An IPO involves underwriting, pricing, and issuing new shares to raise capital, providing companies with funds for expansion and liquidity. Direct listing allows existing shareholders to sell shares without issuing new ones, avoiding underwriting fees and diluting ownership. Companies choose between the two methods based on their capital needs, market conditions, and control preferences.

Table of Comparison

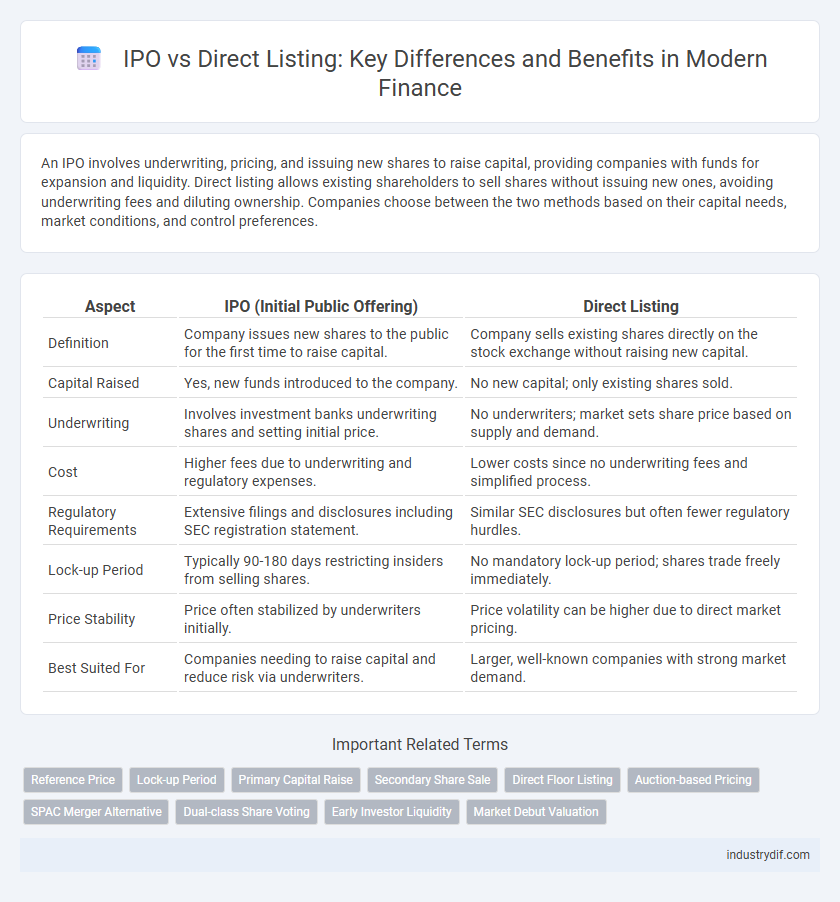

| Aspect | IPO (Initial Public Offering) | Direct Listing |

|---|---|---|

| Definition | Company issues new shares to the public for the first time to raise capital. | Company sells existing shares directly on the stock exchange without raising new capital. |

| Capital Raised | Yes, new funds introduced to the company. | No new capital; only existing shares sold. |

| Underwriting | Involves investment banks underwriting shares and setting initial price. | No underwriters; market sets share price based on supply and demand. |

| Cost | Higher fees due to underwriting and regulatory expenses. | Lower costs since no underwriting fees and simplified process. |

| Regulatory Requirements | Extensive filings and disclosures including SEC registration statement. | Similar SEC disclosures but often fewer regulatory hurdles. |

| Lock-up Period | Typically 90-180 days restricting insiders from selling shares. | No mandatory lock-up period; shares trade freely immediately. |

| Price Stability | Price often stabilized by underwriters initially. | Price volatility can be higher due to direct market pricing. |

| Best Suited For | Companies needing to raise capital and reduce risk via underwriters. | Larger, well-known companies with strong market demand. |

Introduction to IPOs and Direct Listings

Initial Public Offerings (IPOs) involve issuing new shares to raise capital, typically underwritten by investment banks to ensure price stability and market demand. Direct listings allow existing shareholders to sell their shares directly on the exchange without issuing new shares or raising capital, eliminating underwriter involvement and offering greater price transparency. Both methods differ fundamentally in capital generation, regulatory processes, and market impact, influencing corporate finance strategies and investor access.

Key Differences Between IPO and Direct Listing

Initial Public Offerings (IPOs) involve issuing new shares to raise capital through underwriters, whereas Direct Listings allow existing shareholders to sell shares directly without creating new ones, avoiding dilution. IPOs typically include a lock-up period restricting insider sales post-listing, while Direct Listings have no such lock-up, enabling immediate trading by insiders. Underwriting fees are substantial in IPOs, often 7% of proceeds, whereas Direct Listings significantly reduce these costs by eliminating intermediaries.

Advantages of Going Public via IPO

Going public via an IPO provides companies with substantial capital infusion through the sale of new shares, enabling significant funding for expansion and operational projects. IPOs typically generate heightened media coverage and investor interest, helping establish a strong market presence and investor base. The structured process of an IPO offers regulatory clarity and price discovery, which can lead to greater investor confidence and market stability.

Advantages of Opting for a Direct Listing

Direct listings enable companies to go public without issuing new shares, avoiding dilution of existing shareholders' equity and reducing underwriting fees. This method fosters immediate market-driven price discovery, enhancing transparency and potentially reflecting the company's value more accurately. Companies benefit from increased liquidity and the ability to allow early investors and employees to sell shares promptly, providing greater flexibility compared to traditional IPOs.

Costs and Fees Involved: IPO vs Direct Listing

Initial Public Offerings (IPOs) typically involve substantial underwriting fees, often ranging from 5% to 7% of the total capital raised, alongside additional expenses such as legal, accounting, and marketing costs. Direct listings eliminate underwriting fees but may incur significant expenses related to regulatory compliance and market maker services. Companies choosing between IPOs and direct listings must weigh fixed and variable costs associated with each method to optimize capital efficiency and market entry strategies.

Regulatory Requirements and Compliance

IPO processes require extensive regulatory filings, including a detailed prospectus filed with the SEC, mandatory financial audits, and adherence to stringent disclosure requirements to protect investors. Direct listings bypass underwriters and do not involve issuing new shares, reducing compliance burdens but still require comprehensive SEC filings and adherence to securities laws to maintain transparency. Both methods must comply with regulations under the Securities Act of 1933 and the Securities Exchange Act of 1934, ensuring rigorous investor protection and market integrity.

Impact on Share Pricing and Valuation

Initial Public Offerings (IPOs) often involve underwriters who set the share price based on investor demand, which can lead to price stabilization but may also cause initial underpricing or overpricing. Direct listings eliminate underwriters, allowing shares to trade immediately at market-driven prices, reflecting real-time investor sentiment and potentially higher volatility. Valuation in IPOs is typically anchored on roadshow feedback and fixed pricing, while direct listings rely on supply-demand dynamics that may provide a more transparent market valuation.

Investor Access and Share Liquidity

IPO offers investors early access to shares through underwritten allocations, often creating initial pricing stability and broader retail participation. Direct listing provides immediate liquidity by allowing existing shareholders to sell shares directly on the open market, enhancing price transparency but risking volatility without underwriting support. Investor access in direct listings is typically limited to those ready to trade at market prices, contrasting with IPOs' structured initial distribution.

Case Studies: Notable IPOs and Direct Listings

Notable IPOs such as Alibaba's $25 billion offering in 2014 showcase traditional routes attracting vast institutional capital, while Spotify's 2018 direct listing highlights an alternative that avoids underwriting fees and lock-up periods, providing liquidity directly to existing shareholders. Airbnb's 2020 IPO raised $3.5 billion, exemplifying successful capital raising, whereas Slack Technologies' direct listing the same year demonstrated market acceptance of a cost-efficient path to public markets. These case studies underline the strategic divergence between IPOs and direct listings in accessing public equity, with implications for valuation, investor access, and regulatory scrutiny.

Choosing the Right Path: Factors for Companies to Consider

Companies considering going public must evaluate several key factors when choosing between an IPO and a direct listing, such as capital requirements, cost efficiency, and market perception. An IPO typically provides upfront capital through the sale of new shares, while a direct listing allows existing shareholders to sell shares without diluting ownership but does not raise new funds. Market conditions, investor demand, and long-term strategic goals also influence the optimal path for accessing public markets.

Related Important Terms

Reference Price

In an IPO, the reference price is typically set through book-building based on investor demand, providing a guided valuation for shares before trading begins. Direct listings omit this process, allowing shares to trade at market-driven prices without a pre-established reference, leading to potentially higher price volatility at opening.

Lock-up Period

An IPO typically includes a lock-up period of 90 to 180 days, restricting insiders from selling shares to prevent market volatility. Direct listings bypass the lock-up period, allowing existing shareholders to sell shares immediately, increasing liquidity but potentially causing greater price fluctuations.

Primary Capital Raise

An IPO involves issuing new shares to raise primary capital, providing companies with immediate funding and underwriter support for price discovery. Direct listings, by contrast, do not create new shares or raise primary capital, allowing existing shareholders to sell shares without dilution but without generating fresh capital for the company.

Secondary Share Sale

Secondary share sales in IPOs involve underwriters facilitating the sale of existing shares alongside new shares to raise capital, often diluting ownership but providing liquidity and price stabilization. Direct listings enable existing shareholders to sell their shares directly on the market without issuing new shares, avoiding dilution but lacking underwriting support and typical price stabilization mechanisms.

Direct Floor Listing

Direct Floor Listing allows companies to bypass traditional underwriting processes, reducing costs and accelerating market entry by listing shares directly on the exchange floor. This method eliminates the need for initial public offering (IPO) roadshows and book-building, providing increased pricing transparency and immediate liquidity for investors.

Auction-based Pricing

Auction-based pricing in IPOs involves underwriters setting a price through a book-building process, balancing demand and supply before shares hit the market, whereas direct listings utilize a market-driven auction mechanism where investors submit bids and offers simultaneously, potentially leading to more accurate price discovery and reduced underwriting fees. This method in direct listings enhances transparency and can prevent underpricing, often observed in traditional IPO auctions due to underwriter incentives.

SPAC Merger Alternative

A SPAC merger offers companies a faster, less regulatory-intensive alternative to traditional IPOs and direct listings by merging with a publicly traded blank-check company, providing immediate access to capital and liquidity. Unlike IPOs, SPAC mergers bypass price discovery challenges and long roadshows, while direct listings lack capital raising, making SPACs a hybrid solution for firms seeking efficient public market entry.

Dual-class Share Voting

Dual-class share voting structures grant disproportionate voting power to certain shareholders during IPOs, typically benefiting founders and early investors, whereas direct listings often maintain a single-class share structure, promoting equal voting rights among all shareholders. This voting disparity influences control dynamics post-listing, affecting governance and long-term strategic decisions in the public market.

Early Investor Liquidity

An IPO typically restricts early investor liquidity with lock-up periods lasting 90 to 180 days, limiting immediate access to funds, whereas direct listings provide early investors the ability to sell shares immediately upon market debut, enhancing liquidity options. This flexibility in direct listings caters to investors seeking accelerated returns without traditional underwriting constraints.

Market Debut Valuation

IPO offers a market debut valuation established through underwritten price discovery and investor demand, often resulting in a fixed initial share price and potential price stabilization post-listing. Direct listings allow market-driven valuation by enabling existing shareholders to sell shares directly without price stabilization, leading to real-time market-determined pricing reflecting immediate supply and demand dynamics.

IPO vs Direct Listing Infographic

industrydif.com

industrydif.com