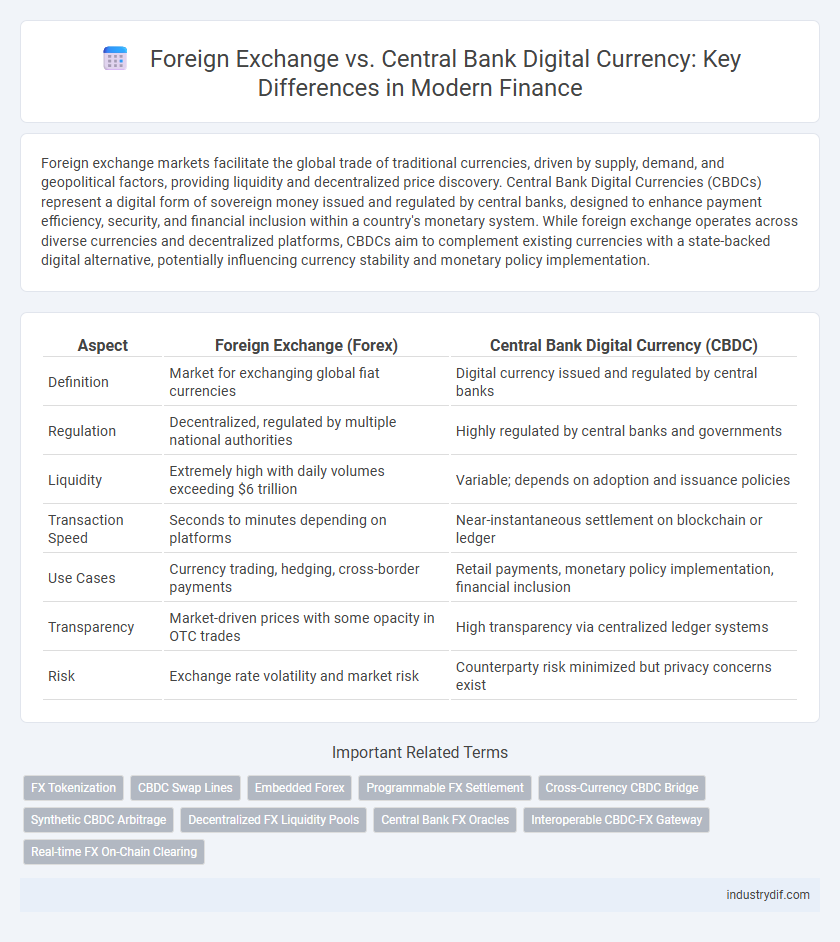

Foreign exchange markets facilitate the global trade of traditional currencies, driven by supply, demand, and geopolitical factors, providing liquidity and decentralized price discovery. Central Bank Digital Currencies (CBDCs) represent a digital form of sovereign money issued and regulated by central banks, designed to enhance payment efficiency, security, and financial inclusion within a country's monetary system. While foreign exchange operates across diverse currencies and decentralized platforms, CBDCs aim to complement existing currencies with a state-backed digital alternative, potentially influencing currency stability and monetary policy implementation.

Table of Comparison

| Aspect | Foreign Exchange (Forex) | Central Bank Digital Currency (CBDC) |

|---|---|---|

| Definition | Market for exchanging global fiat currencies | Digital currency issued and regulated by central banks |

| Regulation | Decentralized, regulated by multiple national authorities | Highly regulated by central banks and governments |

| Liquidity | Extremely high with daily volumes exceeding $6 trillion | Variable; depends on adoption and issuance policies |

| Transaction Speed | Seconds to minutes depending on platforms | Near-instantaneous settlement on blockchain or ledger |

| Use Cases | Currency trading, hedging, cross-border payments | Retail payments, monetary policy implementation, financial inclusion |

| Transparency | Market-driven prices with some opacity in OTC trades | High transparency via centralized ledger systems |

| Risk | Exchange rate volatility and market risk | Counterparty risk minimized but privacy concerns exist |

Understanding Foreign Exchange (Forex): An Overview

Foreign Exchange (Forex) involves the global trading of currencies, enabling businesses and investors to convert one currency into another for international trade, investment, and speculation. Forex markets operate 24/5 with major currency pairs like EUR/USD, USD/JPY, and GBP/USD dominating liquidity and trading volume. Unlike Central Bank Digital Currency (CBDC), which represents a digital form of fiat issued and regulated by a nation's central bank, Forex trading is decentralized and driven by market supply, demand, and geopolitical events.

What Are Central Bank Digital Currencies (CBDCs)?

Central Bank Digital Currencies (CBDCs) are digital forms of a country's fiat currency issued and regulated by the central bank, designed to provide a secure and efficient alternative to physical cash. Unlike traditional foreign exchange, CBDCs operate within the national legal framework and offer direct access to central bank money for the public. These digital currencies enhance transaction speed, reduce costs, and improve transparency in the financial system.

Key Differences Between Forex and CBDCs

Foreign Exchange (Forex) represents the global decentralized market for trading national currencies, driven by supply and demand, geopolitical events, and economic indicators. Central Bank Digital Currency (CBDC) is a digital form of a country's official currency, issued and regulated by the central bank, designed to enhance payment efficiency and financial inclusion. Key differences include Forex's role in market-driven currency valuation versus CBDCs providing a controlled, government-backed digital monetary system with potential impacts on monetary policy and financial stability.

Impact of CBDCs on Global Foreign Exchange Markets

Central Bank Digital Currencies (CBDCs) are reshaping global foreign exchange markets by enhancing transaction speed, reducing costs, and increasing transparency in cross-border payments. The widespread adoption of CBDCs can lead to greater currency stability and more efficient liquidity management while potentially diminishing the dominance of traditional reserve currencies. Market volatility may decline as CBDCs enable real-time settlement and improved regulatory oversight, transforming forex trading dynamics and international capital flows.

Currency Volatility: Forex vs CBDC Stability

Foreign exchange markets experience significant currency volatility driven by factors such as geopolitical events, interest rate changes, and market speculation, impacting international trade and investment decisions. Central Bank Digital Currencies (CBDCs) are designed to offer greater stability by being directly controlled and issued by monetary authorities, reducing speculative risks and stabilizing value. The inherent stability of CBDCs may enhance monetary policy implementation and reduce the exchange rate fluctuations typical in traditional Forex trading.

Regulatory Considerations for Forex and CBDCs

Regulatory frameworks for foreign exchange (Forex) emphasize anti-money laundering (AML) compliance, market transparency, and consumer protection to mitigate risks in decentralized and highly liquid markets. Central Bank Digital Currencies (CBDCs) require tailored regulations addressing data privacy, monetary policy implementation, and systemic stability while ensuring interoperability with existing financial infrastructures. Both Forex and CBDC regulations must adapt to evolving technology standards and cross-border transaction monitoring to prevent illicit activities and maintain financial integrity.

Cross-Border Payments: Efficiency and Challenges

Foreign exchange (FX) markets facilitate cross-border payments by enabling currency conversion but often face challenges such as volatility, high transaction fees, and settlement delays. Central Bank Digital Currencies (CBDCs) offer the potential to enhance efficiency in cross-border settlements through real-time processing, reduced intermediaries, and increased transparency. However, CBDC implementation must address interoperability, regulatory harmonization, and cybersecurity risks to achieve seamless global payment integration.

Security and Risk Management in Forex vs CBDCs

Foreign exchange markets face significant security challenges, including cyberattacks, fraud, and geopolitical risks, necessitating robust risk management frameworks and real-time monitoring systems. Central Bank Digital Currencies (CBDCs) offer enhanced security features such as blockchain encryption, immutable transaction records, and centralized regulatory oversight, reducing fraud and operational risk. However, CBDCs introduce new vulnerabilities related to digital infrastructure resilience and privacy concerns, requiring continuous cybersecurity advancements and regulatory adaptations.

Technological Innovations Driving Forex and CBDC Developments

Technological innovations such as blockchain, artificial intelligence, and distributed ledger technology are revolutionizing both foreign exchange markets and central bank digital currencies (CBDCs). In forex trading, algorithmic trading and real-time data analytics enhance market efficiency and liquidity, while CBDCs leverage secure, programmable digital infrastructures to facilitate seamless cross-border payments and reduce transaction costs. These advancements collectively drive transparency, speed, and security in the global financial ecosystem.

The Future of International Finance: Forex or CBDCs?

Foreign Exchange (Forex) markets continue to dominate global currency trading with daily volumes exceeding $6 trillion, offering liquidity and flexibility unmatched by emerging Central Bank Digital Currencies (CBDCs). CBDCs present a transformative potential for cross-border payments by reducing transaction costs and settlement times through blockchain technology, enhancing transparency and security in international finance. The future of international finance may increasingly integrate CBDCs into traditional Forex systems, combining the benefits of decentralized digital currencies with established global currency exchange infrastructure.

Related Important Terms

FX Tokenization

FX tokenization revolutionizes foreign exchange by converting currencies into secure digital tokens on blockchain networks, enhancing liquidity and reducing transaction costs. Central Bank Digital Currencies (CBDCs) offer state-backed digital assets but lack the decentralized flexibility and interoperability that FX tokenization provides for cross-border payments and trading efficiency.

CBDC Swap Lines

CBDC swap lines enable central banks to exchange digital currencies directly, enhancing cross-border liquidity and reducing reliance on traditional foreign exchange reserves. This mechanism streamlines international settlements by minimizing transaction costs and mitigating currency volatility risks in global finance.

Embedded Forex

Embedded Forex technology integrates foreign exchange capabilities directly into Central Bank Digital Currency (CBDC) platforms, enabling real-time currency conversion and cross-border payments without intermediaries. This seamless integration enhances liquidity management and reduces transaction costs in the digital economy.

Programmable FX Settlement

Programmable FX settlement leverages Central Bank Digital Currency (CBDC) to automate and streamline cross-border currency exchanges, reducing settlement times from days to seconds while enhancing transparency and security. Unlike traditional foreign exchange systems, CBDC-enabled programmable settlements enable conditional payments, smart contract execution, and real-time liquidity management, significantly mitigating counterparty risks and operational inefficiencies in global finance.

Cross-Currency CBDC Bridge

Cross-Currency CBDC Bridges enhance foreign exchange efficiency by enabling seamless, real-time transactions between different central bank digital currencies, reducing reliance on correspondent banks and lowering transaction costs. These bridges utilize blockchain technology to increase transparency, security, and settlement speed in international currency exchange, transforming traditional forex markets.

Synthetic CBDC Arbitrage

Synthetic CBDC arbitrage exploits price discrepancies between Foreign Exchange markets and Central Bank Digital Currency platforms, leveraging synthetic tokens that replicate CBDC values without direct issuance. This strategy enhances liquidity and reduces transaction costs while navigating regulatory frameworks, driving efficiency in cross-border payment settlements.

Decentralized FX Liquidity Pools

Decentralized FX liquidity pools revolutionize foreign exchange by enabling peer-to-peer currency swaps without intermediaries, offering enhanced transparency and reduced transaction costs compared to traditional centralized systems. Unlike Central Bank Digital Currencies (CBDCs), which are issued and regulated by central authorities, decentralized liquidity pools leverage blockchain technology to facilitate direct FX trading with real-time settlement and censorship resistance.

Central Bank FX Oracles

Central Bank FX Oracles provide real-time, verified foreign exchange rate data directly from central banks, enhancing the transparency and accuracy of Central Bank Digital Currency (CBDC) transactions. By integrating these oracles, CBDCs can achieve seamless cross-border settlements and reliable exchange rate feeds critical for monetary policy enforcement and financial stability.

Interoperable CBDC-FX Gateway

Interoperable CBDC-FX gateways enable seamless currency exchange between central bank digital currencies and foreign exchange markets, reducing transaction costs and settlement times. This technology leverages blockchain protocols to enhance liquidity management and cross-border payment efficiency in global finance.

Real-time FX On-Chain Clearing

Real-time FX on-chain clearing leverages blockchain technology to enable instantaneous settlement of foreign exchange transactions, reducing counterparty risk and enhancing transparency compared to traditional systems. Central Bank Digital Currencies (CBDCs) integrate seamlessly with this mechanism, facilitating secure, real-time cross-border payments and improving liquidity management in the FX market.

Foreign Exchange vs Central Bank Digital Currency Infographic

industrydif.com

industrydif.com