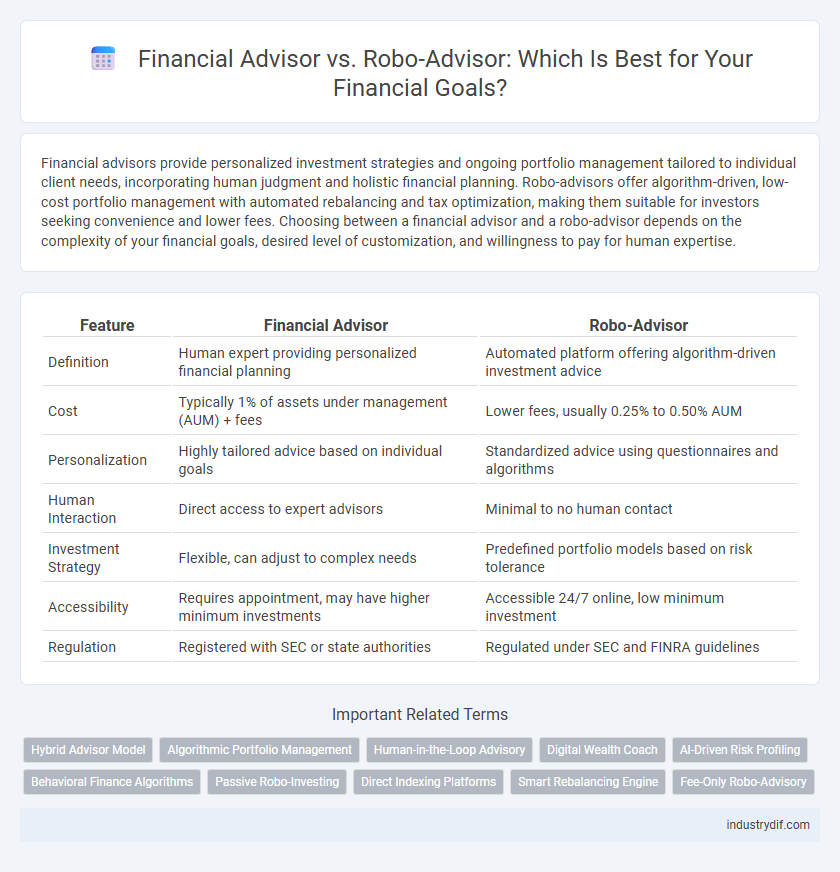

Financial advisors provide personalized investment strategies and ongoing portfolio management tailored to individual client needs, incorporating human judgment and holistic financial planning. Robo-advisors offer algorithm-driven, low-cost portfolio management with automated rebalancing and tax optimization, making them suitable for investors seeking convenience and lower fees. Choosing between a financial advisor and a robo-advisor depends on the complexity of your financial goals, desired level of customization, and willingness to pay for human expertise.

Table of Comparison

| Feature | Financial Advisor | Robo-Advisor |

|---|---|---|

| Definition | Human expert providing personalized financial planning | Automated platform offering algorithm-driven investment advice |

| Cost | Typically 1% of assets under management (AUM) + fees | Lower fees, usually 0.25% to 0.50% AUM |

| Personalization | Highly tailored advice based on individual goals | Standardized advice using questionnaires and algorithms |

| Human Interaction | Direct access to expert advisors | Minimal to no human contact |

| Investment Strategy | Flexible, can adjust to complex needs | Predefined portfolio models based on risk tolerance |

| Accessibility | Requires appointment, may have higher minimum investments | Accessible 24/7 online, low minimum investment |

| Regulation | Registered with SEC or state authorities | Regulated under SEC and FINRA guidelines |

Introduction to Financial Advisors and Robo-Advisors

Financial advisors offer personalized investment strategies and holistic financial planning services tailored to individual client needs, combining expertise with human judgment. Robo-advisors utilize algorithms and automated platforms to provide low-cost, efficient portfolio management based on client risk profiles and financial goals. Both serve distinct roles in wealth management, with financial advisors emphasizing customized advice and robo-advisors focusing on accessibility and automation.

Defining Financial Advisors: Roles and Responsibilities

Financial advisors provide personalized financial planning, investment management, and retirement strategies, tailored to individual client goals and risk tolerance. They conduct in-depth evaluations of a client's financial situation, offer tax planning advice, and continuously monitor portfolios to adjust for market changes. By delivering customized, human-driven guidance, financial advisors address complex needs including estate planning and debt management.

What Are Robo-Advisors? Key Features and Functions

Robo-advisors are automated, algorithm-driven platforms that provide automated financial planning services with minimal human intervention. Key features include portfolio management based on Modern Portfolio Theory, automatic rebalancing, tax-loss harvesting, and low-cost investment options through ETFs and index funds. These platforms use user-input data such as risk tolerance, financial goals, and investment horizon to create personalized investment strategies.

Human Expertise vs. Algorithmic Intelligence

Financial advisors provide personalized strategies by leveraging human expertise, emotional insight, and tailored financial planning, which adapts to complex life situations and changing market conditions. Robo-advisors utilize algorithmic intelligence and data-driven models to offer low-cost, automated investment management with standardized portfolio allocations based on risk tolerance and goals. The choice between a financial advisor and a robo-advisor depends on the investor's need for customized advice versus preference for efficiency and cost-effectiveness.

Cost Comparison: Fees and Value-for-Money

Financial advisors typically charge fees ranging from 0.5% to 2% of assets under management, which can be substantial for high-net-worth individuals, while robo-advisors offer automated investment management with fees between 0.2% and 0.5%, significantly lowering costs. The human element in financial advisors delivers personalized strategies and holistic financial planning, which may justify higher fees for clients seeking tailored advice and complex financial solutions. Robo-advisors provide efficient, low-cost portfolio management with algorithm-driven asset allocation, making them a cost-effective option for investors with simpler financial goals.

Personalization and Client Experience

Financial advisors offer tailored investment strategies through personalized consultations, addressing individual goals, risk tolerance, and lifecycle changes, which enhances client trust and long-term relationships. Robo-advisors utilize algorithms and AI to provide cost-effective, automated portfolio management with limited customization options, primarily based on standardized risk profiles. Client experience with financial advisors is more interactive and adaptive, while robo-advisors excel in accessibility and scalability for users seeking efficient, low-fee solutions.

Investment Strategies and Portfolio Management

Financial advisors provide personalized investment strategies tailored to individual risk tolerance, financial goals, and market conditions, leveraging human insight and experience for dynamic portfolio management. Robo-advisors utilize algorithm-driven models and automated rebalancing to deliver cost-effective, diversified portfolios based on standardized risk assessments and passive investment principles. While financial advisors offer customized advice and behavioral guidance, robo-advisors excel in scalability, low fees, and accessibility for automated portfolio optimization.

Regulatory Considerations and Safety

Financial advisors operate under strict regulatory frameworks such as the SEC and FINRA, ensuring fiduciary responsibility and personalized advice, while robo-advisors comply with regulations like Regulation Best Interest and the Investment Advisers Act but rely heavily on algorithms and automation. Security measures for robo-advisors include advanced encryption and two-factor authentication to protect client data, whereas traditional financial advisors emphasize secure communication channels and regulatory audits to ensure client asset safety. Investors must evaluate the trade-offs between human oversight with personalized compliance and the efficiency of automated regulatory adherence when choosing between financial advisors and robo-advisors.

Suitability: Who Should Choose Which Option?

Financial advisors offer personalized investment strategies tailored to individual financial goals, risk tolerance, and complex tax situations, making them suitable for clients seeking human interaction and customized advice. Robo-advisors utilize algorithm-driven portfolios based on general risk profiles, providing cost-effective and convenient solutions for tech-savvy investors with simpler financial needs. Choosing between the two depends on the degree of personalization required, complexity of financial planning, and preference for human guidance versus automated management.

Future Trends in Financial Advisory Services

Future trends in financial advisory services emphasize increased integration of artificial intelligence and machine learning within robo-advisors, enhancing personalized investment strategies and real-time portfolio management. Hybrid models combining human financial advisors with robo-advisor technology are gaining traction, offering clients customized advice supported by data-driven insights. Regulatory advancements and growing consumer trust in digital platforms are accelerating the adoption of automated advisory services alongside traditional human expertise.

Related Important Terms

Hybrid Advisor Model

The hybrid advisor model combines the personalized expertise of a financial advisor with the efficiency and data-driven insights of robo-advisors, optimizing portfolio management and client engagement. By integrating human judgment and automated algorithms, this approach enhances investment strategies, risk assessment, and cost-effectiveness in wealth management.

Algorithmic Portfolio Management

Algorithmic portfolio management in robo-advisors utilizes advanced algorithms and AI to create and rebalance diversified investment portfolios with minimal human intervention, often resulting in lower fees and increased efficiency compared to traditional financial advisors. While financial advisors offer personalized advice and holistic planning, robo-advisors excel in real-time data analysis and automated asset allocation tailored to individual risk profiles.

Human-in-the-Loop Advisory

Human-in-the-loop advisory combines the personalized expertise of financial advisors with the algorithmic efficiency of robo-advisors, enhancing decision-making through real-time human oversight. This hybrid approach leverages AI-driven data analysis while ensuring clients benefit from tailored strategies and nuanced risk assessments provided by experienced professionals.

Digital Wealth Coach

Digital wealth coaches combine advanced algorithms with personalized guidance, offering tailored investment strategies and real-time portfolio monitoring that traditional financial advisors may not provide. Their integration of artificial intelligence enables continuous risk assessment and adaptive financial planning, optimizing client outcomes in a cost-efficient, scalable manner.

AI-Driven Risk Profiling

AI-driven risk profiling in robo-advisors leverages machine learning algorithms and big data to analyze investors' financial behaviors and market trends in real time, offering personalized portfolio recommendations with minimal human intervention. Financial advisors combine AI tools with expert judgment and emotional intelligence to interpret risk profiles contextually, providing tailored strategies that address complex financial goals and regulatory considerations.

Behavioral Finance Algorithms

Behavioral finance algorithms integrated into robo-advisors analyze investor emotions and cognitive biases to customize portfolio strategies, potentially reducing human error and emotional decision-making. Financial advisors leverage these insights alongside personal interaction to provide tailored guidance, addressing complex financial goals and individual behavioral nuances.

Passive Robo-Investing

Passive robo-investing leverages algorithm-driven platforms to manage diversified portfolios with minimal human intervention, typically reducing fees and enhancing accessibility compared to traditional financial advisors. These automated systems utilize passive index funds and ETFs to optimize long-term growth while maintaining tax efficiency and risk alignment based on individual investor profiles.

Direct Indexing Platforms

Direct indexing platforms within financial advisory blend personalized portfolio customization with advanced algorithmic efficiency, enabling investors to optimize tax-loss harvesting and tailor investments at a granular level. Unlike traditional robo-advisors that rely on pre-built ETFs, these platforms empower clients to own individual securities directly, enhancing customization and potential tax benefits under the supervision of financial advisors.

Smart Rebalancing Engine

A Smart Rebalancing Engine in robo-advisors continuously monitors portfolio allocation and executes automatic adjustments to maintain target investment strategies with precision and efficiency. Financial advisors rely on periodic manual reviews and personalized judgment, often resulting in less frequent and potentially inconsistent rebalancing compared to algorithm-driven automated systems.

Fee-Only Robo-Advisory

Fee-only robo-advisors offer automated portfolio management with transparent, lower-cost fee structures averaging 0.25% annually, eliminating conflicts of interest common in commission-based financial advisor models. These platforms utilize algorithms and low-cost ETFs to provide efficient, unbiased investment strategies, appealing to cost-conscious investors seeking streamlined financial guidance without personal consultation.

Financial Advisor vs Robo-Advisor Infographic

industrydif.com

industrydif.com