Stock markets provide transparent venues where investors buy and sell shares openly, ensuring price discovery and market efficiency. Dark pools, on the other hand, are private exchanges that allow large trades to be executed anonymously, minimizing market impact and reducing information leakage. While stock markets offer liquidity and regulation, dark pools cater to institutional investors seeking discretion and reduced transaction costs.

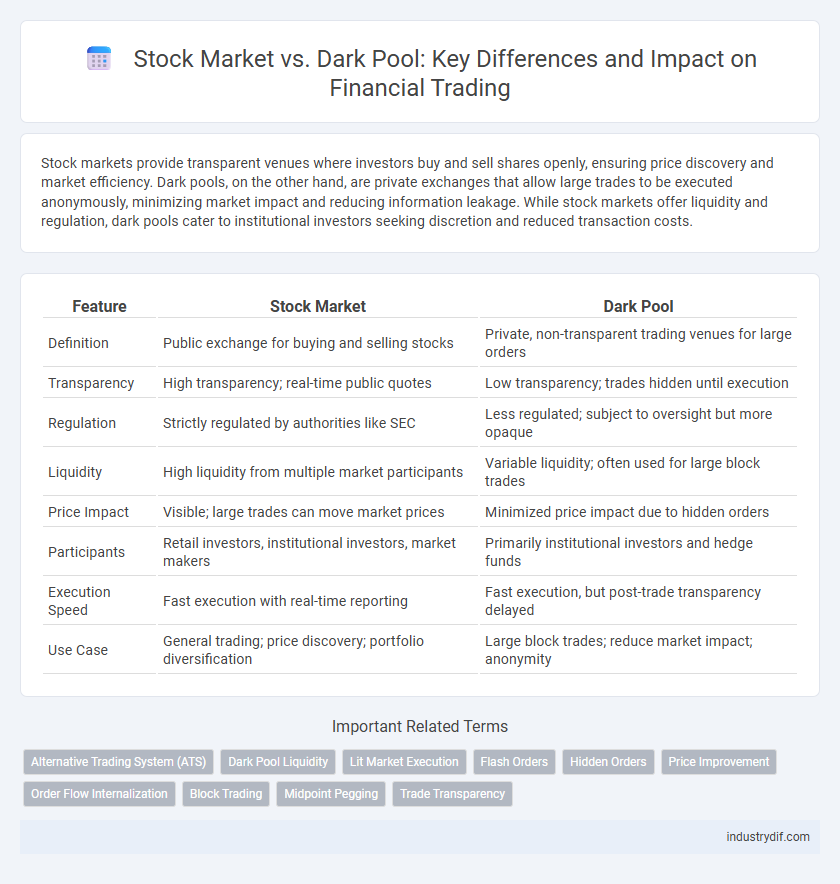

Table of Comparison

| Feature | Stock Market | Dark Pool |

|---|---|---|

| Definition | Public exchange for buying and selling stocks | Private, non-transparent trading venues for large orders |

| Transparency | High transparency; real-time public quotes | Low transparency; trades hidden until execution |

| Regulation | Strictly regulated by authorities like SEC | Less regulated; subject to oversight but more opaque |

| Liquidity | High liquidity from multiple market participants | Variable liquidity; often used for large block trades |

| Price Impact | Visible; large trades can move market prices | Minimized price impact due to hidden orders |

| Participants | Retail investors, institutional investors, market makers | Primarily institutional investors and hedge funds |

| Execution Speed | Fast execution with real-time reporting | Fast execution, but post-trade transparency delayed |

| Use Case | General trading; price discovery; portfolio diversification | Large block trades; reduce market impact; anonymity |

Introduction to Stock Markets and Dark Pools

Stock markets are regulated public exchanges where investors buy and sell shares of publicly traded companies, ensuring transparency and price discovery. Dark pools are private trading venues that allow large institutional investors to execute sizable orders anonymously, minimizing market impact and price fluctuations. The coexistence of stock markets and dark pools offers a balance between transparency and discretion in equity trading.

Key Differences Between Stock Markets and Dark Pools

Stock markets offer transparent trading platforms regulated by government bodies where prices are visible to all market participants, ensuring liquidity and fair price discovery. Dark pools are private trading venues with limited transparency, designed to facilitate large block trades without impacting the public market price. The key differences include visibility of orders, regulatory oversight, and the impact on market price formation.

How Stock Markets Operate

Stock markets operate as regulated exchanges where securities are bought and sold transparently, with prices determined by supply and demand through continuous auction processes. Participants trade publicly listed stocks via centralized order books, ensuring price discovery, liquidity, and real-time reporting to all market participants. This openness contrasts with dark pools, which execute large orders privately, reducing market impact but limiting transparency.

Understanding the Function of Dark Pools

Dark pools are private financial forums for trading securities away from public stock exchanges, allowing institutional investors to execute large trades without impacting market prices. These opaque venues provide anonymity and reduce market impact risk by hiding order sizes and intentions, contrasting with the transparency of public stock markets. Understanding dark pools' functions is crucial for grasping how liquidity and price discovery operate beyond conventional exchanges.

Transparency in Stock Markets vs Dark Pools

Stock markets offer high transparency with real-time price quotations, public order books, and strict regulatory oversight, enabling investors to make informed decisions based on accessible data. In contrast, dark pools operate with limited transparency, executing large trades anonymously to minimize market impact but reducing visibility and price discovery for the broader market. This opacity in dark pools raises concerns over fairness and potential information asymmetry between institutional and retail investors.

Liquidity and Trade Execution

Stock markets offer high liquidity and transparent trade execution through public order books, enabling price discovery and instant order matching. Dark pools provide alternative venues with limited pre-trade transparency, allowing large block trades to execute with minimal market impact and reduced price slippage. Differences in liquidity dynamics and trade execution speed between stock markets and dark pools influence institutional trading strategies and market efficiency.

Regulatory Framework and Compliance

Stock markets operate under stringent regulatory frameworks established by entities such as the SEC, ensuring transparency, fair trading, and investor protection through mandatory public disclosures and real-time reporting. Dark pools, by contrast, are private trading venues that offer anonymity for large block trades but face increasing regulatory scrutiny to prevent market manipulation and ensure compliance with rules like Reg ATS and the Dodd-Frank Act. Compliance challenges in dark pools revolve around balancing confidentiality with the need for oversight, as regulators demand greater transparency to mitigate risks of unfair trading practices.

Impact on Market Efficiency

Dark pools reduce market transparency by allowing large trades to occur off public exchanges, which can obscure true price signals and decrease overall market efficiency. Stock markets offer centralized price discovery and liquidity, providing more accurate reflection of supply and demand dynamics. The coexistence of dark pools and public exchanges creates a complex environment where concealed trading can both mitigate market impact for large investors and potentially distort price formation.

Institutional Investors: Stock Markets vs Dark Pools

Institutional investors increasingly leverage dark pools to execute large block trades without impacting market prices or revealing strategies, contrasting with traditional stock markets where transparency can trigger price volatility. Dark pools offer anonymity and reduced market impact, enabling institutions to optimize trade execution and minimize signaling risk. Despite regulatory scrutiny, dark pools remain a vital alternative for institutional investors seeking discretion and efficiency beyond public exchanges.

Future Trends in Stock Market and Dark Pool Trading

Future trends in stock market trading indicate increased integration of artificial intelligence and algorithmic strategies to enhance market efficiency and liquidity. Dark pool trading is expected to grow, leveraging blockchain technology for greater transparency and reduced transaction costs while maintaining anonymity. Regulatory developments will play a crucial role in shaping the balance between traditional stock exchanges and dark pools, influencing market dynamics and investor behavior.

Related Important Terms

Alternative Trading System (ATS)

Alternative Trading Systems (ATS) operate as private venues for trading securities, providing an alternative to traditional stock exchanges by facilitating large block trades with increased anonymity and reduced market impact. These systems, including dark pools, enhance liquidity and price discovery while bypassing the transparency and regulatory constraints typically associated with public stock markets.

Dark Pool Liquidity

Dark pool liquidity offers institutional investors the advantage of executing large trades anonymously without significantly impacting public market prices, thus preserving secrecy and minimizing market volatility. Unlike traditional stock exchanges where orders are visible and can influence price fluctuations, dark pools facilitate discreet block trading, enhancing liquidity for sizable positions while reducing information leakage.

Lit Market Execution

Lit market execution provides transparent order books and real-time price discovery, enabling investors to trade stocks with visible liquidity and pre-trade information. Unlike dark pools, lit markets reduce information asymmetry and enhance market efficiency by displaying bid and ask prices on public exchanges.

Flash Orders

Flash orders in the stock market enable high-frequency traders to see and act on orders milliseconds before they reach public exchanges, creating a race for speed and information advantage. Dark pools, by contrast, execute large block trades anonymously without pre-trade transparency, reducing market impact but limiting opportunities for flash order exploitation.

Hidden Orders

Hidden orders in the stock market allow investors to execute large trades without revealing their intentions, reducing market impact and price slippage. Dark pools facilitate these hidden orders by providing private trading venues where transactions occur away from public exchanges, enhancing anonymity and liquidity for institutional investors.

Price Improvement

Stock markets provide transparent price discovery through public order books, while dark pools enable institutional investors to achieve price improvement by executing large trades anonymously away from market impact. Price improvement in dark pools often results from matching buy and sell orders at better prices than the national best bid and offer (NBBO), reducing transaction costs and market slippage.

Order Flow Internalization

Order flow internalization occurs when brokers execute client orders within their own systems rather than sending them to public stock markets, impacting price transparency and liquidity dynamics. Dark pools, as private trading venues, facilitate this internalization by matching large orders off-exchange, minimizing market impact and signaling risk for institutional investors.

Block Trading

Block trading in the stock market involves the buying or selling of large quantities of securities, typically exceeding 10,000 shares or $200,000 in value, executed either on public exchanges or through dark pools to minimize market impact and maintain anonymity. Dark pools facilitate block trades by providing a private, non-transparent venue where institutional investors can transact large orders discreetly, reducing the risk of price slippage and information leakage compared to traditional stock market trading.

Midpoint Pegging

Midpoint pegging in stock markets involves setting trade prices at the midpoint between the bid and ask, providing fairer pricing and reduced transaction costs compared to dark pools, where trades occur privately and often lack price transparency. Dark pools may offer large institutional investors anonymity but can result in less price signaling and potential information asymmetry relative to the transparency benefits of midpoint pegging in lit exchanges.

Trade Transparency

Stock market trades are publicly reported in real-time, ensuring high trade transparency and market integrity, while dark pool transactions occur privately, limiting visibility and potentially reducing price discovery efficiency. The lack of transparency in dark pools can lead to information asymmetry, impacting fair market valuation and investor confidence.

Stock Market vs Dark Pool Infographic

industrydif.com

industrydif.com