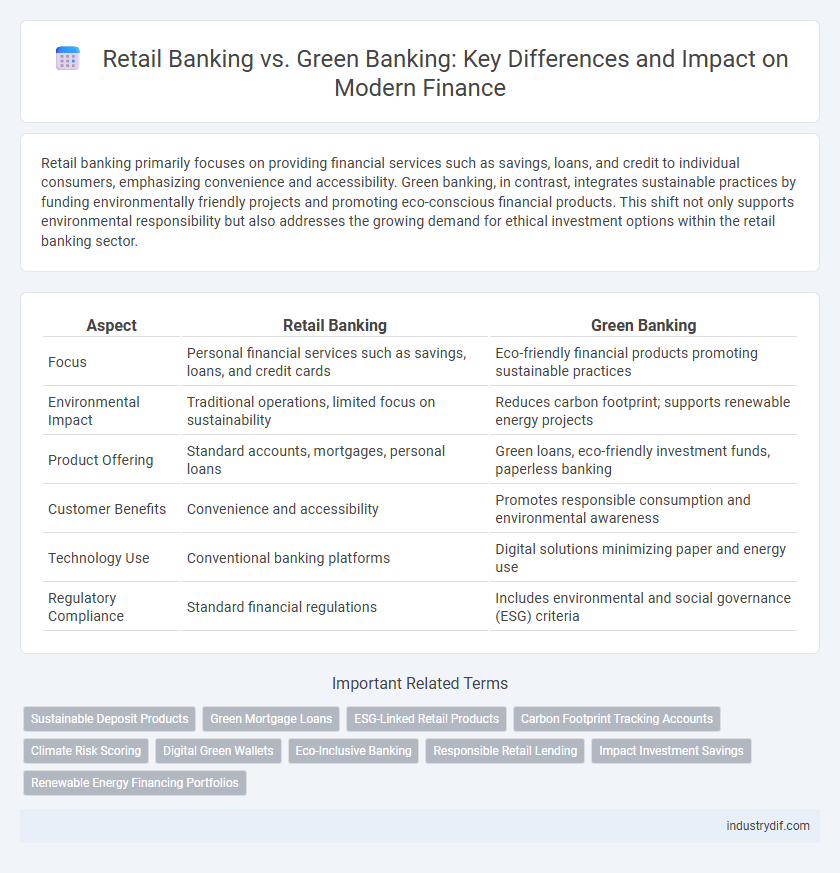

Retail banking primarily focuses on providing financial services such as savings, loans, and credit to individual consumers, emphasizing convenience and accessibility. Green banking, in contrast, integrates sustainable practices by funding environmentally friendly projects and promoting eco-conscious financial products. This shift not only supports environmental responsibility but also addresses the growing demand for ethical investment options within the retail banking sector.

Table of Comparison

| Aspect | Retail Banking | Green Banking |

|---|---|---|

| Focus | Personal financial services such as savings, loans, and credit cards | Eco-friendly financial products promoting sustainable practices |

| Environmental Impact | Traditional operations, limited focus on sustainability | Reduces carbon footprint; supports renewable energy projects |

| Product Offering | Standard accounts, mortgages, personal loans | Green loans, eco-friendly investment funds, paperless banking |

| Customer Benefits | Convenience and accessibility | Promotes responsible consumption and environmental awareness |

| Technology Use | Conventional banking platforms | Digital solutions minimizing paper and energy use |

| Regulatory Compliance | Standard financial regulations | Includes environmental and social governance (ESG) criteria |

Understanding Retail Banking: Core Functions and Services

Retail banking offers essential financial services such as savings and checking accounts, personal loans, mortgages, and credit cards, catering primarily to individual consumers. Its core functions include deposit acceptance, fund withdrawal, payment processing, and consumer credit facilitation, ensuring accessibility and convenience. Understanding these services highlights how retail banking builds customer relationships and supports everyday financial needs.

What is Green Banking? Principles and Objectives

Green banking integrates sustainable environmental practices into retail banking operations, emphasizing reduced carbon footprints, eco-friendly investments, and funding renewable energy projects. Its core principles include promoting financial products that support environmental conservation, minimizing paper use through digital banking, and ensuring ethical lending that favors green businesses. The primary objective is to balance profitability with ecological responsibility, fostering long-term sustainable development in the financial sector.

Key Differences Between Retail and Green Banking

Retail banking primarily focuses on providing financial services such as savings accounts, loans, and mortgages to individual consumers, emphasizing convenience and accessibility. Green banking integrates environmental sustainability into its financial products and services, promoting eco-friendly projects and investments with lower carbon footprints. The key difference lies in retail banking's customer-centric financial offerings versus green banking's commitment to environmental impact and sustainable finance initiatives.

Customer Experience: Retail Banking vs Green Banking

Retail banking prioritizes personalized services, easy access to financial products, and convenience through physical branches and digital platforms, enhancing overall customer satisfaction. Green banking, however, integrates eco-friendly practices and sustainable finance options, appealing to environmentally conscious customers seeking ethical investments and reduced carbon footprints. Both approaches shape customer experience by aligning financial services with individual values and expectations in the evolving banking landscape.

Sustainable Finance Initiatives in Green Banking

Green banking incorporates sustainable finance initiatives by funding projects that promote environmental conservation, such as renewable energy, waste reduction, and sustainable agriculture. Unlike traditional retail banking, green banking prioritizes low-carbon investments and supports clients committed to sustainability goals. These initiatives enhance long-term financial resilience while addressing climate risks and regulatory pressures.

Regulatory Framework: Compliance in Retail vs Green Banking

Retail banking operates under well-established regulatory frameworks such as the Basel III accords and the Dodd-Frank Act, ensuring compliance through capital adequacy, risk management, and consumer protection laws. Green banking compliance integrates environmental regulations like the EU Taxonomy Regulation and the Task Force on Climate-related Financial Disclosures (TCFD) guidelines, emphasizing sustainability reporting and financing projects that reduce carbon footprints. Both sectors require stringent oversight, but green banking demands additional adherence to evolving climate-related legal standards and transparent impact assessments.

Technological Innovations: Digital Transformation in Both Sectors

Retail banking leverages mobile apps, AI-driven chatbots, and personalized financial management tools to enhance customer experience and streamline operations. Green banking incorporates blockchain for transparent environmental impact tracking and IoT devices to monitor energy-efficient projects, promoting sustainable finance. Both sectors prioritize digital transformation, utilizing cloud computing and big data analytics to optimize services and support evolving customer demands.

Risk Management Strategies in Retail and Green Banking

Retail banking employs risk management strategies focused on credit risk assessment, fraud prevention, and regulatory compliance to safeguard consumer deposits and loans. Green banking integrates environmental risk evaluations and sustainable financing guidelines to minimize ecological and reputational risks associated with investments. Both sectors utilize advanced data analytics and stress testing to enhance portfolio resilience and ensure financial stability.

Market Trends: Growth of Retail vs Green Banking Segments

Retail banking continues to dominate the financial market with steady growth driven by consumer demand for personal loans, mortgages, and deposit accounts, reflecting an average annual growth rate of about 5%. Green banking is rapidly expanding, fueled by increased environmental awareness and regulatory incentives, showing a significantly higher growth rate of approximately 15% per year. Market trends indicate a strategic shift where traditional retail banks increasingly integrate sustainable finance products to capture the rising segment of eco-conscious consumers.

Future Outlook: Evolving Roles in the Financial Ecosystem

Retail banking is increasingly integrating digital innovations such as AI-driven personalized services and mobile platforms to enhance customer experience and operational efficiency. Green banking emphasizes sustainable finance initiatives, including green loans, ESG investment products, and carbon footprint reduction strategies, aligning with global climate goals. The future financial ecosystem will see hybrid models where retail banks adopt green banking principles to meet regulatory demands, investor expectations, and growing consumer preference for eco-friendly financial solutions.

Related Important Terms

Sustainable Deposit Products

Sustainable deposit products in retail banking prioritize eco-friendly investments by channeling customer funds into renewable energy projects and socially responsible ventures, enhancing environmental impact alongside financial returns. These green banking options integrate sustainability metrics and offer competitive interest rates to attract environmentally conscious consumers seeking to support climate-positive initiatives through their deposits.

Green Mortgage Loans

Green mortgage loans in retail banking incentivize energy-efficient home improvements and sustainable building practices by offering lower interest rates and favorable terms compared to traditional mortgages. These environmentally focused financial products support carbon footprint reduction while aligning with growing consumer demand for eco-friendly housing solutions.

ESG-Linked Retail Products

ESG-linked retail products in retail banking integrate environmental, social, and governance criteria into financial offerings such as green loans, sustainable savings accounts, and socially responsible investment funds, aligning consumer finance choices with sustainability goals. Green banking emphasizes these ESG-aligned retail products to drive positive environmental impact while promoting transparency, ethical practices, and long-term value creation for both customers and financial institutions.

Carbon Footprint Tracking Accounts

Retail banking traditionally focuses on everyday financial services such as savings accounts, loans, and credit cards, whereas green banking emphasizes sustainable practices, including carbon footprint tracking accounts that enable customers to monitor and reduce their environmental impact. Carbon footprint tracking accounts integrate advanced analytics and reporting tools, helping retail clients make eco-friendly decisions by visualizing emissions data related to their spending habits.

Climate Risk Scoring

Retail banking primarily focuses on consumer financial services, while green banking incorporates climate risk scoring to evaluate the environmental impact and sustainability of investments. Climate risk scoring helps financial institutions assess the potential economic losses due to climate change, enabling more informed lending and investment decisions that support low-carbon and resilient projects.

Digital Green Wallets

Digital green wallets in retail banking integrate eco-friendly financial practices by enabling users to track and reduce their carbon footprint through sustainable spending analytics and green investment options. These wallets leverage blockchain technology and AI-driven insights to promote environmentally conscious transactions, aligning traditional banking services with global sustainability goals.

Eco-Inclusive Banking

Retail banking traditionally focuses on providing financial services to individual consumers, including savings accounts, loans, and credit cards, while green banking emphasizes sustainable finance practices that support environmental conservation and eco-friendly projects. Eco-inclusive banking integrates these models by offering accessible financial products that promote renewable energy investments, reduce carbon footprints, and encourage responsible consumption among mass-market customers.

Responsible Retail Lending

Responsible retail lending in retail banking emphasizes ethical credit practices, transparent terms, and customer financial well-being to prevent over-indebtedness and promote sustainable borrowing habits. Green banking integrates these principles with environmental sustainability by prioritizing loans for eco-friendly projects and encouraging responsible investments that reduce carbon footprints and support renewable energy initiatives.

Impact Investment Savings

Retail banking primarily offers traditional savings accounts with moderate interest rates and limited social impact, while green banking emphasizes impact investment savings that channel funds into environmentally sustainable projects. These impact investment savings not only provide competitive returns but also promote renewable energy, carbon reduction, and ecological restoration initiatives, aligning financial growth with environmental responsibility.

Renewable Energy Financing Portfolios

Retail banking traditionally focuses on consumer deposits, loans, and credit services, while green banking prioritizes financing portfolios dedicated to renewable energy projects such as solar, wind, and bioenergy. Green banking portfolios emphasize sustainable investments, risk mitigation related to climate change, and compliance with environmental regulations to support global decarbonization efforts.

Retail Banking vs Green Banking Infographic

industrydif.com

industrydif.com