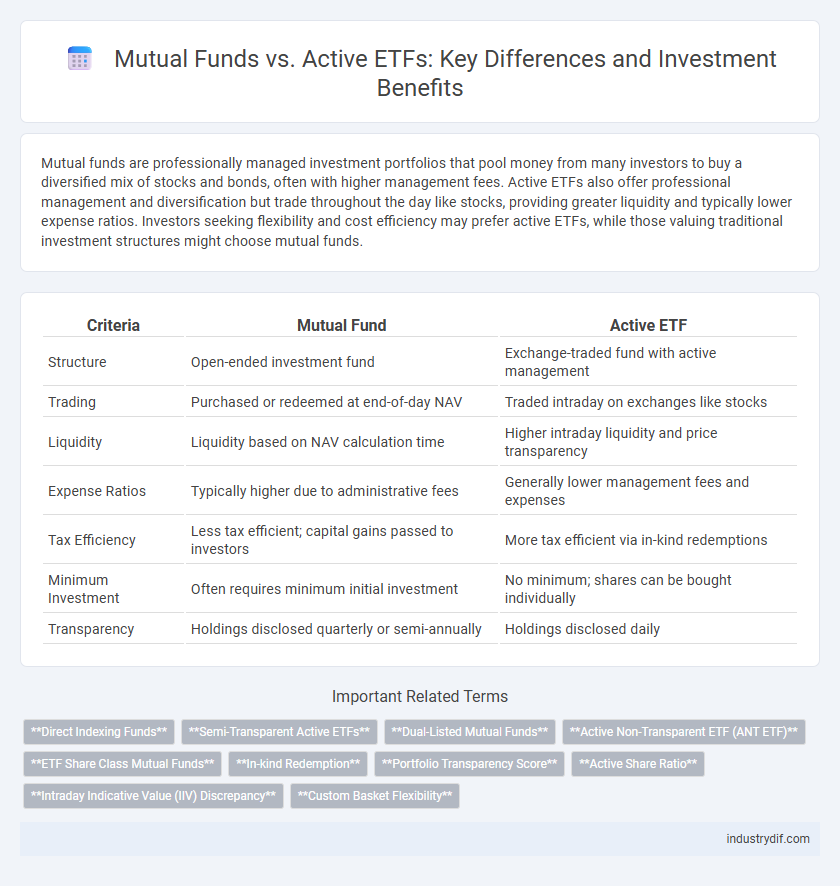

Mutual funds are professionally managed investment portfolios that pool money from many investors to buy a diversified mix of stocks and bonds, often with higher management fees. Active ETFs also offer professional management and diversification but trade throughout the day like stocks, providing greater liquidity and typically lower expense ratios. Investors seeking flexibility and cost efficiency may prefer active ETFs, while those valuing traditional investment structures might choose mutual funds.

Table of Comparison

| Criteria | Mutual Fund | Active ETF |

|---|---|---|

| Structure | Open-ended investment fund | Exchange-traded fund with active management |

| Trading | Purchased or redeemed at end-of-day NAV | Traded intraday on exchanges like stocks |

| Liquidity | Liquidity based on NAV calculation time | Higher intraday liquidity and price transparency |

| Expense Ratios | Typically higher due to administrative fees | Generally lower management fees and expenses |

| Tax Efficiency | Less tax efficient; capital gains passed to investors | More tax efficient via in-kind redemptions |

| Minimum Investment | Often requires minimum initial investment | No minimum; shares can be bought individually |

| Transparency | Holdings disclosed quarterly or semi-annually | Holdings disclosed daily |

Understanding Mutual Funds and Active ETFs

Mutual funds pool capital from multiple investors to invest in diversified portfolios managed by professional fund managers, typically trading at the end of the day at net asset value (NAV). Active ETFs combine the diversification of mutual funds with the intraday trading flexibility of ETFs, allowing investors to buy and sell shares throughout the trading day at market prices. Understanding the structural differences and cost implications, including expense ratios and tax efficiency, is crucial when choosing between mutual funds and active ETFs for portfolio management.

Key Differences Between Mutual Funds and Active ETFs

Mutual funds are typically priced once daily after market close, whereas active ETFs trade throughout the day at market prices, offering greater liquidity and flexibility. Mutual funds often have higher minimum investment requirements and slightly higher expense ratios compared to active ETFs, which generally provide lower fees and easier access through stock exchanges. Additionally, mutual funds are usually managed with a buy-and-hold strategy, whereas active ETFs can employ more dynamic trading strategies to capitalize on short-term market opportunities.

Investment Strategies: Mutual Fund vs Active ETF

Mutual funds typically follow a buy-and-hold investment strategy managed by portfolio managers aiming for long-term growth, often with higher fees due to active management. Active ETFs combine traditional active management with the flexibility of trading like a stock, allowing investors to respond quickly to market changes and potentially lower expense ratios. Both investment vehicles offer diversified portfolios, but Active ETFs provide greater intraday liquidity and tax efficiency compared to conventional mutual funds.

Fee Structures and Expense Ratios Compared

Mutual funds typically have higher expense ratios averaging around 1% to 1.5%, reflecting costs for active management, distribution, and administrative fees. Active ETFs often feature lower expense ratios, ranging from 0.2% to 0.75%, due to their passive trading structures and reduced marketing expenses. Investors should analyze total cost implications, including potential brokerage fees for ETFs, to assess net investment performance.

Liquidity and Trading Flexibility

Mutual funds offer liquidity through end-of-day redemptions at the net asset value (NAV), limiting trading flexibility to once daily. Active ETFs provide intraday trading opportunities with real-time pricing on exchanges, enhancing liquidity and allowing investors to respond instantly to market movements. This increased trading flexibility makes active ETFs a more dynamic vehicle for tactical asset allocation compared to traditional mutual funds.

Tax Efficiency of Mutual Funds vs Active ETFs

Active ETFs generally offer greater tax efficiency compared to mutual funds due to their unique creation and redemption process, which allows in-kind transfers that minimize capital gains distributions. Mutual funds often trigger capital gains taxable events when portfolio managers execute trades within the fund, which are passed on to shareholders. Investors seeking to reduce tax liabilities typically prefer active ETFs for their ability to defer taxes and optimize after-tax returns.

Portfolio Transparency and Disclosure

Mutual funds typically disclose holdings quarterly, resulting in less frequent transparency compared to active ETFs, which provide daily visibility into portfolio compositions. Active ETFs leverage intraday trading and regulatory frameworks to offer investors near-real-time access to asset allocations, enhancing decision-making efficiency. This increased transparency of active ETFs supports more informed portfolio management and risk assessment.

Performance Comparison and Historical Returns

Mutual funds and active ETFs both aim to outperform benchmarks, but active ETFs typically offer greater liquidity and lower expense ratios, which can enhance net returns over time. Historical data shows that while some mutual funds have achieved superior long-term performance, active ETFs often match or exceed those returns due to tax efficiencies and intraday trading flexibility. Investors seeking consistent alpha may find active ETFs more advantageous for tactical asset allocation, whereas mutual funds provide benefits in stability and manager-driven strategies.

Suitability for Different Types of Investors

Mutual funds offer suitability for long-term investors seeking professional management with broad diversification and typically lower trading costs, making them ideal for conservative or retirement-focused portfolios. Active ETFs appeal to investors desiring intraday trading flexibility, tax efficiency, and potential cost advantages, which suits more active traders or those aiming for tactical asset allocation. Understanding individual risk tolerance, investment horizon, and trading preferences helps determine whether a mutual fund or active ETF aligns better with investor goals.

Choosing the Right Option: Mutual Fund or Active ETF

Selecting the right investment vehicle between mutual funds and active ETFs depends on factors like expense ratios, trading flexibility, and tax efficiency. Mutual funds often have higher fees and trade only once a day at net asset value, while active ETFs provide intraday trading and typically lower costs. Investors seeking transparency and lower tax impact may prefer active ETFs, whereas those valuing automatic reinvestment and traditional management might opt for mutual funds.

Related Important Terms

Direct Indexing Funds

Direct indexing funds offer tax efficiency and customization by allowing investors to hold individual securities reflecting an index, unlike traditional mutual funds or active ETFs that pool assets into collective portfolios. These funds enhance portfolio personalization and potential tax-loss harvesting opportunities, making them a strategic choice for investors seeking tailored exposure to specific market segments.

Semi-Transparent Active ETFs

Semi-transparent active ETFs combine the diversification and professional management of mutual funds with the intraday liquidity and tax efficiency of ETFs, while partially revealing portfolio holdings to balance transparency and proprietary protection. These funds typically disclose only a subset of their holdings daily, reducing front-running risks and enhancing flexibility compared to fully transparent active ETFs.

Dual-Listed Mutual Funds

Dual-listed mutual funds offer investors seamless access to diverse markets by trading on multiple exchanges, combining the liquidity of active ETFs with the strategic management of mutual funds. These funds optimize portfolio diversification and cost efficiency while providing real-time pricing and enhanced transparency compared to traditional mutual funds.

Active Non-Transparent ETF (ANT ETF)

Active Non-Transparent ETFs (ANT ETFs) combine the active management benefits of mutual funds with the intraday trading flexibility of ETFs, offering investors enhanced diversification and cost efficiency. Unlike traditional active mutual funds, ANT ETFs maintain portfolio confidentiality through a non-transparent structure, reducing front-running risks while allowing real-time market pricing and liquidity.

ETF Share Class Mutual Funds

ETF share class mutual funds combine the regulatory and tax advantages of ETFs with the mutual fund structure, offering investors greater trading flexibility and potentially lower expense ratios compared to traditional active ETFs. These funds provide daily liquidity and intra-day pricing while maintaining the diverse portfolio management and transparency typical of mutual funds.

In-kind Redemption

In-kind redemption allows active ETFs to exchange securities for shares directly with authorized participants, minimizing capital gains distributions and enhancing tax efficiency compared to mutual funds. Mutual funds typically undergo cash redemptions, which can trigger taxable events and increase fund transaction costs.

Portfolio Transparency Score

Mutual funds typically offer lower portfolio transparency scores compared to active ETFs, as they disclose holdings on a quarterly basis while active ETFs provide daily transparency, enabling investors to monitor real-time asset composition and risk exposure. This increased transparency in active ETFs enhances investor confidence by allowing timely assessment of portfolio strategies and adjustments.

Active Share Ratio

The Active Share Ratio measures the percentage of a portfolio's holdings that differ from its benchmark index, with mutual funds typically exhibiting a higher Active Share Ratio than active ETFs due to more frequent and discretionary security selection. A higher Active Share Ratio indicates greater portfolio differentiation and potential for alpha generation, making it a crucial metric for investors comparing mutual funds and active ETFs in terms of active management intensity.

Intraday Indicative Value (IIV) Discrepancy

Intraday Indicative Value (IIV) discrepancy occurs when the trading price of an Active ETF deviates from its estimated net asset value during market hours, impacting real-time investor decisions. Mutual funds lack intraday trading and IIV, leading to potential mismatches between market dynamics and end-of-day valuation, unlike Active ETFs that provide continuous price discovery and transparency.

Custom Basket Flexibility

Active ETFs offer superior custom basket flexibility by allowing portfolio managers to tailor holdings dynamically throughout the trading day, unlike mutual funds that adjust portfolios only at the end of the trading day based on net asset value (NAV). This intraday adjustability in active ETFs enhances responsiveness to market conditions and investor preferences, providing more timely and precise exposure customization.

Mutual Fund vs Active ETF Infographic

industrydif.com

industrydif.com