Stock market investments involve buying shares of publicly traded companies, offering established liquidity and regulatory protections. Tokenized assets represent fractional ownership of real-world assets on a blockchain, providing increased accessibility and 24/7 trading capabilities. While traditional stocks benefit from decades of market infrastructure and investor confidence, tokenized assets introduce innovative opportunities with enhanced transparency and faster settlement times.

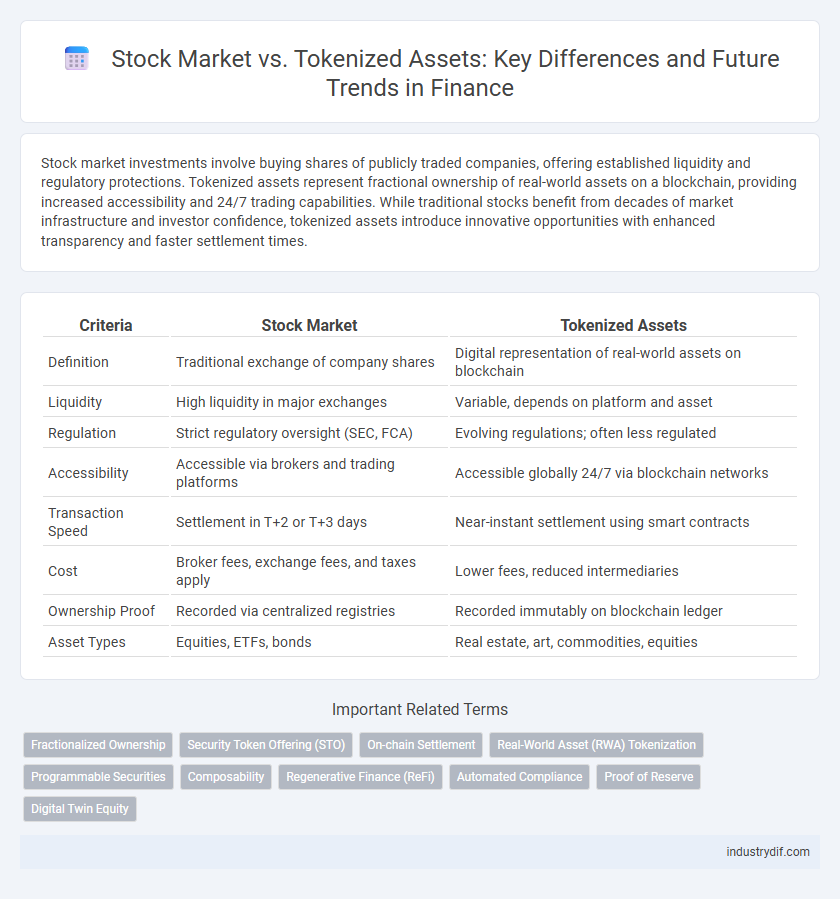

Table of Comparison

| Criteria | Stock Market | Tokenized Assets |

|---|---|---|

| Definition | Traditional exchange of company shares | Digital representation of real-world assets on blockchain |

| Liquidity | High liquidity in major exchanges | Variable, depends on platform and asset |

| Regulation | Strict regulatory oversight (SEC, FCA) | Evolving regulations; often less regulated |

| Accessibility | Accessible via brokers and trading platforms | Accessible globally 24/7 via blockchain networks |

| Transaction Speed | Settlement in T+2 or T+3 days | Near-instant settlement using smart contracts |

| Cost | Broker fees, exchange fees, and taxes apply | Lower fees, reduced intermediaries |

| Ownership Proof | Recorded via centralized registries | Recorded immutably on blockchain ledger |

| Asset Types | Equities, ETFs, bonds | Real estate, art, commodities, equities |

Introduction to Stock Markets and Tokenized Assets

Stock markets are centralized platforms where investors buy and sell shares of publicly listed companies, facilitating capital raising and liquidity. Tokenized assets represent ownership in real-world assets through blockchain-based digital tokens, enabling fractional ownership and increased accessibility. Both systems enhance investment opportunities but differ in regulatory frameworks, liquidity mechanisms, and market transparency.

Core Concepts: Traditional Stocks vs Tokenized Securities

Traditional stocks represent ownership shares in a company, regulated by centralized authorities and traded on established stock exchanges, providing shareholders with voting rights and dividend entitlements. Tokenized securities, leveraging blockchain technology, digitize these assets into tokens that can be traded on decentralized platforms, offering increased liquidity, transparency, and fractional ownership. The core distinction lies in the underlying infrastructure: traditional stocks rely on legacy financial systems, whereas tokenized assets utilize smart contracts to automate compliance and settlement processes.

Regulatory Landscape: Compliance and Legal Frameworks

Stock market investments are governed by established regulatory bodies such as the SEC in the United States, ensuring strict compliance with securities laws and investor protections. Tokenized assets operate within a rapidly evolving legal framework that varies significantly across jurisdictions, often facing challenges related to classification, anti-money laundering (AML) regulations, and investor rights. Navigating these compliance complexities requires understanding both traditional securities regulations and emerging blockchain-specific guidelines to mitigate legal risks in tokenized asset markets.

Accessibility and Market Participation

Stock market investment traditionally requires intermediaries, regulatory compliance, and significant capital, limiting accessibility for many retail investors. Tokenized assets leverage blockchain technology to fractionalize ownership, enabling broader market participation with lower entry barriers and 24/7 trading capabilities. This democratization fosters increased liquidity and inclusivity, attracting diverse investors and expanding global access to financial markets.

Liquidity and Trading Dynamics

Stock markets offer high liquidity with established trading volumes and institutional participation, enabling rapid buying and selling of shares. Tokenized assets leverage blockchain technology to provide fractional ownership and 24/7 trading, enhancing access but often facing lower liquidity due to market fragmentation. Trading dynamics in tokenized assets involve smart contracts and decentralized platforms, contrasting with centralized stock exchanges' regulated order books and settlement systems.

Settlement Times: Instant vs Traditional

Tokenized assets utilize blockchain technology to enable instant settlement, reducing counterparty risk and enhancing liquidity compared to traditional stock market transactions. Traditional stock market settlements typically require two to three business days due to intermediary processing and regulatory compliance. The shift towards tokenized assets promises greater efficiency and transparency in financial markets by significantly accelerating transaction finality.

Transparency and Security Features

Stock markets operate with regulated exchanges ensuring transparency through mandatory disclosures, real-time price updates, and centralized record-keeping, which enhances investor confidence and security. Tokenized assets utilize blockchain technology to provide immutable transaction records, decentralized verification, and smart contracts that automate compliance, offering increased transparency and security compared to traditional systems. The integration of cryptographic security measures in tokenized assets mitigates fraud risks and enables seamless auditability, setting a new standard for asset management and investor protection.

Ownership Models and Fractionalization

Stock market ownership models traditionally involve purchasing shares that represent equity in a company, granting shareholders voting rights and dividends based on company performance. Tokenized assets utilize blockchain technology to represent ownership through digital tokens, enabling more efficient fractionalization and transferability without intermediaries. This fractional ownership model allows investors to hold smaller, divisible portions of assets like real estate or art, enhancing liquidity and accessibility compared to conventional stock shares.

Risks and Challenges: Volatility, Custody, and Fraud

Stock market investments face volatility influenced by economic indicators and geopolitical events, while tokenized assets often experience higher price fluctuations due to lower liquidity and market maturity. Custody risks differ as traditional stocks are held by regulated brokers, whereas tokenized assets rely on digital wallets vulnerable to hacking and loss of private keys. Fraud concerns persist across both, with stock markets regulated by entities like the SEC, while tokenized assets operate in less regulated environments, increasing the potential for scams and market manipulation.

Future Outlook: Integration and Market Evolution

The future outlook of stock markets and tokenized assets highlights increasing integration driven by blockchain technology enhancing transparency, liquidity, and accessibility in traditional financial markets. Tokenized assets enable fractional ownership and 24/7 trading, which are poised to reshape market dynamics by attracting a broader investor base and reducing transaction costs. This evolution supports a hybrid market ecosystem where conventional stocks and digital tokens coexist, promoting innovation and regulatory advancements in finance.

Related Important Terms

Fractionalized Ownership

Fractionalized ownership in tokenized assets offers investors the ability to buy and trade smaller shares of high-value assets, enhancing liquidity and accessibility compared to traditional stock market investments. This digital innovation leverages blockchain technology to provide transparent, secure, and efficient fractional ownership, disrupting conventional equity models and expanding participation in diverse asset classes.

Security Token Offering (STO)

Security Token Offerings (STOs) provide blockchain-based digital tokens representing ownership in real-world assets, offering enhanced transparency, regulatory compliance, and fractional ownership compared to traditional stock market shares. Unlike conventional stocks, STOs leverage smart contracts to automate dividend distribution and voting rights, reducing intermediaries and increasing liquidity in secondary markets.

On-chain Settlement

On-chain settlement in tokenized assets enables instant, transparent, and immutable transaction finality directly on blockchain networks, contrasting sharply with traditional stock market settlements that typically require two to three business days through centralized clearinghouses. This technological advancement reduces counterparty risk, lowers settlement costs, and enhances liquidity by enabling 24/7 trading and real-time asset transfer verification.

Real-World Asset (RWA) Tokenization

Tokenized real-world assets (RWAs) bridge traditional finance and blockchain technology by converting physical assets like real estate, commodities, and fine art into digital tokens, enabling fractional ownership and enhanced liquidity in the stock market. This innovation reduces barriers to entry, improves market transparency, and offers global access to previously illiquid or inaccessible investment opportunities.

Programmable Securities

Programmable securities in tokenized assets offer dynamic automation through smart contracts, enabling conditional dividend payments and automated compliance, unlike traditional stock market equities that depend on centralized intermediaries. This innovation enhances liquidity, transparency, and reduces settlement times by leveraging blockchain technology for real-time asset management and regulatory adherence.

Composability

Tokenized assets demonstrate superior composability compared to traditional stock markets by enabling seamless integration and interoperability across decentralized finance (DeFi) protocols, allowing complex financial constructs like derivatives and pooled investment strategies to be built with greater flexibility. This composability accelerates innovation, reduces transaction costs, and enhances liquidity by enabling tokenized assets to function as modular components within diverse blockchain-based ecosystems.

Regenerative Finance (ReFi)

Tokenized assets in Regenerative Finance (ReFi) leverage blockchain technology to enhance transparency, liquidity, and inclusivity compared to traditional stock markets, enabling direct investment in sustainable projects and environmental initiatives. This shift fosters a decentralized approach to financing regenerative efforts, aligning financial incentives with ecological impact and stakeholder engagement.

Automated Compliance

Automated compliance in the stock market leverages advanced algorithms and regulatory technology to ensure real-time adherence to securities laws, reducing human error and enhancing transparency. Tokenized assets utilize blockchain-based smart contracts to enforce compliance rules automatically, streamlining regulatory reporting and enabling secure, instantaneous audit trails.

Proof of Reserve

Proof of Reserve in tokenized assets ensures transparent verification of backed digital tokens through cryptographic audits and blockchain-based attestations, enhancing investor confidence by demonstrating asset ownership and solvency. Traditional stock markets rely on regulatory oversight and centralized audits to validate asset backing, which may lack the real-time and tamper-evident verification provided by decentralized Proof of Reserve mechanisms in tokenized financial instruments.

Digital Twin Equity

Digital twin equity merges traditional stock market principles with blockchain technology, creating tokenized assets that represent real-world shares. This innovation enhances liquidity, transparency, and fractional ownership, enabling investors to trade digital representations of equities on decentralized platforms efficiently.

Stock Market vs Tokenized Assets Infographic

industrydif.com

industrydif.com