Treasury bonds are government-issued debt securities used to finance public spending with fixed interest payments and low risk, making them a stable investment choice. Green bonds, while also debt instruments, specifically fund environmentally sustainable projects and attract investors interested in supporting climate-friendly initiatives. Both types of bonds offer distinct benefits: treasury bonds provide security and predictable returns, whereas green bonds contribute to environmental impact alongside financial returns.

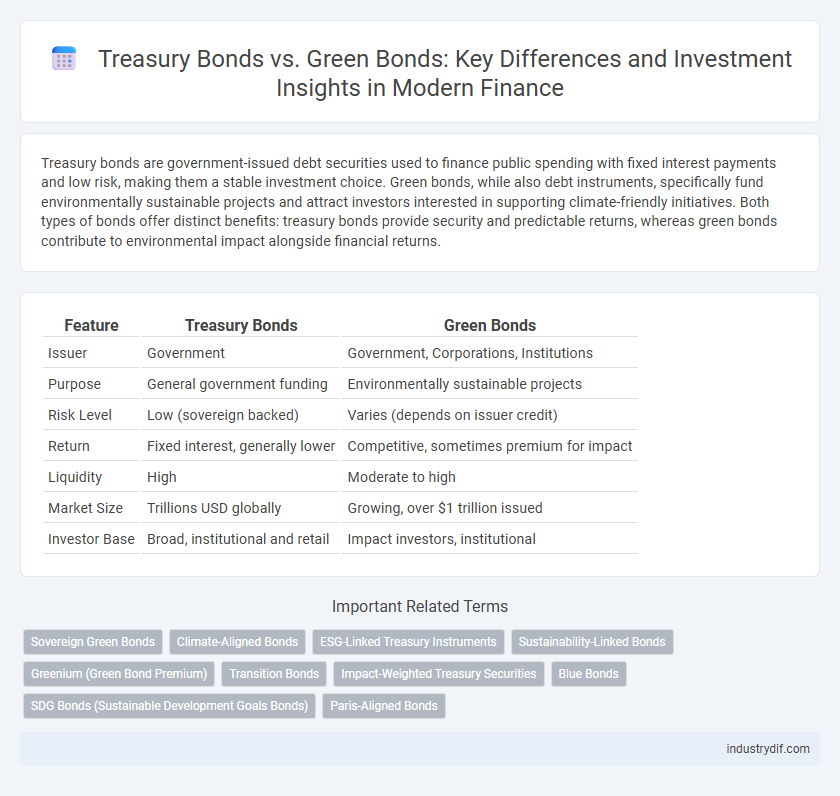

Table of Comparison

| Feature | Treasury Bonds | Green Bonds |

|---|---|---|

| Issuer | Government | Government, Corporations, Institutions |

| Purpose | General government funding | Environmentally sustainable projects |

| Risk Level | Low (sovereign backed) | Varies (depends on issuer credit) |

| Return | Fixed interest, generally lower | Competitive, sometimes premium for impact |

| Liquidity | High | Moderate to high |

| Market Size | Trillions USD globally | Growing, over $1 trillion issued |

| Investor Base | Broad, institutional and retail | Impact investors, institutional |

Defining Treasury Bonds and Green Bonds

Treasury bonds are long-term debt securities issued by the government to finance public spending and manage national debt, offering fixed interest payments over a maturity period typically ranging from 10 to 30 years. Green bonds are specialized fixed-income instruments designed to raise capital exclusively for environmentally sustainable projects, such as renewable energy, clean transportation, and climate change mitigation initiatives. Both types of bonds provide investors with a secure income stream, but green bonds uniquely emphasize funding projects that contribute to ecological sustainability and social impact.

Key Features and Characteristics

Treasury bonds are long-term U.S. government debt securities with fixed interest rates, providing a low-risk investment guaranteed by the government. Green bonds are debt instruments specifically earmarked to finance environmentally sustainable projects, offering investors the dual benefit of financial return and positive environmental impact. Both bond types feature regular coupon payments and defined maturity dates, but green bonds emphasize transparency and impact reporting to ensure funds support green initiatives.

Purpose and Use of Funds

Treasury Bonds are government debt securities issued to finance public spending and manage national debt, typically used for infrastructure, defense, and social programs. Green Bonds, however, are specifically designed to raise funds exclusively for environmentally sustainable projects such as renewable energy, energy efficiency, and climate change mitigation. The primary purpose of Treasury Bonds is fiscal stability and economic growth, while Green Bonds target environmental impact and responsible investment.

Risk and Return Profiles

Treasury bonds are government-backed securities with low risk and stable, predictable returns, making them ideal for conservative investors seeking capital preservation. Green bonds, issued to finance environmentally beneficial projects, often carry slightly higher risk due to project-specific uncertainties but offer the potential for comparable or enhanced returns driven by growing investor demand for sustainable assets. Risk profiles differ as treasury bonds benefit from sovereign credit guarantees, while green bonds' performance may be influenced by regulatory changes and the success of financed initiatives.

Market Demand and Investor Types

Treasury bonds attract significant market demand due to their government backing and low risk, appealing primarily to conservative investors such as pension funds, insurance companies, and risk-averse individuals. Green bonds, driven by growing environmental awareness and ESG mandates, attract a diverse investor base including socially responsible investment funds, impact investors, and corporations seeking sustainable portfolios. The evolving market demand for green bonds reflects increased appetite among investors prioritizing climate-friendly assets alongside traditional fixed-income instruments.

Regulatory Frameworks and Standards

Treasury Bonds operate under established government regulatory frameworks characterized by strict compliance with national debt issuance policies and oversight from central financial authorities. Green Bonds adhere to specialized standards such as the Green Bond Principles (GBP) and are often subject to additional verification and reporting requirements to ensure proceeds finance environmentally sustainable projects. Regulatory bodies increasingly push for transparency and accountability in Green Bonds, integrating environmental, social, and governance (ESG) criteria into financial disclosure mandates.

Environmental Impact and Sustainability

Treasury Bonds primarily serve as government debt instruments with minimal direct environmental impact, whereas Green Bonds specifically finance projects with clear sustainability goals such as renewable energy, clean water, and conservation efforts. Green Bonds are increasingly favored by investors seeking to support environmental initiatives while achieving fiscal returns, reflecting a growing trend towards sustainable finance. The issuance of Green Bonds enables governments and corporations to raise capital dedicated to mitigating climate change and promoting eco-friendly infrastructure.

Maturity Periods and Yield Comparisons

Treasury bonds typically have longer maturity periods ranging from 10 to 30 years, offering steady yields influenced by government credit risk and macroeconomic factors. Green bonds often feature shorter maturities, generally between 5 to 15 years, with yields slightly lower than traditional treasury bonds due to their environmental impact premiums and increasing investor demand. Yield comparisons reveal that while treasury bonds provide traditional risk-return profiles, green bonds attract investors seeking sustainable finance with competitive, though occasionally lower, returns linked to project-specific cash flows.

Issuers and Geographic Distribution

Treasury bonds are predominantly issued by central governments, such as the U.S. Department of the Treasury, serving as a key instrument for national debt financing with widespread issuance concentrated in North America, Europe, and parts of Asia. Green bonds are issued by a diverse range of entities including governments, municipal authorities, and corporations, with significant issuance growth in European countries like France and Germany, as well as emerging markets in Latin America and Asia-Pacific. The geographic distribution of green bonds reflects a growing emphasis on sustainable finance, driven by environmental regulations and investor demand in regions committed to climate goals.

Future Outlook in Fixed-Income Markets

Treasury bonds remain a cornerstone of fixed-income markets due to their low risk and government backing, ensuring continued demand amid economic uncertainty. Green bonds are projected to experience significant growth driven by increasing ESG investment mandates and global sustainability initiatives. Market forecasts indicate that green bond issuance could surpass traditional government securities as institutional investors prioritize environmental impact alongside stable returns.

Related Important Terms

Sovereign Green Bonds

Sovereign Green Bonds are government-issued debt securities specifically designated to fund projects with positive environmental impacts, differentiating them from traditional Treasury Bonds that primarily finance general government expenditures. These bonds attract investors seeking sustainable investment opportunities while supporting national climate goals through transparent use-of-proceeds frameworks.

Climate-Aligned Bonds

Climate-aligned bonds, often categorized under green bonds, specifically finance projects with environmental benefits such as renewable energy and carbon reduction, contrasting with traditional Treasury bonds that primarily support general government funding without targeted sustainability goals. Treasury bonds typically offer lower yields due to their low-risk government backing, while green bonds can attract impact-focused investors seeking both financial returns and positive environmental outcomes.

ESG-Linked Treasury Instruments

ESG-linked Treasury bonds integrate environmental, social, and governance criteria into traditional sovereign debt, offering investors a blend of financial security and impact-driven outcomes. These instruments typically feature performance metrics tied to sustainability goals, providing measurable accountability compared to conventional Treasury bonds, while supporting green infrastructure and social projects.

Sustainability-Linked Bonds

Sustainability-linked bonds differ from traditional Treasury bonds by directly tying financial returns to the issuer's achievement of specific environmental, social, and governance (ESG) targets, thereby aligning investment performance with sustainability outcomes. Unlike green bonds, which are earmarked for green projects, these bonds incentivize continuous improvement across broader sustainability metrics, fostering long-term corporate responsibility and risk mitigation in financial markets.

Greenium (Green Bond Premium)

Green bonds often trade at a premium known as the "greenium," reflecting investor willingness to accept lower yields due to environmental benefits and positive social impact, which contrasts with traditional Treasury bonds that lack this attribute. This greenium signals growing demand for sustainable finance products, influencing pricing dynamics and portfolio allocation strategies in fixed-income markets.

Transition Bonds

Transition bonds serve as a financial bridge within the bond market, facilitating companies' shift toward sustainable practices by funding projects that reduce carbon emissions but do not yet qualify as fully green. Unlike traditional treasury bonds, which primarily finance government debt, transition bonds attract investors interested in supporting environmental targets alongside stable returns.

Impact-Weighted Treasury Securities

Impact-weighted Treasury securities integrate environmental and social metrics into traditional Treasury bonds, offering investors a blend of sovereign credit stability and positive sustainability outcomes. These instruments enhance portfolio diversification while promoting measurable impact, contrasting with green bonds that primarily fund specific environmental projects.

Blue Bonds

Blue Bonds, a subset of green bonds, specifically finance projects that protect ocean and water resources, offering investors sustainable returns tied to marine conservation efforts. Treasury bonds are government-backed debt securities with fixed interest rates, whereas blue bonds combine environmental impact with financial incentives to support biodiversity and climate resilience in aquatic ecosystems.

SDG Bonds (Sustainable Development Goals Bonds)

Treasury Bonds are government-issued debt securities primarily aimed at funding general public expenditures, while Green Bonds specifically finance environmentally-friendly projects aligned with SDG 13 (Climate Action), SDG 7 (Affordable and Clean Energy), and SDG 15 (Life on Land). SDG Bonds broaden this scope by targeting a diverse range of Sustainable Development Goals, including poverty reduction, education, and clean water initiatives, making them a crucial tool for sustainable finance and impact investing.

Paris-Aligned Bonds

Paris-Aligned Bonds, a subset of Green Bonds, specifically target climate goals consistent with the Paris Agreement by financing projects that reduce carbon emissions and promote sustainable development. Treasury Bonds, while backed by government credit and perceived as low-risk, do not inherently prioritize environmental objectives, making Paris-Aligned Bonds a strategic choice for investors seeking both financial security and climate impact alignment.

Treasury Bonds vs Green Bonds Infographic

industrydif.com

industrydif.com