Treasury bills offer a traditional, government-backed short-term investment with predictable returns and high liquidity, making them a secure choice for conservative investors. Tokenized treasury, leveraging blockchain technology, enables fractional ownership and enhanced accessibility, allowing smaller investors to participate with faster settlement and increased transparency. While traditional Treasury bills are widely trusted, tokenized versions present innovative opportunities for efficiency and broader market participation in the finance sector.

Table of Comparison

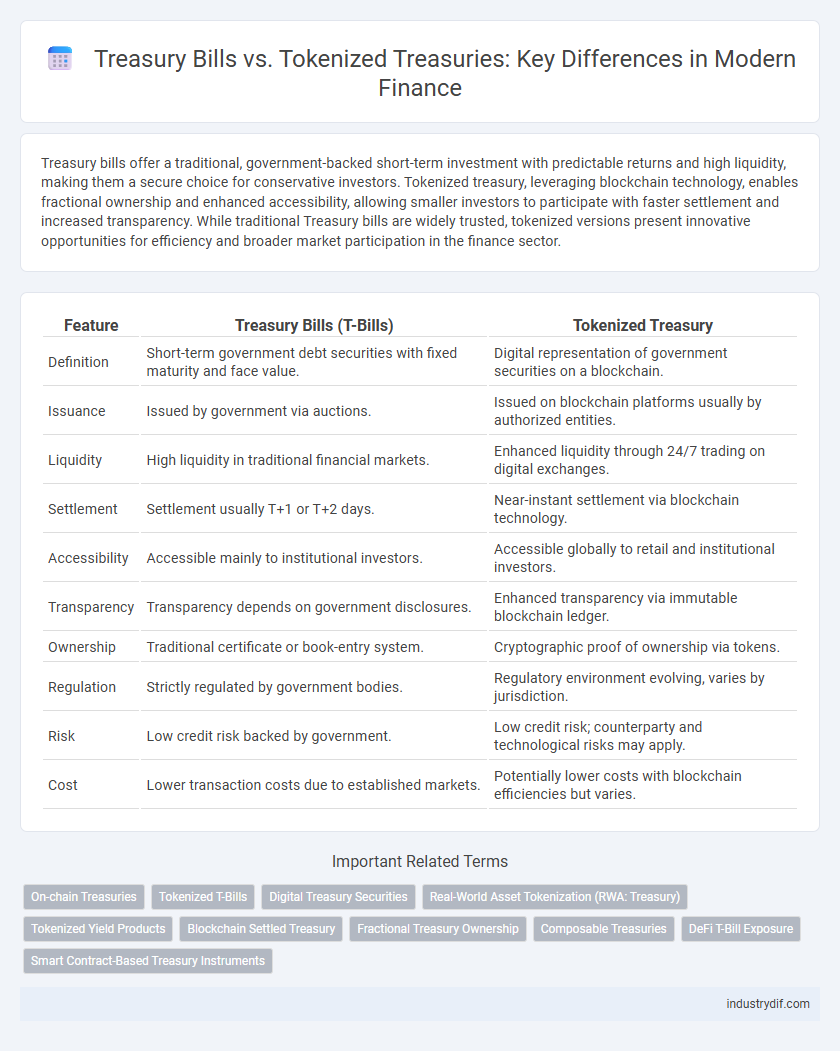

| Feature | Treasury Bills (T-Bills) | Tokenized Treasury |

|---|---|---|

| Definition | Short-term government debt securities with fixed maturity and face value. | Digital representation of government securities on a blockchain. |

| Issuance | Issued by government via auctions. | Issued on blockchain platforms usually by authorized entities. |

| Liquidity | High liquidity in traditional financial markets. | Enhanced liquidity through 24/7 trading on digital exchanges. |

| Settlement | Settlement usually T+1 or T+2 days. | Near-instant settlement via blockchain technology. |

| Accessibility | Accessible mainly to institutional investors. | Accessible globally to retail and institutional investors. |

| Transparency | Transparency depends on government disclosures. | Enhanced transparency via immutable blockchain ledger. |

| Ownership | Traditional certificate or book-entry system. | Cryptographic proof of ownership via tokens. |

| Regulation | Strictly regulated by government bodies. | Regulatory environment evolving, varies by jurisdiction. |

| Risk | Low credit risk backed by government. | Low credit risk; counterparty and technological risks may apply. |

| Cost | Lower transaction costs due to established markets. | Potentially lower costs with blockchain efficiencies but varies. |

Introduction to Treasury Bills and Tokenized Treasury

Treasury Bills (T-Bills) are short-term government debt securities issued at a discount and mature within one year, serving as a low-risk investment option backed by the government's credit. Tokenized Treasury represents the digitization of traditional Treasury assets on blockchain platforms, enabling fractional ownership, enhanced liquidity, and faster settlement times. This innovation bridges conventional finance and decentralized technologies, offering investors seamless access and increased market efficiency in government securities trading.

Key Features of Traditional Treasury Bills

Traditional Treasury Bills (T-Bills) are short-term government debt securities with maturities ranging from a few days to one year, issued at a discount and redeemed at face value to provide a fixed return. They are highly liquid, considered low-risk investments backed by the full faith and credit of the government, and typically do not pay periodic interest but generate profit through capital gains. T-Bills are widely used for cash management and funding government operations, ensuring stable returns and security for conservative investors.

Fundamentals of Tokenized Treasury Assets

Tokenized treasury assets represent traditional treasury bills in a digital format using blockchain technology, enhancing liquidity and transparency in financial markets. These assets enable fractional ownership, allowing investors to buy smaller portions of government debt with reduced barriers to entry. The fundamentals of tokenized treasury assets include smart contract automation, real-time settlement, and increased accessibility to global investors, distinguishing them from conventional treasury bills.

Issuance and Settlement Processes

Treasury Bills (T-Bills) are issued through traditional government auctions with settlement typically occurring via centralized banking systems within one to two business days. Tokenized Treasury Bills leverage blockchain technology, enabling instant issuance and settlement through smart contracts on decentralized ledgers, reducing counterparty risk and enhancing transparency. The tokenized process streamlines compliance and access, providing 24/7 trading capabilities compared to conventional market hours of T-Bills.

Liquidity and Market Accessibility

Treasury Bills offer high liquidity through established secondary markets and government backing, ensuring ease of purchase and quick conversion to cash. Tokenized Treasury instruments enhance market accessibility by enabling fractional ownership and 24/7 trading on blockchain platforms, attracting a broader range of investors. While traditional T-Bills provide stability and trust, tokenized versions unlock increased market participation and decentralized liquidity pools.

Security and Regulatory Considerations

Treasury Bills offer established security through government backing and are regulated by central banking authorities, ensuring investor protection and market stability. Tokenized Treasury assets leverage blockchain technology for transparency and ease of transfer but face evolving regulatory frameworks and potential risks related to cybersecurity and digital asset custody. Investors must evaluate the trade-offs between traditional regulatory certainty and the innovative, yet developing, compliance landscape of tokenized financial instruments.

Yield, Returns, and Risk Comparison

Treasury Bills offer stable, government-backed returns with low risk and predictable yields, typically reflecting short-term interest rates in traditional financial markets. Tokenized Treasury instruments provide enhanced liquidity and fractional ownership, enabling potentially higher yield opportunities through secondary trading, but may introduce additional risks such as platform security and regulatory uncertainty. Comparing returns, traditional T-Bills prioritize capital preservation with modest yields, while tokenized versions might offer greater profitability at the cost of increased volatility and operational risks.

Technology Integration and Blockchain Role

Tokenized Treasury securities leverage blockchain technology to enhance transparency, security, and settlement speed compared to traditional Treasury Bills. Blockchain integration enables real-time tracking, reduces counterparty risk, and automates compliance through smart contracts. This technological innovation facilitates fractional ownership and broader market accessibility, transforming the conventional Treasury market structure.

Use Cases in Modern Financial Portfolios

Treasury bills offer short-term government-backed securities widely used for capital preservation and liquidity management in conservative financial portfolios. Tokenized treasury bills introduce blockchain-enabled fractional ownership, enhancing accessibility and enabling seamless peer-to-peer trading on decentralized platforms. Modern portfolios integrate tokenized treasuries to optimize diversification, improve transparency, and reduce transaction costs in digital asset allocation strategies.

Future Outlook for Treasury Instruments

Tokenized Treasury instruments leverage blockchain technology to enable fractional ownership, enhanced liquidity, and faster settlement times compared to traditional Treasury Bills. Increasing institutional interest and regulatory advancements signal a growing integration of tokenized assets in capital markets. Future Treasury instruments are expected to blend conventional security with digital innovation, optimizing accessibility and efficiency for a broader range of investors.

Related Important Terms

On-chain Treasuries

On-chain Treasuries leverage blockchain technology to digitize traditional treasury bills, providing enhanced liquidity, transparency, and faster settlement through tokenized assets. Unlike conventional Treasury Bills, tokenized treasuries enable fractional ownership and seamless peer-to-peer trading within decentralized finance ecosystems.

Tokenized T-Bills

Tokenized Treasury Bills offer enhanced liquidity and fractional ownership by digitizing traditional government securities on blockchain platforms, enabling faster settlement and lower transaction costs compared to conventional Treasury Bills. This innovation increases accessibility for retail investors while maintaining the creditworthiness and security of government-backed debt instruments.

Digital Treasury Securities

Digital Treasury securities, including Tokenized Treasury Bills, provide enhanced liquidity and fractional ownership compared to traditional Treasury Bills by leveraging blockchain technology for transparent and efficient transactions. This innovation reduces settlement times and broadens investor access, transforming government debt instruments into more flexible and accessible digital assets.

Real-World Asset Tokenization (RWA: Treasury)

Tokenized Treasury Bills represent Real-World Asset Tokenization by digitizing traditional government debt instruments on blockchain platforms, enhancing liquidity and accessibility for investors. This innovation reduces settlement times and provides fractional ownership opportunities, distinguishing it from conventional Treasury Bills traded in centralized markets.

Tokenized Yield Products

Tokenized Treasury yield products offer enhanced liquidity and fractional ownership compared to traditional Treasury Bills, leveraging blockchain technology to enable faster settlement and reduced counterparty risk. These digital assets provide investors with real-time transparency and programmable features, increasing accessibility and efficiency in fixed-income markets.

Blockchain Settled Treasury

Blockchain-settled Treasury Bills enhance traditional Treasury Bills by enabling faster settlement, increased transparency, and reduced counterparty risk through tokenization on distributed ledgers. Tokenized Treasury assets facilitate fractional ownership, improve liquidity, and streamline compliance processes, positioning blockchain as a transformative force in sovereign debt management.

Fractional Treasury Ownership

Tokenized Treasury introduces fractional ownership by dividing traditional Treasury Bills into smaller, blockchain-based digital assets, enabling investors to purchase and trade partial interests with enhanced liquidity and lower entry barriers. This contrasts with conventional Treasury Bills, which require full-unit investments and often lack the flexibility and accessibility that tokenization provides.

Composable Treasuries

Composable Treasuries leverage blockchain technology to fractionalize and tokenize traditional Treasury Bills, enhancing liquidity and enabling seamless integration into decentralized finance ecosystems. Unlike conventional Treasury Bills, Tokenized Treasuries offer programmable smart contract features that allow investors to customize maturity, yield distribution, and collateralization, driving innovation in digital asset management.

DeFi T-Bill Exposure

Tokenized Treasury bills in DeFi platforms provide real-time access, fractional ownership, and enhanced liquidity compared to traditional Treasury bills, enabling broader market participation and faster settlement. DeFi T-Bill exposure leverages blockchain transparency and smart contract automation to reduce intermediaries, lower transaction costs, and increase yield opportunities for investors.

Smart Contract-Based Treasury Instruments

Smart contract-based Treasury instruments transform traditional Treasury bills by enabling automated, transparent, and programmable transactions on blockchain networks, reducing settlement times and counterparty risks. Tokenized Treasury bills offer enhanced liquidity and accessibility by digitizing government debt, allowing fractional ownership and seamless secondary market trading through decentralized platforms.

Treasury Bills vs Tokenized Treasury Infographic

industrydif.com

industrydif.com