Personal loans offer fixed interest rates and repayment schedules, providing borrowers with clear financial commitments and potential credit score improvements. Buy Now Pay Later services enable immediate purchases with deferred payments, often interest-free for short terms but may incur high fees or interest if payments are missed. Choosing between the two depends on the borrower's credit profile, repayment capacity, and the purchase amount.

Table of Comparison

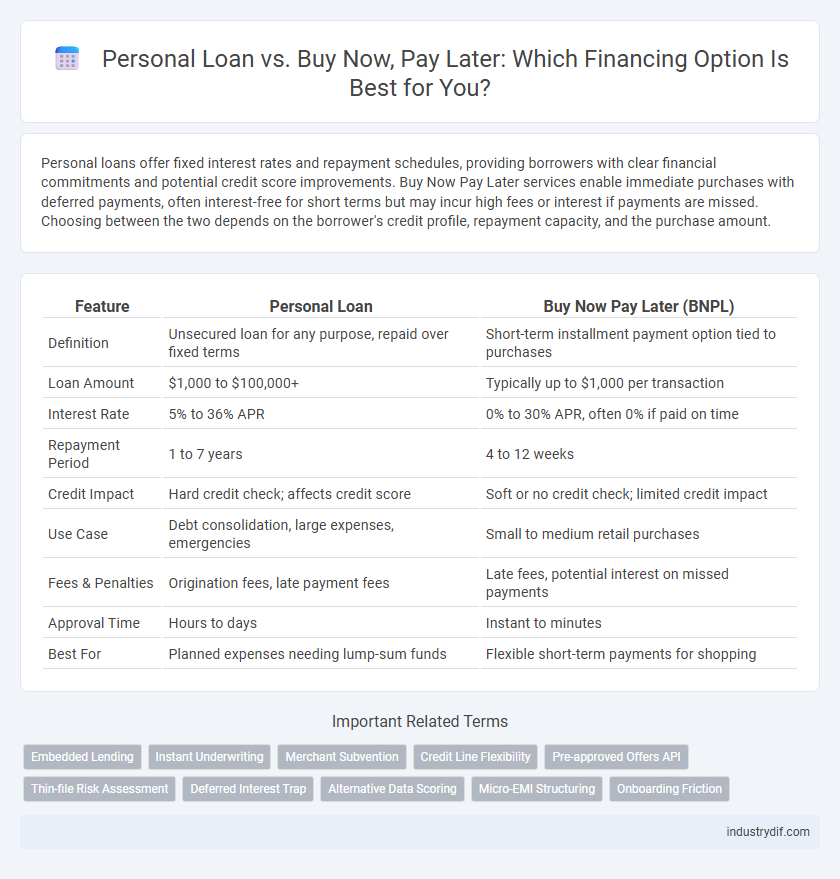

| Feature | Personal Loan | Buy Now Pay Later (BNPL) |

|---|---|---|

| Definition | Unsecured loan for any purpose, repaid over fixed terms | Short-term installment payment option tied to purchases |

| Loan Amount | $1,000 to $100,000+ | Typically up to $1,000 per transaction |

| Interest Rate | 5% to 36% APR | 0% to 30% APR, often 0% if paid on time |

| Repayment Period | 1 to 7 years | 4 to 12 weeks |

| Credit Impact | Hard credit check; affects credit score | Soft or no credit check; limited credit impact |

| Use Case | Debt consolidation, large expenses, emergencies | Small to medium retail purchases |

| Fees & Penalties | Origination fees, late payment fees | Late fees, potential interest on missed payments |

| Approval Time | Hours to days | Instant to minutes |

| Best For | Planned expenses needing lump-sum funds | Flexible short-term payments for shopping |

Introduction to Personal Loans and Buy Now Pay Later

Personal loans are unsecured loans provided by banks or financial institutions, allowing borrowers to access a fixed amount of money with fixed interest rates and repayment schedules. Buy Now Pay Later (BNPL) services offer a short-term financing option that enables consumers to purchase products immediately and pay in installments, often interest-free for a limited period. Both options impact credit scores differently and suit varied financial needs depending on repayment capacity and purchase intent.

Key Differences Between Personal Loans and BNPL

Personal loans offer fixed amounts with structured repayment terms and typically involve interest rates based on creditworthiness, making them suitable for larger, planned expenses. Buy Now Pay Later (BNPL) services provide short-term, interest-free or low-interest installment options at the point of sale, ideal for smaller purchases and immediate financing needs. Key differences include credit requirements, repayment flexibility, and potential impact on credit scores, with personal loans often requiring credit checks and longer commitment periods compared to BNPL's quick approval process and shorter repayment cycles.

Eligibility and Approval Criteria

Personal loan eligibility typically requires a strong credit score, steady income, and a low debt-to-income ratio, while Buy Now Pay Later (BNPL) services often approve users based on basic credit checks or alternative data like purchase history. Approval for personal loans involves thorough credit evaluation and income verification by banks or financial institutions, whereas BNPL providers favor quick, digital approvals with minimal credit impact. Borrowers with limited credit history may find BNPL more accessible, but personal loans offer larger amounts and longer repayment terms.

Interest Rates and Fee Structures

Personal loans typically offer fixed interest rates ranging from 6% to 36%, with transparent fee structures including origination fees of 1% to 8%. Buy Now Pay Later (BNPL) services usually provide interest-free periods but may impose late fees or deferred interest if payments are missed. Comparing these, personal loans often have higher credit requirements but predictable costs, while BNPL options offer short-term flexibility with potential for unexpected fees.

Impact on Credit Score

Personal loans typically have a more substantial impact on credit scores due to hard credit inquiries and installment payment history, which can improve credit if managed responsibly. Buy Now Pay Later (BNPL) services often perform soft credit checks, minimizing immediate credit score effects, but missed payments can lead to negative reporting and score reduction. Understanding the repayment terms and timely payments for both options is crucial to maintaining or enhancing credit health.

Flexibility and Repayment Terms

Personal loans offer fixed repayment schedules and consistent interest rates, providing borrowers with predictable monthly payments over a set term, typically ranging from 12 to 60 months. Buy Now Pay Later (BNPL) services allow for more flexible, short-term repayment options, often interest-free if paid within the promotional period, but may incur high fees or interest if payments are delayed. The choice between the two depends on the borrower's need for structured repayment commitment versus the convenience of splitting purchases without immediate interest.

Suitable Use Cases for Each Option

Personal loans are ideal for financing larger expenses like home improvements, debt consolidation, or medical bills due to their fixed terms and lower interest rates. Buy Now Pay Later (BNPL) services suit smaller, short-term purchases such as electronics or clothing, offering interest-free periods and flexible repayment schedules. Choosing the right option depends on the purchase amount, repayment capacity, and urgency of the expense.

Risks and Consumer Protections

Personal loans typically involve fixed interest rates and structured repayment schedules regulated by financial authorities, offering consumers clearer protections and recourse in case of default. Buy Now Pay Later (BNPL) services often have variable terms, limited regulatory oversight, and can lead to impulse spending, increasing the risk of debt accumulation without comprehensive consumer safeguards. Understanding the differences in credit reporting, interest charges, and dispute resolution mechanisms is crucial to managing financial exposure effectively.

Market Trends and Industry Adoption

The personal loan market continues to grow steadily, driven by increasing consumer demand for flexible borrowing options and favorable interest rates, with market size projected to reach $175 billion by 2025. Buy Now Pay Later (BNPL) services are rapidly gaining traction, capturing a significant share of the retail financing sector by offering interest-free installment plans, with adoption rates soaring by over 40% annually in developed markets. Financial institutions and retailers are increasingly integrating BNPL solutions to enhance customer experience and drive sales, signaling a shift in industry adoption towards more flexible, technology-driven credit products.

Choosing the Right Option for Your Financial Needs

Personal loans offer fixed interest rates and structured repayment terms, making them suitable for financing larger expenses or consolidating debt with predictable monthly payments. Buy Now Pay Later (BNPL) services provide short-term, interest-free installment plans ideal for smaller purchases but often come with high late fees if payments are missed. Assess your spending amount, repayment capacity, and credit impact to choose between personal loans' stability and BNPL's convenience depending on your specific financial goals.

Related Important Terms

Embedded Lending

Embedded lending integrates personal loans directly into the checkout process, providing seamless access to financing options without separate application steps, contrasting with Buy Now Pay Later (BNPL) typically offering short-term, interest-free installments. This embedded approach enhances customer experience and approval rates by leveraging real-time data analytics and credit scoring within ecosystem platforms, driving higher conversion and responsible lending.

Instant Underwriting

Personal loans typically involve a thorough underwriting process that can take hours or days, whereas Buy Now Pay Later (BNPL) services often use instant underwriting powered by automated algorithms and alternative data sources to approve transactions within seconds. Instant underwriting in BNPL reduces friction at checkout, enabling consumers to access credit quickly without traditional credit checks, though it may come with higher interest rates or fees compared to personal loans.

Merchant Subvention

Merchant subvention in Buy Now Pay Later (BNPL) programs often subsidizes the cost of financing, enabling consumers to access interest-free or low-interest deferrals, unlike traditional personal loans that rely on borrower creditworthiness and typically carry higher interest rates. This merchant-funded model enhances purchase conversion rates for retailers while shifting financing costs away from consumers, creating a competitive advantage over conventional personal loans in the retail financing landscape.

Credit Line Flexibility

Personal loans offer fixed loan amounts with set repayment schedules, limiting credit line flexibility compared to Buy Now Pay Later (BNPL) options that provide revolving credit allowing consumers to make multiple purchases within a predefined limit. BNPL services enhance credit line flexibility by enabling users to spread payments over time on various transactions without reapplying for new credit, unlike personal loans which require full disbursement upfront.

Pre-approved Offers API

Pre-approved offers API enables lenders to quickly assess borrower eligibility and deliver personalized personal loan and Buy Now Pay Later (BNPL) options, streamlining the credit decision process. Integrating this API enhances user experience by providing instant financing solutions with transparent terms, driving higher conversion rates in digital lending platforms.

Thin-file Risk Assessment

Personal loans typically undergo a comprehensive thin-file risk assessment leveraging alternative data like utility payments and rental history to evaluate creditworthiness, whereas Buy Now Pay Later (BNPL) platforms often use limited credit checks and real-time behavioral analytics, resulting in varying risk profiles. This divergence in data sources and evaluation methods significantly impacts approval rates and default predictions for individuals with thin credit files.

Deferred Interest Trap

Personal loans offer fixed interest rates and clear repayment terms, minimizing the risk of falling into a deferred interest trap commonly associated with Buy Now Pay Later (BNPL) plans that often accrue high interest if balances are not paid in full within promotional periods. BNPL programs may seem attractive for short-term financing, but hidden deferred interest charges can significantly increase the total cost of purchases if consumers miss payments or fail to pay off balances promptly.

Alternative Data Scoring

Alternative data scoring in personal loans leverages non-traditional financial indicators such as utility payments, rental history, and social behavior to assess creditworthiness, offering a more inclusive evaluation than traditional credit scores. Buy Now Pay Later (BNPL) services typically use alternative data to provide quick, short-term credit approvals, but often lack the depth of assessment found in personal loan underwriting, impacting risk management and borrower terms.

Micro-EMI Structuring

Micro-EMI structuring in personal loans offers customized repayment plans with smaller, fixed installments over an extended period, providing borrowers with predictable cash flow management. Buy Now Pay Later (BNPL) schemes typically feature shorter-term micro-EMIs but may incur higher interest rates and limited credit flexibility compared to traditional personal loan products.

Onboarding Friction

Personal loans typically involve rigorous onboarding processes including credit checks, income verification, and lengthy approval times, creating significant onboarding friction for borrowers. Buy Now Pay Later (BNPL) services offer streamlined onboarding with minimal approval barriers and instant access, reducing friction and accelerating consumer adoption in the finance sector.

Personal Loan vs Buy Now Pay Later Infographic

industrydif.com

industrydif.com