Stock trading allows investors to buy and sell whole shares of a company, often requiring a significant capital investment, while fractional shares enable purchasing a portion of a share for a lower cost. Fractional shares provide increased accessibility and diversification opportunities for small investors by allowing them to invest in high-priced stocks without needing full-share prices. This approach democratizes stock market participation and can enhance portfolio flexibility and risk management.

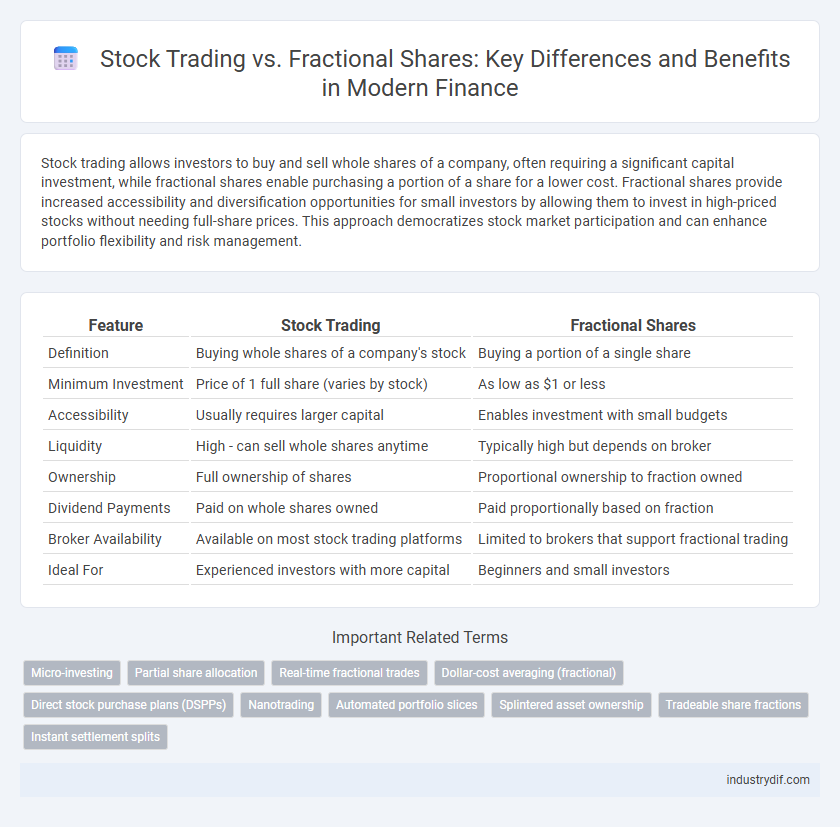

Table of Comparison

| Feature | Stock Trading | Fractional Shares |

|---|---|---|

| Definition | Buying whole shares of a company's stock | Buying a portion of a single share |

| Minimum Investment | Price of 1 full share (varies by stock) | As low as $1 or less |

| Accessibility | Usually requires larger capital | Enables investment with small budgets |

| Liquidity | High - can sell whole shares anytime | Typically high but depends on broker |

| Ownership | Full ownership of shares | Proportional ownership to fraction owned |

| Dividend Payments | Paid on whole shares owned | Paid proportionally based on fraction |

| Broker Availability | Available on most stock trading platforms | Limited to brokers that support fractional trading |

| Ideal For | Experienced investors with more capital | Beginners and small investors |

Overview of Stock Trading and Fractional Shares

Stock trading involves buying and selling whole shares of publicly traded companies on stock exchanges like the NYSE or NASDAQ, providing full ownership and voting rights per share. Fractional shares allow investors to purchase a portion of a single stock, enabling diversification and access to high-priced stocks with smaller capital. This approach lowers investment barriers and enhances portfolio flexibility by accommodating varying budget sizes.

Key Differences Between Stock Trading and Fractional Shares

Stock trading involves purchasing whole shares of a company, typically requiring higher capital investment, whereas fractional shares allow investors to buy a portion of a single share, enabling diversification with limited funds. Fractional share trading offers greater accessibility and flexibility, especially for high-priced stocks like Amazon or Google, while traditional stock trading often incurs higher transaction costs and minimum investment requirements. Key differences also include liquidity variations and the impact on dividend distribution, as fractional shares pay dividends proportionally to the share owned.

Accessibility: Who Can Invest?

Stock trading typically requires investors to purchase whole shares, which can limit accessibility for those with smaller capital. Fractional shares allow investors to buy portions of expensive stocks, lowering the barrier to entry and enabling broader participation. This democratization of investing increases market accessibility for individuals with varying financial means.

Minimum Investment Requirements

Stock trading typically requires purchasing whole shares, often leading to higher minimum investment amounts depending on the stock price. Fractional shares allow investors to buy partial shares of expensive stocks, significantly lowering the entry barrier to investing with small amounts. This flexibility enables investors with limited capital to diversify their portfolios without needing a large upfront investment.

Liquidity and Trading Flexibility

Stock trading offers high liquidity with shares readily bought or sold on major exchanges during market hours, enabling immediate execution of trades. Fractional shares enhance trading flexibility by allowing investors to buy portions of expensive stocks without needing full shares, facilitating diversified portfolios with smaller capital. However, fractional shares may have limited liquidity and potentially longer execution times compared to whole shares, impacting the speed at which positions can be adjusted.

Costs and Fees Comparison

Stock trading often involves higher costs due to full-share purchases, including brokerage commissions, bid-ask spreads, and potential minimum investment requirements. Fractional shares reduce entry barriers by allowing investors to buy partial shares, minimizing overall fees and enabling diversified portfolios with lower capital. Lower transaction fees and no need to meet full-share prices make fractional shares a cost-effective option for small or budget-conscious investors.

Portfolio Diversification Opportunities

Stock trading enables investors to purchase whole shares, often limiting diversification due to higher capital requirements for multiple stocks. Fractional shares allow investors to buy portions of expensive stocks, facilitating broader portfolio diversification with lower investment amounts. This accessibility helps balance risk by spreading investments across various sectors and companies more efficiently.

Risks and Limitations

Stock trading involves buying and selling whole shares, exposing investors to higher capital requirements and potential market volatility risks, as price fluctuations affect the entire share value. Fractional shares allow investment in portions of a stock, reducing initial investment risk but may come with limitations like lack of voting rights and restricted transferability. Both options carry liquidity risks, but fractional shares often have lower barriers to entry and limited availability on all trading platforms.

Tax Implications

Stock trading typically involves buying and selling whole shares, which can trigger capital gains taxes on the entire transaction value, potentially resulting in significant tax liabilities. Fractional share investing allows for more precise portfolio diversification and tax-loss harvesting by enabling partial ownership, which can optimize tax efficiency by minimizing taxable events. Understanding the differences in reporting and tax treatment between full shares and fractional shares is crucial for effective tax planning in investment strategies.

Choosing the Right Option for Your Investment Strategy

Stock trading offers full-share purchases that provide complete ownership and voting rights in a company, ideal for investors seeking direct control and long-term growth potential. Fractional shares allow diversification by enabling investors to buy portions of expensive stocks with smaller capital, making them suitable for beginners or those with limited funds. Selecting the right option depends on your investment goals, risk tolerance, and budget, balancing the desire for ownership against the need for portfolio diversification.

Related Important Terms

Micro-investing

Stock trading typically involves purchasing whole shares, often requiring significant capital, while fractional shares enable investors to buy portions of a stock, lowering entry barriers and facilitating micro-investing strategies. Micro-investing platforms leverage fractional shares to allow users to invest small amounts regularly, promoting portfolio diversification and accessibility in the stock market.

Partial share allocation

Partial share allocation allows investors to purchase fractions of high-priced stocks, making diversification more accessible and cost-effective compared to full stock trading where investors must buy whole shares. This method maximizes capital efficiency by enabling precise investment amounts and seamless portfolio customization in the stock market.

Real-time fractional trades

Real-time fractional trades enable investors to buy and sell portions of high-value stocks instantly, enhancing liquidity and market accessibility compared to traditional stock trading where full shares must be transacted. This innovation broadens investor participation by lowering capital barriers and allowing diversified portfolios with smaller investment amounts.

Dollar-cost averaging (fractional)

Dollar-cost averaging through fractional shares allows investors to consistently invest fixed amounts regardless of stock price fluctuations, reducing the risk of market timing and lowering the barrier to entry for expensive stocks. Unlike traditional stock trading that requires whole shares, fractional share investing enables diversified portfolios with smaller capital by purchasing portions of high-value stocks over time.

Direct stock purchase plans (DSPPs)

Direct stock purchase plans (DSPPs) enable investors to buy whole shares directly from companies, often with lower fees compared to traditional stock trading platforms, while fractional shares allow for investing smaller amounts by purchasing portions of a share. DSPPs provide opportunities for dividend reinvestment and cost averaging, making them appealing for long-term investors seeking to build ownership without paying brokerage commissions on each transaction.

Nanotrading

Nanotrading enables investors to buy ultra-small portions of stocks, allowing greater portfolio diversification with minimal capital. Unlike traditional stock trading, which requires purchasing whole shares, nanotrading facilitates fractional ownership of high-value stocks, increasing market accessibility and liquidity.

Automated portfolio slices

Automated portfolio slices enable investors to diversify efficiently by purchasing fractional shares, reducing entry barriers to high-priced stocks and optimizing risk distribution. Stock trading with fractional shares leverages algorithm-driven allocation, allowing precise investment proportionality without the need to buy whole shares.

Splintered asset ownership

Stock trading offers full ownership of shares, enabling investors to exercise voting rights and receive dividends based on the number of whole shares held. Fractional shares provide splintered asset ownership by allowing investors to buy partial shares, making high-priced stocks more accessible but often with limited voting privileges and proportional dividend distributions.

Tradeable share fractions

Tradeable share fractions enable investors to buy portions of high-priced stocks, increasing portfolio diversification and accessibility without the need to purchase whole shares. This fractional investing method enhances liquidity and lowers entry barriers in stock trading, making market participation more flexible and cost-effective.

Instant settlement splits

Stock trading typically involves full-share purchases with settlement periods of up to two business days, while fractional shares enable investors to buy portions of stocks with instant settlement splits, enhancing liquidity and flexibility. Instant settlement in fractional shares reduces waiting time for fund availability, allowing faster reinvestment and portfolio diversification compared to traditional stock trading.

Stock trading vs Fractional shares Infographic

industrydif.com

industrydif.com