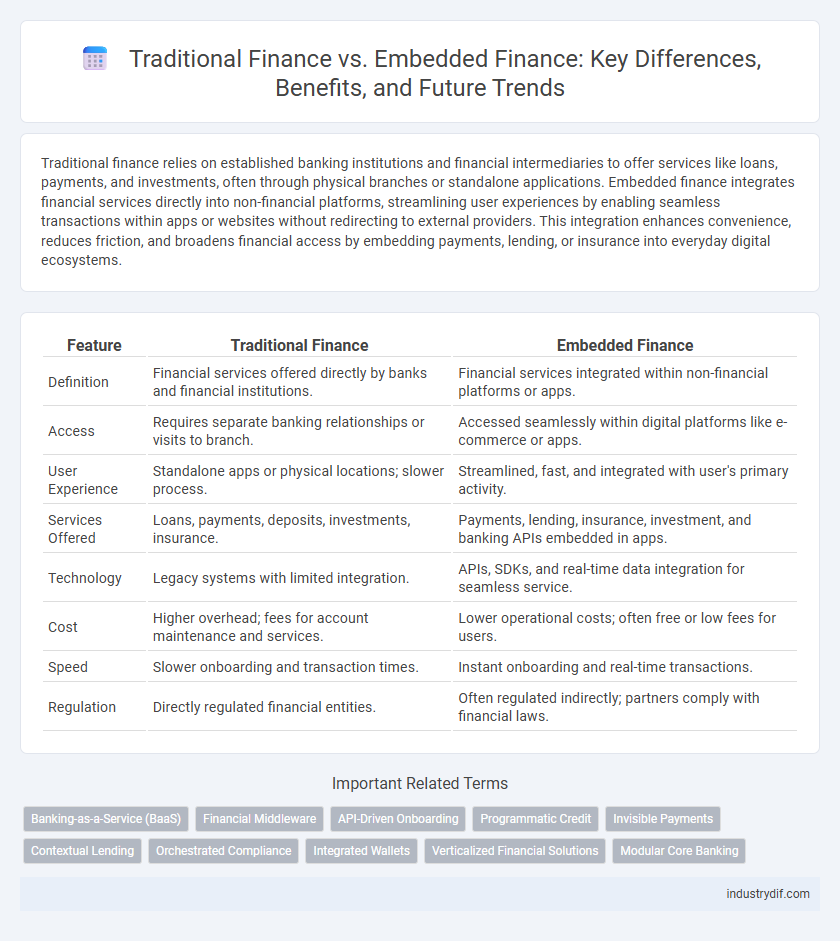

Traditional finance relies on established banking institutions and financial intermediaries to offer services like loans, payments, and investments, often through physical branches or standalone applications. Embedded finance integrates financial services directly into non-financial platforms, streamlining user experiences by enabling seamless transactions within apps or websites without redirecting to external providers. This integration enhances convenience, reduces friction, and broadens financial access by embedding payments, lending, or insurance into everyday digital ecosystems.

Table of Comparison

| Feature | Traditional Finance | Embedded Finance |

|---|---|---|

| Definition | Financial services offered directly by banks and financial institutions. | Financial services integrated within non-financial platforms or apps. |

| Access | Requires separate banking relationships or visits to branch. | Accessed seamlessly within digital platforms like e-commerce or apps. |

| User Experience | Standalone apps or physical locations; slower process. | Streamlined, fast, and integrated with user's primary activity. |

| Services Offered | Loans, payments, deposits, investments, insurance. | Payments, lending, insurance, investment, and banking APIs embedded in apps. |

| Technology | Legacy systems with limited integration. | APIs, SDKs, and real-time data integration for seamless service. |

| Cost | Higher overhead; fees for account maintenance and services. | Lower operational costs; often free or low fees for users. |

| Speed | Slower onboarding and transaction times. | Instant onboarding and real-time transactions. |

| Regulation | Directly regulated financial entities. | Often regulated indirectly; partners comply with financial laws. |

Defining Traditional Finance

Traditional finance encompasses conventional banking services offered by established financial institutions such as banks, credit unions, and investment firms, focusing on activities like savings, loans, and asset management. These services typically require customers to interact directly with the financial entity through physical branches or dedicated online platforms. Traditional finance relies heavily on legacy infrastructure and regulatory frameworks, resulting in slower transaction times and limited integration with non-financial digital ecosystems.

What is Embedded Finance?

Embedded finance integrates financial services directly into non-financial platforms, allowing businesses to offer payment processing, lending, or insurance within their own apps or websites. This seamless integration enhances user experience by eliminating the need to switch between multiple platforms for financial transactions. By leveraging APIs from fintech providers, embedded finance enables real-time access to banking and financial products embedded in everyday digital interactions.

Key Differences Between Traditional and Embedded Finance

Traditional finance relies on standalone banking services and financial products offered by established institutions, whereas embedded finance integrates financial services directly into non-financial platforms and applications. Key differences include the user experience, with embedded finance providing seamless, real-time access within ecosystems, while traditional finance often requires separate interactions through banks or brokers. Embedded finance also accelerates innovation through API-driven models, contrasting with the slower, legacy infrastructure typical of traditional finance.

Advantages of Traditional Finance

Traditional finance offers well-established regulatory frameworks that ensure transparency and consumer protection, fostering trust among investors and clients. It provides comprehensive financial services through specialized institutions with deep expertise and risk management capabilities. Access to large-scale capital markets and robust infrastructure enables efficient handling of complex transactions and long-term financing.

Benefits of Embedded Finance

Embedded finance integrates financial services directly into non-financial platforms, enhancing customer experience by enabling seamless transactions and reducing friction. It allows businesses to offer tailored financial products such as loans, payments, and insurance at the point of need, driving higher conversion rates and customer loyalty. This integration boosts revenue streams while lowering operational costs and expanding reach without the need for traditional banking infrastructure.

Challenges Facing Traditional Finance

Traditional finance faces challenges such as high operational costs, lengthy approval processes, and limited accessibility for underbanked populations. Legacy systems hinder seamless integration with modern technologies, leading to slower transactions and reduced customer satisfaction. Security concerns and regulatory compliance complexities further strain traditional financial institutions in adapting to evolving market demands.

Risks and Considerations in Embedded Finance

Embedded finance introduces new risks such as regulatory compliance challenges, data security vulnerabilities, and increased operational complexity due to integrating financial services within non-financial platforms. Companies must consider third-party dependencies and the potential for systemic risks that arise from interconnected ecosystems. Ensuring robust fraud prevention measures and transparent governance is critical to mitigating these embedded financial risks.

Impact on Consumer Experience

Traditional finance relies on standalone banking services requiring users to interact with multiple platforms, often leading to friction and delays in transactions. Embedded finance integrates financial services directly into non-financial platforms, enabling seamless user experiences with instant payments, credit access, and insurance options within familiar apps. This integration significantly enhances consumer convenience, reduces processing times, and personalizes financial interactions, driving higher user satisfaction and engagement.

Regulatory Landscape: Traditional vs Embedded Finance

Traditional finance operates under well-established regulatory frameworks such as Basel III, Dodd-Frank, and MiFID II, ensuring stringent capital requirements and consumer protections. Embedded finance faces evolving regulatory challenges as non-financial platforms integrate financial services, prompting regulators to adapt rules on licensing, data privacy, and anti-money laundering compliance. Navigating the regulatory landscape requires embedded finance providers to collaborate with banking partners and maintain adherence to both financial authorities and sector-specific regulations.

Future Trends in Financial Services

Future trends in financial services highlight the shift from traditional finance models, centered on banks and standalone institutions, towards embedded finance, where financial services are seamlessly integrated within non-financial platforms. This integration leverages APIs and real-time data analytics to provide personalized, frictionless user experiences while enabling businesses to offer credit, payments, and insurance directly within their ecosystems. The convergence of AI, blockchain, and open banking regulations will accelerate embedded finance adoption, transforming customer engagement and expanding market reach beyond conventional financial boundaries.

Related Important Terms

Banking-as-a-Service (BaaS)

Banking-as-a-Service (BaaS) revolutionizes traditional finance by enabling non-bank businesses to offer financial services directly through embedded platforms, streamlining customer access and reducing dependency on legacy banking infrastructure. This integration fosters seamless, scalable financial products such as payments, lending, and account management, transforming user experiences while driving new revenue streams for both fintech companies and traditional banks.

Financial Middleware

Financial middleware acts as a crucial integration layer bridging traditional finance systems with modern embedded finance solutions, enabling seamless data exchange, real-time processing, and enhanced scalability. By leveraging APIs and microservices architecture, this middleware facilitates efficient transaction management, risk assessment, and customer experience improvements across diverse financial platforms.

API-Driven Onboarding

API-driven onboarding in embedded finance streamlines customer integration by enabling seamless access to financial products within non-financial platforms, significantly reducing friction and improving user experience compared to traditional finance's separate and often manual onboarding processes. This technology accelerates identity verification, KYC compliance, and account setup, enhancing operational efficiency and enabling faster customer acquisition.

Programmatic Credit

Programmatic credit in traditional finance relies on manual underwriting and legacy banking infrastructure, resulting in slower loan approvals and higher operational costs. Embedded finance integrates programmatic credit directly into third-party platforms via APIs, enabling real-time credit decisions and seamless lending experiences within non-financial applications.

Invisible Payments

Invisible payments in embedded finance streamline transactions by integrating payment processing directly within platforms, eliminating the need for separate payment steps typical in traditional finance. This seamless approach enhances user experience and accelerates cash flow by automating payment collection and settlements within everyday digital interactions.

Contextual Lending

Traditional finance relies on standalone loan products often requiring lengthy applications, while embedded finance integrates contextual lending directly within platforms, enabling real-time credit offers based on user behavior and transaction data. Contextual lending leverages AI-driven risk assessment and seamless user experience, significantly improving approval rates and reducing friction compared to legacy methods.

Orchestrated Compliance

Traditional finance relies on manual regulatory processes and standalone compliance checks, causing delays and higher risks of non-compliance. Embedded finance integrates real-time orchestrated compliance within digital platforms, ensuring continuous monitoring and seamless adherence to regulatory requirements.

Integrated Wallets

Integrated wallets in embedded finance streamline user transactions by seamlessly connecting payment services directly within non-financial platforms, enhancing convenience and reducing reliance on external banking apps. Traditional finance relies on standalone banking infrastructure, whereas embedded finance wallets leverage APIs to deliver real-time financial services embedded into apps, improving speed and user engagement.

Verticalized Financial Solutions

Verticalized financial solutions in traditional finance rely on standalone products tailored for specific industries, often requiring multiple integrations and manual processes; embedded finance streamlines these offerings by seamlessly integrating payment, lending, and insurance services directly into industry-specific platforms, enhancing customer experience and operational efficiency. This transformation enables businesses to deliver personalized, context-aware financial solutions that drive higher engagement and revenue growth within sectors like retail, healthcare, and real estate.

Modular Core Banking

Modular core banking systems enable traditional finance institutions to integrate embedded finance solutions by offering flexible, API-driven architectures that support real-time transactions and personalized financial services. This shift from monolithic legacy systems to modular platforms accelerates innovation, reduces time-to-market, and enhances customer experience through seamless digital integration.

Traditional Finance vs Embedded Finance Infographic

industrydif.com

industrydif.com