Traditional banks offer established financial services with widespread physical branches and regulatory stability, while neobanks provide fully digital experiences with lower fees and enhanced user interfaces. Neobanks leverage advanced technology to deliver instant account setup, real-time notifications, and personalized financial management tools that appeal to tech-savvy customers. Despite limited in-person support, neobanks drive financial innovation by prioritizing convenience, speed, and transparency over traditional banking methods.

Table of Comparison

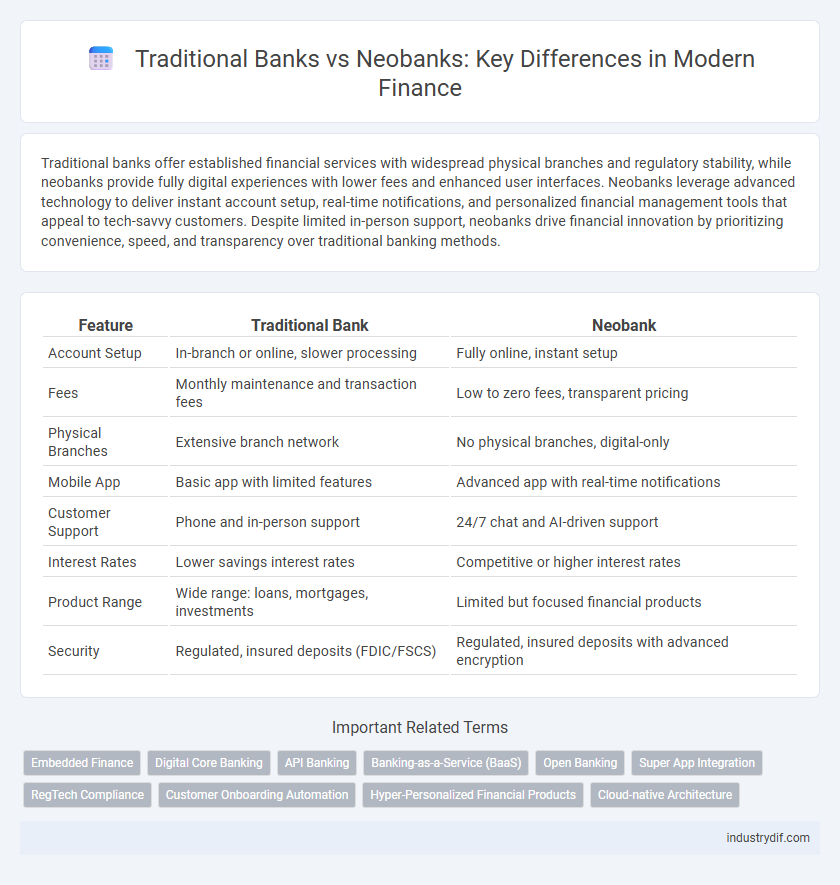

| Feature | Traditional Bank | Neobank |

|---|---|---|

| Account Setup | In-branch or online, slower processing | Fully online, instant setup |

| Fees | Monthly maintenance and transaction fees | Low to zero fees, transparent pricing |

| Physical Branches | Extensive branch network | No physical branches, digital-only |

| Mobile App | Basic app with limited features | Advanced app with real-time notifications |

| Customer Support | Phone and in-person support | 24/7 chat and AI-driven support |

| Interest Rates | Lower savings interest rates | Competitive or higher interest rates |

| Product Range | Wide range: loans, mortgages, investments | Limited but focused financial products |

| Security | Regulated, insured deposits (FDIC/FSCS) | Regulated, insured deposits with advanced encryption |

Overview: Traditional Banks and Neobanks Defined

Traditional banks operate as established financial institutions with physical branches, offering comprehensive services such as savings accounts, loans, and investment products regulated by federal authorities. Neobanks function exclusively online, leveraging digital platforms and advanced technology to provide streamlined banking services with lower fees and faster transactions. Both entities target different customer preferences, with traditional banks emphasizing trust and stability, while neobanks focus on innovation and convenience.

Core Differences in Service Delivery

Traditional banks offer in-person branch services, supporting face-to-face customer interactions and cash handling, while neobanks operate exclusively online, providing swift, user-friendly digital experiences via mobile apps. Neobanks leverage advanced fintech technologies to deliver real-time transaction updates and personalized financial insights, whereas traditional banks focus on comprehensive service portfolios, including loans and wealth management with established regulatory frameworks. The core difference lies in service delivery models: traditional banks rely on physical infrastructure and legacy systems, whereas neobanks prioritize agile, technology-driven platforms optimized for convenience and lower operational costs.

Regulatory Framework and Compliance

Traditional banks operate under well-established regulatory frameworks with stringent compliance requirements set by government agencies like the FDIC and OCC, ensuring robust consumer protection and financial stability. Neobanks, while offering innovative digital-first services, face evolving regulations often centered on partnering with licensed banks to maintain compliance with AML, KYC, and data security standards. Regulatory scrutiny on neobanks is increasing as they expand their offerings, prompting continuous adaptation to meet complex compliance mandates in both regional and international financial markets.

Digital Innovation and Technology Integration

Traditional banks often rely on legacy systems that limit rapid technology integration, whereas neobanks leverage cloud-based platforms enabling real-time updates and seamless digital innovation. Neobanks prioritize user experience through AI-driven personalization, automated services, and API-based ecosystems, contrasting with traditional banks' more manual, in-branch processes. The agility in adopting fintech tools and blockchain technologies gives neobanks a competitive edge in delivering efficient, secure, and scalable financial services.

Cost Structure and Pricing Models

Traditional banks often maintain higher operational costs due to extensive branch networks and legacy systems, leading to fee-based pricing models including account maintenance fees and transaction charges. Neobanks leverage digital-only platforms with minimal overhead, enabling lower or no fees and competitive interest rates through subscription or freemium pricing structures. This shift in cost structure allows neobanks to offer more transparent and affordable financial services compared to traditional banks.

Customer Experience and Personalization

Traditional banks often rely on legacy systems that can limit real-time personalization, leading to slower customer service and less tailored product offerings. Neobanks leverage advanced data analytics and AI to deliver highly personalized experiences, including instant account setup, customized financial advice, and seamless mobile interaction. This digital-first approach enhances customer satisfaction by offering convenience, faster response times, and individualized financial solutions.

Security Measures and Risk Mitigation

Traditional banks implement extensive security protocols such as multifactor authentication, encryption, and physical branch security to protect customer assets and data. Neobanks leverage advanced cybersecurity technologies, including AI-driven fraud detection and biometric verification, to mitigate risks in a digital-first environment. Both banking models face regulatory compliance requirements, but neobanks invest heavily in real-time threat monitoring to address emerging cyber threats and maintain customer trust.

Accessibility and Market Reach

Traditional banks operate through extensive branch networks, providing physical access to financial services but often limited by geographic constraints and operating hours. Neobanks leverage digital platforms to offer 24/7 accessibility, enabling them to reach underserved and global markets without physical infrastructure limitations. The digital-first approach of neobanks expands market reach and enhances convenience, while traditional banks maintain a strong presence among customers preferring in-person interactions.

Product Offerings: Loans, Savings, and Investments

Traditional banks provide a wide range of loan products including mortgages, personal loans, and auto loans supported by comprehensive savings accounts with tiered interest rates. Neobanks primarily focus on streamlined digital savings accounts and micro-investment options with competitive interest but often lack extensive loan offerings. Investment services in traditional banks include brokerage accounts and retirement planning, while neobanks tend to offer basic investment features integrated into mobile apps for user convenience.

Future Trends and Industry Outlook

Neobanks harness advanced AI and blockchain technologies to drive personalized banking experiences and streamline operations, outpacing traditional banks in digital innovation. The industry outlook indicates a growing consumer preference for seamless mobile banking, predictive analytics, and decentralized finance solutions that challenge conventional banking models. Traditional banks are increasingly investing in fintech partnerships and upgrading legacy systems to remain competitive amidst the evolving financial ecosystem.

Related Important Terms

Embedded Finance

Traditional banks rely on legacy infrastructure and branch networks, limiting their agility in integrating embedded finance solutions that enhance customer experiences through seamless third-party services. Neobanks leverage API-driven platforms to embed financial products like payments, lending, and insurance directly into non-financial apps, enabling real-time, personalized financial services that drive innovation and customer engagement.

Digital Core Banking

Traditional banks often rely on legacy core banking systems that limit agility and slow down digital innovation, while neobanks leverage fully digital core banking platforms enabling seamless, real-time transaction processing and personalized customer experiences. The shift to cloud-native infrastructure in neobanks facilitates faster product deployment, enhanced scalability, and improved operational efficiency compared to the inflexible architectures of traditional banks.

API Banking

Traditional banks rely on legacy systems with limited API integration, resulting in slower and less flexible financial services, while neobanks utilize advanced API banking to offer seamless, real-time transactions and customizable digital solutions. API banking empowers neobanks to efficiently connect with third-party providers, driving innovation and enhancing customer experience through personalized financial products.

Banking-as-a-Service (BaaS)

Traditional banks leverage well-established Banking-as-a-Service (BaaS) platforms to offer comprehensive financial products, benefiting from regulatory compliance and extensive customer trust. Neobanks utilize BaaS infrastructure to deliver seamless digital banking experiences with agile innovation, lower operational costs, and faster market entry.

Open Banking

Traditional banks often rely on legacy systems that limit their agility in adopting open banking APIs, resulting in slower integration of third-party financial services. Neobanks leverage open banking to offer seamless, real-time connectivity with multiple financial platforms, enhancing personalized customer experiences and enabling innovative product ecosystems.

Super App Integration

Traditional banks often struggle with seamless integration of super app features due to legacy infrastructure and regulatory constraints. Neobanks leverage agile platforms and APIs to integrate diverse financial services and third-party applications, creating unified super app ecosystems that enhance customer experience and drive higher engagement.

RegTech Compliance

Traditional banks rely heavily on established RegTech solutions to ensure compliance with regulatory requirements through robust, manual-heavy processes and legacy systems, while neobanks leverage agile, cloud-based RegTech platforms to automate real-time compliance monitoring, reducing operational costs and enhancing regulatory reporting accuracy. Advanced AI-driven risk assessment tools and blockchain technology integration give neobanks a competitive edge in swiftly adapting to evolving regulatory landscapes compared to the slower compliance adaptation mechanisms of traditional banks.

Customer Onboarding Automation

Traditional banks rely heavily on manual processes for customer onboarding, leading to longer verification times and higher operational costs, whereas neobanks leverage advanced automation technologies like AI-driven KYC and biometric authentication to streamline account opening, enhance user experience, and reduce fraud risk. Automated onboarding systems in neobanks can significantly improve customer acquisition rates by offering instant identity verification and seamless digital document processing.

Hyper-Personalized Financial Products

Traditional banks rely on standardized financial products with limited customization, which often fail to meet the unique needs of individual customers. Neobanks leverage big data analytics and AI to offer hyper-personalized financial products, optimizing customer experiences through tailored savings plans, personalized credit offerings, and real-time financial insights.

Cloud-native Architecture

Traditional banks often rely on legacy IT infrastructure that limits scalability and agility, whereas neobanks leverage cloud-native architecture to enable rapid deployment, seamless updates, and improved customer experience. Cloud-native technologies like microservices, containerization, and APIs empower neobanks to offer personalized financial services with enhanced security and operational efficiency.

Traditional Bank vs Neobank Infographic

industrydif.com

industrydif.com