Crowdfunding allows businesses to raise capital by collecting small amounts of money from a large number of people, often in exchange for products or equity, providing a quick boost in visibility and customer engagement. Revenue-based financing offers a flexible repayment model where lenders receive a percentage of future revenue until a predetermined amount is paid, aligning repayment with business performance and cash flow. Choosing between crowdfunding and revenue-based financing depends on the company's growth stage, funding needs, and appetite for investor involvement or debt obligations.

Table of Comparison

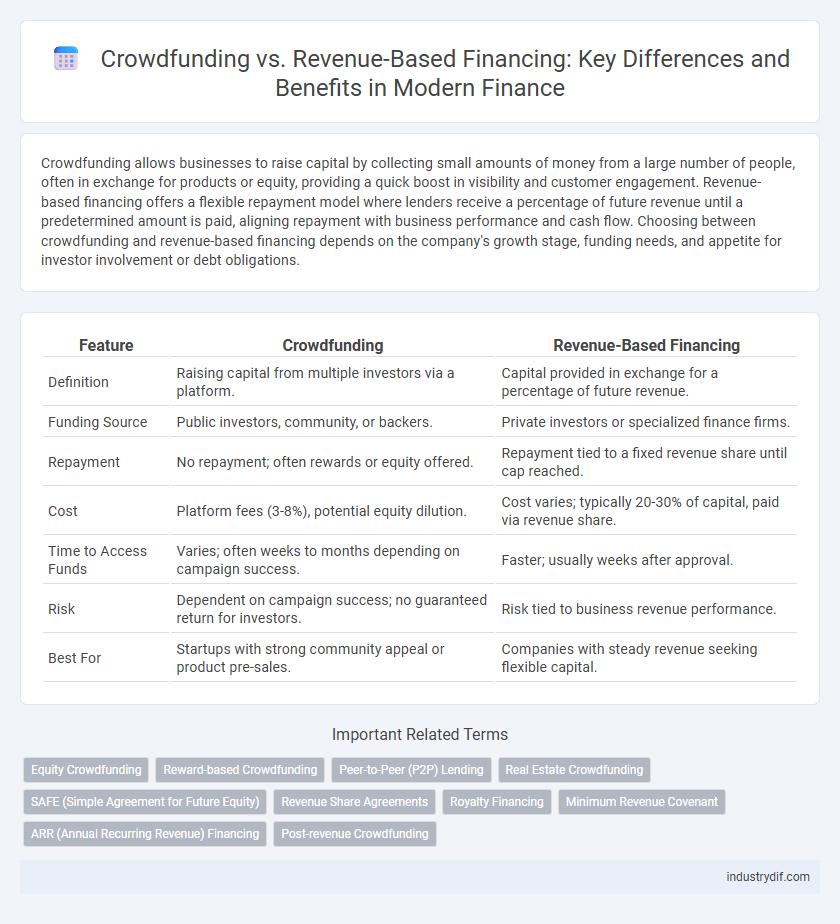

| Feature | Crowdfunding | Revenue-Based Financing |

|---|---|---|

| Definition | Raising capital from multiple investors via a platform. | Capital provided in exchange for a percentage of future revenue. |

| Funding Source | Public investors, community, or backers. | Private investors or specialized finance firms. |

| Repayment | No repayment; often rewards or equity offered. | Repayment tied to a fixed revenue share until cap reached. |

| Cost | Platform fees (3-8%), potential equity dilution. | Cost varies; typically 20-30% of capital, paid via revenue share. |

| Time to Access Funds | Varies; often weeks to months depending on campaign success. | Faster; usually weeks after approval. |

| Risk | Dependent on campaign success; no guaranteed return for investors. | Risk tied to business revenue performance. |

| Best For | Startups with strong community appeal or product pre-sales. | Companies with steady revenue seeking flexible capital. |

Introduction to Crowdfunding and Revenue-Based Financing

Crowdfunding enables businesses to raise capital by collecting small amounts of money from a large number of people through online platforms, offering rewards or equity in return. Revenue-based financing involves investors providing funds in exchange for a fixed percentage of the company's ongoing gross revenues until a predetermined amount is repaid. Both methods offer alternative funding solutions that bypass traditional loans and equity financing, catering to different business needs and growth stages.

Core Concepts: How Crowdfunding Works

Crowdfunding involves raising small amounts of capital from a large number of individuals, typically via online platforms, to fund a business project or venture. Contributors may receive rewards, early access, or equity, depending on the crowdfunding model chosen. This method leverages social networks and community support to achieve funding goals without incurring traditional debt or giving up significant control.

Core Concepts: Understanding Revenue-Based Financing

Revenue-based financing provides businesses with capital in exchange for a fixed percentage of ongoing gross revenues until the agreed-upon amount is repaid, differing from crowdfunding where funds are raised from multiple investors without strict repayment terms. This financing model aligns investor returns directly with company performance, offering flexibility by avoiding equity dilution and fixed debt schedules. Understanding revenue-based financing's core concept highlights its suitability for companies with steady revenue streams seeking growth capital without relinquishing ownership.

Key Differences Between Crowdfunding and Revenue-Based Financing

Crowdfunding involves raising small amounts of capital from a large number of individuals, often in exchange for rewards or equity, while revenue-based financing provides investors with a fixed percentage of future revenue until a predetermined return is reached. Crowdfunding typically suits startups seeking validation and community engagement, whereas revenue-based financing is ideal for businesses with predictable revenue streams that prefer flexible repayment tied to performance. The key difference lies in funding structure, risk exposure, and investor returns tied to revenue versus upfront contributions.

Investor Profiles and Risk Assessment

Crowdfunding attracts a diverse group of individual backers who often seek engagement and shared vision rather than solely financial returns, making it suitable for early-stage ventures with high growth potential but elevated risk. Revenue-based financing appeals to more risk-averse investors prioritizing steady cash flow and predictable returns, as repayments are tied directly to a company's revenue performance, mitigating default risk. Investor profiles vary significantly, with crowdfunding investors tolerating higher uncertainty for equity or perks, while revenue-based financiers emphasize risk assessment through historical sales data and revenue forecasts.

Funding Speed and Accessibility

Crowdfunding offers rapid access to capital by leveraging a broad base of individual investors, often securing funds within days to weeks, making it highly accessible for startups and small businesses. Revenue-based financing typically requires a more detailed vetting process, resulting in slower funding speed but provides ongoing capital linked to future revenues without diluting ownership. While crowdfunding excels in speed and mass appeal, revenue-based financing offers tailored accessibility for businesses with predictable revenue streams seeking flexible repayment options.

Impacts on Ownership and Equity

Crowdfunding allows entrepreneurs to raise capital without giving up equity, maintaining full ownership control while engaging a broad base of small investors. Revenue-based financing provides funds in exchange for a percentage of future revenue, preserving equity but imposing ongoing financial obligations tied to business performance. Choosing between these options impacts control, dilution, and financial flexibility, making ownership structure a critical factor in financing decisions.

Financial Repayment Structures Compared

Crowdfunding involves raising small amounts of capital from numerous backers, usually without requiring repayment or equity, making it a low-risk option for startups. Revenue-based financing provides capital in exchange for a fixed percentage of future revenues until a predetermined repayment cap is reached, aligning repayments directly with business performance. This repayment structure offers more flexibility compared to traditional loans, as payments fluctuate with revenue, reducing financial stress during low-income periods.

Industry Suitability and Business Stages

Crowdfunding is ideal for early-stage startups and creative industries seeking market validation and community support without immediate revenue expectations. Revenue-based financing suits established businesses in scalable sectors with predictable revenue streams, enabling growth without equity dilution. Both financing methods cater to different risk profiles and cash flow predictability, aligning with distinct business stages and industry needs.

Choosing the Best Financing Option for Your Business

Crowdfunding offers access to a broad investor base, ideal for startups seeking to validate ideas and raise capital without incurring debt or diluting equity. Revenue-based financing provides flexible repayment tied to business performance, allowing companies with steady cash flows to avoid fixed loan obligations. Choosing between these options depends on your business model, growth stage, and cash flow predictability, ensuring alignment with long-term financial goals.

Related Important Terms

Equity Crowdfunding

Equity crowdfunding allows investors to acquire shares in early-stage companies, offering potential for significant returns as the business grows, whereas revenue-based financing provides capital in exchange for a fixed percentage of ongoing gross revenues without diluting ownership. Unlike revenue-based financing, equity crowdfunding involves greater risk and regulatory compliance but can fuel long-term growth through broader investor participation and brand advocacy.

Reward-based Crowdfunding

Reward-based crowdfunding allows entrepreneurs to raise capital by offering non-monetary incentives to backers, making it ideal for early-stage projects with strong consumer appeal. Unlike revenue-based financing, which requires sharing a percentage of future earnings, reward-based crowdfunding provides upfront funds without imposing repayment obligations or equity dilution.

Peer-to-Peer (P2P) Lending

Peer-to-peer (P2P) lending, a subset of crowdfunding, connects individual investors directly with borrowers, offering flexible revenue-based financing as repayments are tied to the borrower's ongoing revenue streams rather than fixed loan schedules. This model reduces default risk through performance-based repayments and provides startups and small businesses with scalable capital without diluting equity or relying on traditional creditworthiness metrics.

Real Estate Crowdfunding

Real estate crowdfunding pools capital from multiple investors to fund property projects, offering equity stakes and potential asset appreciation, while revenue-based financing provides flexible capital repayment through a percentage of the project's income, preserving ownership control without equity dilution. Investors in real estate crowdfunding benefit from diversified property portfolios and passive income, whereas revenue-based financing attracts developers seeking non-dilutive funding linked directly to project cash flow.

SAFE (Simple Agreement for Future Equity)

SAFE (Simple Agreement for Future Equity) offers startups a streamlined alternative to traditional crowdfunding by allowing investors to convert their investment into equity at a future valuation event, aligning incentives without immediate debt obligations. Revenue-based financing contrasts with SAFE by requiring periodic repayments tied directly to revenue, providing investors with returns linked to operational success rather than potential equity upside.

Revenue Share Agreements

Revenue Share Agreements (RSAs) offer businesses flexible financing by allowing investors to receive a percentage of ongoing revenue until a predetermined amount is repaid, contrasting with crowdfunding which typically involves raising capital from multiple contributors without direct revenue participation. RSAs provide a performance-linked repayment structure that aligns investor returns with the company's revenue growth, reducing the risk of dilution and avoiding fixed debt obligations.

Royalty Financing

Royalty financing, a form of revenue-based financing, enables investors to receive a percentage of a company's ongoing gross revenues until a predetermined amount is repaid, offering flexible repayment tied to business performance. Unlike traditional crowdfunding, which raises funds in exchange for equity or rewards, royalty financing aligns investor returns directly with sales, minimizing dilution and providing predictable cash flow management for growing enterprises.

Minimum Revenue Covenant

Revenue-based financing requires a minimum revenue covenant to ensure consistent cash flow for repayments, which reduces risk for investors, while crowdfunding rarely imposes such financial covenants, offering more flexible terms for entrepreneurs. This covenant in revenue-based financing aligns investor returns directly with the company's performance, unlike crowdfunding's equity or donation models that do not link repayment to revenue thresholds.

ARR (Annual Recurring Revenue) Financing

Revenue-based financing aligns with companies having strong ARR growth by providing capital in exchange for a fixed percentage of future recurring revenue, ensuring flexible repayment tied directly to cash flow. In contrast, crowdfunding often lacks this ARR-linked repayment structure, making revenue-based financing more suitable for SaaS businesses aiming to scale predictable, subscription-driven revenues.

Post-revenue Crowdfunding

Post-revenue crowdfunding enables businesses with established sales to raise capital by offering equity shares or rewards, leveraging their proven market traction to attract investors. Revenue-based financing provides flexible funding by allowing companies to repay investors through a fixed percentage of ongoing revenues, aligning repayment with business performance without diluting ownership.

Crowdfunding vs Revenue-based financing Infographic

industrydif.com

industrydif.com