Payment processing involves traditional transactions where customers actively complete payments using cards, cash, or digital wallets, requiring manual input and confirmation. Invisible payments streamline the experience by automatically charging customers through sensors or pre-authorized accounts, eliminating the need for direct interaction at the point of sale. This evolution enhances convenience, reduces friction, and accelerates transaction speed, driving higher customer satisfaction and operational efficiency.

Table of Comparison

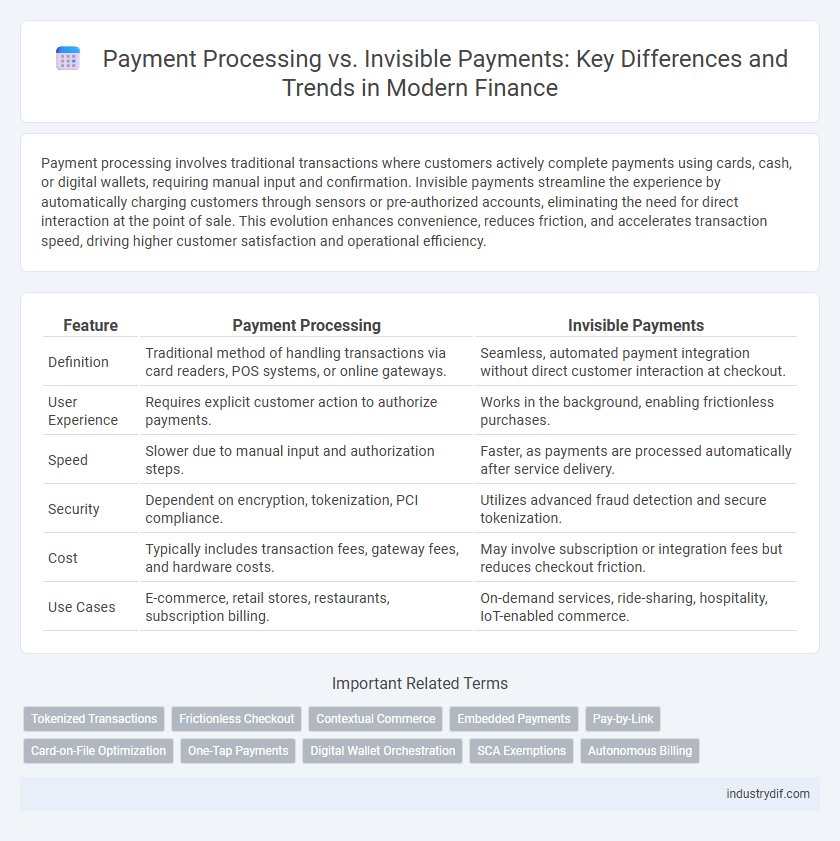

| Feature | Payment Processing | Invisible Payments |

|---|---|---|

| Definition | Traditional method of handling transactions via card readers, POS systems, or online gateways. | Seamless, automated payment integration without direct customer interaction at checkout. |

| User Experience | Requires explicit customer action to authorize payments. | Works in the background, enabling frictionless purchases. |

| Speed | Slower due to manual input and authorization steps. | Faster, as payments are processed automatically after service delivery. |

| Security | Dependent on encryption, tokenization, PCI compliance. | Utilizes advanced fraud detection and secure tokenization. |

| Cost | Typically includes transaction fees, gateway fees, and hardware costs. | May involve subscription or integration fees but reduces checkout friction. |

| Use Cases | E-commerce, retail stores, restaurants, subscription billing. | On-demand services, ride-sharing, hospitality, IoT-enabled commerce. |

Understanding Payment Processing: Key Concepts

Payment processing involves the secure transfer of funds between customers and merchants, utilizing methods such as credit cards, digital wallets, and bank transfers through payment gateways and processors. Key concepts include authorization, capturing, and settlement, which ensure transaction validity and fund availability. Understanding these steps helps businesses optimize cash flow, reduce fraud, and improve customer experience during checkout.

Defining Invisible Payments in Modern Finance

Invisible payments in modern finance refer to seamless, automated transactions that occur without direct user interaction, often integrated into digital platforms or services. These payments leverage technologies like tokenization, biometric authentication, and machine learning to enhance security and convenience while reducing friction in the customer experience. The rise of invisible payments addresses consumer demand for efficiency in e-commerce, subscription services, and contactless retail environments.

How Traditional Payment Processing Systems Work

Traditional payment processing systems involve multiple steps including authorization, authentication, and settlement, relying on card networks and banks to validate transactions securely. Merchants capture payment details through point-of-sale terminals or online gateways, which route data to acquiring banks and payment processors for approval. This process typically incurs transaction fees and requires customer interaction to complete payments, contrasting with the seamless experience offered by invisible payment methods.

The Rise of Invisible Payments: What’s Driving the Shift?

The rise of invisible payments is driven by advancements in AI, biometric authentication, and IoT integration, enabling seamless and secure transactions without interrupting the customer experience. Consumer demand for frictionless checkout and increased mobile commerce adoption accelerates the shift towards invisible payment solutions. Financial institutions and retailers leverage real-time data analytics and tokenization to enhance transaction speed while minimizing fraud risk.

Key Technologies Behind Invisible Payments

Invisible payments rely heavily on biometric authentication, near-field communication (NFC), and artificial intelligence (AI) to enable seamless transactions without explicit user interaction. Advanced tokenization and blockchain technologies ensure secure data transfer while minimizing fraud risks in these frictionless payment experiences. Real-time data analytics and machine learning algorithms further optimize transaction speed and accuracy, enhancing overall customer satisfaction in the finance sector.

Security Considerations: Payment Processing vs Invisible Payments

Payment processing systems rely on encryption protocols like TLS and PCI DSS compliance to secure transactions, minimizing risks of data breaches and fraud. Invisible payments leverage tokenization and biometric authentication to enhance security by reducing exposure of sensitive information during transactions. Both methods require rigorous cybersecurity measures, but invisible payments often provide an added layer of protection by streamlining user authentication and reducing manual intervention.

User Experience: Friction vs Seamlessness

Payment processing systems often introduce friction through manual inputs and authentication steps, potentially disrupting the user experience and increasing abandonment rates. Invisible payments leverage technologies like tokenization and biometric authentication to create seamless transactions that require minimal user interaction. This frictionless approach enhances customer satisfaction and accelerates the checkout process, driving higher conversion rates and loyalty.

Regulatory Implications for Both Payment Types

Payment processing systems are subject to stringent regulatory frameworks like PCI DSS, AML, and GDPR to ensure transaction security, data privacy, and fraud prevention. Invisible payments, which leverage biometric authentication and seamless integration, face evolving regulatory scrutiny regarding consumer consent and data protection under laws such as PSD2 and CCPA. Both payment types must navigate compliance challenges while adopting advanced technologies to maintain trust and meet legal standards within the financial ecosystem.

Business Impact: Operational Efficiency and Costs

Payment processing systems streamline transaction workflows, reducing manual input and minimizing errors, which significantly enhances operational efficiency for businesses. Invisible payments further optimize this by enabling seamless, automatic transactions without customer intervention, lowering labor costs and accelerating cash flow. Both solutions contribute to cost savings through faster reconciliations and decreased transaction friction, driving improved profitability and scalable growth.

The Future of Payments: Trends and Predictions

Payment processing is evolving rapidly with the integration of AI-driven fraud detection and blockchain technology to enhance security and transparency. Invisible payments, powered by IoT devices and biometrics, are gaining traction as they enable seamless, contactless transactions without traditional point-of-sale interactions. Future payment trends indicate a shift towards fully automated, user-centric systems emphasizing speed, convenience, and enhanced data privacy in global financial ecosystems.

Related Important Terms

Tokenized Transactions

Tokenized transactions enhance payment processing by replacing sensitive card details with encrypted tokens, significantly reducing fraud risk and ensuring PCI compliance. Invisible payments leverage tokenization to facilitate seamless, contactless transactions that improve customer experience while maintaining robust security standards.

Frictionless Checkout

Frictionless checkout enhances customer experience by minimizing steps in payment processing, reducing cart abandonment rates by up to 40%. Invisible payments leverage secure tokenization and real-time data verification, enabling seamless transactions without manual input or delays at checkout.

Contextual Commerce

Payment processing involves traditional transactional systems requiring direct customer interaction at checkout, while invisible payments streamline purchases by automating payment authorization within contextual commerce environments. Contextual commerce leverages data-driven insights and seamless integrations to enable frictionless payments embedded in customer experiences across digital platforms.

Embedded Payments

Embedded payments streamline transaction flows by integrating payment processing directly within apps or platforms, reducing friction and enhancing user experience. This seamless approach to payment processing improves conversion rates and operational efficiency compared to traditional or invisible payment methods.

Pay-by-Link

Pay-by-Link technology streamlines payment processing by generating secure, unique URLs that customers can use to complete transactions without entering traditional payment portals, enhancing user convenience and reducing drop-off rates. Invisible Payments, leveraging seamless background transaction methods, prioritize frictionless experiences but often lack the explicit authorization benefits and traceability offered by Pay-by-Link solutions in finance.

Card-on-File Optimization

Card-on-file optimization enhances payment processing by securely storing customer card data, reducing friction in repeat transactions and increasing conversion rates. Invisible payments leverage this optimization to streamline checkout experiences, enabling seamless, frictionless transactions without interrupting the user journey.

One-Tap Payments

One-tap payments streamline payment processing by enabling instant transactions with a single touch, reducing friction and enhancing user experience compared to traditional methods requiring multiple steps. This innovation in invisible payments leverages tokenization and biometric authentication to securely authorize payments without interrupting the customer journey.

Digital Wallet Orchestration

Digital wallet orchestration streamlines payment processing by enabling seamless integration of multiple digital wallets within a single platform, enhancing transaction speed and security. This orchestration supports invisible payments by facilitating real-time fund transfers without interrupting the customer experience, driving higher conversion rates and operational efficiency.

SCA Exemptions

Payment processing under Strong Customer Authentication (SCA) faces challenges with friction during authentication, whereas invisible payments leverage SCA exemptions such as low-risk transactions, recurring payments, and trusted beneficiaries to enable seamless, compliant transactions without interrupting the customer experience. Utilizing SCA exemptions in invisible payments reduces transaction decline rates and improves conversion while maintaining regulatory compliance in European markets.

Autonomous Billing

Autonomous billing enhances payment processing by enabling seamless transactions without manual intervention, reducing errors and improving efficiency in revenue collection. Invisible payments leverage autonomous billing systems to facilitate frictionless customer experiences by automating recurring charges and real-time authorization.

Payment Processing vs Invisible Payments Infographic

industrydif.com

industrydif.com