Mutual funds offer daily liquidity and diversified portfolios, making them ideal for investors seeking flexibility and ease of access. Interval funds combine features of closed-end funds with periodic liquidity windows, allowing for potentially higher returns but limited redemption opportunities. Both fund types cater to different investment strategies, with mutual funds prioritizing liquidity and interval funds focusing on stability and income generation.

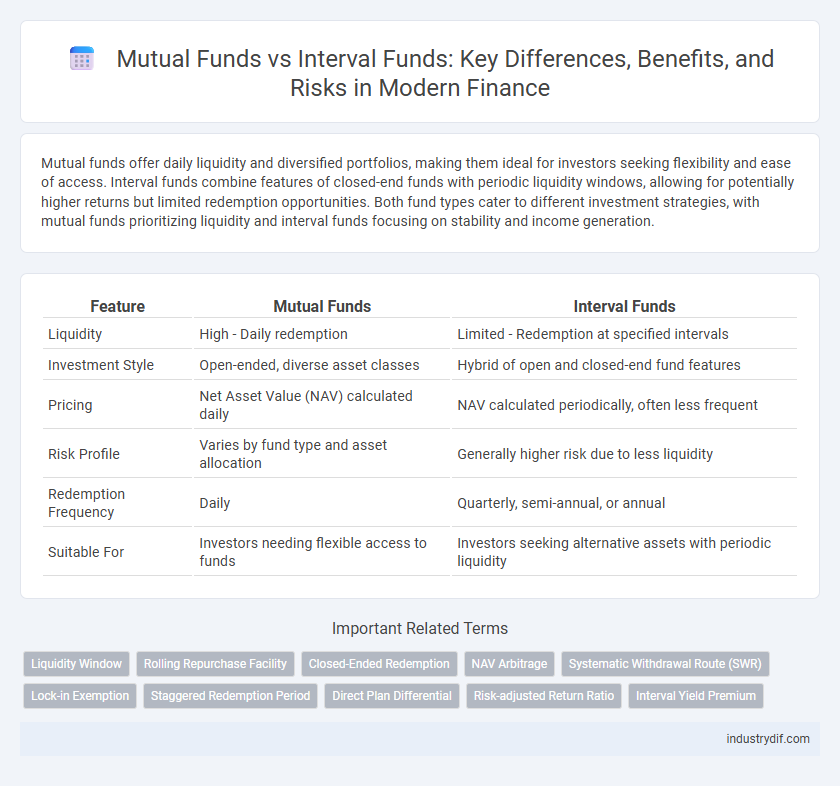

Table of Comparison

| Feature | Mutual Funds | Interval Funds |

|---|---|---|

| Liquidity | High - Daily redemption | Limited - Redemption at specified intervals |

| Investment Style | Open-ended, diverse asset classes | Hybrid of open and closed-end fund features |

| Pricing | Net Asset Value (NAV) calculated daily | NAV calculated periodically, often less frequent |

| Risk Profile | Varies by fund type and asset allocation | Generally higher risk due to less liquidity |

| Redemption Frequency | Daily | Quarterly, semi-annual, or annual |

| Suitable For | Investors needing flexible access to funds | Investors seeking alternative assets with periodic liquidity |

Understanding Mutual Funds: Definition and Key Features

Mutual funds pool money from multiple investors to invest in diversified portfolios of stocks, bonds, or other securities, offering professional management and liquidity through daily redemption options. Key features include open-ended structure, varying risk levels tailored to investment objectives, and transparent pricing based on net asset value (NAV). These funds provide diversification, ease of access for retail investors, and regulatory oversight to protect investor interests.

What Are Interval Funds? Structure and Characteristics

Interval funds are a type of closed-end fund that periodically offers to buy back a portion of outstanding shares at net asset value, combining features of both open-end and closed-end funds. Their structure allows investors limited liquidity through scheduled repurchase offers while maintaining a diversified portfolio managed by professionals. Characteristics include less frequent trading, potential exposure to illiquid assets, and a focus on income generation through dividends or interest payments.

Investment Objectives: Mutual Funds vs Interval Funds

Mutual funds aim to provide liquidity and diversification by continuously offering shares that investors can buy or sell at net asset value, targeting growth, income, or balanced investment objectives. Interval funds combine features of mutual funds and closed-end funds, investing in less liquid assets while restricting redemptions to specific intervals, enabling pursuit of higher returns through alternative investments. Investors selecting between mutual funds and interval funds should consider their liquidity needs, risk tolerance, and focus on long-term capital appreciation versus income generation.

Liquidity Comparison: Redemption and Withdrawal Processes

Mutual funds offer high liquidity, allowing investors to redeem shares at the end of each trading day based on the net asset value (NAV), facilitating quick access to funds. Interval funds restrict redemptions to specific periods, typically quarterly or semi-annually, limiting investor access to capital but potentially reducing market volatility and providing stability. Understanding these redemption and withdrawal processes is crucial for investors prioritizing liquidity versus long-term investment strategies in the mutual fund and interval fund markets.

Portfolio Diversification: How Each Fund Type Manages Risk

Mutual funds achieve portfolio diversification by investing in a broad mix of assets such as stocks, bonds, and money market instruments, which helps spread risk and enhance potential returns. Interval funds, a hybrid between closed-end and open-end funds, manage risk through limited periodic redemptions and investments in less liquid, higher-yielding assets, offering a risk-return profile distinct from traditional mutual funds. Both fund types adjust asset allocation dynamically to mitigate market volatility, but interval funds typically incorporate illiquid securities that require longer investment horizons.

Fee Structures and Expense Ratios: Mutual vs Interval Funds

Mutual funds typically charge a management fee ranging from 0.5% to 1.5% of assets under management, with expense ratios averaging around 0.74% for equity funds and 0.45% for bond funds. Interval funds often have higher expense ratios, averaging between 1.5% and 2.5%, due to the additional costs of managing illiquid assets and periodic share repurchase programs. Understanding these fee structures is critical for investors seeking cost-efficient investment vehicles aligned with their liquidity preferences.

Regulatory Framework Governing Each Fund Type

Mutual funds in the United States are primarily regulated under the Investment Company Act of 1940, which mandates strict disclosure, liquidity, and investor protection requirements. Interval funds, although also subject to the same Investment Company Act, have additional regulatory provisions allowing them to limit investor redemptions to specific intervals, enhancing portfolio stability and liquidity management. The SEC enforces distinct guidelines for interval funds concerning redemption windows and net asset value calculations to ensure compliance with these specialized liquidity restrictions.

Performance Metrics: Evaluating Returns and Volatility

Mutual funds typically offer higher liquidity with daily redemption options, making their performance metrics more sensitive to short-term market fluctuations and often reflecting lower volatility. Interval funds, by limiting redemptions to specific intervals, tend to invest in less liquid, potentially higher-yielding assets, which can result in higher returns but increased volatility over evaluation periods. Comparing returns and volatility, investors should analyze metrics such as the Sharpe ratio, standard deviation, and average annual returns to gauge risk-adjusted performance effectively between the two fund types.

Suitable Investors: Who Should Choose Mutual or Interval Funds?

Mutual funds suit investors seeking daily liquidity and diversified portfolio management with varying risk levels, ideal for those prioritizing accessibility and flexibility. Interval funds target investors comfortable with periodic liquidity windows, aiming for exposure to less liquid assets for potentially higher returns and reduced volatility. Understanding individual investment horizons and risk tolerance is crucial when selecting between mutual funds and interval funds for optimal financial planning.

Pros and Cons: Summarizing Mutual Funds and Interval Funds

Mutual funds offer high liquidity and professional management but can be prone to market volatility and lack flexibility in asset liquidation. Interval funds combine some liquidity with access to less liquid, potentially higher-yielding assets, though they involve periodic redemption windows and higher risk exposure. Both investment vehicles provide diversification, yet mutual funds suit investors prioritizing daily trading ease, while interval funds appeal to those seeking alternative assets with controlled liquidity.

Related Important Terms

Liquidity Window

Mutual funds offer daily liquidity, allowing investors to buy and sell shares at the end of each trading day based on the net asset value (NAV). Interval funds provide limited liquidity through periodic redemption windows, typically quarterly or semi-annually, which restricts immediate access to capital but can support investments in less liquid assets.

Rolling Repurchase Facility

Mutual funds provide daily liquidity, allowing investors to redeem shares at the fund's net asset value (NAV) on any business day, while interval funds offer a rolling repurchase facility that permits limited periodic redemptions, typically at predetermined intervals and percentages. This rolling repurchase feature balances liquidity and capital stability, enabling interval funds to invest in less liquid assets compared to traditional mutual funds.

Closed-Ended Redemption

Mutual funds offer open-ended redemption, allowing investors to buy and sell shares at NAV on any business day, while interval funds, a type of closed-ended fund, permit limited periodic redemptions at predetermined intervals, combining the benefits of liquidity with stability. Interval funds typically provide liquidity windows quarterly or semi-annually, reducing market volatility risks common to traditional closed-ended funds, making them appealing for investors seeking controlled redemption options.

NAV Arbitrage

Mutual funds typically allow daily liquidity at net asset value (NAV), minimizing NAV arbitrage opportunities, whereas interval funds limit redemptions to specific intervals, which can create temporary mispricings between market price and NAV that investors may exploit. The structured redemption cycles of interval funds result in less frequent NAV adjustments compared to the daily pricing of mutual funds, increasing the potential for NAV arbitrage strategies.

Systematic Withdrawal Route (SWR)

Systematic Withdrawal Route (SWR) in Mutual Funds offers regular, flexible income by allowing investors to withdraw a fixed amount at specified intervals, ideal for steady cash flow needs. Interval Funds combine features of open-ended and close-ended funds, permitting withdrawals during specific intervals, which can limit liquidity but often provide better portfolio stability and potential for higher returns.

Lock-in Exemption

Mutual funds generally do not have a lock-in period, allowing investors to redeem units at their convenience, whereas interval funds impose specific lock-in periods during which redemptions are restricted to predetermined intervals, providing stability and reducing liquidity risk. This lock-in exemption makes mutual funds more liquid, while interval funds cater to investors seeking structured investment horizons with periodic liquidity windows.

Staggered Redemption Period

Mutual funds offer daily liquidity with investors able to redeem shares at the NAV on any business day, while interval funds impose staggered redemption periods, allowing redemptions only at specific intervals such as quarterly or semi-annually, enhancing portfolio stability and managing liquidity risk. The staggered redemption schedule in interval funds supports investment in less liquid assets by reducing the pressure of sudden large withdrawals compared to the continuous redemption feature of mutual funds.

Direct Plan Differential

Direct plans in mutual funds offer lower expense ratios by eliminating distributor commissions, enabling investors to maximize returns compared to interval funds that typically do not provide direct plan options. Interval funds, blending features of open and closed-ended funds, often incur higher costs and limited liquidity, making direct plans in mutual funds more cost-effective and accessible for retail investors.

Risk-adjusted Return Ratio

Mutual funds typically offer higher liquidity but may exhibit greater volatility, impacting their risk-adjusted return ratios compared to interval funds, which balance risk and return by restricting redemption opportunities and investing in less liquid assets. Interval funds often provide enhanced risk-adjusted returns through diversification into alternative investments, making them suitable for investors seeking stable income with moderate risk exposure.

Interval Yield Premium

Interval funds often offer a yield premium compared to traditional mutual funds due to their ability to invest in less liquid, higher-yielding assets with periodic liquidity windows. The structured redemption periods in interval funds reduce liquidity risk, enabling portfolio managers to capture enhanced income through alternative credit instruments and private equity exposure.

Mutual Funds vs Interval Funds Infographic

industrydif.com

industrydif.com