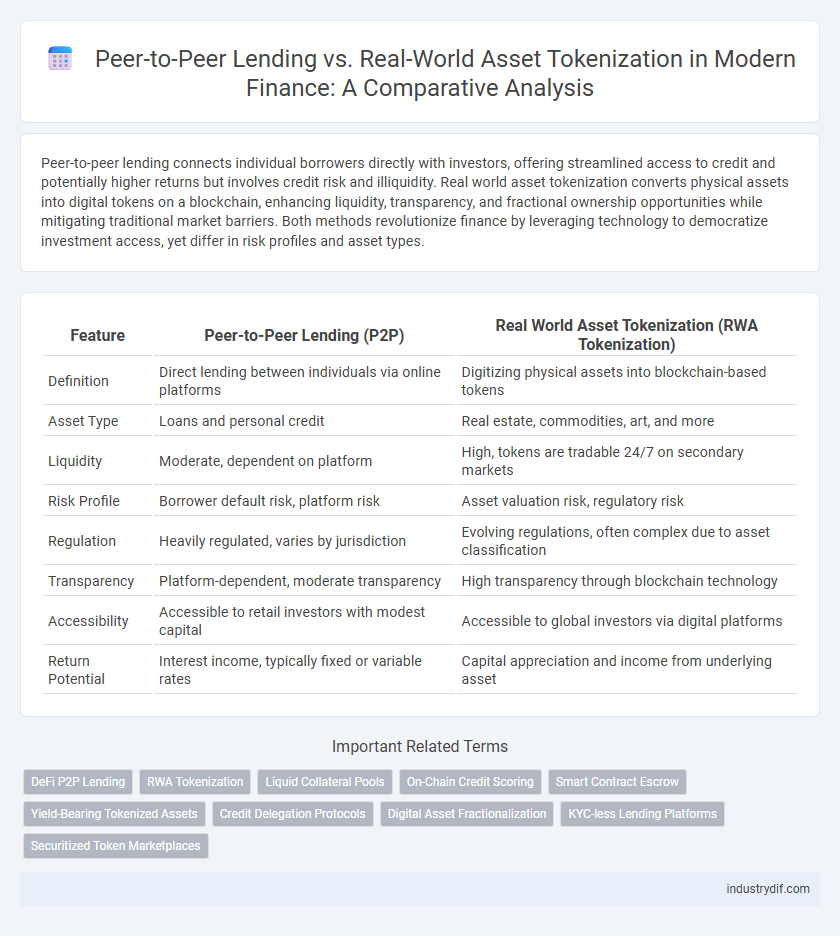

Peer-to-peer lending connects individual borrowers directly with investors, offering streamlined access to credit and potentially higher returns but involves credit risk and illiquidity. Real world asset tokenization converts physical assets into digital tokens on a blockchain, enhancing liquidity, transparency, and fractional ownership opportunities while mitigating traditional market barriers. Both methods revolutionize finance by leveraging technology to democratize investment access, yet differ in risk profiles and asset types.

Table of Comparison

| Feature | Peer-to-Peer Lending (P2P) | Real World Asset Tokenization (RWA Tokenization) |

|---|---|---|

| Definition | Direct lending between individuals via online platforms | Digitizing physical assets into blockchain-based tokens |

| Asset Type | Loans and personal credit | Real estate, commodities, art, and more |

| Liquidity | Moderate, dependent on platform | High, tokens are tradable 24/7 on secondary markets |

| Risk Profile | Borrower default risk, platform risk | Asset valuation risk, regulatory risk |

| Regulation | Heavily regulated, varies by jurisdiction | Evolving regulations, often complex due to asset classification |

| Transparency | Platform-dependent, moderate transparency | High transparency through blockchain technology |

| Accessibility | Accessible to retail investors with modest capital | Accessible to global investors via digital platforms |

| Return Potential | Interest income, typically fixed or variable rates | Capital appreciation and income from underlying asset |

Introduction to Peer-to-Peer Lending and Asset Tokenization

Peer-to-peer lending facilitates direct borrowing and lending between individuals without traditional financial intermediaries, leveraging online platforms to match lenders with borrowers efficiently. Asset tokenization transforms real-world assets like real estate or commodities into digital tokens on a blockchain, enabling fractional ownership and increased liquidity. Both innovations enhance access to capital and diversify investment opportunities by utilizing technology-driven, decentralized financial models.

Core Mechanisms: P2P Lending vs RWA Tokenization

Peer-to-peer lending connects individual borrowers directly with lenders through online platforms, leveraging credit assessments and smart contracts to facilitate transparent loan agreements without intermediaries. Real world asset tokenization digitizes ownership of tangible assets like real estate or commodities, issuing blockchain-based tokens that represent fractional shares, enabling liquidity and diversified investment opportunities. While P2P lending revolves around debt instruments and interest repayments, RWA tokenization focuses on asset-backed securities and secondary market trading of tokenized assets.

Regulatory Frameworks in P2P Lending and Tokenization

Regulatory frameworks for Peer-to-Peer (P2P) lending emphasize consumer protection, anti-money laundering (AML) compliance, and transparency through licensing and operational guidelines enforced by financial authorities such as the SEC or FCA. In contrast, Real World Asset (RWA) tokenization navigates evolving securities laws and digital asset regulations, requiring adherence to both traditional asset laws and blockchain-specific compliance measures, often under jurisdictions like the EU's MiCA framework or the U.S. SEC's stance on digital securities. Understanding these distinct regulatory environments is crucial for investors and platforms to mitigate legal risks and ensure compliance in their respective financial ecosystems.

Risk Assessment and Mitigation Strategies

Peer-to-peer lending relies heavily on borrower credit scoring and platform risk assessment models, which can struggle with default prediction and liquidity risks. Real-world asset tokenization leverages blockchain for transparent ownership and employs asset-backed collateral to mitigate credit risk while enhancing liquidity through secondary markets. Effective risk mitigation in both models entails comprehensive due diligence, dynamic loan-to-value adjustments, and diversification across borrowers or tokenized assets.

Investor Access and Participation Models

Peer-to-peer (P2P) lending offers direct investor-to-borrower interactions, enabling individual investors to fund loans with relatively low entry barriers and diversified participation through online platforms. Real-world asset tokenization transforms physical assets into digital tokens on blockchain networks, expanding investor access by fractionalizing ownership and allowing secondary market trading for increased liquidity. While P2P lending emphasizes credit risk and borrower profiles, real-world asset tokenization focuses on asset-backed security and broader market participation through seamless, borderless investment opportunities.

Liquidity and Secondary Market Opportunities

Peer-to-peer lending platforms offer moderate liquidity through defined loan terms and secondary markets that allow partial loan transfers, but these markets are often less liquid and less regulated. Real-world asset tokenization significantly enhances liquidity by enabling fractional ownership and instant trading of tokenized assets on decentralized exchanges, expanding secondary market opportunities globally. Consequently, tokenization provides superior flexibility and accessibility for investors seeking quick asset liquidation compared to traditional peer-to-peer loan structures.

Returns and Profitability Analysis

Peer-to-peer lending platforms typically offer annual returns ranging from 5% to 12%, with profitability influenced by borrower credit risk and platform fees. Real world asset tokenization can provide diversified income streams by enabling fractional ownership of tangible assets, often yielding steady cash flows tied to real estate, commodities, or art, with potential for capital appreciation. Comparative profitability depends on market volatility, liquidity, and underlying asset performance, where tokenized assets might offer enhanced liquidity but also require thorough valuation analysis to ascertain risk-adjusted returns.

Technological Infrastructure and Innovation

Peer-to-peer lending platforms leverage blockchain technology to create decentralized marketplaces, enabling direct borrower-lender interactions with reduced intermediaries and enhanced transparency. Real world asset tokenization uses advanced smart contract frameworks on interoperable blockchains to fractionalize tangible assets like real estate or commodities, increasing liquidity and enabling 24/7 global trading. Innovations in cryptographic security, automated compliance protocols, and real-time settlement differentiate tokenization's infrastructure from the more streamlined, user-focused design of P2P lending systems.

Security, Transparency, and Trust Factors

Peer-to-peer lending platforms enhance trust by directly connecting borrowers and investors with transparent credit scoring and repayment histories, yet they face security risks like platform insolvency and fraud. Real world asset tokenization leverages blockchain technology to provide immutable transaction records and fractional ownership, significantly increasing transparency and reducing counterparty risk. Both methods rely heavily on regulatory compliance and technological safeguards to ensure security, but tokenization offers superior auditability and trust through decentralized verification.

Future Trends: Convergence and Industry Impact

Peer-to-peer lending and real-world asset tokenization are increasingly converging as blockchain technology enables decentralized finance (DeFi) platforms to integrate traditional credit models with digital asset frameworks. This convergence drives enhanced liquidity, transparency, and access to diverse investment opportunities, accelerating the democratization of finance. Industry impact includes disruption of conventional banking models and emergence of hybrid financial ecosystems that leverage smart contracts for efficiency and reduced counterparty risk.

Related Important Terms

DeFi P2P Lending

DeFi P2P lending enables direct, blockchain-based loan agreements between individuals, eliminating traditional intermediaries and reducing costs while providing greater transparency and access to global liquidity. In contrast, real world asset tokenization converts physical assets into digital tokens for fractional ownership, offering diversified investment opportunities but relying on regulatory frameworks and asset valuation accuracy.

RWA Tokenization

Real World Asset (RWA) Tokenization transforms tangible assets like real estate, commodities, or receivables into blockchain-based digital tokens, enhancing liquidity and enabling fractional ownership for investors. Unlike Peer-to-Peer Lending, which connects borrowers directly with lenders, RWA Tokenization offers diversified exposure to physical assets, reducing counterparty risk and unlocking new capital markets through transparent, immutable records.

Liquid Collateral Pools

Peer-to-peer lending platforms often face liquidity constraints due to individually matched loans, whereas real world asset tokenization enables the creation of liquid collateral pools by fractionalizing physical assets into tradable digital tokens. These liquid collateral pools enhance market efficiency and risk diversification, providing investors with increased flexibility and real-time liquidity in asset-backed financing.

On-Chain Credit Scoring

On-chain credit scoring leverages blockchain data to provide transparent, immutable credit histories, enhancing risk assessment accuracy in peer-to-peer lending compared to traditional methods. Real-world asset tokenization benefits from integrating on-chain credit scores to enable more secure and efficient lending processes by directly linking borrower credibility with tangible asset-backed tokens.

Smart Contract Escrow

Smart contract escrow in peer-to-peer lending automates transaction security by holding funds until loan conditions are met, reducing counterparty risk and enhancing trust between borrowers and lenders. In real world asset tokenization, smart contract escrow ensures that asset transfers and payments occur only when predefined compliance and ownership criteria are satisfied, increasing transparency and liquidity in asset-backed transactions.

Yield-Bearing Tokenized Assets

Yield-bearing tokenized assets in real world asset tokenization offer fractional ownership with transparent, blockchain-based yield distribution, enhancing liquidity compared to traditional peer-to-peer lending models where returns are less liquid and dependent on borrower credit risk. Tokenized assets integrate smart contracts to automate yield payments, reducing intermediaries and operational costs, thus providing more efficient and secure income streams for investors in the finance sector.

Credit Delegation Protocols

Credit Delegation Protocols in Peer-to-Peer Lending enable borrowers to access funds without direct collateral by assigning credit to trusted third parties, enhancing liquidity and risk distribution. In contrast, Real World Asset Tokenization leverages blockchain to represent tangible assets as digital tokens, providing transparent ownership and fractional investment opportunities while mitigating credit risk through asset-backed security.

Digital Asset Fractionalization

Peer-to-peer lending platforms enable digital asset fractionalization by allowing investors to directly fund loans in smaller increments, increasing liquidity and access to credit markets. Real world asset tokenization further enhances fractional ownership by converting physical assets like real estate or commodities into digital tokens, creating seamless tradability and improved market efficiency.

KYC-less Lending Platforms

Peer-to-peer lending platforms without KYC offer streamlined access to credit by bypassing traditional identity verification, increasing anonymity but raising regulatory and security concerns. In contrast, real world asset tokenization integrates compliance measures, providing secure, transparent ownership of physical assets while promoting liquidity in regulated markets.

Securitized Token Marketplaces

Securitized token marketplaces enable fractional ownership of real-world assets, offering enhanced liquidity and transparency compared to traditional peer-to-peer lending platforms, which primarily rely on direct borrower-lender credit assessments. By leveraging blockchain technology, tokenization facilitates regulatory compliance and real-time trading of asset-backed securities, transforming capital access and risk distribution within decentralized finance ecosystems.

Peer-to-Peer Lending vs Real World Asset Tokenization Infographic

industrydif.com

industrydif.com