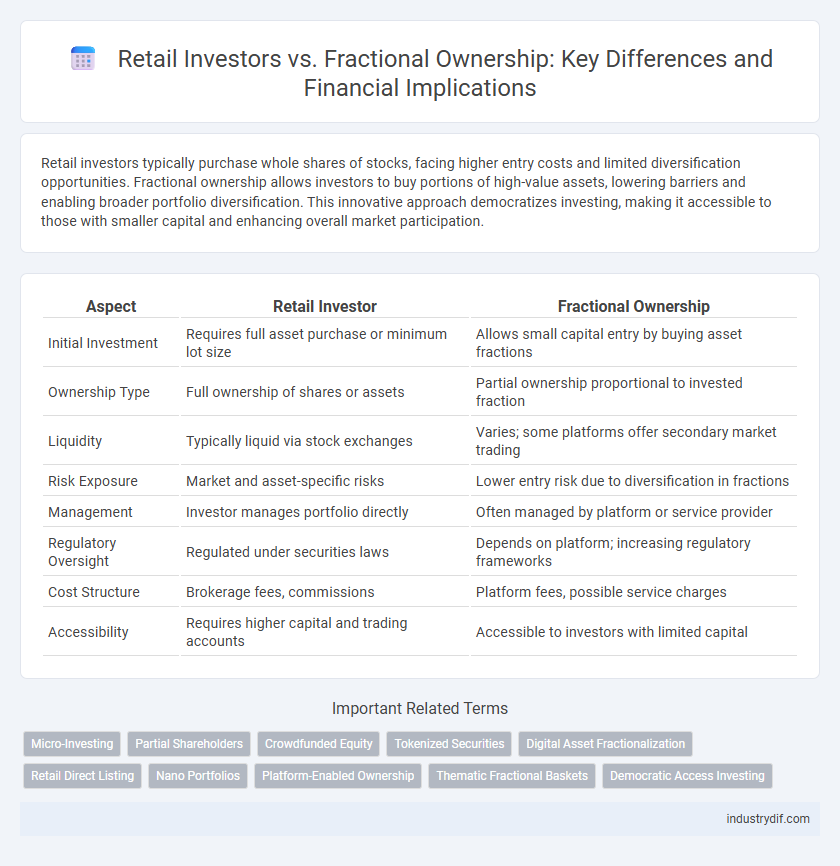

Retail investors typically purchase whole shares of stocks, facing higher entry costs and limited diversification opportunities. Fractional ownership allows investors to buy portions of high-value assets, lowering barriers and enabling broader portfolio diversification. This innovative approach democratizes investing, making it accessible to those with smaller capital and enhancing overall market participation.

Table of Comparison

| Aspect | Retail Investor | Fractional Ownership |

|---|---|---|

| Initial Investment | Requires full asset purchase or minimum lot size | Allows small capital entry by buying asset fractions |

| Ownership Type | Full ownership of shares or assets | Partial ownership proportional to invested fraction |

| Liquidity | Typically liquid via stock exchanges | Varies; some platforms offer secondary market trading |

| Risk Exposure | Market and asset-specific risks | Lower entry risk due to diversification in fractions |

| Management | Investor manages portfolio directly | Often managed by platform or service provider |

| Regulatory Oversight | Regulated under securities laws | Depends on platform; increasing regulatory frameworks |

| Cost Structure | Brokerage fees, commissions | Platform fees, possible service charges |

| Accessibility | Requires higher capital and trading accounts | Accessible to investors with limited capital |

Definition of Retail Investor

A retail investor is an individual who purchases securities, mutual funds, or exchange-traded funds (ETFs) for personal accounts rather than for an organization or institution. These investors typically buy smaller quantities of assets compared to institutional investors and have limited access to sophisticated financial products. Retail investors play a significant role in financial markets by driving demand for stocks and contributing to market liquidity.

Overview of Fractional Ownership

Fractional ownership enables retail investors to purchase partial shares of high-value assets, such as real estate or luxury items, reducing the capital required for entry. This investment model offers greater diversification and liquidity compared to traditional whole-asset purchases, allowing investors to access markets previously out of reach. Platforms facilitating fractional ownership leverage blockchain technology and smart contracts to ensure transparency and efficient management of shared assets.

Key Differences between Retail Investor and Fractional Ownership

Retail investors typically purchase whole shares or traditional financial products, gaining full ownership and control over their investments. Fractional ownership allows investors to buy a portion of an asset or share, lowering the entry barrier and enabling diversification with smaller capital. The key difference lies in the ownership structure: retail investors hold complete units, while fractional ownership involves shared equity and proportional returns.

Accessibility and Minimum Investment Requirements

Retail investors often face high minimum investment thresholds that limit access to diversified portfolios, whereas fractional ownership drastically lowers these barriers by allowing investors to purchase partial shares of high-value assets. This enhanced accessibility enables small-scale investors to participate in markets traditionally dominated by wealthier individuals or institutions. By reducing capital requirements, fractional ownership democratizes investment opportunities and promotes broader financial inclusion.

Risk and Return Profiles

Retail investors typically face higher risk exposure due to limited diversification and larger capital commitments, while fractional ownership allows for reduced risk through asset division and lower investment thresholds. Return profiles for retail investors often fluctuate significantly with market volatility, whereas fractional ownership can provide more stable, steady returns by enabling diversified holdings across various asset classes. Risk mitigation and consistent returns make fractional ownership an attractive option for retail investors seeking balanced portfolio growth.

Liquidity and Exit Options

Retail investors often face limited liquidity due to traditional investment structures requiring full ownership stakes, which can restrict timely exit options. Fractional ownership enhances liquidity by allowing partial asset sales, enabling investors to divest portions of their holdings without selling entire assets. This structure provides more flexible exit strategies, appealing to investors seeking faster access to capital and diversified risk management in financial markets.

Regulatory Environment

Retail investors face distinct regulatory frameworks designed to protect individual participants, including mandatory disclosures and suitability standards enforced by authorities such as the SEC and FINRA. Fractional ownership introduces novel regulatory considerations, bridging traditional securities laws and emerging fintech guidelines, often requiring enhanced transparency and compliance with custody rules. Regulatory clarity continues to evolve, balancing investor protection with innovation in fractional share access and trading platforms.

Asset Classes Available for Investment

Retail investors have access to a broad range of asset classes including stocks, bonds, mutual funds, and ETFs, providing diversification and liquidity. Fractional ownership opens up investment in traditionally high-cost assets such as real estate, fine art, and luxury collectibles by allowing investors to buy portions of these assets. This approach enhances portfolio variety and accessibility, enabling retail investors to participate in markets previously limited to institutional or high-net-worth individuals.

Advantages and Disadvantages

Retail investors benefit from direct control over investment decisions and full ownership of assets, but they face high capital requirements and limited diversification. Fractional ownership lowers entry barriers by allowing investments in high-value assets with smaller capital, enhancing portfolio diversification but potentially exposing investors to management fees and less control over asset decisions. Both approaches offer unique trade-offs between control, cost, and accessibility in personal finance and investment strategies.

Future Trends in Retail Investing and Fractional Ownership

Retail investing is evolving with the rise of fractional ownership, enabling investors to diversify portfolios by purchasing partial shares in high-value assets previously inaccessible to individual investors. Advances in blockchain technology and digital platforms are expected to drive the growth of fractional ownership, reducing barriers related to liquidity and transaction costs. These trends suggest a future where retail investors gain increased market participation, greater asset diversification, and enhanced opportunities for wealth accumulation.

Related Important Terms

Micro-Investing

Retail investors increasingly leverage fractional ownership to maximize portfolio diversification with limited capital by purchasing partial shares in high-value assets. Micro-investing platforms facilitate this trend by enabling small, regular investments that democratize access to traditionally expensive securities.

Partial Shareholders

Partial shareholders gain investment opportunities through fractional ownership, allowing retail investors to buy portions of high-value stocks without committing full capital. This approach increases portfolio diversification and accessibility, enabling retail investors to participate in markets previously limited to larger investors.

Crowdfunded Equity

Crowdfunded equity allows retail investors to acquire fractional ownership in startups and private companies by pooling small investments, enhancing portfolio diversification and access to high-growth opportunities. This model democratizes finance by lowering entry barriers, enabling investors to participate in equity markets traditionally dominated by institutional players.

Tokenized Securities

Tokenized securities enable retail investors to participate in fractional ownership by converting traditional assets into digital tokens, lowering entry barriers and increasing liquidity in financial markets. This blockchain-based innovation democratizes investment opportunities, allowing smaller investors to diversify portfolios and access high-value assets previously restricted to institutional players.

Digital Asset Fractionalization

Digital asset fractionalization enables retail investors to own smaller, more affordable portions of high-value assets such as real estate or fine art, significantly lowering the entry barriers compared to traditional full ownership. This innovative approach enhances liquidity and diversification by allowing fractional shares to be traded on digital platforms, making investment opportunities more accessible and flexible for individual investors.

Retail Direct Listing

Retail investors gain direct access to public offerings through Retail Direct Listings, bypassing traditional intermediaries and enabling fractional ownership opportunities. This democratizes equity investment by allowing smaller, more flexible stakes in companies, enhancing liquidity and market participation.

Nano Portfolios

Nano portfolios enable retail investors to access fractional ownership by allowing them to invest small amounts across diversified assets, reducing entry barriers and enhancing portfolio diversification. This approach leverages fractional shares to democratize wealth building, providing retail investors with greater flexibility and targeted exposure to high-value securities.

Platform-Enabled Ownership

Platform-enabled ownership revolutionizes retail investing by allowing individuals to acquire fractional shares of high-value assets, lowering entry barriers and enhancing portfolio diversification. Retail investors benefit from increased liquidity and accessibility through digital platforms that aggregate fractional ownership opportunities across real estate, stocks, and alternative investments.

Thematic Fractional Baskets

Thematic fractional baskets enable retail investors to diversify their portfolios by purchasing small shares of curated asset groups aligned with specific market trends or sectors, increasing accessibility to high-value investments previously limited to institutional investors. This approach enhances risk management and capital allocation efficiency by allowing investors to tailor exposure across multiple themes such as technology, sustainability, or healthcare without the need for significant upfront capital.

Democratic Access Investing

Retail investors gain greater market entry through fractional ownership, enabling portfolio diversification with lower capital requirements. This approach democratizes investing by allowing individuals to acquire partial shares of high-value assets, previously accessible only to institutional investors.

Retail Investor vs Fractional Ownership Infographic

industrydif.com

industrydif.com