Portfolio management typically involves professional oversight of a diversified set of assets to achieve specific investment goals, leveraging strategic asset allocation and risk management techniques. Direct indexing allows investors to replicate a benchmark index by purchasing individual securities, offering greater tax-loss harvesting opportunities and personalized customization. Investors seeking tailored strategies and enhanced tax efficiency may prefer direct indexing, while those valuing professional management and broad diversification often choose portfolio management services.

Table of Comparison

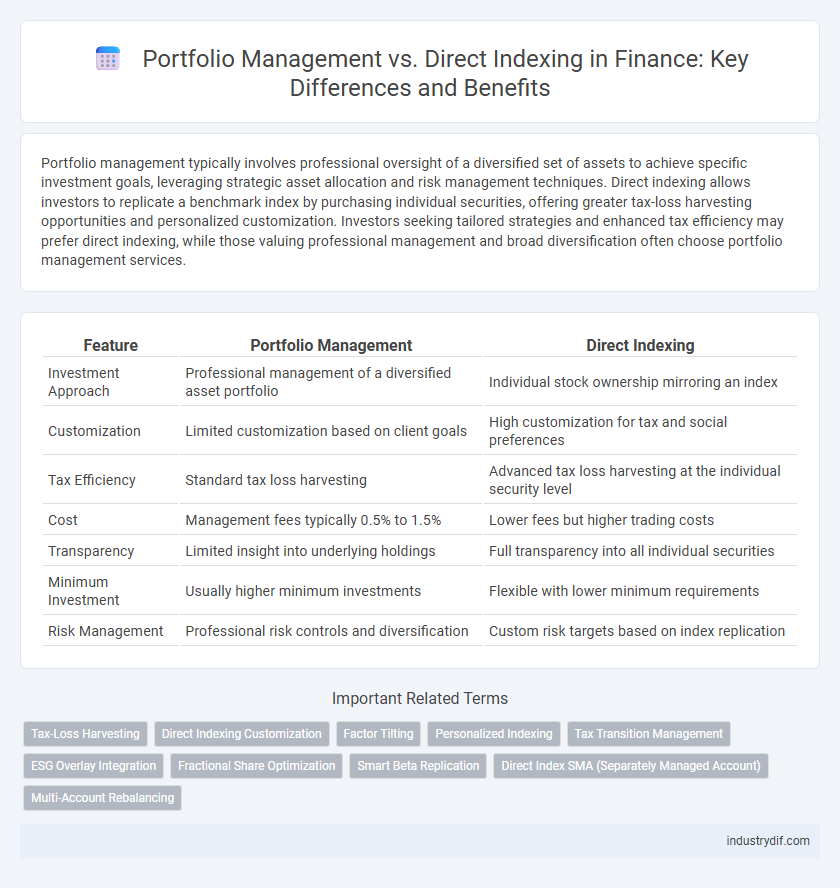

| Feature | Portfolio Management | Direct Indexing |

|---|---|---|

| Investment Approach | Professional management of a diversified asset portfolio | Individual stock ownership mirroring an index |

| Customization | Limited customization based on client goals | High customization for tax and social preferences |

| Tax Efficiency | Standard tax loss harvesting | Advanced tax loss harvesting at the individual security level |

| Cost | Management fees typically 0.5% to 1.5% | Lower fees but higher trading costs |

| Transparency | Limited insight into underlying holdings | Full transparency into all individual securities |

| Minimum Investment | Usually higher minimum investments | Flexible with lower minimum requirements |

| Risk Management | Professional risk controls and diversification | Custom risk targets based on index replication |

Overview of Portfolio Management and Direct Indexing

Portfolio management involves selecting and managing a diversified mix of assets to achieve specific investment goals, often utilizing mutual funds or ETFs to balance risk and return. Direct indexing allows investors to replicate a market index by directly owning the individual securities, providing opportunities for tax-loss harvesting and personalized customization. Both strategies aim to optimize portfolio performance, with direct indexing offering enhanced control over asset selection compared to traditional portfolio management approaches.

Key Differences Between Portfolio Management and Direct Indexing

Portfolio management involves selecting and overseeing a diversified mix of assets to meet investment goals, often through mutual funds or ETFs, while direct indexing allows investors to buy individual securities within an index, providing greater tax-loss harvesting opportunities and customization. Portfolio management typically offers professional oversight and risk management, whereas direct indexing requires more hands-on management but enables personalized exposure to specific stocks. The main differences lie in control, tax efficiency, costs, and the level of customization each approach provides to meet distinct investor preferences.

Customization Capabilities in Direct Indexing

Direct indexing offers superior customization capabilities compared to traditional portfolio management by allowing investors to tailor individual security selections based on specific tax considerations, ESG preferences, or risk tolerance. Unlike pooled funds, direct indexing enables precise control over asset allocation and exclusion of unwanted companies, enhancing personalization and tax optimization. This granular customization supports more efficient tax-loss harvesting and aligns investments closely with individual financial goals.

Investment Strategies in Portfolio Management

Portfolio management employs diversified investment strategies to balance risk and return across asset classes, using methods like asset allocation, rebalancing, and risk assessment to optimize performance. Direct indexing enhances these strategies by allowing investors to replicate index returns through individual securities, enabling tax-loss harvesting, personalized customization, and greater control over portfolio composition. Integrating direct indexing with traditional portfolio management strategies can improve tax efficiency while maintaining alignment with long-term investment goals.

Tax Efficiency: Direct Indexing vs Portfolio Management

Direct indexing offers superior tax efficiency compared to traditional portfolio management by allowing investors to harvest tax losses at an individual security level within their index replication. Unlike pooled funds or ETFs, direct indexing enables customized tax-loss harvesting strategies that can maximize after-tax returns and minimize capital gains distributions. This tailored approach helps investors strategically offset taxable gains across specific holdings, providing more precise tax management in a diversified portfolio.

Cost Structures: Fees and Expenses Comparison

Portfolio management generally involves management fees averaging 0.50% to 1.00% of assets under management, alongside potential performance fees, whereas direct indexing typically incurs lower management fees but higher transaction costs due to individualized stock selection. Direct indexing may also generate tax-loss harvesting opportunities that can offset some expenses, enhancing after-tax returns. Evaluating total cost structures requires analyzing both explicit fees and implicit costs like bid-ask spreads and tax implications to optimize portfolio efficiency.

Technology’s Role in Direct Indexing

Technology enables direct indexing to offer personalized portfolios by leveraging advanced algorithms and big data analytics, which enhances precision in asset selection and tax optimization. Automated platforms streamline the management of thousands of individual securities, reducing costs and operational complexity compared to traditional portfolio management. Real-time data integration allows investors to dynamically adjust holdings, improving responsiveness to market changes and alignment with specific investment goals.

Risk Management Approaches

Portfolio management employs diversified asset allocation and dynamic rebalancing strategies to mitigate market risk and optimize returns, using quantitative models to monitor volatility and correlation among assets. Direct indexing allows for customized risk control through tax-loss harvesting and exclusion of specific securities, enabling tailored exposure to individual stock risks while maintaining broad market representation. Both approaches integrate advanced analytics and real-time data to enhance risk-adjusted performance and align with investor-specific risk tolerances and objectives.

Suitability for Different Investor Profiles

Portfolio management suits investors seeking professional oversight and diversified asset allocation tailored to risk tolerance and financial goals. Direct indexing appeals to investors desiring personalized tax management and concentrated exposure to specific stocks within a benchmark. Each approach aligns differently with investor profiles ranging from passive investors to those requiring active customization and tax-loss harvesting strategies.

Future Trends in Portfolio Management and Direct Indexing

Future trends in portfolio management emphasize the integration of artificial intelligence and machine learning to enhance predictive analytics and risk assessment. Direct indexing is gaining momentum due to its customization capabilities, tax efficiency, and the ability to closely mimic market indices while allowing for personalized exclusions and factor tilts. Advancements in technology platforms are accelerating the adoption of direct indexing, transforming it into a scalable solution for retail and institutional investors seeking tailored exposure and improved after-tax returns.

Related Important Terms

Tax-Loss Harvesting

Tax-loss harvesting in portfolio management typically involves selling securities at a loss to offset capital gains, optimizing tax efficiency across a diversified portfolio. Direct indexing enhances this strategy by allowing investors to individually customize and sell specific securities within an index, increasing precision in realizing losses and minimizing wash-sale risks.

Direct Indexing Customization

Direct indexing offers unparalleled customization by allowing investors to tailor their portfolios to specific tax strategies, ESG preferences, and individual stock selections, unlike traditional portfolio management that relies on predefined mutual funds or ETFs. This level of personalization enhances tax-loss harvesting opportunities and ensures alignment with unique financial goals, making direct indexing a powerful tool for sophisticated investors.

Factor Tilting

Portfolio management leveraging factor tilting enhances risk-adjusted returns by systematically overweighting factors such as value, momentum, and low volatility within diversified assets. Direct indexing enables precise factor exposure customization at the individual security level, optimizing tax efficiency and aligning portfolios with specific investment objectives.

Personalized Indexing

Personalized indexing offers a tailored approach to portfolio management by directly replicating an index while allowing customization based on individual investor preferences, tax considerations, and risk tolerance. This method enhances diversification and cost efficiency compared to traditional portfolio management, which typically involves active stock selection or mutual fund investment.

Tax Transition Management

Portfolio management offers tax transition management by rebalancing assets to minimize capital gains taxes through strategic asset sales. Direct indexing enhances tax efficiency by allowing investors to apply personalized tax-loss harvesting across individual securities, maximizing after-tax returns.

ESG Overlay Integration

Portfolio management with ESG overlay integration enables diversified asset allocation while embedding environmental, social, and governance criteria systematically, enhancing risk-adjusted returns and aligning with sustainable investment goals. Direct indexing offers granular control by customizing individual securities to reflect specific ESG preferences, allowing precise tax-loss harvesting and personalized impact strategies.

Fractional Share Optimization

Fractional Share Optimization enhances portfolio management by enabling precise allocation of assets through direct indexing, allowing investors to buy partial shares that align closely with individualized index strategies. This approach maximizes tax efficiency and diversification while reducing transaction costs compared to traditional portfolio management techniques.

Smart Beta Replication

Smart Beta Replication leverages systematic factor tilts to replicate portfolio performance while minimizing tracking error and transaction costs compared to traditional portfolio management. Direct indexing offers enhanced tax efficiency and customization by directly owning underlying securities, enabling precise Smart Beta exposure aligned with individual investment objectives.

Direct Index SMA (Separately Managed Account)

Direct Index SMAs offer personalized portfolio management by allowing investors to directly own individual securities within an index, optimizing tax efficiency through strategic tax-loss harvesting and customized exposure. Unlike traditional portfolio management, Direct Index SMAs provide greater transparency, control over stock selection, and the ability to tailor holdings to specific financial goals and risk tolerance.

Multi-Account Rebalancing

Multi-account rebalancing in portfolio management enables synchronized adjustments across various accounts, optimizing asset allocation while minimizing tax implications. Direct indexing enhances this process by allowing personalized tax-loss harvesting and tailored exposure to individual securities, resulting in more efficient multi-account portfolio alignment.

Portfolio management vs Direct indexing Infographic

industrydif.com

industrydif.com