&A) undergo rigorous regulatory scrutiny from bodies such as the Federal Trade Commission (FTC) and the Securities and Exchange Commission (SEC), ensuring compliance with antitrust laws and protecting shareholder interests. Special Purpose Acquisition Companies (SPACs) face evolving SEC regulations aimed at increasing transparency, disclosure requirements, and investor protections due to concerns over rapid deal timelines and valuation complexities. Understanding the contrasting regulatory frameworks is crucial for navigating legal risks and optimizing transaction strategies in the current financial landscape.

Financial Structures: M&A vs SPACs

Mergers and Acquisitions (M&A) typically involve complex financial structures including asset purchases, stock swaps, and cash transactions designed to integrate companies and optimize shareholder value. Special Purpose Acquisition Companies (SPACs) use a unique financial structure where a publicly traded shell company raises capital through an IPO to acquire a target company, enabling faster market entry with fewer regulatory hurdles. The distinct capital deployment strategies and risk allocation in M&A versus SPAC deal structures affect valuation, due diligence processes, and investor returns.

Due Diligence Processes in M&A and SPACs

Due diligence in mergers and acquisitions involves comprehensive financial, legal, and operational assessments to uncover risks and validate the target company's valuation, often requiring extensive time and resources. In contrast, SPAC transactions typically feature accelerated due diligence processes due to predefined timelines, relying heavily on public disclosures and sponsor reputations. Both approaches demand meticulous analysis but differ in scope and depth, impacting deal certainty and regulatory scrutiny.

Advantages and Disadvantages of M&A

Mergers and Acquisitions (M&A) offer companies strategic growth through increased market share, operational synergies, and enhanced competitive positioning, but they often involve complex due diligence, regulatory scrutiny, and significant integration challenges. High transaction costs and time-consuming negotiations can delay value realization compared to the faster capital-raising process of SPACs. Despite these drawbacks, M&A deals provide greater control over the combined entity and long-term value creation potential.

Pros and Cons of Using SPACs for Going Public

SPACs offer a faster and more certain route to going public compared to traditional IPOs, often closing deals within months and providing access to experienced sponsors and capital. However, SPACs may result in diluted shares and less rigorous regulatory scrutiny, potentially increasing risk for investors. The SPAC process can limit price discovery and lead to overvaluation, contrasting with the transparency and market-driven pricing of mergers and acquisitions.

Market Trends in M&A and SPAC Activity

Mergers and acquisitions (M&A) activity has shown steady growth driven by strategic consolidation and sector diversification, notably in technology, healthcare, and energy industries. Special Purpose Acquisition Companies (SPACs) experienced a surge in market activity, peaking in 2021 with record capital raised, but have since faced regulatory scrutiny and declining investor interest, resulting in slower deal closures. Current market trends indicate a cautious resurgence in both M&A and SPAC transactions, supported by favorable financing conditions and evolving investor preferences.

Strategic Considerations for Choosing M&A or SPAC Pathways

Mergers and Acquisitions (M&A) offer comprehensive due diligence and strategic integration, enabling firms to align closely with long-term corporate objectives and operational synergies. Special Purpose Acquisition Companies (SPACs) provide a faster, more flexible alternative for accessing capital markets and liquidity, appealing to companies prioritizing speed and reduced regulatory hurdles. Evaluating market volatility, valuation certainty, and shareholder alignment remains critical when deciding between M&A and SPAC pathways for growth and expansion.

Related Important Terms

De-SPAC Transaction

De-SPAC transactions involve a Special Purpose Acquisition Company merging with a private operating company to take it public, providing faster market entry compared to traditional mergers and acquisitions (M&A), which often require longer due diligence and regulatory approval. This streamlined process in De-SPAC deals enhances capital access and liquidity while potentially reducing valuation uncertainties typical in conventional M&A transactions.

Reverse Merger

Reverse mergers enable private companies to enter public markets quickly by merging with a shell company, providing an alternative to traditional mergers and acquisitions (M&A) and SPAC (Special Purpose Acquisition Company) deals. This process reduces regulatory scrutiny and timelines compared to conventional IPOs, offering a strategic shortcut in the evolving landscape of corporate finance transactions.

PIPE Financing (Private Investment in Public Equity)

PIPE financing plays a critical role in SPAC transactions by providing immediate capital infusion post-merger, often at a lower cost and with fewer regulatory hurdles compared to traditional mergers and acquisitions. Unlike conventional M&A deals that rely heavily on bank financing and lengthy due diligence, PIPE investments enable faster deal closure and offer institutional investors attractive equity stakes in a public company formed through a SPAC.

Earnout Provision

Earnout provisions in mergers and acquisitions (M&A) enable sellers to receive contingent payments based on future financial performance, aligning incentives post-transaction and mitigating valuation discrepancies. In contrast, SPAC transactions often lack detailed earnout mechanisms, prioritizing rapid deal closure and fixed valuation structures over performance-based adjustments.

Rollover Equity

Rollover equity in mergers and acquisitions allows existing shareholders to retain a stake in the combined entity, aligning interests and facilitating smoother transitions during ownership changes. In SPAC transactions, rollover equity functions similarly by enabling target company shareholders to reinvest proceeds into the new public entity, preserving upside potential while accelerating market access.

Up-C Structure

The Up-C structure in mergers and acquisitions offers significant tax advantages by allowing private company owners to retain tax basis and defer recognition of gain when transitioning through a Special Purpose Acquisition Company (SPAC) transaction. By combining the operational benefits of an M&A deal with the capital-raising efficiency of a SPAC, the Up-C structure enhances shareholder value and optimizes equity incentives.

SPAC Sponsor Promote

SPAC sponsor promote typically involves a 20% equity stake granted to sponsors at a nominal price, incentivizing them to identify and complete acquisition targets efficiently. This structure contrasts with traditional mergers and acquisitions, where sponsor compensation is directly tied to deal performance and lacks the upfront equity stake inherent in SPAC promotes.

Redomiciliation

Mergers and acquisitions (M&A) often involve complex redomiciliation processes to transfer corporate domicile, enabling companies to optimize tax benefits and regulatory compliance across jurisdictions. In contrast, SPACs typically streamline redomiciliation by merging with a target company already established in a preferred jurisdiction, accelerating market entry without the extensive restructuring common in traditional M&A transactions.

Forward Purchase Agreement (FPA)

Forward Purchase Agreements (FPAs) in Mergers and Acquisitions (M&A) provide a structured mechanism for buyers to commit capital in advance, reducing deal uncertainty and enhancing valuation clarity compared to the more flexible but speculative nature of Special Purpose Acquisition Companies (SPACs). FPAs enable precise financial planning and risk mitigation by locking in purchase terms prior to closing, offering strategic advantages over the contingent capital deployment typical in SPAC transactions.

Target Company Lock-up

Target company lock-up periods in mergers and acquisitions generally restrict insiders from selling shares post-transaction, stabilizing stock price and ensuring long-term commitment. In SPAC deals, lock-up durations can vary but often provide less stringent restrictions, potentially increasing short-term volatility for the target company's stock.

Mergers and Acquisitions vs SPAC Infographic

industrydif.com

industrydif.com