Paper currency offers tangible, anonymous transactions but lacks the efficiency and security features of central bank digital currency (CBDC). CBDCs enable real-time settlement, traceability, and reduced transaction costs, enhancing monetary policy effectiveness and combating illicit activities. Transitioning to digital currency can transform financial systems by promoting financial inclusion and streamlining cross-border payments.

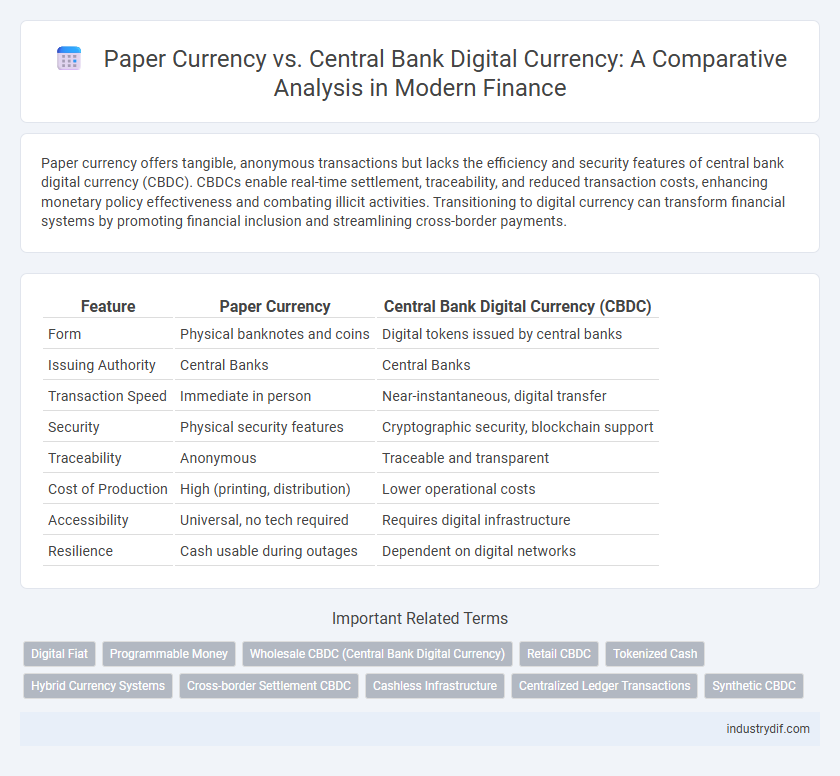

Table of Comparison

| Feature | Paper Currency | Central Bank Digital Currency (CBDC) |

|---|---|---|

| Form | Physical banknotes and coins | Digital tokens issued by central banks |

| Issuing Authority | Central Banks | Central Banks |

| Transaction Speed | Immediate in person | Near-instantaneous, digital transfer |

| Security | Physical security features | Cryptographic security, blockchain support |

| Traceability | Anonymous | Traceable and transparent |

| Cost of Production | High (printing, distribution) | Lower operational costs |

| Accessibility | Universal, no tech required | Requires digital infrastructure |

| Resilience | Cash usable during outages | Dependent on digital networks |

Introduction to Paper Currency and Central Bank Digital Currency

Paper currency, issued and regulated by central banks, serves as a tangible medium of exchange backed by government authority and widely accepted for daily transactions. Central Bank Digital Currency (CBDC) represents a digital form of sovereign money, designed to offer secure, programmable, and efficient payment solutions while maintaining the trust and stability associated with traditional fiat currency. The evolution from physical banknotes to CBDCs aims to enhance financial inclusion, reduce transaction costs, and support monetary policy implementation in the digital economy.

Historical Evolution of Currency Systems

Paper currency emerged in the 7th century Tang Dynasty as a more efficient alternative to metal coins, revolutionizing trade and commerce by reducing the physical burden of transactions. Central Bank Digital Currency (CBDC) represents the latest evolution in monetary systems, leveraging blockchain technology and digital ledgers to enhance transaction security, transparency, and speed. The historical shift from tangible paper money to digital currencies reflects broader technological advancements and changing economic demands for more resilient and accessible forms of money.

Key Characteristics of Paper Currency

Paper currency serves as a tangible medium of exchange issued and backed by a government's central bank, characterized by physical durability, portability, and ease of recognition through standardized designs and security features like watermarks and holograms. Unlike Central Bank Digital Currency (CBDC), paper currency operates without the need for digital infrastructure, enabling anonymous transactions and functioning universally in cash-based economies. Its physical form limits supply control but ensures immediate liquidity and accessibility for all socioeconomic groups.

Defining Central Bank Digital Currency (CBDC)

Central Bank Digital Currency (CBDC) represents a digital form of a country's sovereign currency issued and regulated by the central bank, designed to complement or replace physical paper currency. Unlike traditional money, CBDC exists electronically, enabling instant, secure transactions and improved monetary policy implementation. Its integration into the financial system aims to enhance payment efficiency, reduce costs, and support financial inclusion.

Security and Fraud Prevention: Physical vs. Digital

Physical paper currency faces challenges such as counterfeiting and theft, relying on tactile security features like watermarks and holograms to deter fraud. Central Bank Digital Currency (CBDC) leverages advanced cryptographic protocols and blockchain technology, enhancing transaction transparency and reducing risks of duplication or unauthorized access. Digital ledgers enable real-time monitoring and instant verification, significantly improving fraud detection and prevention compared to traditional cash.

Transaction Efficiency: Speed and Cost Comparison

Central Bank Digital Currency (CBDC) significantly enhances transaction efficiency by enabling near-instant settlement times compared to the slower processing of paper currency transactions, which often require physical handling and intermediaries. The operational costs associated with CBDCs are lower due to reduced need for cash handling, printing, and security measures, while paper currency incurs continuous expenses related to production, distribution, and anti-counterfeiting efforts. Digital transactions through CBDCs also offer improved scalability and lower friction, making them a more cost-effective and faster alternative to traditional paper money for both domestic and cross-border payments.

Impacts on Monetary Policy and Regulation

Central Bank Digital Currency (CBDC) enhances the effectiveness of monetary policy by enabling real-time tracking of money supply and improving transmission mechanisms compared to traditional paper currency. CBDCs provide central banks with greater control over liquidity management, allowing for targeted stimulus and more precise interest rate implementation. Regulatory frameworks must evolve to address CBDC's potential risks such as digital fraud, privacy concerns, and cross-border regulatory coordination to ensure financial stability.

Privacy and Data Protection Considerations

Paper currency offers inherent privacy by enabling anonymous transactions without digital footprints, reducing risks of data breaches and surveillance. Central Bank Digital Currency (CBDC) introduces enhanced traceability and data collection, raising concerns about user privacy and potential misuse of sensitive financial information. Effective privacy measures and robust data protection frameworks are critical to balancing transparency, regulatory compliance, and individual financial confidentiality in CBDC systems.

Financial Inclusion and Accessibility

Central Bank Digital Currency (CBDC) enhances financial inclusion by providing secure, low-cost access to digital payment systems for unbanked and underbanked populations, overcoming the physical and logistical limitations of paper currency. Unlike cash, CBDCs enable instant, traceable transactions and integration with mobile technology, expanding accessibility in remote and underserved areas. The seamless interoperability of CBDCs with digital wallets facilitates broader participation in formal financial ecosystems, promoting economic empowerment and reducing reliance on informal cash-based economies.

Future Trends in Currency and Payments

Central Bank Digital Currencies (CBDCs) are poised to transform future payment systems by enhancing transaction speed, security, and accessibility compared to traditional paper currency. Innovations in blockchain technology and real-time settlement networks will drive broader adoption of CBDCs, reducing reliance on physical cash and decreasing transaction costs. Governments and financial institutions are investing heavily in digital currency infrastructure to support seamless cross-border payments and improve financial inclusion globally.

Related Important Terms

Digital Fiat

Central Bank Digital Currency (CBDC) represents a government-backed digital form of fiat money, offering enhanced security, faster transactions, and improved traceability compared to traditional paper currency. Unlike physical notes, digital fiat enables real-time settlement and programmable features, transforming monetary policy implementation and financial inclusion.

Programmable Money

Programmable money embedded in Central Bank Digital Currencies (CBDCs) offers enhanced automation and conditional transaction capabilities unavailable in traditional paper currency, enabling real-time compliance and targeted monetary policies. By integrating smart contract functionalities, CBDCs facilitate precise control over money flows, reducing fraud and increasing efficiency in the financial system.

Wholesale CBDC (Central Bank Digital Currency)

Wholesale Central Bank Digital Currency (CBDC) enhances the settlement efficiency between financial institutions by enabling instant and secure transactions on a distributed ledger, reducing counterparty risks and operational costs compared to traditional paper currency systems. The integration of Wholesale CBDC fosters greater liquidity management and regulatory transparency within interbank markets, supporting a more resilient and modernized financial infrastructure.

Retail CBDC

Retail CBDCs offer enhanced transaction speed, lower costs, and improved traceability compared to traditional paper currency, promoting financial inclusion through digital wallets accessible to unbanked populations. Central banks can implement programmable features and real-time monitoring in Retail CBDC systems, increasing monetary policy effectiveness while reducing risks of counterfeit and physical currency management.

Tokenized Cash

Tokenized cash, representing central bank digital currency (CBDC), offers enhanced security and traceability compared to traditional paper currency by leveraging blockchain technology for instantaneous and tamper-proof transactions. This digital form enables centralized monetary control while maintaining the convenience and universal acceptance of physical cash within a regulated financial ecosystem.

Hybrid Currency Systems

Hybrid currency systems combine paper currency and central bank digital currency (CBDC) to leverage the tangible security of cash with the efficiency and traceability of digital payments, enhancing financial inclusion and transaction speed. Integrating CBDCs with traditional cash frameworks supports liquidity management and monetary policy implementation while addressing concerns related to privacy and systemic risks.

Cross-border Settlement CBDC

Cross-border settlement using Central Bank Digital Currency (CBDC) offers enhanced transaction speed, reduced costs, and increased transparency compared to traditional paper currency systems. The integration of CBDCs in international finance improves liquidity management and mitigates counterparty risks through real-time settlement and programmable smart contracts.

Cashless Infrastructure

Central Bank Digital Currency (CBDC) offers a secure and efficient alternative to traditional paper currency by enabling seamless, real-time digital transactions within a cashless infrastructure. Integrating CBDCs into existing financial systems reduces reliance on physical cash, enhancing transaction speed, transparency, and accessibility in the digital economy.

Centralized Ledger Transactions

Central Bank Digital Currency (CBDC) transactions utilize a centralized ledger maintained by the issuing authority, enabling real-time tracking, enhanced security, and streamlined settlement processes compared to traditional paper currency. This centralized ledger infrastructure reduces transaction costs and mitigates fraud risks by providing transparent and immutable records accessible only to authorized participants.

Synthetic CBDC

Synthetic CBDCs leverage digital ledger technology to enable central banks to issue digital currencies through intermediaries, enhancing scalability and privacy compared to traditional paper currency and direct CBDCs. This model facilitates efficient transactions and financial inclusion by integrating private-sector infrastructure while maintaining central bank oversight and monetary policy control.

Paper Currency vs Central Bank Digital Currency Infographic

industrydif.com

industrydif.com