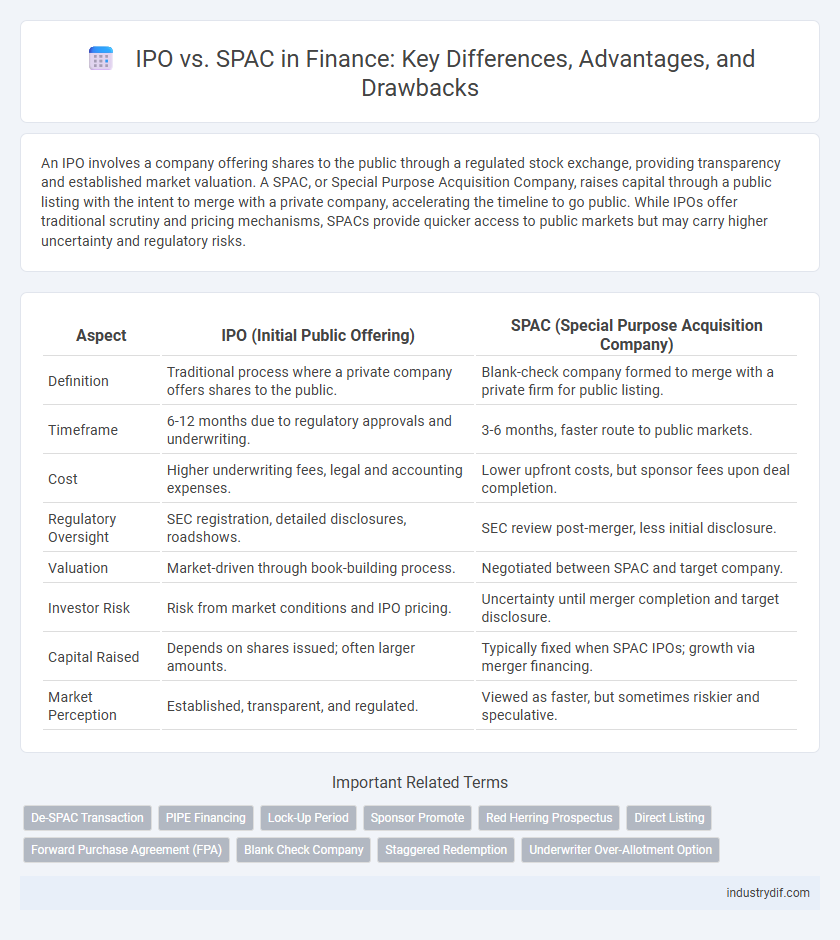

An IPO involves a company offering shares to the public through a regulated stock exchange, providing transparency and established market valuation. A SPAC, or Special Purpose Acquisition Company, raises capital through a public listing with the intent to merge with a private company, accelerating the timeline to go public. While IPOs offer traditional scrutiny and pricing mechanisms, SPACs provide quicker access to public markets but may carry higher uncertainty and regulatory risks.

Table of Comparison

| Aspect | IPO (Initial Public Offering) | SPAC (Special Purpose Acquisition Company) |

|---|---|---|

| Definition | Traditional process where a private company offers shares to the public. | Blank-check company formed to merge with a private firm for public listing. |

| Timeframe | 6-12 months due to regulatory approvals and underwriting. | 3-6 months, faster route to public markets. |

| Cost | Higher underwriting fees, legal and accounting expenses. | Lower upfront costs, but sponsor fees upon deal completion. |

| Regulatory Oversight | SEC registration, detailed disclosures, roadshows. | SEC review post-merger, less initial disclosure. |

| Valuation | Market-driven through book-building process. | Negotiated between SPAC and target company. |

| Investor Risk | Risk from market conditions and IPO pricing. | Uncertainty until merger completion and target disclosure. |

| Capital Raised | Depends on shares issued; often larger amounts. | Typically fixed when SPAC IPOs; growth via merger financing. |

| Market Perception | Established, transparent, and regulated. | Viewed as faster, but sometimes riskier and speculative. |

Overview of IPO and SPAC

An Initial Public Offering (IPO) involves a private company offering shares to the public for the first time to raise capital and achieve public market status, regulated by strict disclosure requirements and underwriters. A Special Purpose Acquisition Company (SPAC) is a shell corporation listed on a stock exchange with the purpose of acquiring a private company to take it public faster and with fewer regulatory hurdles. IPOs typically require extensive due diligence and longer timelines, while SPACs offer a quicker, streamlined path to public markets through a reverse merger.

Key Differences Between IPO and SPAC

An IPO (Initial Public Offering) involves a private company selling shares to the public for the first time through underwriters, providing direct access to capital markets and strict regulatory scrutiny by the SEC. A SPAC (Special Purpose Acquisition Company) is a shell company that raises funds through an IPO to acquire an existing private company, enabling faster public market entry with potentially less regulatory complexity before the merger. Key differences include the time frame--IPOs can take several months, whereas SPAC mergers often complete within weeks--and the pricing mechanism: IPOs have fixed pricing set during underwriting, while SPACs negotiate valuation during the merger process.

Process of Going Public: IPO vs SPAC

The process of going public through an IPO involves extensive regulatory filings with the SEC, including a detailed prospectus and a rigorous roadshow to attract institutional investors. In contrast, a SPAC merger allows a private company to go public by merging with a publicly traded shell company, significantly reducing the time and regulatory complexity compared to the traditional IPO route. Both methods provide access to capital markets, but SPACs often offer a faster timeline and more negotiation flexibility on valuation.

Advantages of IPO

IPO offers direct access to public capital markets, enabling companies to raise substantial funds with greater transparency and regulatory oversight. It enhances corporate credibility and investor confidence through rigorous disclosure requirements mandated by regulatory bodies like the SEC. IPOs also allow for price discovery based on market demand, potentially leading to higher valuation compared to SPAC mergers.

Advantages of SPAC

SPACs offer faster access to public capital markets compared to traditional IPOs, often completing the process within months rather than years. They provide greater certainty of valuation and deal terms by negotiating directly with the target company before the merger. This streamlined approach reduces market volatility risk and offers private companies an efficient route to liquidity and growth capital.

Risks Associated with IPO and SPAC

IPO risks include market volatility impacting share pricing, regulatory scrutiny causing delays, and potential undervaluation due to limited investor information. SPAC risks involve reliance on the sponsor's expertise, uncertain target company quality, and pressure to complete deals within a specified timeframe, which can compromise due diligence. Both methods expose investors to liquidity challenges and valuation discrepancies.

Regulatory Considerations for IPO and SPAC

IPO regulatory considerations involve strict scrutiny from the SEC, including detailed disclosures in the S-1 filing, compliance with the Securities Act of 1933, and adherence to stringent due diligence processes to protect investors. SPACs face regulations from both the SEC and stock exchanges, with increased focus on the accuracy of business combination disclosures, shareholder approvals, and ongoing reporting obligations post-merger under the Exchange Act. Both structures require transparent financial statements and adhere to anti-fraud provisions, but SPACs encounter heightened regulatory attention due to recent market volatility and investor protection concerns.

Cost Comparison: IPO vs SPAC

IPO processes typically incur higher underwriting fees, averaging 7% of the raised capital, while SPAC mergers often involve sponsor promote structures costing around 20% equity dilution. Regulatory compliance and roadshow expenses drive IPO costs significantly higher compared to SPACs, which leverage existing listings to reduce time and fees. Despite lower upfront costs, SPACs may result in higher long-term dilution and potential governance complexities impacting overall financial efficiency.

Market Trends: IPO vs SPAC

Market trends reveal a shifting landscape as SPACs gained significant popularity, offering faster and more flexible access to public markets compared to traditional IPOs. Recent data shows a decline in SPAC filings, driven by regulatory scrutiny and market volatility, while IPO activity is regaining momentum with increased investor confidence. Investors and companies increasingly evaluate SPACs and IPOs based on valuation transparency, regulatory environment, and long-term growth prospects.

Choosing the Right Path: IPO or SPAC

Selecting between an IPO and a SPAC depends on company goals, market conditions, and desired timelines; IPOs offer traditional transparency and investor confidence through rigorous regulatory scrutiny, while SPACs provide faster access to capital and reduced market exposure risks. Firms aiming for extensive public visibility and broader investor reach often prefer IPOs, whereas companies seeking speed and flexibility might opt for the SPAC route. Evaluating valuation certainty, control retention, and shareholder alignment is crucial when determining the optimal path for going public.

Related Important Terms

De-SPAC Transaction

De-SPAC transactions expedite public market entry by merging the SPAC with a target company, bypassing the lengthy IPO process. This method often provides faster capital access and greater valuation certainty compared to traditional IPOs, though it may involve dilution risks.

PIPE Financing

PIPE financing provides a crucial capital injection in SPAC transactions by allowing institutional investors to buy shares at a discounted price before the merger, increasing deal certainty. Unlike traditional IPOs, PIPE deals often close faster and raise larger amounts, enhancing liquidity and reducing market risk for the combined company.

Lock-Up Period

The lock-up period for IPOs typically ranges from 90 to 180 days, restricting insiders from selling shares to prevent market volatility, whereas SPACs often have varied or shorter lock-up durations depending on merger agreements. Understanding the differences in lock-up periods is crucial for investors assessing liquidity risks and potential share price impacts post-deal.

Sponsor Promote

Sponsor promote in IPOs typically involves underwriters receiving a fixed percentage of the offering, aligning incentives with long-term performance, while SPAC sponsor promote grants founders a substantial equity stake, often 20%, designed to reward deal completion but potentially diluting shareholder value. The differing structures impact investor alignment and post-merger governance, with SPAC promotes potentially incentivizing rapid acquisitions over sustained growth.

Red Herring Prospectus

The Red Herring Prospectus is a preliminary registration document filed by companies planning an IPO, detailing financials and business risks without final pricing, crucial for investor evaluation and regulatory compliance. In contrast, SPACs bypass this extensive prospectus stage, relying on a shell company to acquire a target, often accelerating market entry but offering less initial disclosure.

Direct Listing

Direct listings offer companies a cost-effective alternative to traditional IPOs by allowing existing shareholders to sell shares directly on the public market without underwriting or new capital issuance. Unlike SPACs, direct listings provide greater price transparency and market-driven valuation, avoiding the dilution and speculative risks associated with merger-led public offerings.

Forward Purchase Agreement (FPA)

A Forward Purchase Agreement (FPA) in a SPAC transaction secures committed capital from investors before the public listing, providing predictable funding and reducing market risk compared to traditional IPOs. This agreement enhances deal certainty and timing flexibility, making SPACs with FPAs an attractive alternative for companies seeking efficient access to public markets.

Blank Check Company

A Blank Check Company, often synonymous with a SPAC (Special Purpose Acquisition Company), raises capital through an IPO with the sole purpose of acquiring a private company, enabling a faster and less regulatory-intensive route to public markets compared to a traditional IPO. Unlike traditional IPOs where companies directly offer their shares to the public, SPACs provide private companies with a pre-funded shell corporation to merge with, simplifying valuation and often accelerating the timeline to go public.

Staggered Redemption

Staggered redemption in SPACs allows investors to redeem their shares in multiple phases post-IPO, providing enhanced liquidity management compared to traditional IPOs, which typically offer a single exit point at the offering. This mechanism reduces immediate redemption pressure on the SPAC trust and helps stabilize post-merger stock prices by pacing investor exits over time.

Underwriter Over-Allotment Option

The underwriter over-allotment option, commonly known as the greenshoe option, allows underwriters in both IPOs and SPAC mergers to purchase additional shares, up to 15% of the offering size, to stabilize the stock price post-deal. This tool mitigates price volatility by enabling underwriters to cover excess demand or short positions, ensuring smoother market integration and investor confidence in both traditional IPOs and SPAC transactions.

IPO vs SPAC Infographic

industrydif.com

industrydif.com