Stock markets offer regulated environments for trading shares of publicly listed companies, providing transparency and established investor protections. Digital asset exchanges facilitate the trading of cryptocurrencies and tokenized assets, often with higher volatility and less regulation. Investors must weigh liquidity, risk, and compliance factors when choosing between traditional stock markets and digital asset exchanges.

Table of Comparison

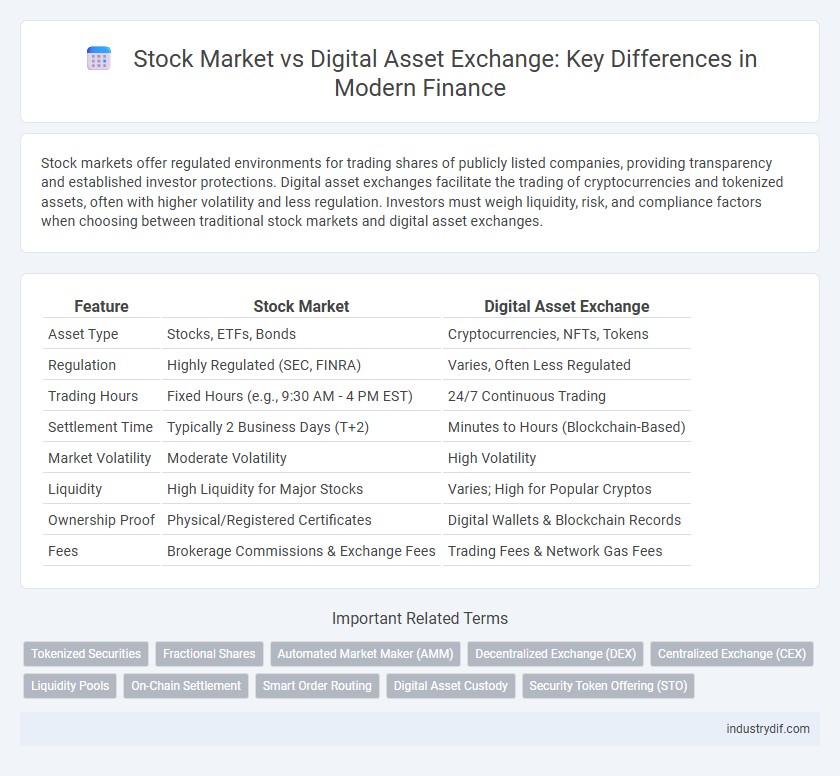

| Feature | Stock Market | Digital Asset Exchange |

|---|---|---|

| Asset Type | Stocks, ETFs, Bonds | Cryptocurrencies, NFTs, Tokens |

| Regulation | Highly Regulated (SEC, FINRA) | Varies, Often Less Regulated |

| Trading Hours | Fixed Hours (e.g., 9:30 AM - 4 PM EST) | 24/7 Continuous Trading |

| Settlement Time | Typically 2 Business Days (T+2) | Minutes to Hours (Blockchain-Based) |

| Market Volatility | Moderate Volatility | High Volatility |

| Liquidity | High Liquidity for Major Stocks | Varies; High for Popular Cryptos |

| Ownership Proof | Physical/Registered Certificates | Digital Wallets & Blockchain Records |

| Fees | Brokerage Commissions & Exchange Fees | Trading Fees & Network Gas Fees |

Introduction to Stock Markets and Digital Asset Exchanges

Stock markets are centralized platforms where publicly traded company shares are bought and sold, regulated by authorities such as the SEC to ensure transparency and investor protection. Digital asset exchanges facilitate trading of cryptocurrencies and tokenized assets, operating on blockchain technology and offering 24/7 global access without traditional intermediaries. Both platforms provide liquidity and price discovery but differ fundamentally in regulation, asset types, and trading hours.

Key Differences Between Stock Markets and Digital Asset Exchanges

Stock markets primarily facilitate the trading of equity securities representing ownership in companies, regulated by government agencies like the SEC to ensure transparency and investor protection. Digital asset exchanges enable the trading of cryptocurrencies and tokenized assets with operations often decentralized and subject to varying regulatory standards. Liquidity, market hours, asset types, and regulatory frameworks are critical factors distinguishing these two financial trading platforms.

Regulatory Frameworks: Traditional vs Digital Platforms

Stock markets operate under well-established regulatory frameworks imposed by authorities like the SEC in the U.S., ensuring investor protection, transparency, and market integrity through strict compliance requirements. Digital asset exchanges face evolving regulations that vary widely by jurisdiction, often focusing on anti-money laundering (AML), know-your-customer (KYC) protocols, and cryptocurrency-specific guidelines. The disparity in regulatory clarity creates different operational risks and compliance burdens, influencing investor confidence and market stability in both traditional and digital platforms.

Trading Hours and Liquidity Dynamics

Stock markets typically operate within fixed trading hours, such as 9:30 AM to 4:00 PM EST, resulting in predictable liquidity cycles and volume surges during market openings and closings. Digital asset exchanges, on the other hand, function 24/7, providing continuous liquidity and enabling traders to respond instantly to market events without time restrictions. This around-the-clock accessibility often leads to higher volatility but offers greater flexibility compared to traditional stock market trading sessions.

Asset Types: Stocks vs Digital Tokens

Stocks represent ownership shares in publicly traded companies, providing investors with dividends and voting rights, while digital tokens are blockchain-based assets that can signify ownership, utility, or access within decentralized platforms. Stock markets regulate trading with centralized authorities ensuring transparency, whereas digital asset exchanges operate on decentralized or hybrid frameworks enabling 24/7 global access to various tokenized assets. Differences in asset liquidity, market volatility, and regulatory oversight highlight unique risk profiles between traditional stock investments and digital tokens.

Investor Access and Market Participation

Stock markets offer broad investor access through regulated platforms with standardized trading hours and established compliance measures, attracting institutional and retail participation. Digital asset exchanges provide continuous, 24/7 market access with lower entry barriers, enabling global investors to trade cryptocurrencies and tokenized assets seamlessly. Enhanced technological infrastructure and decentralized finance protocols expand participation opportunities beyond traditional financial intermediaries.

Technology and Security Mechanisms

Stock markets leverage established trading technologies with robust circuit breakers and regulatory oversight to ensure transaction integrity and reduce volatility. Digital asset exchanges utilize blockchain technology, offering decentralized ledgers and cryptographic security that provide transparency and mitigate fraud risks. Advanced encryption protocols and multi-factor authentication are critical in both platforms, but digital asset exchanges uniquely depend on smart contracts to automate and secure asset transfers.

Settlement Processes and Transaction Times

Stock market settlement processes typically require T+2 days, involving multiple intermediaries such as clearinghouses and custodians to ensure trade finality and regulatory compliance. Digital asset exchanges leverage blockchain technology to enable near-instantaneous settlement, reducing counterparty risk and eliminating the need for centralized intermediaries. This rapid settlement enhances liquidity and lowers operational costs compared to traditional stock markets.

Risk Management in Stock Markets vs Digital Asset Exchanges

Risk management in stock markets relies on established regulatory frameworks and traditional tools such as stop-loss orders and portfolio diversification to mitigate volatility and systemic risks. Digital asset exchanges face elevated risks due to higher market volatility, regulatory uncertainty, and cybersecurity threats, necessitating advanced risk controls like real-time monitoring, robust encryption, and smart contract audits. Investors in digital asset exchanges must adopt dynamic risk assessment models to address rapid price fluctuations and potential platform vulnerabilities.

Future Trends: Convergence and Divergence in Financial Markets

Stock markets and digital asset exchanges are increasingly exhibiting convergence through the integration of blockchain technology, enabling greater transparency and security in transactions. Divergence remains evident as traditional stock markets continue to operate under stringent regulatory frameworks, while digital asset exchanges navigate evolving guidelines and decentralized protocols. Future trends suggest a hybrid financial ecosystem where institutional investors leverage both platforms for diversified portfolios and liquidity optimization.

Related Important Terms

Tokenized Securities

Tokenized securities on digital asset exchanges offer fractional ownership, enhanced liquidity, and 24/7 trading capabilities compared to traditional stock markets that rely on centralized clearinghouses and limited trading hours. Regulatory frameworks for tokenized assets continue to evolve, aiming to bridge the gap between conventional financial markets and blockchain-based platforms while ensuring investor protection and compliance.

Fractional Shares

Fractional shares allow investors to buy less than one full share of a company on stock markets, increasing accessibility and diversification with lower capital requirements. Digital asset exchanges similarly offer fractional ownership but extend this concept to cryptocurrencies and tokenized assets, providing greater flexibility and liquidity in 24/7 trading environments.

Automated Market Maker (AMM)

Automated Market Makers (AMMs) revolutionize liquidity provision in digital asset exchanges by using algorithmic pricing models, contrasting with traditional stock market order books that rely on buyer-seller matching. AMMs enable continuous trading with decentralized pools, reducing reliance on centralized intermediaries and enhancing market efficiency in the cryptocurrency ecosystem.

Decentralized Exchange (DEX)

Decentralized exchanges (DEX) enable peer-to-peer trading of digital assets without intermediaries, offering enhanced privacy and reduced counterparty risk compared to traditional stock markets. Unlike centralized stock exchanges, DEX platforms leverage blockchain technology to provide transparent, efficient, and independently verifiable transaction records.

Centralized Exchange (CEX)

Centralized Exchanges (CEX) in stock markets and digital asset trading offer high liquidity, robust security protocols, and regulatory compliance, making them preferred platforms for executing large-volume transactions efficiently. CEXs bridge traditional finance and crypto markets by providing centralized custody of assets, order matching engines, and user-friendly interfaces that facilitate seamless asset exchange and portfolio management.

Liquidity Pools

Liquidity pools in stock markets often rely on centralized exchanges with designated market makers ensuring continuous asset availability and stable pricing, while digital asset exchanges leverage decentralized liquidity pools where users contribute crypto assets to facilitate peer-to-peer trading with minimal slippage. The inherent transparency and programmability of decentralized liquidity pools enhance efficiency and accessibility but may expose traders to impermanent loss risks absent in traditional stock market setups.

On-Chain Settlement

On-chain settlement in digital asset exchanges offers enhanced transparency and faster transaction finality compared to traditional stock market clearing, which relies on centralized intermediaries and can take days to complete. This blockchain-based process reduces counterparty risk and improves auditability by recording every trade on a distributed ledger accessible to all network participants.

Smart Order Routing

Smart Order Routing (SOR) in stock markets enhances trade execution by automatically directing orders to multiple exchanges based on real-time price and liquidity, optimizing transaction speed and cost-efficiency. In digital asset exchanges, SOR algorithms navigate fragmented liquidity pools across decentralized platforms, ensuring best price discovery and seamless digital asset swaps.

Digital Asset Custody

Digital asset custody involves securing cryptocurrencies and tokens using advanced cryptographic techniques and blockchain-based wallets, offering enhanced protection against cyber threats compared to traditional stock market custodianship. Institutional-grade digital asset custody solutions provide multi-signature authorizations, cold storage, and regulatory compliance, addressing unique risks inherent to decentralized digital exchanges.

Security Token Offering (STO)

Security Token Offerings (STOs) merge the regulatory rigor of traditional stock markets with the innovation of digital asset exchanges by issuing blockchain-based tokens that represent ownership in real-world assets. STOs provide enhanced investor protection through compliance with securities laws while enabling greater liquidity and fractional ownership compared to conventional stock trading.

Stock Market vs Digital Asset Exchange Infographic

industrydif.com

industrydif.com