Currency exchange involves converting one fiat currency into another, typically facilitated by banks or foreign exchange markets, with fees influenced by market rates and institutional margins. Digital asset swapping refers to the direct exchange of cryptocurrencies or tokens on blockchain platforms, often enabled without intermediaries, using decentralized exchanges or smart contracts. While currency exchange relies on regulatory frameworks and centralized systems, digital asset swapping offers increased speed and accessibility through decentralized protocols.

Table of Comparison

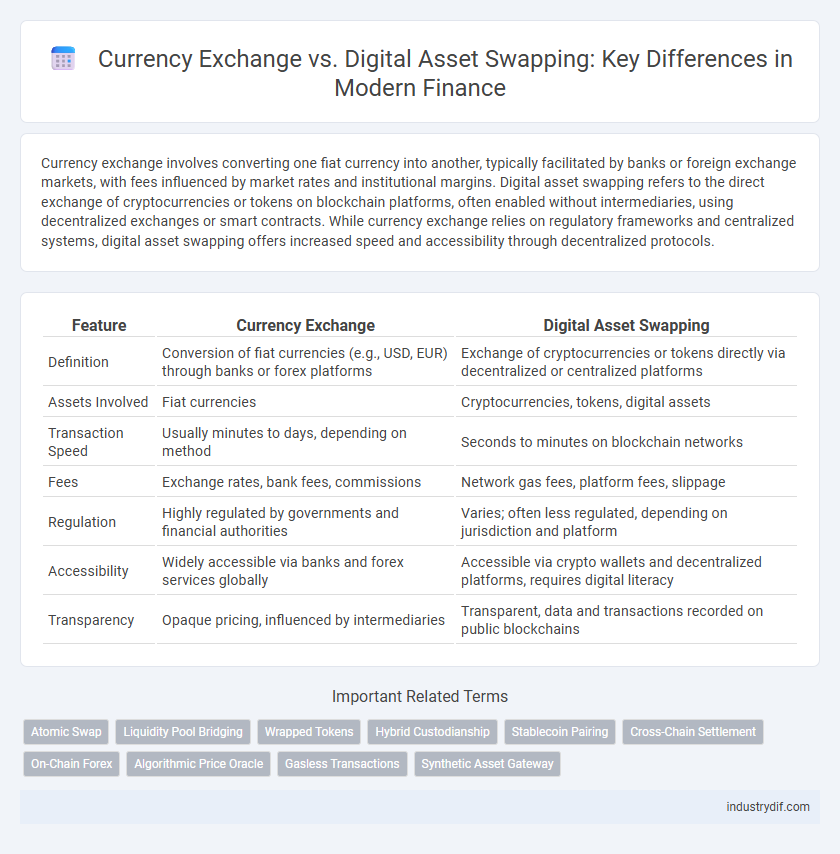

| Feature | Currency Exchange | Digital Asset Swapping |

|---|---|---|

| Definition | Conversion of fiat currencies (e.g., USD, EUR) through banks or forex platforms | Exchange of cryptocurrencies or tokens directly via decentralized or centralized platforms |

| Assets Involved | Fiat currencies | Cryptocurrencies, tokens, digital assets |

| Transaction Speed | Usually minutes to days, depending on method | Seconds to minutes on blockchain networks |

| Fees | Exchange rates, bank fees, commissions | Network gas fees, platform fees, slippage |

| Regulation | Highly regulated by governments and financial authorities | Varies; often less regulated, depending on jurisdiction and platform |

| Accessibility | Widely accessible via banks and forex services globally | Accessible via crypto wallets and decentralized platforms, requires digital literacy |

| Transparency | Opaque pricing, influenced by intermediaries | Transparent, data and transactions recorded on public blockchains |

Defining Currency Exchange and Digital Asset Swapping

Currency exchange involves converting one national currency into another to facilitate international trade, travel, or investment, typically conducted through banks or exchange platforms using real-time market rates. Digital asset swapping refers to the direct exchange of cryptocurrencies or tokens on decentralized platforms without converting to fiat currencies, leveraging blockchain technology for peer-to-peer transactions. Both processes differ fundamentally in their mediums, regulatory frameworks, and operational mechanics within the financial ecosystem.

Key Differences Between Fiat and Digital Asset Transactions

Currency exchange involves converting government-issued fiat currencies like USD, EUR, or JPY, regulated by central banks and subject to strict compliance and anti-money laundering protocols. Digital asset swapping refers to exchanging cryptocurrencies or tokens such as Bitcoin, Ethereum, or stablecoins on decentralized platforms, characterized by blockchain verification and lower regulatory oversight. Key differences lie in transaction speed, decentralization, and liquidity, with fiat exchanges often relying on traditional banking infrastructure while digital asset swaps utilize peer-to-peer networks and smart contracts.

How Traditional Currency Exchange Works

Traditional currency exchange operates through centralized financial institutions like banks and currency exchange bureaus that use established foreign exchange (forex) markets to determine rates based on real-time supply and demand. Transactions typically involve converting one fiat currency into another at rates influenced by geopolitical events, interest rates, and economic indicators. These exchanges often include fees or spreads and require compliance with regulatory standards such as anti-money laundering (AML) and know your customer (KYC) protocols.

Understanding Digital Asset Swapping Mechanisms

Digital asset swapping involves the direct exchange of cryptocurrencies or tokens through decentralized protocols without relying on traditional currency exchange intermediaries. These mechanisms utilize smart contracts on blockchain platforms like Ethereum to facilitate peer-to-peer trades securely and transparently, reducing counterparty risk. Automated Market Makers (AMMs) and liquidity pools play a critical role by enabling continuous token swaps and enhancing liquidity across decentralized exchanges (DEXs).

Regulatory Frameworks Governing Exchanges

Currency exchange operates under established regulatory frameworks such as the Bank Secrecy Act (BSA) and anti-money laundering (AML) laws, enforced by entities like the Financial Crimes Enforcement Network (FinCEN) and the Office of the Comptroller of the Currency (OCC). Digital asset swapping often encounters evolving regulatory landscapes, with agencies such as the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) assessing whether tokens qualify as securities or commodities, impacting compliance requirements. Both traditional currency exchanges and digital asset platforms must implement robust Know Your Customer (KYC) procedures to meet global standards and mitigate financial crime risks.

Security Considerations: Currency Exchange vs Digital Swapping

Currency exchange involves regulated financial institutions subject to stringent compliance standards and anti-money laundering protocols, offering robust security measures such as insured accounts and fraud detection systems. Digital asset swapping operates on decentralized platforms that rely on blockchain technology's cryptographic security but faces risks including smart contract vulnerabilities and insufficient regulatory oversight. Users must weigh the transparency and immutability of blockchain against the traditional protections and legal recourse available in currency exchanges.

Cost Structure and Fees Analysis

Currency exchange typically involves fixed spreads and variable transaction fees that depend on liquidity and regulatory frameworks, often leading to higher costs for cross-border transfers. Digital asset swapping operates on decentralized platforms with lower fees, primarily influenced by blockchain network congestion and smart contract execution costs. Comparing both, digital asset swapping offers a more transparent and generally cheaper cost structure, especially for high-frequency and international transactions.

Speed and Efficiency of Transactions Compared

Currency exchange transactions typically involve intermediaries such as banks or brokers, resulting in longer processing times and higher fees. Digital asset swapping utilizes blockchain technology, enabling near-instantaneous and cost-effective transactions with minimal intermediaries. The decentralized nature of digital asset platforms enhances efficiency by reducing settlement times from days to mere seconds compared to traditional currency exchange systems.

Global Accessibility and Market Reach

Currency exchange platforms offer extensive global accessibility through established financial networks, enabling users to trade fiat currencies across nearly all countries with stable regulatory oversight. Digital asset swapping leverages blockchain technology, providing borderless transactions that reach underserved or unbanked populations, thus expanding market reach beyond traditional financial infrastructures. The combination of fiat currency exchange and digital asset swapping enhances liquidity and inclusivity in global markets, driving seamless cross-border value transfers in finance.

Future Trends in Exchange and Swapping Technologies

Future trends in currency exchange highlight the integration of blockchain technology and AI-driven predictive analytics to enhance transaction speed and security. Digital asset swapping is evolving with the adoption of decentralized finance (DeFi) protocols and cross-chain interoperability, enabling seamless asset transfers across multiple blockchain platforms. These innovations are driving a shift toward more efficient, transparent, and user-centric financial ecosystems in both traditional currency exchange and digital asset swapping markets.

Related Important Terms

Atomic Swap

Currency exchange typically relies on centralized intermediaries to facilitate traditional fiat conversions, whereas digital asset swapping utilizes peer-to-peer protocols like Atomic Swap to enable direct, trustless exchanges of cryptocurrencies across different blockchains, enhancing security and reducing transaction costs. Atomic Swaps operate through smart contracts that automatically execute trades only when both parties fulfill predefined conditions, eliminating the need for third-party custodians and minimizing counterparty risk.

Liquidity Pool Bridging

Liquidity pool bridging in currency exchange enables seamless conversion of fiat currencies by aggregating funds to enhance transaction speed and reduce slippage. In digital asset swapping, liquidity pools facilitate decentralized trading across blockchain networks, providing continuous liquidity and minimizing price impact.

Wrapped Tokens

Wrapped tokens enable seamless digital asset swapping by representing cryptocurrencies from one blockchain on another, enhancing liquidity and interoperability without the need for traditional currency exchange. This bridging mechanism reduces reliance on centralized exchanges, allowing faster and more cost-efficient cross-chain transactions in decentralized finance contexts.

Hybrid Custodianship

Hybrid custodianship in currency exchange and digital asset swapping enhances security by combining traditional financial oversight with blockchain transparency, ensuring compliance while reducing counterparty risk. This model integrates multi-signature wallets and regulated custody solutions, enabling seamless asset liquidity across fiat and digital currencies within a single framework.

Stablecoin Pairing

Stablecoin pairing enhances liquidity and reduces volatility in digital asset swapping by pegging cryptocurrencies to fiat currencies, offering a more predictable exchange rate compared to traditional currency exchange markets. This stable value framework facilitates seamless cross-border transactions and efficient portfolio management within decentralized finance ecosystems.

Cross-Chain Settlement

Cross-chain settlement enables seamless currency exchange and digital asset swapping by facilitating transactions across different blockchain networks, reducing intermediaries and enhancing liquidity. This technology supports real-time asset transfer and minimizes settlement risk, optimizing global financial operations and streamlining cross-border payments.

On-Chain Forex

On-chain forex enables seamless currency exchange by leveraging blockchain technology to provide transparent, secure, and instantaneous cross-border transactions without intermediaries. Digital asset swapping, while similar, primarily facilitates peer-to-peer token exchanges within decentralized finance platforms, emphasizing liquidity and programmable contract capabilities over traditional fiat currency conversion.

Algorithmic Price Oracle

Algorithmic price oracles play a critical role in both currency exchange and digital asset swapping by providing real-time, reliable price feeds derived from decentralized data sources and smart contract verification. These oracles enhance market efficiency and reduce arbitrage risks by ensuring accurate asset valuations in automated trading and liquidity pool management.

Gasless Transactions

Gasless transactions significantly reduce costs in currency exchange by eliminating transaction fees typically associated with blockchain networks, offering a more efficient alternative to digital asset swapping. Leveraging meta-transactions and relayer networks, gasless swaps enable seamless currency conversion without users needing to hold native tokens for gas, enhancing liquidity and user experience in decentralized finance (DeFi).

Synthetic Asset Gateway

Synthetic asset gateways facilitate seamless digital asset swapping by creating tokenized representations of underlying currencies without requiring direct currency exchange. This technology enhances liquidity and enables users to access diverse financial instruments through synthetic derivatives, reducing counterparty risk and improving transaction efficiency in decentralized finance ecosystems.

Currency Exchange vs Digital Asset Swapping Infographic

industrydif.com

industrydif.com