Mutual funds pool investor capital managed by professional portfolio managers, offering diversified exposure and regulated oversight to minimize risks. Decentralized Autonomous Organizations (DAOs) operate on blockchain technology, enabling collective decision-making without intermediaries, which introduces transparency but increases volatility and regulatory uncertainty. Investors seeking traditional stability might favor mutual funds, whereas those valuing innovation and decentralized control could explore DAOs despite higher risks.

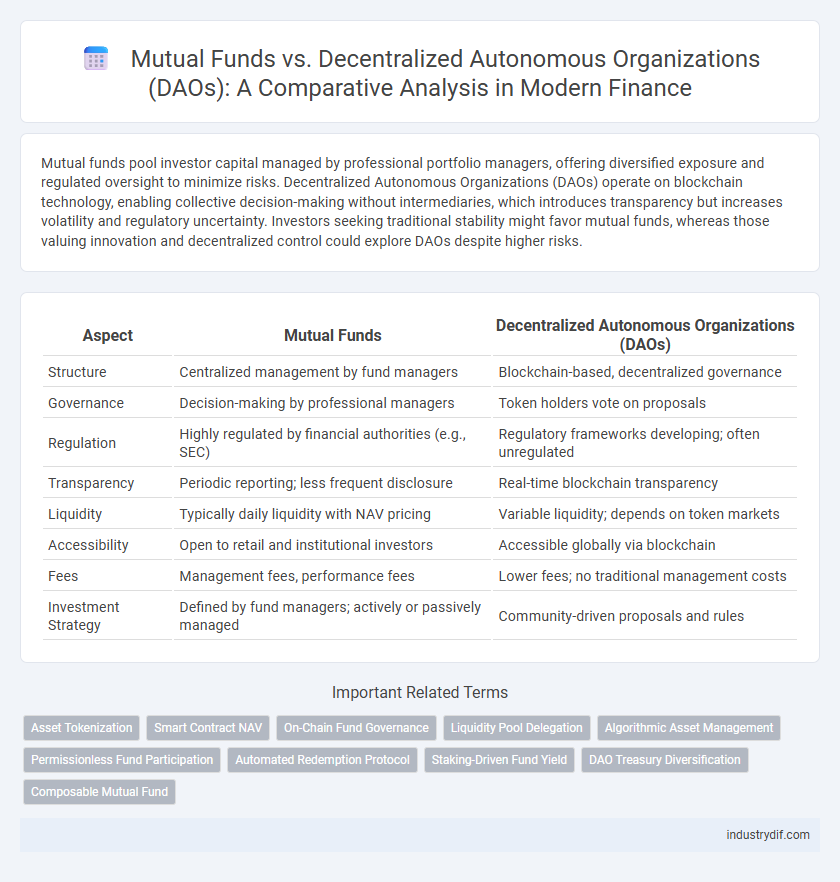

Table of Comparison

| Aspect | Mutual Funds | Decentralized Autonomous Organizations (DAOs) |

|---|---|---|

| Structure | Centralized management by fund managers | Blockchain-based, decentralized governance |

| Governance | Decision-making by professional managers | Token holders vote on proposals |

| Regulation | Highly regulated by financial authorities (e.g., SEC) | Regulatory frameworks developing; often unregulated |

| Transparency | Periodic reporting; less frequent disclosure | Real-time blockchain transparency |

| Liquidity | Typically daily liquidity with NAV pricing | Variable liquidity; depends on token markets |

| Accessibility | Open to retail and institutional investors | Accessible globally via blockchain |

| Fees | Management fees, performance fees | Lower fees; no traditional management costs |

| Investment Strategy | Defined by fund managers; actively or passively managed | Community-driven proposals and rules |

Overview: Mutual Funds vs Decentralized Autonomous Organizations

Mutual funds pool capital from multiple investors to invest in diversified portfolios managed by professional fund managers, offering regulated, centralized control and liquidity. Decentralized Autonomous Organizations (DAOs) leverage blockchain technology to enable community-driven investment decisions through smart contracts, ensuring transparency, autonomy, and reduced intermediary costs. While mutual funds emphasize regulatory compliance and traditional asset management, DAOs prioritize decentralized governance and innovative digital asset participation within the financial ecosystem.

Key Structural Differences

Mutual funds operate under centralized management with fund managers making investment decisions on behalf of investors, offering regulatory oversight and transparent reporting standards. Decentralized Autonomous Organizations (DAOs) function through blockchain technology, enabling token holders to participate directly in governance and investment choices via smart contracts, fostering a decentralized and trustless environment. The key structural difference lies in centralized authority and regulatory compliance in mutual funds versus decentralized governance and automated execution within DAOs.

Governance Models Compared

Mutual funds operate under centralized governance structures managed by professional fund managers and regulatory bodies, ensuring investor protection and compliance with financial regulations. Decentralized Autonomous Organizations (DAOs) utilize blockchain-based governance with decision-making distributed among token holders, promoting transparency and community-driven control. This contrast highlights that mutual funds prioritize regulatory oversight, while DAOs emphasize decentralized participation and automated governance through smart contracts.

Accessibility and Investor Participation

Mutual funds offer broad accessibility through regulated platforms, enabling investors to participate with relatively low initial capital and benefiting from professional fund management. Decentralized Autonomous Organizations (DAOs) provide a more direct and inclusive approach by allowing token holders to engage in governance and decision-making, thus democratizing investment participation. While mutual funds cater to traditional investors with established compliance standards, DAOs attract tech-savvy individuals seeking transparency and autonomous asset management.

Regulatory and Compliance Considerations

Mutual funds operate under stringent regulatory frameworks established by entities like the SEC, requiring comprehensive disclosure, investor protection measures, and adherence to fiduciary duties. Decentralized Autonomous Organizations (DAOs), governed by blockchain protocols and smart contracts, face a complex and evolving regulatory landscape with limited clear guidelines, often raising concerns about legal accountability and compliance with securities laws. Regulatory uncertainty around DAOs complicates investor safeguards, contrasting with the well-defined compliance standards that mutual funds must consistently uphold.

Transparency and Reporting Standards

Mutual funds operate under strict regulatory frameworks requiring detailed transparency and standardized reporting, including audited financial statements and regular disclosures to investors, ensuring accountability and clear insight into fund performance. Decentralized Autonomous Organizations (DAOs) leverage blockchain technology to offer transparent, real-time transaction records accessible to all participants, but they often lack standardized reporting frameworks and formal audits commonly seen in traditional finance. While mutual funds excel in regulatory compliance and investor protection through established reporting standards, DAOs provide enhanced operational transparency but face challenges in uniform disclosure and investor assurance.

Fee Structures and Cost Efficiency

Mutual funds typically charge management fees ranging from 0.5% to 2% annually, along with potential sales loads and administrative expenses, which can reduce overall investor returns. Decentralized Autonomous Organizations (DAOs), operating on blockchain technology, often feature lower operational costs and minimal fees due to automation and the absence of intermediaries. This cost efficiency in DAOs can lead to higher net returns compared to traditional mutual funds, making them an attractive alternative for cost-conscious investors.

Risk Management Approaches

Mutual funds implement risk management through portfolio diversification, professional fund managers, and regulatory oversight that enforces transparency and limits exposure to volatile assets. Decentralized Autonomous Organizations (DAOs) employ algorithmic governance and smart contracts to automate risk controls, relying on community-driven decision-making and decentralized consensus to adapt quickly to market fluctuations. While mutual funds benefit from centralized expertise and regulatory frameworks, DAOs present a novel approach centered on transparency, automation, and collective risk assessment in decentralized finance ecosystems.

Performance and Yield Potential

Mutual funds offer historically stable returns through diversified asset management by professional fund managers, often yielding annual returns averaging between 5% to 10%. Decentralized Autonomous Organizations (DAOs), leveraging blockchain technology and decentralized governance, can potentially achieve higher yield through innovative DeFi protocols but carry increased volatility and risk. Performance comparison depends on investor risk tolerance, as mutual funds provide consistent growth while DAOs offer greater yield potential driven by emerging decentralized finance opportunities.

Future Trends in Investment Vehicles

Mutual funds continue evolving with enhanced AI-driven portfolio management and increased integration of sustainable investing criteria, shifting toward personalized investor experiences. Decentralized Autonomous Organizations (DAOs) are emerging as innovative investment vehicles, leveraging blockchain transparency and smart contracts to democratize asset management and reduce costs. Future trends indicate a convergence where traditional mutual funds might adopt decentralized tech features, blending regulatory compliance with blockchain efficiency to attract tech-savvy investors.

Related Important Terms

Asset Tokenization

Mutual funds pool investor capital to invest in diversified portfolios managed by financial professionals, while Decentralized Autonomous Organizations (DAOs) leverage blockchain technology to enable asset tokenization, allowing fractional ownership and increased liquidity of underlying assets. Asset tokenization in DAOs provides transparent governance, real-time transferability, and reduced intermediaries, enhancing accessibility compared to traditional mutual fund structures.

Smart Contract NAV

Mutual Funds operate with traditional Net Asset Value (NAV) calculations updated once daily, whereas Decentralized Autonomous Organizations (DAOs) leverage smart contract-enabled NAVs that update in real-time, providing greater transparency and efficiency. Smart contract NAVs automate asset valuation on blockchain, reducing operational costs and minimizing human errors compared to conventional mutual fund processes.

On-Chain Fund Governance

Mutual funds operate under centralized regulatory frameworks with fund managers making decisions, whereas Decentralized Autonomous Organizations (DAOs) utilize blockchain-based on-chain governance protocols enabling token holders to vote transparently on fund management and investment strategies. This on-chain governance mechanism enhances decentralization, auditability, and community-driven decision-making, reducing reliance on traditional intermediaries in fund administration.

Liquidity Pool Delegation

Mutual funds pool investor capital managed by professional fund managers, offering liquidity through shares traded on regulated exchanges, whereas Decentralized Autonomous Organizations (DAOs) utilize smart contracts to enable liquidity pool delegation, allowing token holders to contribute assets and earn rewards without centralized control. Liquidity pool delegation in DAOs enhances decentralized finance (DeFi) participation by providing continuous asset liquidity and governance voting power, contrasting with traditional mutual funds' centralized liquidity management and regulatory constraints.

Algorithmic Asset Management

Mutual funds utilize traditional portfolio managers relying on human expertise and regulatory frameworks, whereas Decentralized Autonomous Organizations (DAOs) implement algorithmic asset management through smart contracts on blockchain platforms, providing transparency, automation, and reduced operational costs. Algorithmic strategies in DAOs enable real-time asset rebalancing and decentralized decision-making, offering a novel approach to investment management compared to the centralized control in mutual funds.

Permissionless Fund Participation

Mutual funds require regulatory approval and intermediary oversight, limiting fund participation to accredited investors and imposing strict compliance measures, whereas Decentralized Autonomous Organizations (DAOs) enable permissionless fund participation through blockchain technology, allowing anyone with internet access to join, contribute, and vote transparently without centralized control. This permissionless access in DAOs fosters inclusive investment opportunities and democratizes asset management by automating rules via smart contracts and reducing entry barriers inherent in traditional mutual funds.

Automated Redemption Protocol

Mutual funds utilize traditional automated redemption protocols that process investor withdrawal requests through centralized intermediaries, ensuring regulated liquidity and compliance with financial standards. Decentralized Autonomous Organizations (DAOs) implement smart contract-based automated redemption protocols that enable seamless, transparent, and trustless asset liquidation directly on blockchain platforms, reducing reliance on third parties and lowering transaction costs.

Staking-Driven Fund Yield

Mutual funds generate yield through active portfolio management and dividend distributions, while Decentralized Autonomous Organizations (DAOs) leverage staking-driven mechanisms to earn returns by locking tokens in blockchain protocols, enabling automated, transparent yield generation. Staking in DAOs aligns investor incentives with platform governance, often providing higher yield potentials compared to traditional mutual fund dividends, particularly in DeFi ecosystems.

DAO Treasury Diversification

DAO treasury diversification leverages blockchain transparency and smart contract automation to allocate assets across cryptocurrencies, DeFi protocols, and tokenized securities, reducing systemic risk and enhancing liquidity management. Unlike traditional mutual funds, DAOs offer decentralized governance, enabling token holders to dynamically vote on portfolio adjustments, fostering a more adaptive and inclusive approach to treasury diversification.

Composable Mutual Fund

Composable Mutual Funds leverage blockchain technology to enable customizable, transparent, and automated asset management, offering greater flexibility compared to traditional Mutual Funds by integrating smart contracts within Decentralized Autonomous Organizations (DAOs). These structures allow investors to tailor portfolios dynamically while benefiting from decentralized governance and reduced intermediaries, enhancing efficiency and security in fund management.

Mutual Funds vs Decentralized Autonomous Organizations Infographic

industrydif.com

industrydif.com