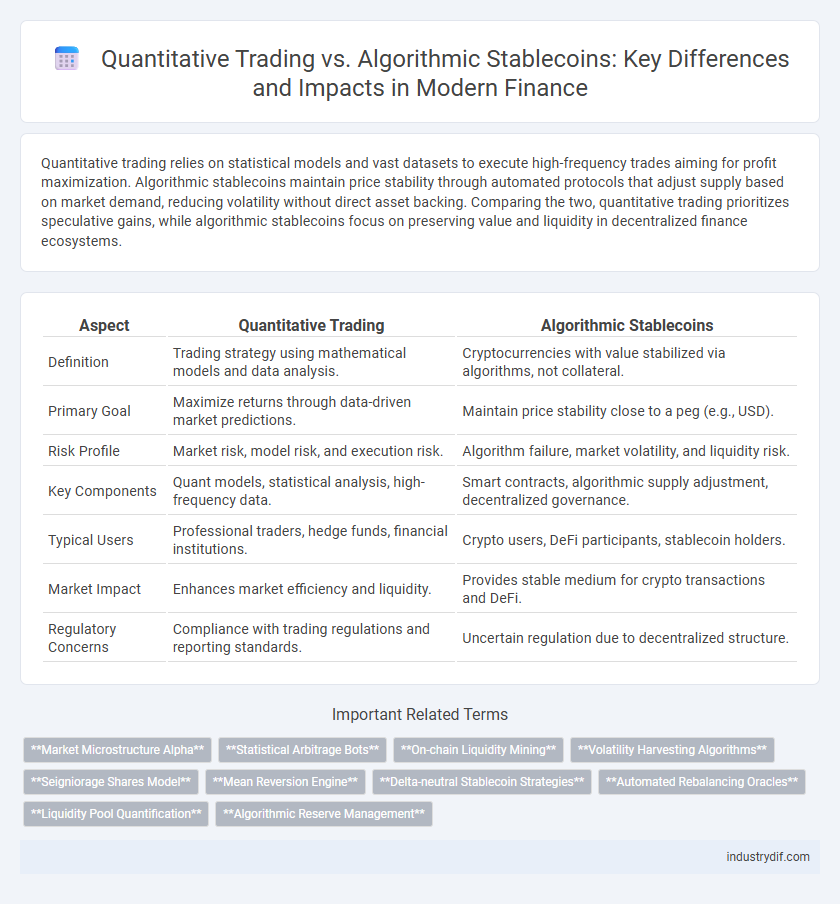

Quantitative trading relies on statistical models and vast datasets to execute high-frequency trades aiming for profit maximization. Algorithmic stablecoins maintain price stability through automated protocols that adjust supply based on market demand, reducing volatility without direct asset backing. Comparing the two, quantitative trading prioritizes speculative gains, while algorithmic stablecoins focus on preserving value and liquidity in decentralized finance ecosystems.

Table of Comparison

| Aspect | Quantitative Trading | Algorithmic Stablecoins |

|---|---|---|

| Definition | Trading strategy using mathematical models and data analysis. | Cryptocurrencies with value stabilized via algorithms, not collateral. |

| Primary Goal | Maximize returns through data-driven market predictions. | Maintain price stability close to a peg (e.g., USD). |

| Risk Profile | Market risk, model risk, and execution risk. | Algorithm failure, market volatility, and liquidity risk. |

| Key Components | Quant models, statistical analysis, high-frequency data. | Smart contracts, algorithmic supply adjustment, decentralized governance. |

| Typical Users | Professional traders, hedge funds, financial institutions. | Crypto users, DeFi participants, stablecoin holders. |

| Market Impact | Enhances market efficiency and liquidity. | Provides stable medium for crypto transactions and DeFi. |

| Regulatory Concerns | Compliance with trading regulations and reporting standards. | Uncertain regulation due to decentralized structure. |

Defining Quantitative Trading in Modern Finance

Quantitative trading in modern finance involves using mathematical models and statistical analysis to identify and execute high-frequency trades on financial markets, relying on vast datasets and algorithmic strategies to maximize returns. It leverages machine learning, artificial intelligence, and automated systems to predict price movements and optimize portfolio performance with minimal human intervention. This approach contrasts with algorithmic stablecoins, which are digital currencies designed to maintain price stability through decentralized algorithms rather than profit-driven trading strategies.

Understanding Algorithmic Stablecoins

Algorithmic stablecoins use smart contract algorithms to maintain price stability without collateral backing, distinguishing them from traditional stablecoins. These tokens dynamically adjust supply through programmed rules that expand or contract based on market demand, aiming to peg their value to an asset like the US dollar. Understanding their mechanisms is crucial for evaluating risks related to volatility, liquidity, and regulatory exposure in decentralized finance (DeFi) markets.

Core Principles Behind Quantitative Trading Strategies

Quantitative trading strategies rely on mathematical models and statistical analysis to identify trading opportunities and manage risk by processing vast datasets and executing trades based on predefined rules. These core principles include quantitative signal generation, systematic order execution, and rigorous risk management designed to optimize returns while minimizing market exposure. In contrast to the stablecoin algorithms that maintain price stability through monetary policy and collateral mechanisms, quantitative trading focuses on exploiting market inefficiencies through data-driven decision-making.

Mechanisms of Algorithmic Stablecoin Stability

Algorithmic stablecoins maintain price stability through smart contract protocols that dynamically adjust token supply based on market demand, using mechanisms such as seigniorage shares or elastic supply models. These protocols often employ incentivization methods like arbitrage opportunities and collateral utilization to ensure peg adherence without centralized reserves. Market-driven feedback loops and automated supply contractions or expansions underpin the stability mechanism, differentiating them from traditional quantitative trading strategies that rely on statistical arbitrage and predictive modeling.

Risk Management in Quantitative Trading

Risk management in quantitative trading revolves around sophisticated statistical models that predict market behavior and limit exposure through automated stop-loss orders and dynamic position sizing. Unlike algorithmic stablecoins, which primarily focus on maintaining price stability via supply adjustments, quantitative trading demands continuous recalibration of risk parameters to mitigate volatility and market anomalies. Effective risk management integrates real-time data analytics, portfolio diversification, and risk-adjusted performance metrics to safeguard capital and optimize returns.

Volatility Control in Algorithmic Stablecoins

Quantitative trading employs data-driven models and statistical techniques to capitalize on market inefficiencies, while algorithmic stablecoins rely on automated protocols to maintain price stability through supply adjustments. Volatility control in algorithmic stablecoins hinges on algorithmic mechanisms like dynamic supply expansion and contraction, seigniorage shares, and collateralization tiers to counteract market fluctuations. This system aims to minimize price deviation from the peg by automatically balancing demand and supply, contrasting with quantitative trading's focus on exploiting price volatility for profit.

Asset Allocation: Quantitative Trading vs Stablecoin Reserves

Quantitative trading employs advanced mathematical models and statistical analysis to optimize asset allocation, dynamically adjusting portfolios based on market signals and risk parameters. In contrast, algorithmic stablecoins maintain asset reserves designed to stabilize value, often using programmable mechanisms to balance supply and demand without significant exposure to market volatility. The core difference lies in quantitative trading's active asset rebalancing for profit maximization versus stablecoin reserves' passive stability-focused capital management.

Regulatory Considerations for Both Approaches

Quantitative trading strategies must navigate stringent financial regulations related to market manipulation, transparency, and compliance with securities laws enforced by bodies such as the SEC and CFTC. Algorithmic stablecoins face heightened regulatory scrutiny concerning monetary policy implications, consumer protection, and anti-money laundering (AML) requirements, which require clear collateralization and transparency standards. Both approaches demand robust legal frameworks to ensure adherence to evolving regulatory guidelines, risk management protocols, and maintaining systemic stability within financial markets.

Technological Infrastructure Comparison

Quantitative trading relies on advanced data analytics platforms, high-frequency trading algorithms, and low-latency networks to execute trades autonomously based on mathematical models. Algorithmic stablecoins utilize decentralized blockchain protocols, smart contracts, and automated supply adjustment mechanisms to maintain stablecoin peg stability without centralized collateral. Both infrastructures emphasize automation, but quantitative trading prioritizes real-time market data processing, whereas algorithmic stablecoins focus on secure, transparent, and tamper-resistant decentralized systems.

Future Trends: Quantitative Trading and Algorithmic Stablecoins

Future trends in quantitative trading emphasize increased integration of artificial intelligence and machine learning to enhance predictive accuracy and risk management. Algorithmic stablecoins are evolving with improved decentralized governance mechanisms and dynamic collateral models to ensure stability amid volatile markets. Both sectors are leveraging blockchain innovations and real-time data analytics to drive efficiency and transparency in financial ecosystems.

Related Important Terms

Market Microstructure Alpha

Market microstructure alpha in quantitative trading leverages high-frequency data and order flow dynamics to capitalize on short-term price inefficiencies, enhancing execution strategies and profitability. In contrast, algorithmic stablecoins utilize market microstructure signals to maintain price stability and peg integrity, but their alpha generation primarily focuses on balancing supply and demand rather than exploiting microstructural arbitrage opportunities.

Statistical Arbitrage Bots

Statistical arbitrage bots in quantitative trading exploit price inefficiencies across correlated financial instruments by using mathematical models and high-frequency data analysis to execute rapid buy and sell orders. Unlike algorithmic stablecoins, which maintain price stability through programmed incentives and collateral mechanisms, statistical arbitrage bots focus solely on profit generation by capturing short-term market deviations.

On-chain Liquidity Mining

On-chain liquidity mining in quantitative trading leverages algorithmic strategies to optimize asset allocation and maximize returns through real-time data analysis and execution on decentralized exchanges. In contrast, algorithmic stablecoins utilize liquidity mining to stabilize token value by incentivizing participants to provide liquidity, thereby enhancing network stability and reducing volatility on-chain.

Volatility Harvesting Algorithms

Volatility harvesting algorithms in quantitative trading exploit price fluctuations to generate consistent returns by strategically rebalancing portfolios across volatile assets. In contrast, algorithmic stablecoins use volatility harvesting mechanisms to maintain price stability by dynamically adjusting supply and collateralization in response to market volatility.

Seigniorage Shares Model

The Seigniorage Shares Model in quantitative trading leverages algorithmic mechanisms to maintain stablecoin price stability by dynamically adjusting supply based on demand fluctuations, optimizing liquidity and minimizing volatility. This model contrasts traditional algorithmic stablecoins by integrating predictive analytics and market data to enhance efficiency in supply modulation and capital allocation.

Mean Reversion Engine

The Mean Reversion Engine in quantitative trading exploits price fluctuations by anticipating that asset prices will revert to their historical average, leveraging statistical models to optimize trade timing and risk management. In contrast, algorithmic stablecoins use mean reversion mechanisms to maintain price stability by dynamically adjusting supply through smart contracts, ensuring the token price stays close to a target peg despite market volatility.

Delta-neutral Stablecoin Strategies

Delta-neutral stablecoin strategies in quantitative trading leverage automated algorithms to maintain a market-neutral position, aiming to profit from price discrepancies without exposure to directional risk. These strategies often involve dynamic rebalancing and arbitrage between stablecoins and volatile assets, optimizing yield while mitigating volatility inherent in crypto markets.

Automated Rebalancing Oracles

Automated rebalancing oracles play a crucial role in quantitative trading by providing real-time, data-driven adjustments to asset portfolios, ensuring optimal allocation based on market conditions and risk parameters. In algorithmic stablecoins, these oracles underpin dynamic supply management mechanisms by continuously monitoring price stability and triggering token minting or burning to maintain peg accuracy and reduce volatility.

Liquidity Pool Quantification

Liquidity pool quantification in quantitative trading involves precise measurement of asset volumes and volatility to optimize trade execution and risk management, whereas in algorithmic stablecoins, it focuses on maintaining peg stability by dynamically adjusting collateral and liquidity parameters. Effective liquidity pool monitoring ensures robust price discovery in trading and preserves the stablecoin's value against market fluctuations.

Algorithmic Reserve Management

Algorithmic stablecoins utilize algorithmic reserve management to maintain price stability by dynamically adjusting supply through smart contracts without relying on traditional collateral. This mechanism contrasts with quantitative trading, which leverages statistical models and historical data to execute trades, as algorithmic stablecoins focus on automated reserve balancing to ensure peg resilience.

Quantitative Trading vs Algorithmic Stablecoins Infographic

industrydif.com

industrydif.com