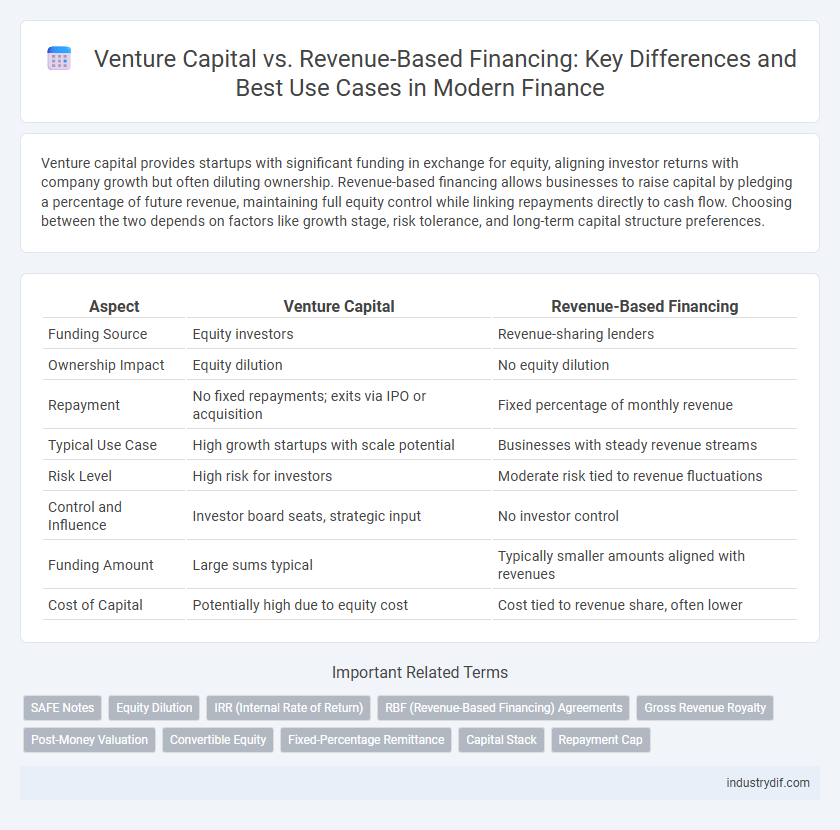

Venture capital provides startups with significant funding in exchange for equity, aligning investor returns with company growth but often diluting ownership. Revenue-based financing allows businesses to raise capital by pledging a percentage of future revenue, maintaining full equity control while linking repayments directly to cash flow. Choosing between the two depends on factors like growth stage, risk tolerance, and long-term capital structure preferences.

Table of Comparison

| Aspect | Venture Capital | Revenue-Based Financing |

|---|---|---|

| Funding Source | Equity investors | Revenue-sharing lenders |

| Ownership Impact | Equity dilution | No equity dilution |

| Repayment | No fixed repayments; exits via IPO or acquisition | Fixed percentage of monthly revenue |

| Typical Use Case | High growth startups with scale potential | Businesses with steady revenue streams |

| Risk Level | High risk for investors | Moderate risk tied to revenue fluctuations |

| Control and Influence | Investor board seats, strategic input | No investor control |

| Funding Amount | Large sums typical | Typically smaller amounts aligned with revenues |

| Cost of Capital | Potentially high due to equity cost | Cost tied to revenue share, often lower |

Introduction to Venture Capital and Revenue-Based Financing

Venture capital involves investing equity in early-stage companies with high growth potential, providing significant capital in exchange for ownership stakes and strategic guidance. Revenue-based financing offers a flexible alternative where investors receive a percentage of the company's ongoing revenue until a predefined return is achieved, avoiding equity dilution. This approach aligns investor returns directly with business performance, making it attractive for companies with steady revenue streams seeking growth capital without giving up control.

Key Differences Between Venture Capital and Revenue-Based Financing

Venture capital involves equity investment where investors receive ownership stakes and significant influence in a company, while revenue-based financing provides capital repaid through a percentage of ongoing revenues without equity dilution. Key differences include the risk-return profile, with venture capital offering high risk and potentially high returns, compared to revenue-based financing's lower risk and predictable repayment tied directly to company performance. Furthermore, venture capital typically suits high-growth startups aiming for rapid scaling, whereas revenue-based financing is preferable for businesses with steady revenue streams seeking flexible repayment terms.

How Venture Capital Works: Structure and Process

Venture capital involves investors providing equity funding to startups in exchange for ownership stakes, typically through structured funding rounds such as seed, Series A, and later stages. The process begins with due diligence, followed by valuation negotiations, term sheet agreements, and board involvement, aligning investor interests with company growth. This equity-based model emphasizes high growth potential and exit strategies like IPOs or acquisitions to generate returns.

Revenue-Based Financing: Definition and Mechanisms

Revenue-based financing is a capital-raising method where investors provide funds to a business in exchange for a fixed percentage of the company's ongoing gross revenues until a predetermined amount, typically a multiple of the original investment, is repaid. Unlike traditional venture capital, this financing model does not require equity dilution or ownership stake, allowing founders to retain control over their companies. The repayment amount and timeline are directly tied to the company's revenue performance, making it a flexible and scalable option for startups with predictable revenue streams.

Equity Dilution in Venture Capital vs Revenue-Based Models

Venture capital typically involves significant equity dilution as investors receive ownership stakes in exchange for funding, which can reduce founders' control and future profit shares. In contrast, revenue-based financing requires repayments as a fixed percentage of revenue without ceding equity, preserving ownership but potentially impacting cash flow. Understanding the balance between ownership dilution and repayment obligations is crucial for startups choosing the optimal financing model.

Investment Criteria: What VCs and Revenue-Based Lenders Look For

Venture Capital firms prioritize high-growth potential startups with scalable business models, strong management teams, and significant market opportunity, often seeking equity stakes and control rights. Revenue-based lenders focus on businesses with consistent revenue streams, positive cash flow, and profitability, emphasizing repayment ability through a fixed percentage of monthly revenue rather than equity dilution. Both investors evaluate financial health, growth trajectory, and risk profile, but revenue-based financing is typically preferred for companies needing flexible, non-dilutive capital without relinquishing ownership.

Pros and Cons of Venture Capital

Venture capital offers substantial funding and strategic support, enabling rapid business growth and access to valuable industry networks. However, it often requires giving up significant equity and control, potentially leading to pressure for aggressive scaling and high exit expectations. Entrepreneurs must weigh the benefits of capital infusion against dilution and the demands of investor involvement.

Advantages and Disadvantages of Revenue-Based Financing

Revenue-based financing offers founders non-dilutive capital, allowing them to retain full equity while repaying investors through a fixed percentage of future revenues. The model aligns investor returns with business performance, reducing pressure during low-revenue periods but may result in higher overall cost compared to traditional loans. Limitations include capped funding amounts and potential cash flow strain from revenue share commitments, making it less suitable for early-stage companies with unpredictable income streams.

Ideal Business Profiles for Each Financing Method

Venture capital best suits high-growth startups with scalable business models, strong market potential, and a willingness to dilute equity for rapid expansion. Revenue-based financing aligns with established businesses generating consistent revenue and seeking non-dilutive funding, allowing repayments as a percentage of monthly earnings. Founders prioritizing equity retention and strategic support often prefer venture capital, while those valuing flexible repayment tied to cash flow lean toward revenue-based financing.

Choosing the Right Funding: Venture Capital or Revenue-Based Financing?

Venture capital provides substantial equity investment and strategic support ideal for startups seeking rapid growth and market expansion, while revenue-based financing offers flexible, debt-like funding with repayments tied to monthly revenue, minimizing ownership dilution. Choosing the right funding depends on factors such as business stage, growth potential, cash flow stability, and willingness to share control; venture capital suits disruptive, high-growth companies, whereas revenue-based financing benefits steady-revenue firms focusing on maintaining equity. Careful evaluation of financial goals and risk tolerance ensures alignment with the appropriate financing model for long-term business success.

Related Important Terms

SAFE Notes

SAFE notes enable startups to raise venture capital by offering investors convertible equity with deferred valuation, contrasting with revenue-based financing which repays investors through a percentage of future revenues without equity dilution. Venture capital via SAFE notes typically supports high-growth startups seeking significant funding rounds, while revenue-based financing suits businesses prioritizing steady cash flow and avoiding ownership loss.

Equity Dilution

Venture capital financing typically involves significant equity dilution as investors receive ownership stakes in exchange for capital, potentially reducing founders' control over the company. Revenue-based financing offers non-dilutive capital where repayments are tied to a percentage of revenue, preserving ownership but potentially impacting cash flow during growth periods.

IRR (Internal Rate of Return)

Venture capital typically targets higher IRRs, often exceeding 20%, by investing in high-growth startups with significant equity appreciation potential. Revenue-based financing offers more predictable cash flows and moderate IRRs, generally ranging from 15% to 25%, by tying returns directly to a company's revenue performance without diluting equity.

RBF (Revenue-Based Financing) Agreements

Revenue-based financing (RBF) agreements provide startups and growing companies with flexible capital by allowing repayments as a fixed percentage of monthly revenue, eliminating the need for equity dilution typical in venture capital deals. This financing model aligns investor returns directly with business performance, offering scalability and reduced financial risk compared to traditional equity financing structures.

Gross Revenue Royalty

Gross Revenue Royalty in revenue-based financing offers startups a flexible repayment model tied directly to total sales, contrasting with venture capital that dilutes equity for upfront capital. This approach aligns investor returns with business revenue performance without sacrificing ownership, making it attractive for companies prioritizing control and consistent cash flow-based repayments.

Post-Money Valuation

Post-money valuation in venture capital reflects the company's value immediately after the funding round, calculated by adding the investment amount to the pre-money valuation, often resulting in equity dilution for founders. In revenue-based financing, valuation is less explicit, with repayments tied to a percentage of ongoing revenue, allowing companies to avoid equity dilution and maintain control while investors receive returns based on future sales performance.

Convertible Equity

Convertible equity in venture capital provides startups with flexible funding by allowing investors to convert their investment into equity at a later valuation, avoiding immediate dilution and interest payments. Revenue-based financing offers recurrent repayments tied to revenue performance, but convertible equity better aligns investor returns with company growth without fixed repayment obligations.

Fixed-Percentage Remittance

Fixed-percentage remittance in revenue-based financing involves entrepreneurs repaying investors with a fixed portion of their ongoing gross revenues until a predetermined cap is reached, offering flexibility without equity dilution. Unlike venture capital, which demands equity stakes and potential control rights, this repayment structure aligns investor returns directly with business performance, minimizing financial strain during low-revenue periods.

Capital Stack

Venture capital typically occupies the equity layer in the capital stack, offering high-growth potential but diluting ownership, while revenue-based financing sits in the debt segment, providing flexible repayments tied to revenue without equity loss. Understanding the capital stack positioning helps founders balance control with funding needs, optimizing financial strategy and long-term value creation.

Repayment Cap

Venture capital typically involves equity stakes without fixed repayment caps, while revenue-based financing sets a predefined repayment cap linked to a multiple of the invested amount, ensuring returns are capped regardless of business performance. This repayment cap provides clarity and limits the investor's returns, making revenue-based financing a less dilutive option for startups seeking predictable exit terms.

Venture Capital vs Revenue-based Financing Infographic

industrydif.com

industrydif.com