SWIFT relies on a centralized network for cross-border payment messaging, ensuring standardized and secure communication between financial institutions. Blockchain settlement offers decentralized, real-time transaction processing with enhanced transparency and reduced intermediary costs. The adoption of blockchain can streamline settlement times and mitigate risks associated with traditional SWIFT transfers.

Table of Comparison

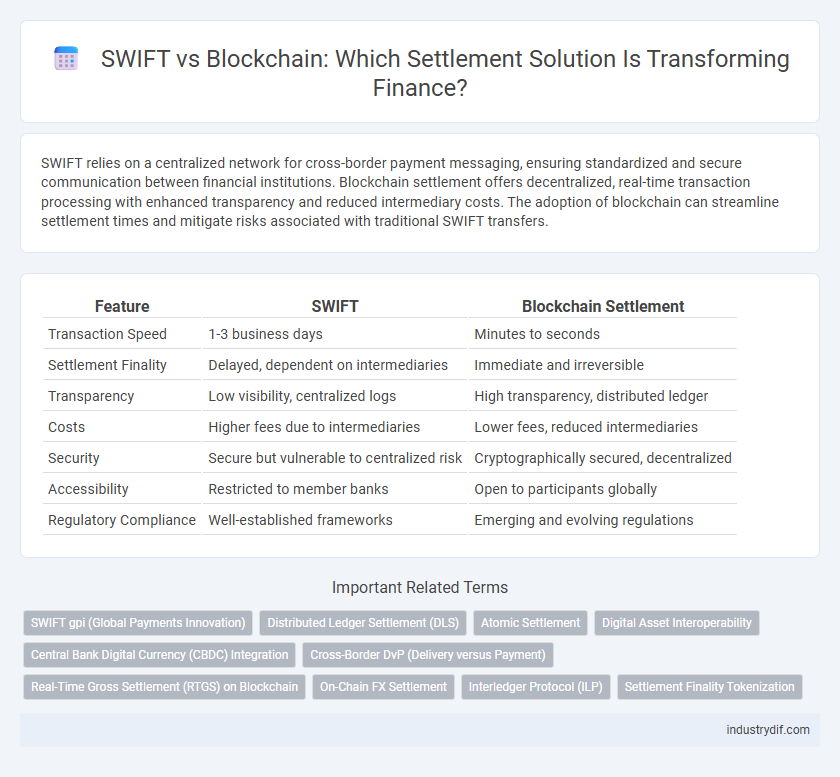

| Feature | SWIFT | Blockchain Settlement |

|---|---|---|

| Transaction Speed | 1-3 business days | Minutes to seconds |

| Settlement Finality | Delayed, dependent on intermediaries | Immediate and irreversible |

| Transparency | Low visibility, centralized logs | High transparency, distributed ledger |

| Costs | Higher fees due to intermediaries | Lower fees, reduced intermediaries |

| Security | Secure but vulnerable to centralized risk | Cryptographically secured, decentralized |

| Accessibility | Restricted to member banks | Open to participants globally |

| Regulatory Compliance | Well-established frameworks | Emerging and evolving regulations |

Overview of SWIFT and Blockchain in Finance

SWIFT is a globally recognized financial messaging network facilitating secure international transactions through standardized messaging protocols used by over 11,000 financial institutions across 200 countries. Blockchain settlement employs decentralized ledger technology enabling real-time, transparent, and immutable recording of financial transactions, reducing intermediaries and settlement times. While SWIFT focuses on secure message exchange and established correspondent banking relationships, blockchain transforms settlement processes by automating asset transfers and enhancing operational efficiency in cross-border payments.

SWIFT Settlement: Traditional Methods Explained

SWIFT settlement relies on a global messaging network facilitating secure, standardized communication between banks for international transactions. This traditional method ensures compliance with regulatory frameworks and offers interoperability across diverse financial institutions, but often involves longer processing times and higher fees. Despite emerging alternatives, SWIFT remains the backbone of cross-border payment settlement due to its established infrastructure and extensive global reach.

Blockchain Settlement: How It Works

Blockchain settlement operates through a decentralized ledger technology that records financial transactions across multiple nodes, ensuring transparency and immutability. Each transaction is verified by consensus mechanisms such as proof of work or proof of stake, reducing the need for intermediaries and minimizing settlement times compared to traditional SWIFT messaging. Smart contracts automate and enforce settlement terms, enhancing efficiency and security in cross-border payments and asset transfers.

Speed and Efficiency Comparison

SWIFT transactions typically take 1-3 business days due to multiple intermediaries and batch processing methods, limiting real-time capabilities essential for modern finance. Blockchain settlement operates on decentralized ledgers, achieving near-instantaneous transaction finality within minutes through consensus mechanisms, significantly enhancing speed and operational efficiency. The immutable and transparent nature of blockchain reduces errors and reconciliation times, outperforming SWIFT's traditional centralized intermediaries in settlement efficiency.

Security Protocols: SWIFT vs Blockchain

SWIFT employs a centralized security protocol with multi-layered encryption and strict authentication measures, ensuring secure communication between financial institutions globally. Blockchain settlement utilizes decentralized cryptographic protocols, leveraging consensus mechanisms like proof-of-work or proof-of-stake to maintain data integrity and transparency. While SWIFT relies on intermediary security controls, blockchain inherently secures transactions through immutable ledgers and distributed validation.

Transparency and Traceability in Transactions

Blockchain settlement offers superior transparency and traceability in transactions compared to SWIFT, as all transaction data is recorded on an immutable distributed ledger accessible to authorized participants. SWIFT relies on intermediary banks and messaging systems, which can obscure transaction details and delay verification processes. Enhanced transparency in blockchain reduces fraud risks and accelerates dispute resolution by providing real-time, auditable transaction histories.

Cost Implications for Financial Institutions

SWIFT transactions typically incur intermediary bank fees and correspondent charges, leading to higher overall costs for financial institutions. Blockchain settlement reduces reliance on intermediaries by enabling peer-to-peer transfers, which significantly lowers transaction fees and processing expenses. However, initial investments in blockchain infrastructure and regulatory compliance may offset short-term savings.

Regulatory Compliance and Standards

SWIFT operates within a well-established regulatory framework, adhering to stringent international compliance standards such as anti-money laundering (AML) and know-your-customer (KYC) protocols, ensuring secure cross-border financial transactions. Blockchain settlement introduces decentralized consensus mechanisms, which challenge traditional regulatory oversight but offer enhanced transparency and immutability, prompting regulators to develop new compliance standards tailored to distributed ledger technology. Financial institutions adopting blockchain must navigate evolving regulations like the EU's MiCA and FATF guidelines to maintain compliance while leveraging faster settlement capabilities.

Adoption Challenges and Industry Integration

SWIFT faces adoption challenges due to legacy infrastructure and regulatory compliance requirements, while blockchain settlement struggles with scalability, interoperability, and standardization across financial institutions. Industry integration for SWIFT benefits from widespread global acceptance and established messaging protocols, whereas blockchain requires extensive collaboration to create unified frameworks and address legal uncertainties. Both systems must overcome resistance to change and ensure robust security to achieve seamless settlement adoption within the financial ecosystem.

Future Trends in Financial Settlement Systems

Future trends in financial settlement systems highlight blockchain's potential to enhance transaction speed, transparency, and security compared to traditional SWIFT networks. Integration of distributed ledger technology (DLT) promises real-time cross-border settlements, reducing reliance on intermediaries and lowering operational costs. Central banks and financial institutions are increasingly exploring hybrid models combining SWIFT's established infrastructure with blockchain innovations to optimize efficiency and compliance.

Related Important Terms

SWIFT gpi (Global Payments Innovation)

SWIFT gpi revolutionizes cross-border payments by enabling faster, transparent, and traceable transactions across over 11,000 financial institutions worldwide, significantly reducing settlement times compared to traditional SWIFT messaging. Blockchain settlement offers decentralized and immutable transaction records but currently faces scalability and regulatory challenges, positioning SWIFT gpi as a more widely adopted solution for efficient global payment processing.

Distributed Ledger Settlement (DLS)

Distributed Ledger Settlement (DLS) leverages blockchain technology to enable real-time, transparent, and immutable transaction recording, contrasting with SWIFT's traditional message-based system that processes payments through correspondent banks with settlement delays. DLS reduces counterparty risk and operational costs by automating reconciliations and enabling peer-to-peer settlements without intermediaries, enhancing efficiency in cross-border finance.

Atomic Settlement

Atomic settlement on blockchain enables simultaneous transfer of assets between parties, eliminating settlement risk inherent in SWIFT's traditional messaging system, which relies on intermediary banks and can result in payment delays or failures. Utilizing smart contracts, blockchain ensures real-time, irreversible settlement across different asset classes, enhancing security and efficiency compared to SWIFT's multi-step reconciliation process.

Digital Asset Interoperability

SWIFT's global messaging network enables standardized financial communication across banks but faces limitations in real-time settlement and asset interoperability. Blockchain settlement platforms offer decentralized, transparent digital asset interoperability, reducing transaction times and enhancing cross-border settlement efficiency through programmable smart contracts.

Central Bank Digital Currency (CBDC) Integration

SWIFT remains the dominant global financial messaging network facilitating cross-border payments, but its settlement process often involves multiple intermediaries causing delays and higher costs. Central Bank Digital Currency (CBDC) integration with blockchain settlement platforms offers real-time settlement, increased transparency, and reduced counterparty risk by enabling direct, instant transfer of value across borders, potentially transforming the efficiency and security of international financial transactions.

Cross-Border DvP (Delivery versus Payment)

SWIFT facilitates cross-border DvP by enabling secure, standardized messaging between financial institutions but relies on correspondent banking networks, which can introduce latency and settlement risk. Blockchain settlement platforms offer real-time, transparent DvP through decentralized ledgers, reducing counterparty risk and operational inefficiencies while enhancing settlement finality in international transactions.

Real-Time Gross Settlement (RTGS) on Blockchain

Real-Time Gross Settlement (RTGS) on blockchain offers instantaneous, secure fund transfers by leveraging decentralized ledgers, significantly reducing settlement times compared to traditional SWIFT systems that rely on batch processing and intermediary banks. Blockchain-based RTGS enhances transparency and fraud resistance while lowering operational costs and settlement risks inherent in the SWIFT network's legacy infrastructure.

On-Chain FX Settlement

On-chain FX settlement leverages blockchain technology to enable real-time, transparent cross-border currency exchanges with reduced counterparty risk compared to traditional SWIFT systems that rely on intermediaries and deferred net settlements. This decentralized approach enhances settlement speed, lowers transaction costs, and increases operational efficiency in global foreign exchange transactions.

Interledger Protocol (ILP)

The Interledger Protocol (ILP) enhances cross-border payments by enabling interoperability between SWIFT's traditional banking networks and emerging blockchain settlement systems, reducing transaction times and costs. ILP facilitates seamless value transfers across disparate ledgers, optimizing liquidity management and improving settlement finality in global finance.

Settlement Finality Tokenization

SWIFT settlement relies on intermediary banks and messaging protocols to finalize transactions, often causing delays and settlement risks, whereas blockchain settlement utilizes distributed ledger technology to achieve near-instant settlement finality by recording transactions on an immutable ledger. Tokenization in blockchain enhances settlement efficiency by representing assets digitally, enabling seamless transfer and reducing counterparty risk compared to traditional SWIFT systems.

SWIFT vs Blockchain Settlement Infographic

industrydif.com

industrydif.com